Two years after the beginning of the COVID-19 crisis, incomes of the self-employed in the UK are still well below their pre-pandemic levels. The number of self-employed workers dropped during the crisis and has not yet recovered. Robert Blackburn and Maria Ventura write that the solo self-employed, representing 85 per cent of self-employment in 2019, may be hit particularly hard by inflation. These workers would be willing to sacrifice, on average, 10 per cent of their income for a scheme providing systematic income insurance.

| #LSEUKEconomy |

|---|

The beginning of 2022 has marked the end of COVID-19 restrictions and the resumption of most economic activity. This has come with new economic and geopolitical events which are, once again, challenging self-employed workers. With Stephen Machin, director of the LSE’s Centre for Economic Performance, we ran a survey in May 2022 to capture how the self-employed are dealing with the aftermath of COVID-19 as well as the new economic challenges. This follows from our previous investigations in May 2020, September 2020, February 2021, and September 2021, allowing us to monitor the experiences of the self-employed for the whole length of the COVID-19 crisis.

Little or no income recovery for the self-employed

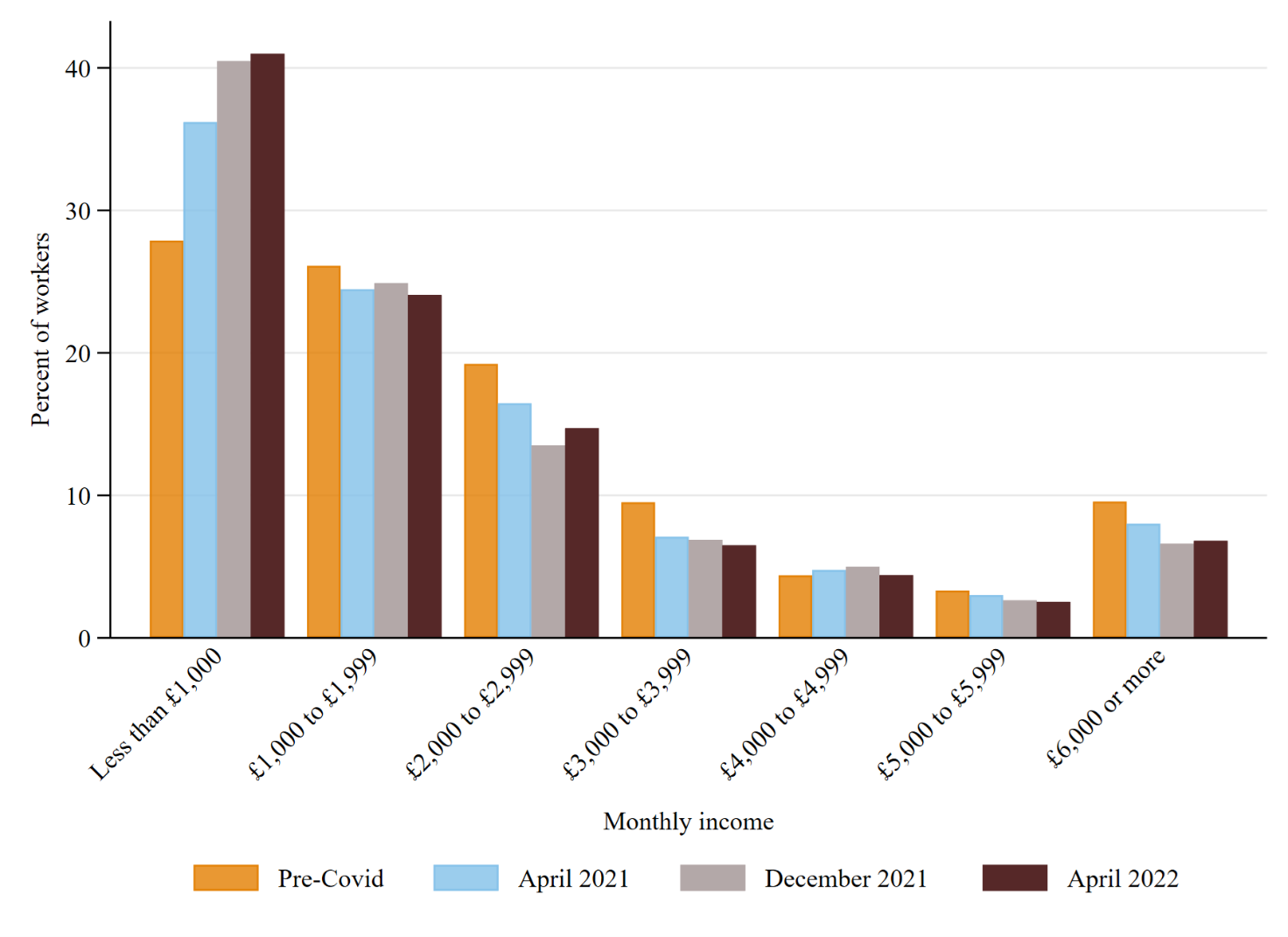

Two years after the beginning of the COVID-19 crisis, incomes of the self-employed are still well below their pre-pandemic levels. Our survey data show that, after a little hint of recovery in August 2021, incomes now look lower than a year ago, with the share of self-employed earning less than £1,000 up 5 percentage points since April 2021 (Figure 1). The same is true about profit levels, although weekly hours worked show some weak signs of recovery.

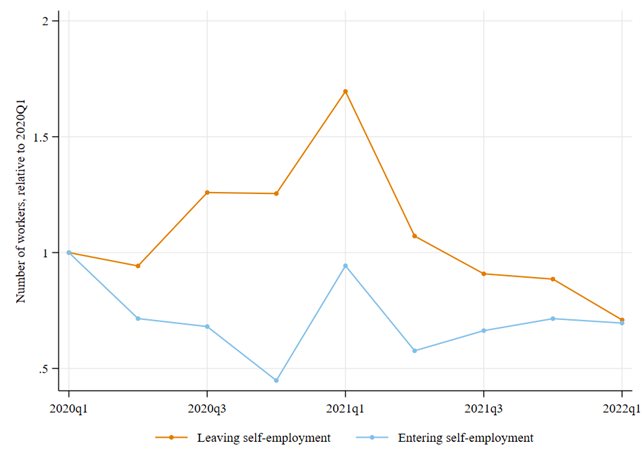

Low financial gains from self-employment are reflected in the recent trends of people moving into and out of the sector. While the number of employee workers is now restored, and even above pre-COVID levels, the number of self-employed workers dropped during the crisis and has not yet recovered. Figure 2 shows how the great outflow experienced in the first year of the pandemic has not been matched by a subsequent increased inflow, resulting in a loss of around 800,000 self-employed.

The share of self-employed workers still reporting financial difficulties with their daily expenses is also consistent with this gloomy picture. One third of them still report struggling with their daily finances, showing no improvement compared to previous reports. Workers have also been hit unequally across occupations with, for example, those in healthcare four times more likely to report troubles meeting basic expenses than those in education. For the most vulnerable groups, this often translates in having to use their savings to pay potential unexpected expenses, if they are able to do so at all.

New challenges are hitting the self-employed

While the country has started to recover from the end of COVID restrictions, new macro shocks have struck the economy, pushing inflation to a 40-year high. With smaller businesses being more vulnerable to such shocks, the solo self-employed, who according to the IFS represented 85 per cent of self-employment in 2019, may be hit particularly hard by the increase in input prices.

Our new survey data reports the effects of rising inflation on the self-employed. When asked about the issue affecting them over the last months, one third report the cost of energy as the most challenging, closely followed by COVID-19. Nevertheless, almost 50 per cent of self-employed claim being affected in some measure by the former, confirming its pervasive aspect. This is exacerbating the already heavy burden brought by the aftermath of COVID and poses a concern about whether vulnerable businesses will survive the next few months. As energy bills represent up to 33 per cent of small businesses costs and prices are set to rise further, their worry seems well justified.

Figure 1. Monthly incomes before COVID-19 and in April 2021, December 2021, and April 2022

Source: LSE-CEP Survey of UK Self-employment May 2022

Most self-employed workers value government support despite their desire for independence

The past two years have seen an unprecedented effort by the government to fill in the gap of income insurance for the self-employed. Through the Self-Employment Income Support Scheme (SEISS) it has provided five rounds of grants for smaller businesses, covering up to 80 per cent of their monthly profits. Although generous, the scheme has not been able to match the effectiveness of the furlough for employees, partly because of poor targeting and low awareness of availability and eligibility among workers.

Figure 2. Flows in and out of self-employment, relative to 2020Q1

Source: Five quarter longitudinal Labour Force Survey

Given the novelty of this policy, we have investigated, at each round of our survey, self-employed worker’s willingness to pay for structured government support to be available in times of hardships. We find that throughout the past two years, the desirability of income insurance has remained meaningful and virtually unchanged. The self-employed would be willing to sacrifice, on average, 10 per cent of their income for a scheme providing systematic income insurance.

Even so, a significant share of self-employed (35 per cent) claim they would not take the support, even if provided for free. A similar pattern emerges among the self-employed who reported not claiming any SEISS grant although eligible, of which 62 per cent declared not needing it or wanting it. More generally, these facts seem to reflect the trait of autonomy usually found and valued among self-employed.

Explore our dedicated hub showcasing LSE research and commentary on the state of the UK economy and its future.

♣♣♣

Notes:

- This blog post is based on the COVID-19 analysis paper COVID-19 and the self-employed: a two-year update, LSE’s Centre for Economic Performance (CEP).

- The post represents the views of its author(s), not the position of LSE Business Review or the London School of Economics.

- Featured image by Kelly Sikkema on Unsplash

- When you leave a comment, you’re agreeing to our Comment Policy.