Food supply chains were affected first by Brexit and the COVID-19 pandemic, and now by the Ukraine-Russia war. The war is disrupting international trade and raising prices for several items, such as oil and fertiliser. Cesar Revoredo-Giha, Faical Akaichi, and Montse Costa-Font analyse producer prices for food and drink and their relationship to fuel prices.

The latest annual inflation for March 2022 reached 7%, more than three times the Bank of England’s inflation target of 2% and higher than the 6% forecasted for March by the Office for Budget Responsibility. The situation related to Ukraine and Russia (e.g., higher prices for petrol, cereals and sunflower oil), as mentioned by the British Retail Consortium, is part of the reason. Aside that, the higher retail inflation reflects a combination of higher commodity prices due to pressures brought on by the recovery of global supply chains, higher energy prices, and higher transportation costs due to increases in oil prices, which makes shipping more expensive.

Since these costs only affect consumers indirectly, as they need to be passed on by retailers, less attention has been paid to the changes in producer prices. Nevertheless, producer prices are interesting because they reflect the factors that disrupted domestic supply chains, such as Brexit and the COVID-19 pandemic. These two events have affected the flow of materials and inputs (domestic and imported), as well as energy and labour.

Producer price indices (PPI) comprise two groups: outputs and inputs. Output producer price indexes reflect the evolution in the prices of goods produced by manufacturers in the UK for sale domestically. Input price indices measure the evolution in the prices of materials and fuel purchased by the UK manufacturing industry as part of their current expenditure. In this note, we focus on food producer prices, which is the most important group within the PPI (ONS).

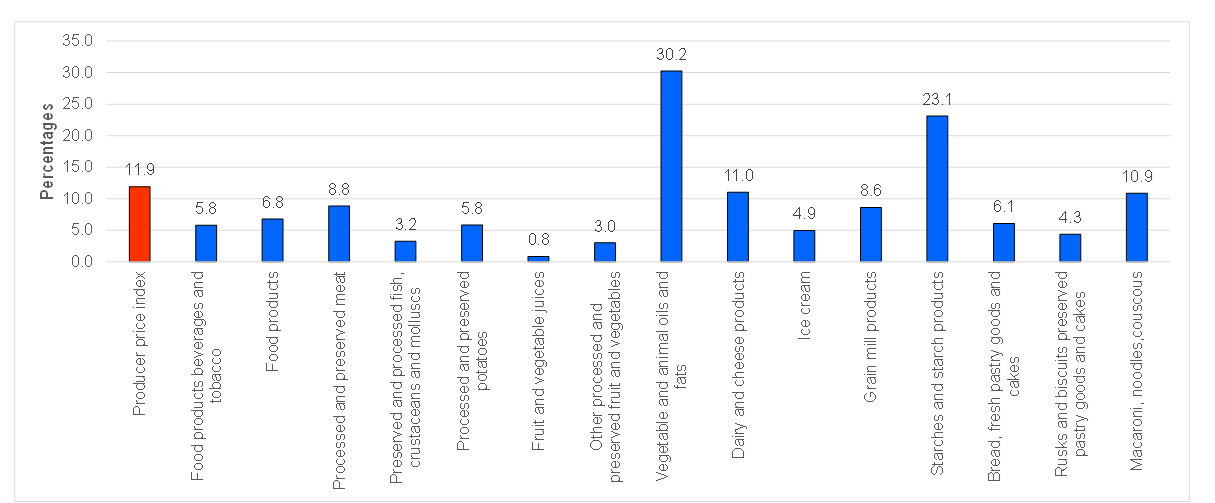

Figure 1 shows the annual inflation in output prices including the output producer price (i.e., food and non-food) for comparison purposes. All the categories show inflation, but those above the PPI annual inflation are ‘vegetables, and animal oils and fats’ (partly associated with the increase in world oilseed prices), ‘starches and starch products’ (partly due to the increase in wheat and potato prices) and ‘macaroni, noodles, and couscous’ (associated with the increase in cereal prices). Note that ‘processed and preserved meat’, ‘dairy and cheese products’, and ‘grain mill products’ are not far from the PPI annual averages.

Figure 1. Output producer price inflation March 2022

Note: Percentage change with respect to the same month of the previous year. Source: Own elaboration based on ONS data

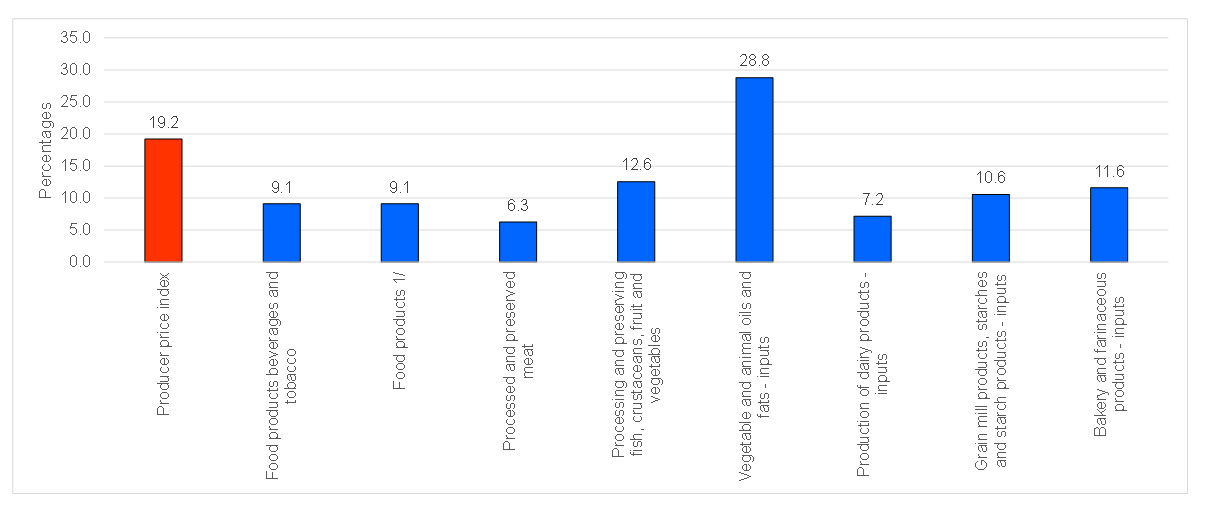

Figure 2 shows the annual increase in input prices. Although only ‘vegetable, and animal oils and fats’ show an increase in inputs prices well above the input part of the PPI (28.8%), the minimum increase in costs is 6.3% in the case of preserved meats and 7.3% in dairy products.

Figure 2. Input producer price inflation March 2022

Notes: Percentage change with respect to the same month of the previous year. 1/ simple average of domestic and imported input prices. Source: Own elaboration based on ONS data.

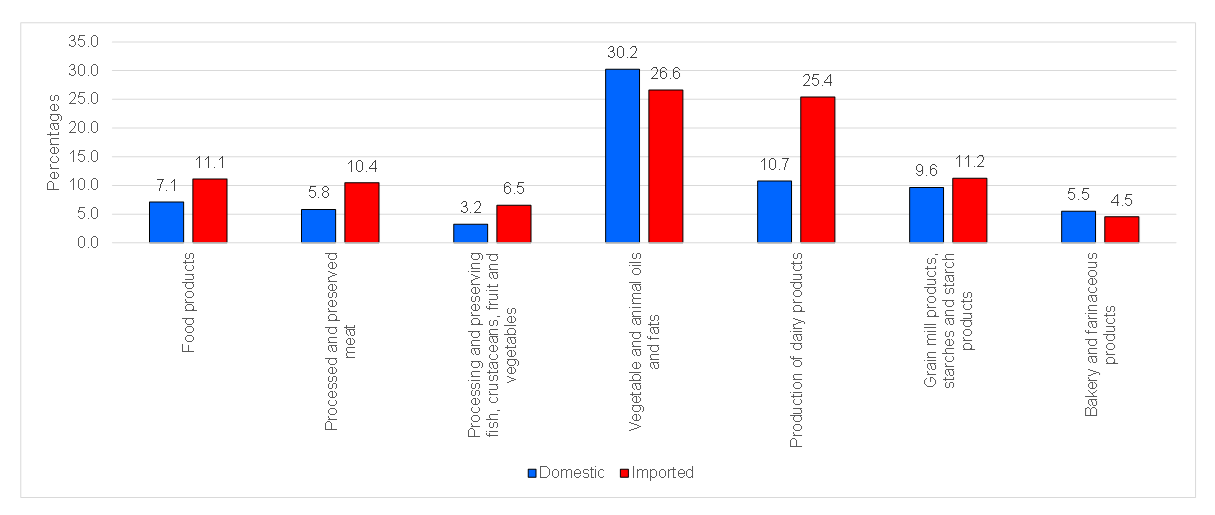

Input prices can be broken down into domestic and imported. Figure 3 shows the annual increase in the prices of domestic and imported inputs. In the case of ‘food products’, Figure 3 shows an increase in both their domestic and imported inputs. It is clear from the figure that input price increases are affecting all the sectors.

Figure 3. Domestic and imported inputs producer price inflation March 2022

Note: Percentage change with respect to the same month of the previous year. Source: Own elaboration based on ONS data

What are the prospects?

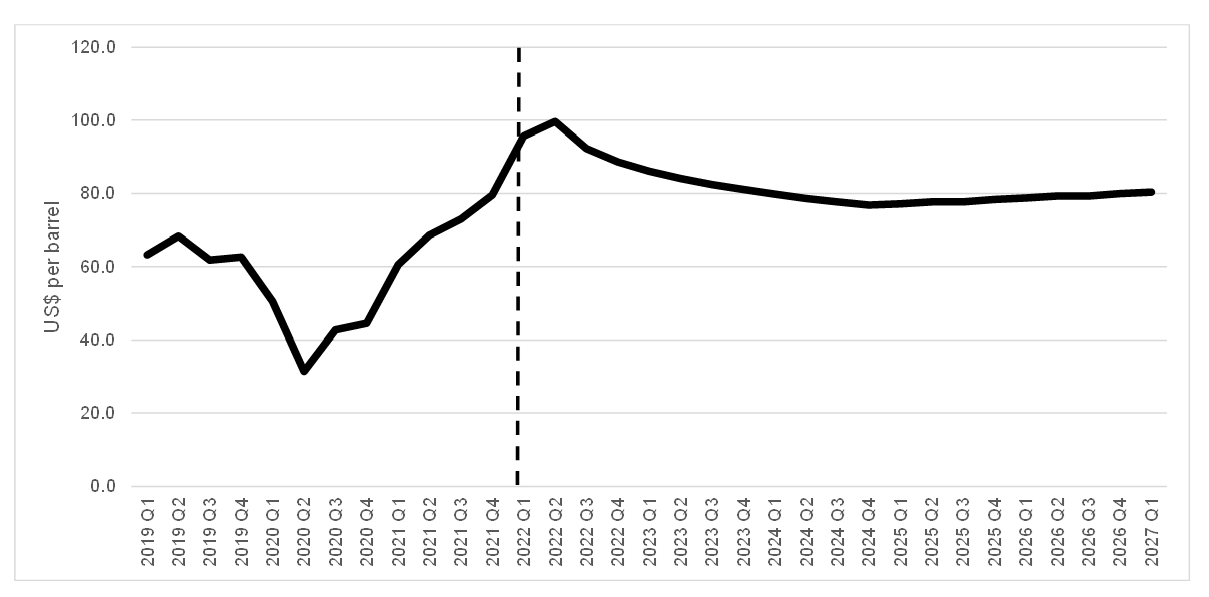

The conflict between Ukraine and Russia has affected several world commodity prices (e.g., cereals and fertiliser); however, for the industrial sector, the impact the war is having on the global oil market is the most important one. Figure 4 depicts the revised forecast for oil prices by the Office for Budget Responsibility, taking into account the latest events. It shows that prices are still to reach their highest point, forecasted to happen by the second quarter of 2022. Note that the forecasted prices after that are expected to be at levels well above those of 2019 and 2020.

Figure 4. Forecasted quarterly oil prices up to Q1 2027

Note: Dashed line indicates the latest available information (March 2022). Source: Office for Budget Responsibility.

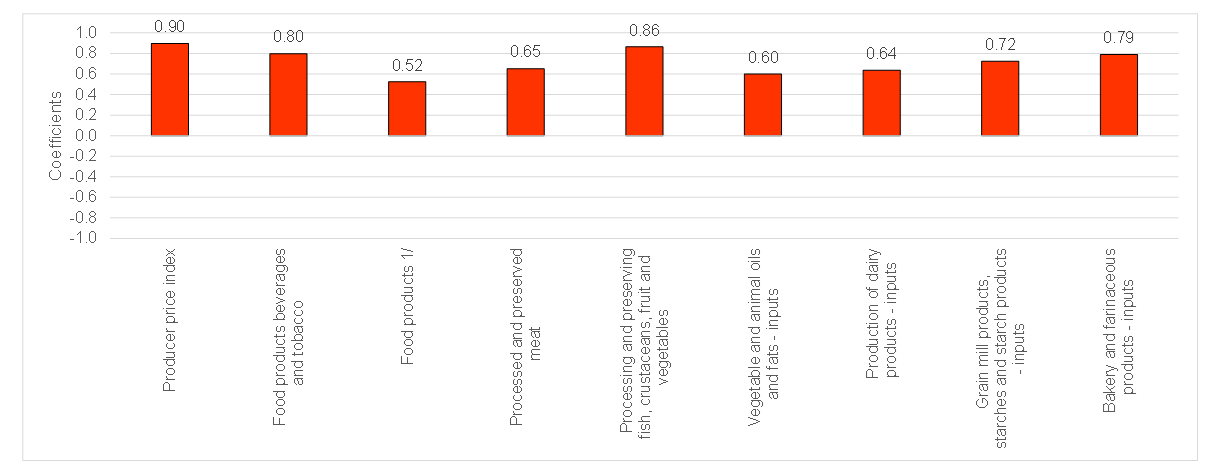

Figures 5 and 6 are a simple attempt to illustrate how important oil prices are to food outputs and inputs. The figures show the correlation coefficients, i.e., the measures of the degree of association between the prices of inputs and outputs, and the price of crude oil. The coefficients range between 1 and -1. The closer the coefficient is to 1, the greater the positive level of association (prices move in the same direction); the closer it is to -1, the greater the negative level of association (prices move in different directions).

Figure 5. Correlation coefficients of the annual changes in output prices and crude oil prices (2019-2022)

Source: Own elaboration based on ONS data

Figure 6. Correlation coefficients of the annual changes in input prices and crude oil prices (2019-2022)

Source: Own elaboration based on ONS data

As shown in Figure 5 and 6, the prices of both outputs and inputs show a significant degree of association with the movement of crude oil prices. In the case of food products, the correlation coefficient reaches 0.75, indicating a high degree of association and highlighting the importance of oil price movements for our supply chains.

Final remarks

It is important to keep track of prices related to food supply chains because they have been affected by the COVID-19 pandemic (with, for instance, a shortage of labour supply) and they will be further affected by the impacts of the Ukraine-Russia conflict on international trade, such as increases in the prices of oil, fertiliser, vegetable oil, and feeding.

The implications of this war have here been illustrated for the case of oil prices. Other commodities like cereals and oilseeds, or inputs such as fertilisers, will modify their profitability and in some cases their viability. In fact, the future of grain and oils production is uncertain, adding instability to the market equilibrium (oils and fats international, 2022). UK food processors might need to look for input substitution and crop diversification to mitigate the impact of certain price increases on retail food product prices.

Inflation is expected to be further propagated, since it represents not just the direct effect of global prices on a particular food sector, but the interrelationships between sectors as suppliers and customers.

As domestic and imported costs increase, they will eventually be passed on to consumers by retailers. How much is passed on is not clear because it depends on the negotiation between manufacturers and retailers, which will be a source of friction between retailers and the rest of the upstream food supply chain.

Finally, producer price inflation is a vital component of the final inflation that is passed to consumers (retail inflation) and therefore it is important to observe its evolution as it has important implications for the UK’s cost of living.

♣♣♣

Notes:

- This blog post expresses the views of its author(s), not the position of LSE Business Review or the London School of Economics.

- Featured image by Raphael Rychetsky on Unsplash

- When you leave a comment, you’re agreeing to our Comment Policy.