The importance of Multinational Enterprises (MNEs) and Foreign Direct Investment (FDI) in the global economy has become increasingly apparent over time, framing the debate about their impact on the recipient economies. Countries fiercely compete to attract MNEs in light of the expected benefits that may stem from their presence and operations, despite the lack of consensus in the academic literature on the nature and extent of such benefits.

Some scholars have argued that MNEs possess more advanced technology due to their access to superior knowledge, and that positive effects may arise when their activities in the host economies spread out to domestic firms. Others have cautioned against the perverse consequences that may derive, for example, from ‘market-stealing’ effects by foreign subsidiaries. Also, domestic firms may find it difficult to absorb the latest technologies coming from FDI. These negative consequences are expected to be more pronounced within the highly competitive industries in which foreign MNEs operate, rather than in related industries where direct competition is lower and production linkages are more likely to emerge.

Our research helps shed light on this question by providing new evidence of the impact of foreign corporations’ investments on the innovation ability of domestic firms operating in the same industrial sector. We look at investment inflows from abroad over the period 1998-2005, and their impact on same-industry domestic firms’ innovation in the subsequent years (2005-2007).

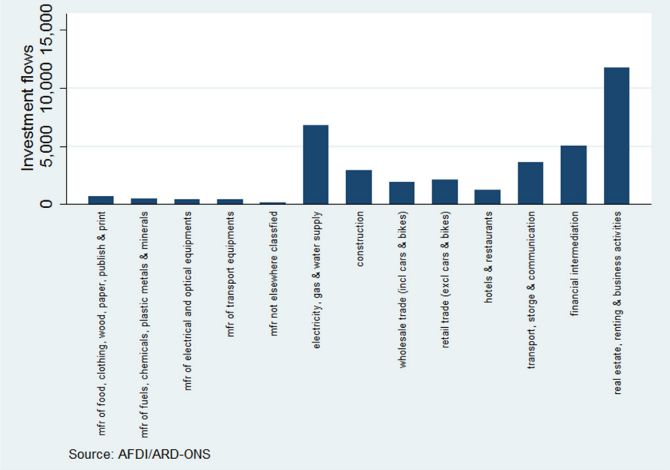

The UK has traditionally been a popular destination of foreign direct investment. Our data show that over the period 1998-2005 the country has received significant FDI inflows, mainly concentrated in the service industries (Figure 1).

Figure 1: Foreign investment inflows by sector – 1998-2005

Note: FDI inflows calculated in £ millions

We find that foreign direct investment has a positive effect on the innovative performance of domestic firms in the same industry. But the individual characteristics of these firms play a key role in mediating their capability and willingness to appropriate such benefits:

| 1. The capacity to absorb new knowledge is a necessary pre-condition for them to gain from foreign investment. In fact, if knowledge originates elsewhere or is carried by external actors (such as foreign MNEs), the receiving node (i.e., the domestic firm) has to play an active role in animating and recreating that knowledge in a different context. However, absorbing new knowledge and being an innovative firm – i.e., a firm that is keenly engaged in generating and exploiting new ideas and technology for commercial purposes – is not a sufficient condition for them to reap the benefits of FDI. Other firm characteristics also play an important role. |

| 2. We assume that the intensity of knowledge flows from foreign MNEs crucially depends on how both sides perceive the advantage of committing to innovation-enhancing interactions. Highly internationalised domestic firms (those selling their products abroad on other European and world markets) have fewer incentives to interact with foreign MNEs, since they already have access to the capabilities and infrastructure disseminating global knowledge. They engage in international trade, or are part of nationally-owned corporate groups (often multinational). For them, the potential gains from imitation and learning from foreign MNE innovation practices is therefore low. These dynamics are reinforced by competition effects: internationalised firms are also more likely to be direct competitors of foreign MNEs active in their same industry, with disincentives for cooperation and knowledge-sharing. |

| 3. Conversely, our research shows that the positive impact of foreign MNE investment is particularly evident for less internationalised firms serving the regional and/or national market. If domestic firms engage predominantly with local (regional and national) markets, the likelihood and intensity of their links with foreign enterprises may be higher, and they have a higher potential in terms of imitation and learning from FDI in their same industry. |

| 4. Although our analysis supports the attraction of foreign investments as a policy option, it also claims for a greater attention to monitoring the industry structure and the competitive advantages of domestic firms. Attracting FDI cannot be disjoined from horizontal support to domestic firms’ absorptive capacity, as well as initiatives to embed them into national, regional and sectoral systems of innovation. Isolated firms do not forge innovative linkages, neither with other local firms nor with foreign MNEs. A systemic and interactive platform for innovation has to be supported as a pre-requisite to strengthen domestic firms as active recipients of knowledge flows. |

If the less internationalized firms are those more likely to benefit from the operations of MNEs – as our research suggests – they are also the most difficult actors to be mobilized as part of a broad development strategy. Finally, policies should also take a broad and holistic approach to innovation so as to incorporate tools targeting the service sector (where large part of the economy-wide beneficial effects may come from), beyond the typical manufacturing-oriented technological innovation.

♠♠♠

Featured Image Credit: John Fielding CC-BY-2.0

Riccardo Crescenzi is an Associate Professor of Economic Geography in the Department of Geography and Environment, and a researcher at LSE’s Spatial Economics Research Centre (SERC). Riccardo is a visiting scholar at Harvard University Kennedy School of Government’s Taubman Centre for State and Local Government, and the current holder of a European Research Council (ERC) Starting Grant. His research is focused on regional economic development and growth, innovation, multinational firms and the analysis and evaluation of European Union development policies.

Luisa Gagliardi is an LSE Fellow in the Department of Geography and Environment, and Research Affiliate to the Research Centre of Regional Economics, Transports and Tourism (CERTeT) at Bocconi University in Milan and to the LSE’s Spatial Economics Research Centre (SERC). Her research interests include regional and urban economics, labour economics and economic geography.

Luisa Gagliardi is an LSE Fellow in the Department of Geography and Environment, and Research Affiliate to the Research Centre of Regional Economics, Transports and Tourism (CERTeT) at Bocconi University in Milan and to the LSE’s Spatial Economics Research Centre (SERC). Her research interests include regional and urban economics, labour economics and economic geography.

Simona Iammarino is Head of Department and Professor of Economic Geography at the LSE Department of Geography & Environment, and a researcher at the LSE’s Spatial Economics Research Centre (SERC). She joined the LSE in 2009 as a Reader. She was previously Reader at the Science and Technology Policy Research (SPRU), University of Sussex. Simona’s main research interests lie in the following areas: multinational corporations, location and innovation strategies, and local economic development; geography of innovation and technological change; regional systems of innovation; regional and local economic development and policy. Her most recent book, co-authored by Philip McCann, is Multinationals and Economic Geography. Location, Technology, and Innovation, Edwar Elgar (2013).

1 Comments