Daniel Stempel and Ulrike Neyer analyse the effects of gender discrimination on macroeconomic outcomes. Their study suggests that if there were no gender discrimination, adverse economic shocks like the COVID-19 pandemic would be less detrimental to economic activity. Additional consequences of gender discrimination come via monetary policy: central bank reactions to the crisis end up increasing discriminatory wage gaps and are less effective at stabilising the economy.

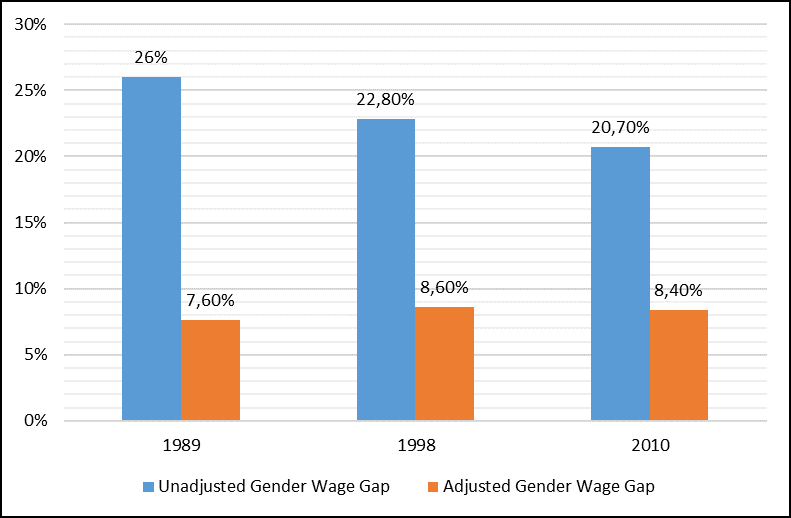

The gender wage gap is oftentimes referred to as a first indication of potential discrimination against women. In order to isolate the part of the wage gap that can be ascribed to gender discrimination, empirical studies estimate adjusted gender wage gaps, thereby taking into account productivity measures such as work experience, hours worked, education, industry, occupation, or union status. These adjusted gaps are smaller but significant and persistent over time (see figure 1). Similar results are brought forward with respect to Canada, Sweden, the United Kingdom, or Germany, for instance.

Figure 1. Unadjusted and adjusted gender wage gap in the United States

Source: Blau and Kahn (2017).

Importantly, our paper motivates the inclusion of discriminatory behaviour by firms into our analysis by the relatively constant and persistent adjusted gender wage gap.

Simulating the COVID-19 pandemic

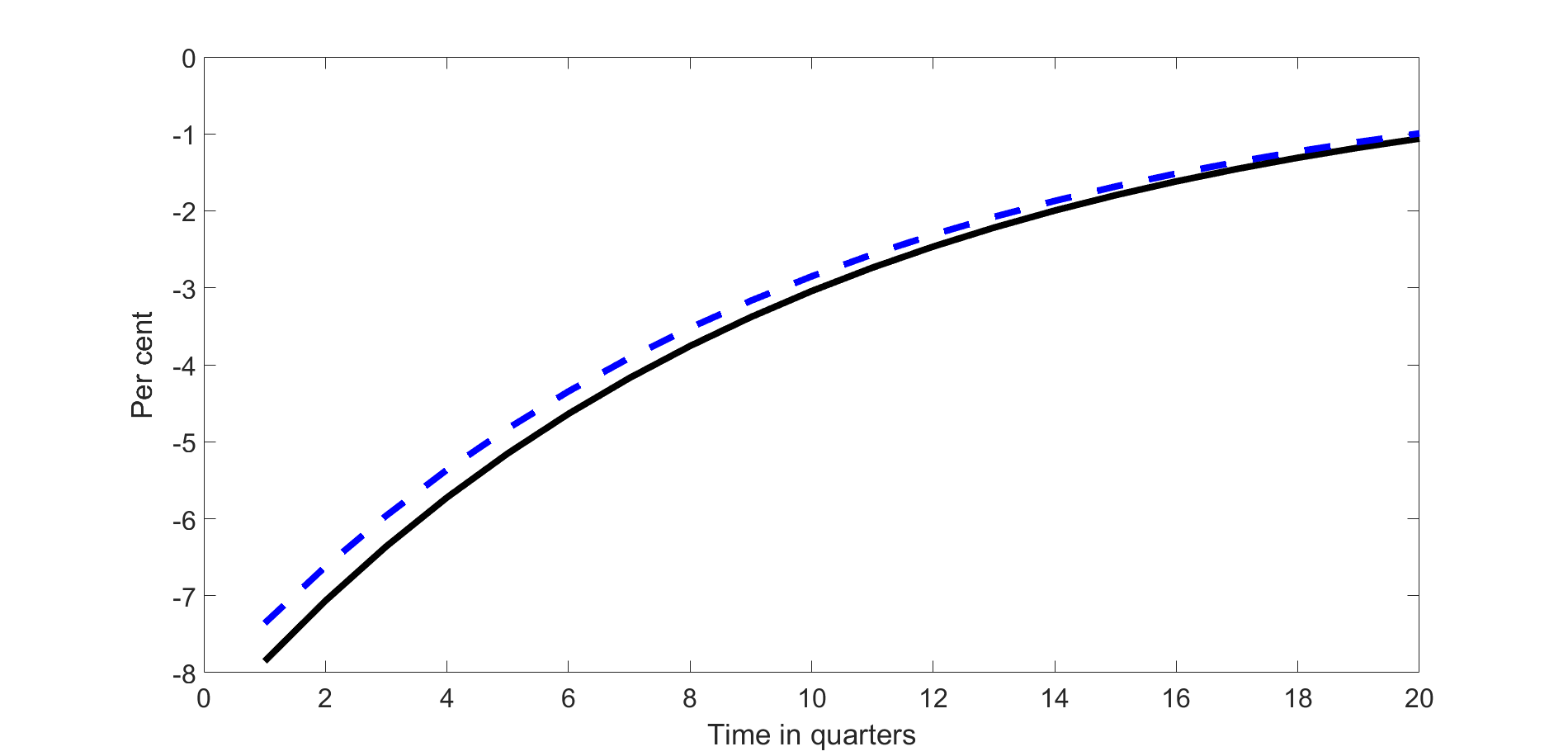

We simulate an adverse macroeconomic shock like the COVID-19 pandemic. Worldwide, countries experience(d) high levels of macroeconomic distress. In particular, the Bureau of Economic Analysis in the US (2021) reports that US GDP decreased by a quarterly rate of about 7.85 per cent in the second quarter of 2020 due to the COVID-19 pandemic. However, our model suggests that the economic downturn would be significantly lower in an economy without gender discrimination: instead of a GDP decline of 7.85 per cent (solid black line), GDP would only decrease by about 7.35 per cent (dashed blue line), as figure 2 shows.

Thus, gender discrimination worsens the macroeconomic downturn by 0.5 percentage points or 7 per cent in this example. The aforementioned effects should be interpreted with caution: while our model shows a significant impact of gender discrimination on GDP and other macroeconomic variables, we do not aim at estimating the exact quantitative extent of these effects. The presented numbers therefore serve as a first indication of the impact of gender discrimination on macroeconomic outcomes rather than an exact prediction of the extent of these effects. Note, for instance, that the results are calculated based on a discriminatory gender wage gap of 5 per cent, which is considerably lower than the estimated adjusted gender wage gap in the US (see figure 1).

Figure 2. Immediate GDP development after a COVID-19 shock

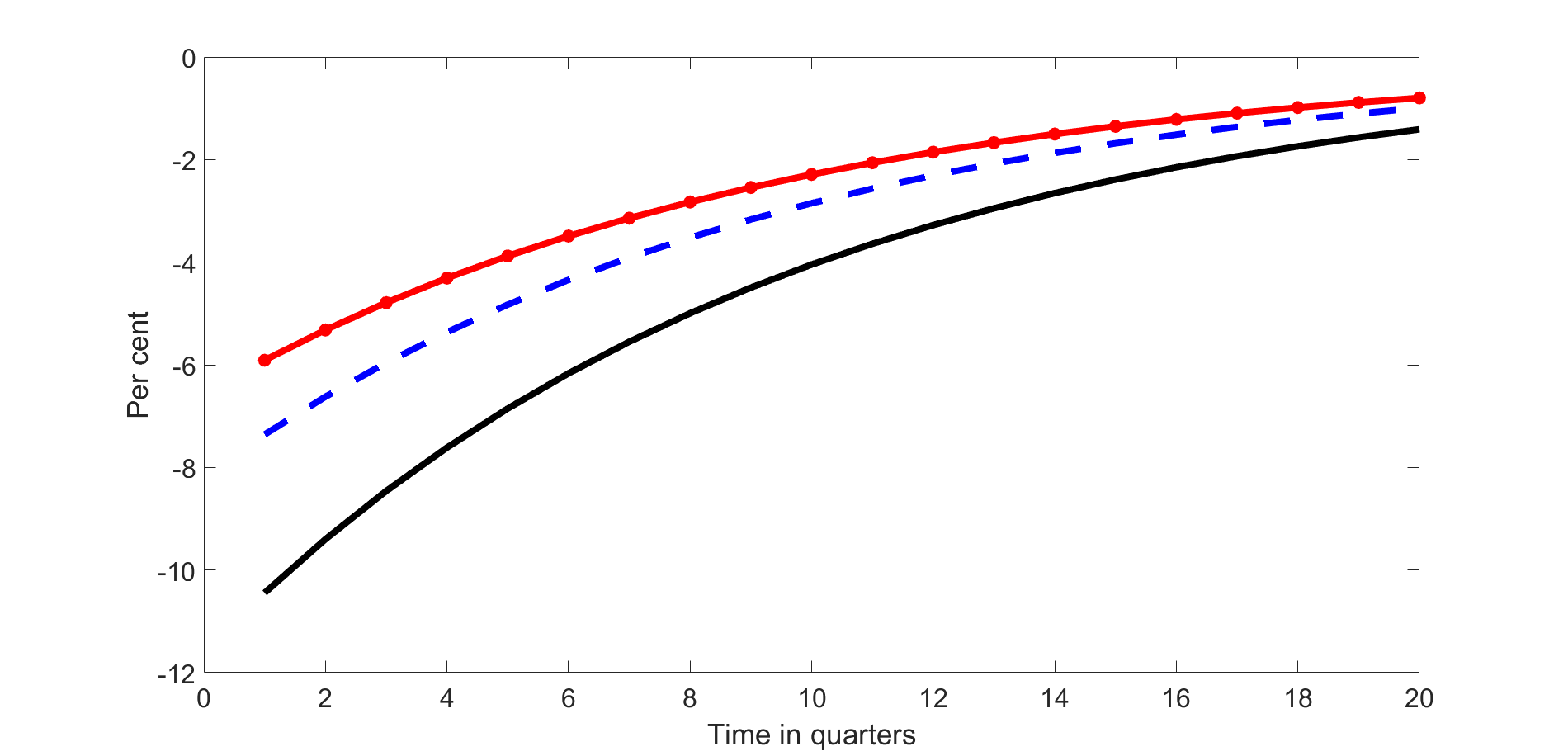

We show that this negative effect on economic activity is explained by the impact of gender discrimination on the time women and men spend in labour market work. After this adverse shock, both women and men decrease their labour market work, as depicted in figure 3. If there were no gender discrimination, women and men would reduce their labour market work equally, by about 7.35 per cent (dashed blue line). Due to gender discrimination, however, this drop is inefficiently high for women (solid black line, about 10.44 per cent) and inefficiently low for men (dotted red line, about 5.91 per cent). This implies that the productivity of women and men is utilised inefficiently by firms and the economy is more vulnerable when hit by adverse shocks.

Figure 3. Immediate labour market work development after a COVID-19 shock

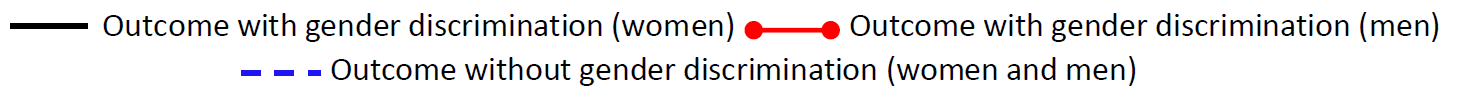

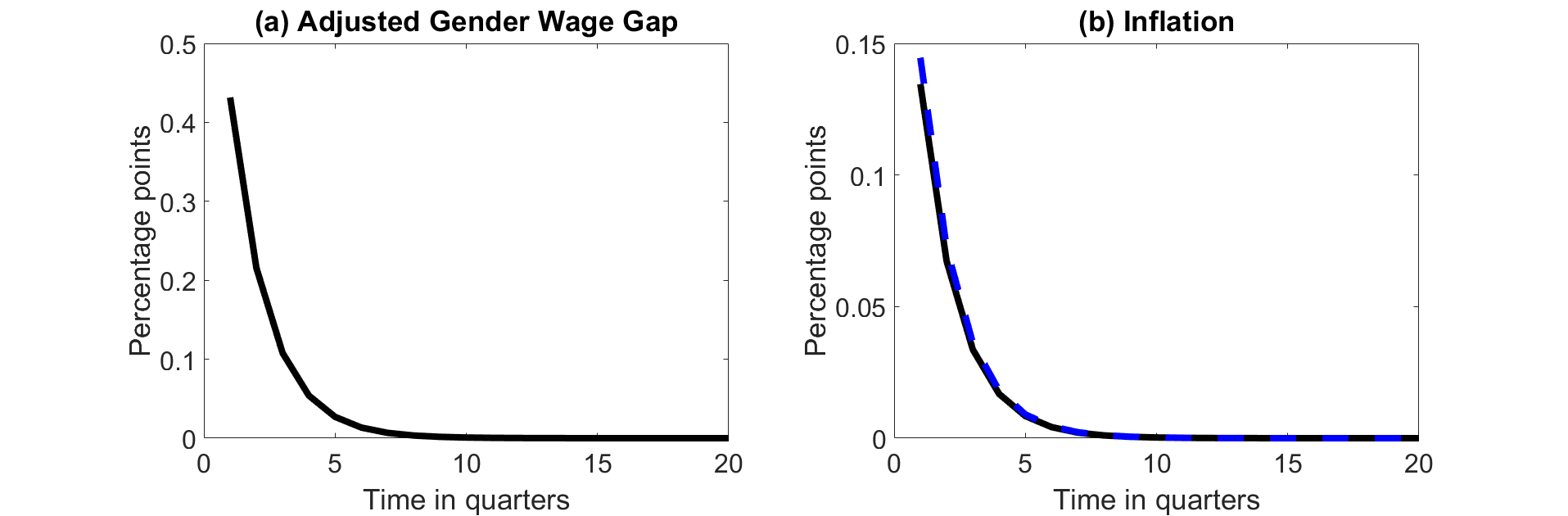

Naturally, the distortions caused by the pandemic also lead to a reaction by the Federal Reserve (FED). In particular, in March 2020, the FED decreased the target range for the federal funds rate by 0.5 percentage points to mitigate the impact of the COVID-19 pandemic on the US economy. Figure 4(a) shows that our results suggest that these types of expansionary monetary policy measures have gender-specific distributional effects: in our model, a decrease of the monetary policy rate by 0.5 percentage points leads to an increase of the adjusted (or discriminatory) wage gap of 0.43 percentage points. Note that, after March 2020, the FED conducted several other policy measures that are likely to have similar distributional effects.

Figure 4. Immediate gender wage gap and inflation development after expansionary monetary policy

As shown in figure 4(b), we additionally find that expansionary monetary policy is less effective: inflation increases about 0.01 percentage point (or 7 per cent) less due to gender discrimination.

Overall, our results have considerable policy implications: gender discrimination does not only lead to inefficient outcomes for women or households but has negative implications for the entire economy. This implies that institutional measures that aim at combating gender discrimination (such as pay transparency laws, for instance) may also be efficient stabilizations tools. Simultaneously, our results contribute to the discussion around central banks’ impact on income inequality by providing new findings with respect to the effects on discriminatory wage gaps.

♣♣♣

Notes:

- This blog post is based on the paper “Gender Discrimination, Inflation, and the Business Cycle”, presented at the Royal Economic Society’s annual conference 2021.

- The post expresses the views of its author(s), and do not necessarily represent those of LSE Business Review or the London School of Economics.

- Featured image by Mark König on Unsplash

- When you leave a comment, you’re agreeing to our Comment Policy