Between 2010 and 2015, solar power in the UK benefitted from feed-in-tariffs—guaranteed prices for power generation. In this period, British commercial utility-scale solar power grew at a fast pace. Sugandha Srivastav writes that feed-in tariffs were what the industry needed to get started, but when the policy was prematurely diluted in 2016, growth plummeted. She says that government support is necessary for private markets to deepen and for technologies to mature. She also emphasises that arbitrary rules banning solar projects from farmland should be avoided to let the market decide upon the best use of land.

Policy instruments to reduce risk play a critical role in incentivising investment in new clean technologies since market failures related to incomplete information and imperfect credit markets result in under-investment.

Risk-reduction and the growth of solar power in the UK are two closely intertwined themes. Between 2010 and 2015, solar power benefitted from feed-in-tariffs, that is, guaranteed prices for power generation. During this time, utility-scale solar farms started popping up all across the country at unprecedented rates.

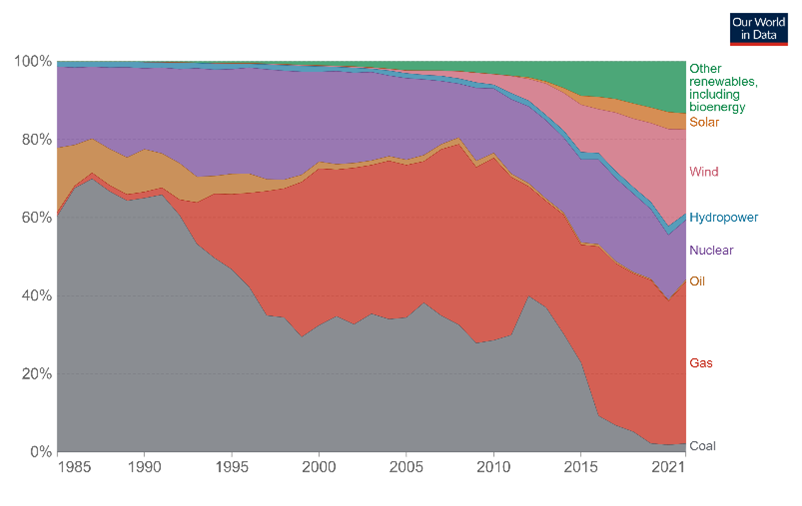

Figure 1. Electricity production by source, UK

Source: Our World in Data, based on BP Statistical Review of World Energy (2022); Our World in Data based on Ember’s Global Electricity Review (2022); Our World in Data based on Ember’s European Electricity Review (2022). Note: “Other renewables” include biomass and waste, geothermal, wave, and tidal. From ourworldindata.org/energy (Creative Commons licence, attribution required).

Understanding how to bring renewable power to the grid in a timely manner is important. The UK has a target to fully decarbonise its grid by 2035. This means the 43% of the current power generation which comes from fossil fuels must drop to zero in just 12 years.

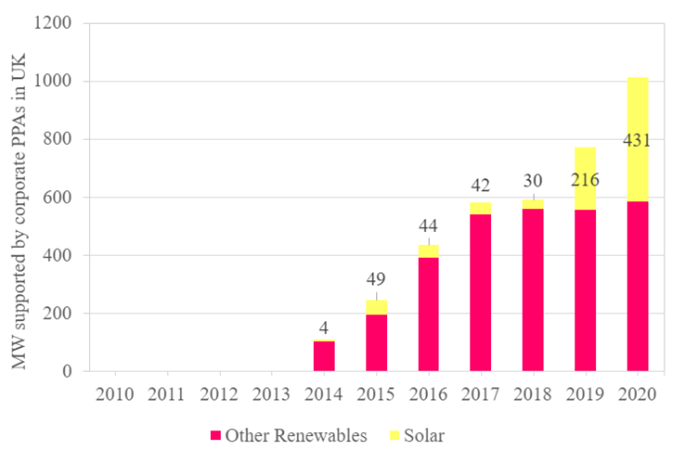

Luckily, we can learn from recent history. A solar developer in 2010, in the UK, would have struggled to find private finance at reasonable rates or insurance products (Figure 2). Since no utility-scale solar farm had been ever built in the country, private markets simply did not know what the risks and rewards would look like, or what contingencies a standard insurance contract for solar power should insure against. Against a backdrop of very limited/non-existent private risk-hedging instruments, the government’s scheme to introduce feed-in-tariffs, which provided an inflation-indexed fixed rate for power generated and exported to the grid over 25 years was exactly what the industry needed to get started.

Figure 2. MW supported by power purchase agreements in the UK

Source: Srivastav (2022) using data from RE-Source 2020

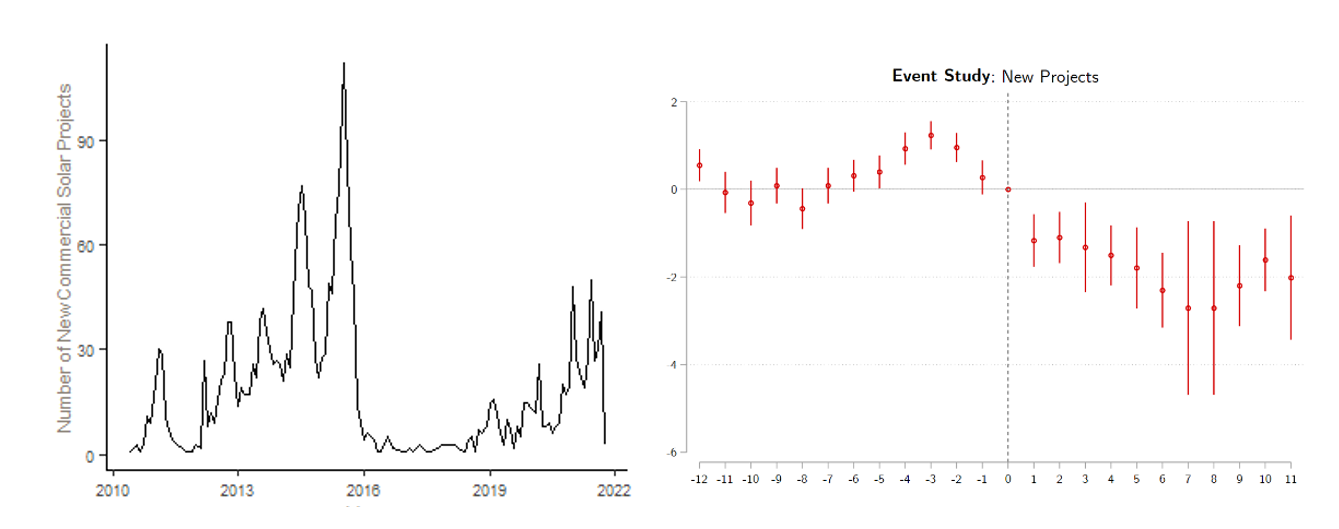

With the introduction of feed-in-tariffs in 2010, we saw the emergence and growth of commercial utility-scale solar power in the UK, and when the policy was significantly diluted in 2016, this growth plummeted, only to slowly recover a few years later when the technology had matured (Figure 3). But entry rates never reached previous peak levels. An event study plot shows a clear anticipation effect where solar developers hastened to enter the market to secure favourable 25-year contracts before the feed-in-tariff policy was watered down.

Figure 3. New commercial solar projects

Source: Srivastav (2022) using data from Renewable Energy Planning Database (2022)

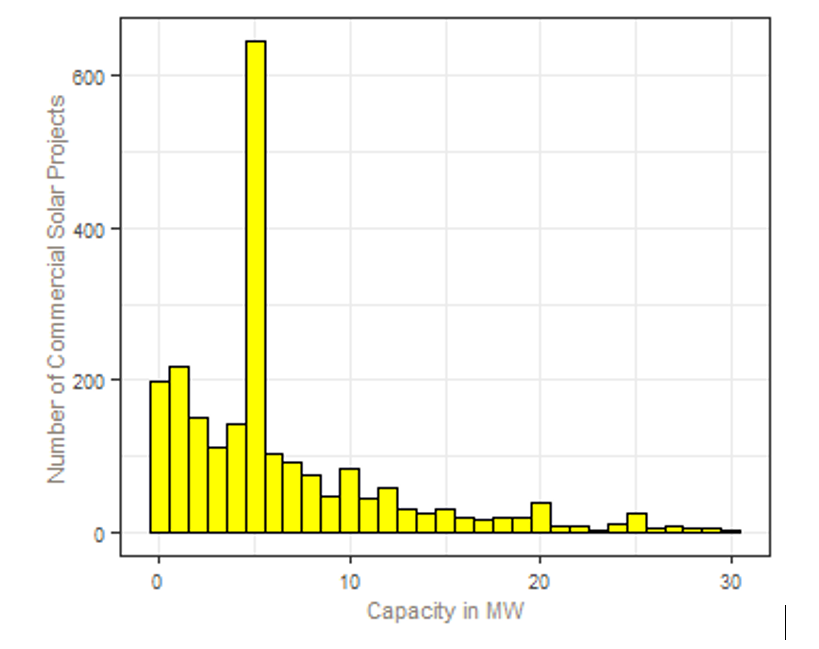

However, only relying on time-variation to pin down cause and effect is often unconvincing since many things could have changed in 2016. Perhaps more compelling is the clustering that happened around the feed-in-tariff’s eligibility threshold of 5 MW. The vast majority of commercial solar farms were exactly 5 MW, illustrating that firms were actively selecting around the policy and valued its benefits (Figure 4). Even though solar farms greater than 5 MW could benefit from the Renewables Obligation scheme, which gave tradable certificates, most firms preferred the guaranteed (“no-risk”) price under the feed-in-tariff as opposed to the variable (“risky”) price of renewable obligation certificates.

Figure 4. Number of commercial solar projects per MW capacity

Source: Srivastav (2022) using data from Renewable Energy Planning Database (2022)

But what if the feed-in-tariff created perverse incentives for projects that would have anyway entered the market to strategically downsize to become eligible for the policy? This would be a negative outcome since it would represent lost solar capacity instead of truly additional solar capacity.

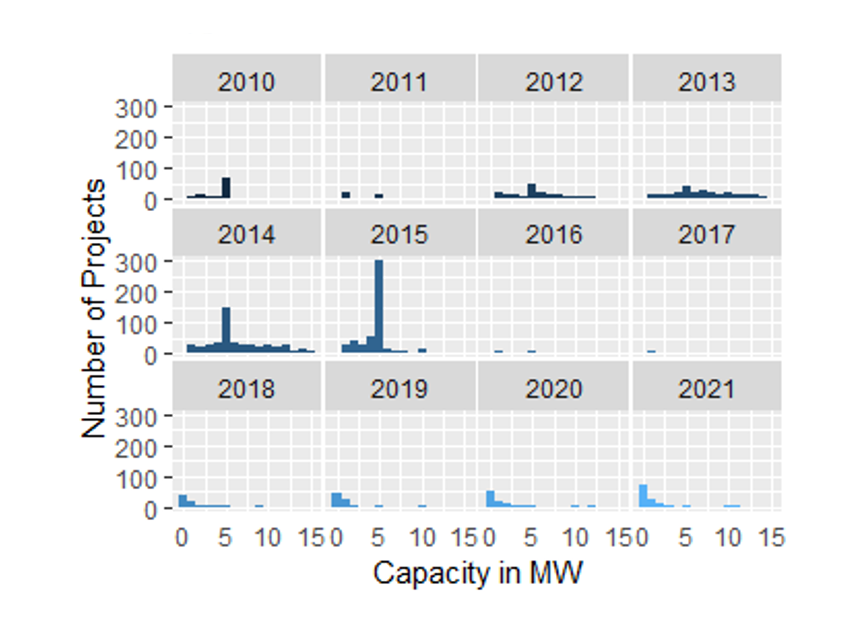

Two pieces of evidence potentially allay concerns about this. First, if after the feed-in-tariff was removed, there was a lot of entry at higher capacities, this could raise concerns that there was strategic manipulation during feed-in-tariff years. However, as Figure 5 shows, in post policy years (2019 onwards), there is hardly any entry at larger capacities up to 15 MW (there is some clustering in later years around 50 MW but this is still very small). Second, a bunching estimator can test this more formally by creating a no feed-in-tariff counterfactual. This method also suggests that the large mass of projects at 5 MW was additional and not just relocation from larger capacities. Specifically, only 6% of that capacity can be attributed to strategic downsizing, although the usual critiques of this estimation strategy apply.

Figure 5. Solar projects by size

Source: Srivastav (2022) using data from Renewable Energy Planning Database (2022)

The balance of different types of evidence points towards a potentially very large and significant impact. I find that the feed-in-tariff results in at least 2.3 GW of additional solar capacity between 2010-2015 (equal to one-fifth of the UK’s total solar capacity today). However, this is a lower bound estimate as it only considers utility-scale solar projects in a small window around the 5 MW eligibility threshold where there is causal identification. The true impacts are likely to be much larger.

Finally, in 2016, when the feed-in-tariff was highly diluted, there was no bunching at 5 MW, illustrating that apart from the discontinuity created by the feed-in-tariff, there are no other drivers that make firms choose solar farms sized at 5 MW.

Should the feed-in-tariff exist in perpetuity? No. It was precisely the fact that the feed-in-tariff was around for a limited amount of time that there was a rush to take advantage of it before it was gone. Precisely when the policy should be phased out is subjective. Entry rates and capacity additions did fall when the policy was diluted. Policymakers ultimately need to balance considerations around decarbonisation targets, energy security, and the costs of such schemes as well as their distributional consequences.

On the distributional side, feed-in-tariffs for rooftop solar were regressive since the scheme was funded by all ratepayers but high-income households disproportionately benefitted (Grover 2013). However, feed-in-tariffs for utility-scale solar supported general power generation and consequently did not confer private benefits for any one specific party.

The next iteration of solar support in the UK is doing-away with arbitrary cut-offs, such as the 5 MW threshold, and instead using an auction mechanism (see the contract-for-differences scheme). However, this market is currently threatened with claims that solar projects will not be allowed on most farmland. Such regulation could significantly damage the UK’s solar industry. It also goes against the idea that the market can decide what is the best use of land.

To conclude, some things are clear: risk-reduction can help bring early-stage technologies to market as it did for solar in the UK. Perfectly functioning credit markets for new technologies are often a fantasy. Government support in the early years can provide the necessary time and information for private markets to deepen and for technologies to mature, and as this happens, support can be phased out. Finally, regulation should be consistent with net-zero targets and avoid arbitrary rules.

You may like this episode of the LSE IQ podcast: How can we survive mass extinction?

♣♣♣

Notes:

- This blog post is based on “Bringing Breakthrough Technologies to Market: Evidence from Renewable Energy Feed-in-Tariffs”. Working Paper, presented at LSE’s Environment Week (September 2022).

- The post represents the views of its author(s), not the position of LSE Business Review or the London School of Economics.

- Featured image by Zbynek Burival on Unsplash

- When you leave a comment, you’re agreeing to our Comment Policy.