Amid the renewed drives for economic growth, self-employed workers still struggle to recover fully from the COVID-19 crisis. Robert Blackburn and Maria Ventura write that In September 2021, 28% of workers reported financial difficulties dealing with basic expenses in the previous month and explain why the government’s support scheme has not reached many of the self-employed.

With the UK economy starting to revert to its pre-crisis level, self-employed workers are also returning to their activities. However, even with the relaxation of COVID-19 restrictions, they still have less work and lower incomes than 18 months ago. Together with Stephen Machin, we ran a survey in September 2021 to capture how the self-employed are recovering from the COVID-19 crisis. This follows earlier surveys in May 2020, September 2020 and February 2021, enabling us to track changes over time.

A slow recovery for the self-employed

As recent reports show, although UK employment has started picking up in the last quarter, most figures still remain far from pre-crisis levels. This is also true for the self-employed. Two out of five of our survey respondents still claimed having less work than usual in August 2021, with 72% of them attributing their decreased activity to the pandemic.

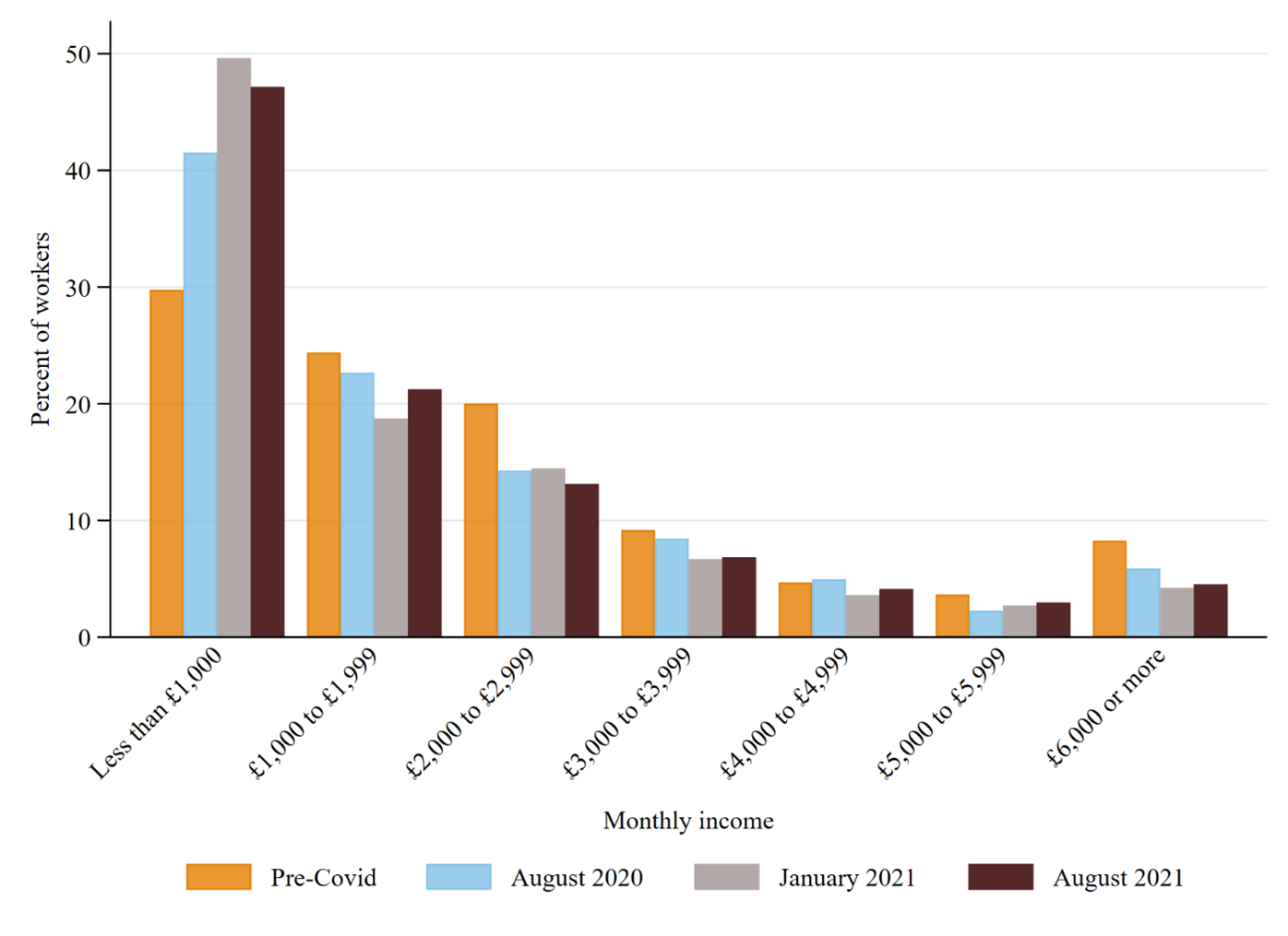

The reduced work level amongst the self-employed is reflected in the distribution of their incomes. Figure 1 shows the monthly income of the self-employed using self-reported data from our surveys. This shows that more than 45% of the self-employed have incomes of less than £1,000. Strikingly, very little has changed since January 2021, when the UK was going through a second national lockdown. And the figure looks very similar when looking at profits, with more than 50% of the self-employed reporting monthly returns of less than £1,000 both in January and August 2021. It is no surprise that in September 2021, 28% of workers reported financial difficulties dealing with basic expenses in the previous month. This figure has remained roughly constant since February 2021.

Our analysis also uncovers inequalities in the impact of the crisis and its aftermaths on different demographic groups. In particular, we found that women, parents and younger self-employed people report greater financial distress. The Resolution Foundation has recently confirmed that the closure of schools and childcare providers in the past year may have created a burden on mothers and this may have wage effects in the longer term. A forthcoming report by the OECD also highlights how the negative effects of the crisis are uneven and disproportionately affect those self-employed groups that are already at a disadvantage, such as young workers and some ethnic minorities, exacerbating the challenges to their economic engagement and business start-up.

Figure 1. Monthly incomes before COVID and in August 2020, January 2021 and August 2021

Source: LSE-CEP Survey of UK Self-employment September 2021

Low awareness of available support has reduced its take-up

Throughout the crisis, the government has made available the Self-Employed Income Support Scheme (SEISS). The support programme has been described, at the beginning of the crisis, as providing an “unprecedented level of support” to those workers who were more in need of it. In spite of its levels of expenditure, this measure has been widely criticised for not being well targeted and excluding particularly vulnerable categories such as the newly self-employed or those at the margins.

As the fifth and last payment round closed for applications on 30 September 2021, official statistics highlight a decreasing take-up since its launch, with number of claims dropping by more than 50% in the last wave, compared to the first one. Our survey results reflect this drop and find it to be closely related to a continuing low awareness around government support and eligibility requirements. It is also consistent with the last grant receiving decreased media coverage with respect to previous rounds. Moreover, the application process became slightly more complicated because of the new requirement to provide turnover figures in order to work out eligibility and payment amount. Accordingly, a fifth of applicants reported finding it difficult to calculate their turnover and 38% remained unsure, even after submitting the claim, of whether they would receive the high or low grant.

Newly self-employed workers may be less resilient in the future

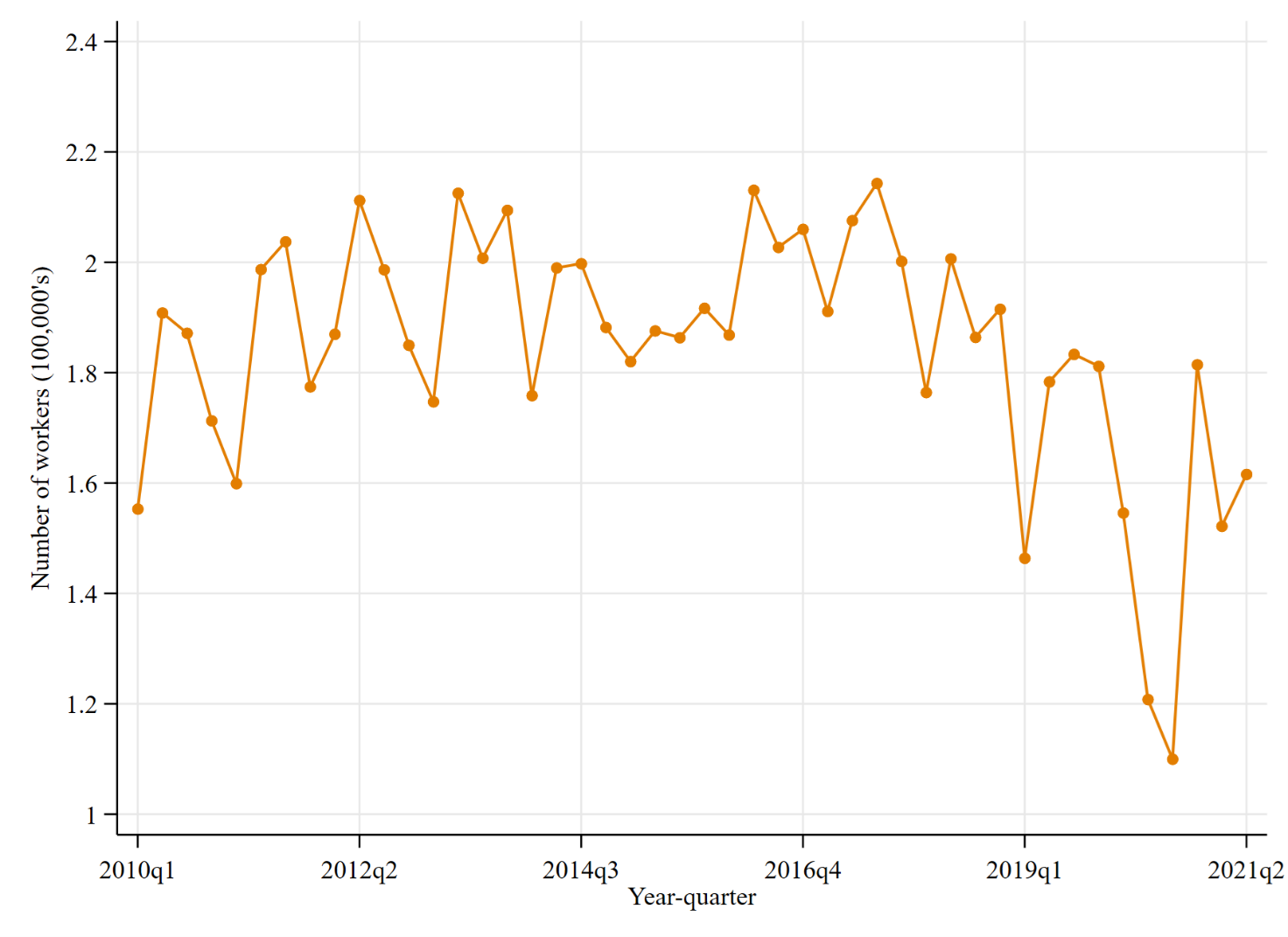

After several months witnessing consistent outflows of the self-employed, the labour market has recently experienced surges of workers into the sector. Figure 2 shows how the jump in the number of self-employed at the end of 2020 was the greatest in the last 10 years. In the survey we investigate whether incoming workers differ from individuals that have remained self-employed. We find that new entrants are less inclined to see themselves as still being self-employed in five years’ time than those who have been self-employed for longer periods. They are also more likely to have left, or considered leaving self-employment in the last few months, and place an emphasis on the value of employment stability. On the other hand, those who have been self-employed for more than five years report retirement as the most likely potential reason for leaving their job.

Figure 2. Number of new self-employed workers

Source: Quarterly Labour Force Survey

Interestingly, workers who have been self-employed for longer also appear to have had a better understanding of government income support and have used it more during the crisis. This greater know-how among the ‘established’ self-employed may be a reflection of having a clearer understanding of government support systems, as well as receiving advice from their professional and trade networks. Nevertheless, the fact that the newly self-employed have been less responsive to the availability of government resources when they had the chance, might also be a signal of low levels of commitment to this form of employment.

♣♣♣

Notes:

- This blog post is based on Covid-19 and the self-employed – 18 months into the crisis, with Stephen Machin, Paper Number CEPCOVID-19-025, of LSE’s Centre for Economic Performance.

- The post represents the views of its author(s), not the position of LSE Business Review or the London School of Economics.

- Featured image by Artem Beliaikin on Unsplash

- When you leave a comment, you’re agreeing to our Comment Policy.