Public investment in developing energy sources that don’t cause climate change is a strategy for economic growth that could also contribute to the UK’s levelling up agenda, says Ralf Martin. His analysis indicates that subsidies for research and development in ‘clean’ technologies can bring returns more than 40% higher than average.

| #LSEUKEconomy |

|---|

Changing our behaviours will not be enough to address the climate emergency. The UK Climate Change Committee estimates that 84% of the UK path to net zero will have to be delivered via technology, rather than behavioural changes. This means we need further improvements in energy technologies that don’t have negative effects on the environment – that requires reducing the costs and improving the convenience of these “clean” options via innovation. That’s why many governments are targeting public subsidies for research and development (R&D) at clean technologies.

Governments have traditionally supported R&D efforts with the aim of promoting economic growth. This can work because private investors are likely to underinvest in innovation because they don’t internalise knowledge spillovers from their innovation efforts. For example, a firm might conduct research to develop a new product. When deciding how much money to spend on research they will consider the likely profit they will make if the research leads to a successful product. But they disregard the profits of other firms who might – on seeing the new product or the underlying research – be inspired to launch new related products also.

Does this mean that investments in clean innovation are a way both to promote growth and to prevent the climate emergency? This depends on- the opportunity cost of such an effort. If governments fund clean R&D, they will not fund something else, which might have been more beneficial for growth in the short run. In a new study in collaboration with the UK’s Department for Business, Energy and Industrial Strategy, we have been comparing the returns of public investments in various clean technologies with other leading technology areas such as artificial intelligence (AI) or biotechnology.

We use a new indicator – the Industrial Strategy Index (Guillard et al, 2021) – to estimate the economic return of public R&D subsidies. This takes into account the value of both direct and indirect knowledge spillovers from R&D. It also accounts for the fact that the value and cost of an innovative step might vary considerably between different technology types. We also consider that most knowledge spillovers will flow across national boundaries. But governments will typically want to target R&D investments that benefit their own constituencies. With our method, we take this into account even if the knowledge flows are indirect: they might traverse other countries before flowing back to the UK.

With this approach, we find that clean technologies are among the best R&D subsidy investments in which the UK government can engage, with returns that are more than 40% higher than average returns. In particular, R&D investments in tidal and offshore wind have the highest returns.

Spreading the spillovers

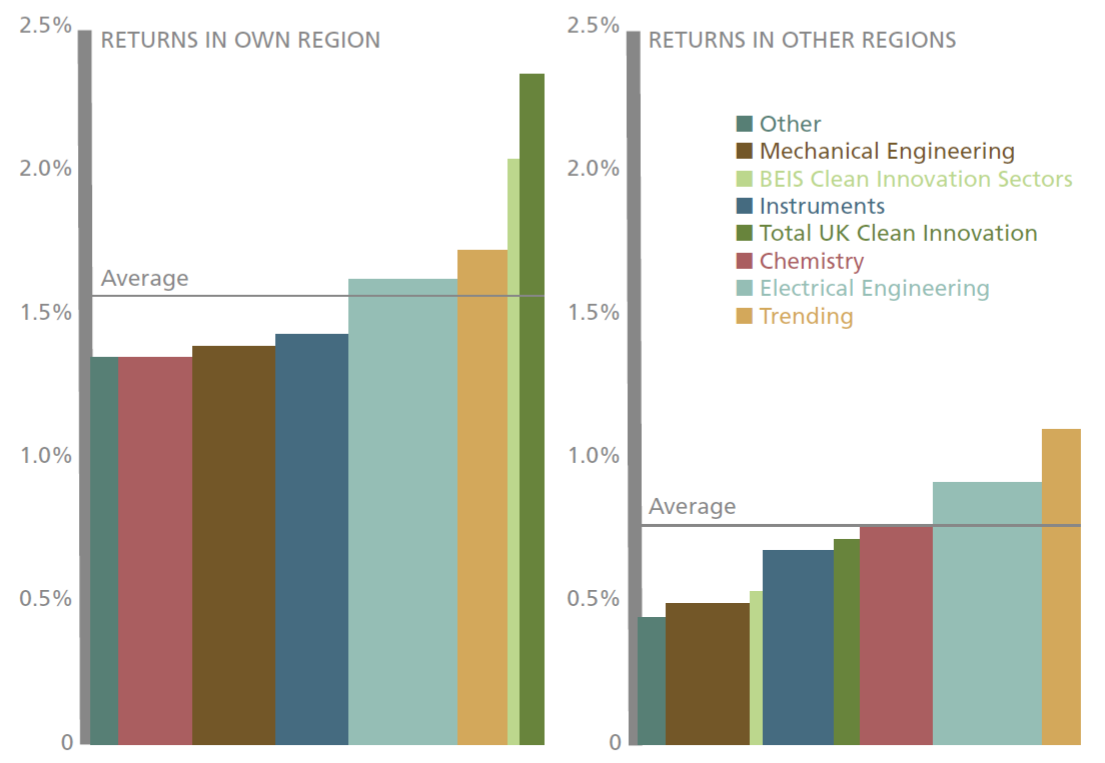

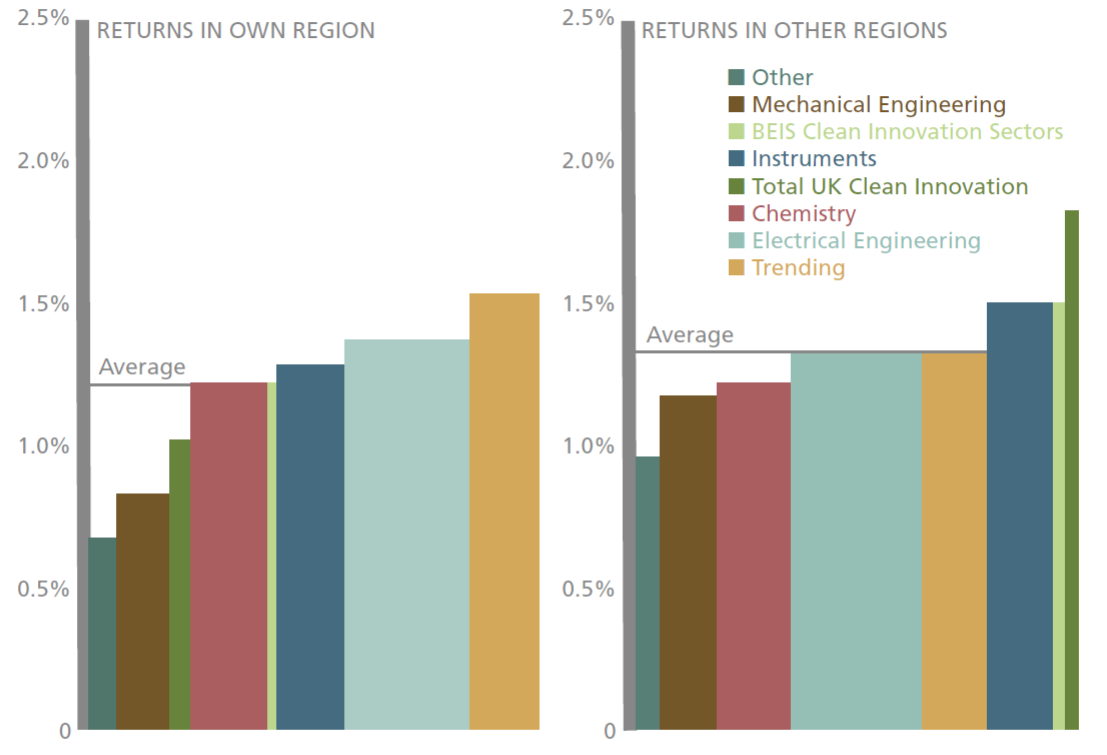

In a related study (Curran et al, 2022) we find that targeting clean technologies can be part of a sensible strategy for levelling up. For that we look separately at the returns of R&D subsidies for high productivity versus low productivity parts of the UK. Crucially, in doing so we only consider returns from knowledge spillovers if they are internalised within a respective regional grouping. This suggests that it is particularly in low productivity regions where clean technologies generate the highest returns. Figure 1A shows how the returns to public investments outside the “golden triangle” of Oxford, Cambridge and London have relatively high returns within the same regions, but less impact elsewhere. This is in contrast with high productivity areas inside the golden triangle where other technologies generate higher returns, as shown in Figure 1B.

Behaviour change is not enough to address the climate crisis

Figure 1A. Investments in clean innovation outside the golden triangle generate relatively high returns within these same regions. Returns to public investment in innovation taking place in non ‘golden triangle’ regions, retained in those regions (left panel) and felt in the rest of the country (right panel).

Figure 1B. Investments in clean technologies in golden triangle regions generate relatively high returns for the rest of the country.

Notes: Figure 1A: The vertical axis shows the estimated returns to a £1 additional R&D subsidy in the field within the same region where investments are made (left panel), and in the rest of the country (right panel). The horizontal line is weighted average return across all technologies for the relevant geography. The horizontal width of the bar indicates the size of a particular technology grouping by number of innovations outside the golden triangle. Patents from 2005-2014 are included. Figure 1B: the horizontal width of the bar indicates the size of a particular technology grouping by number of innovations inside the golden triangle. Source: Economy 2030 Inquiry (May 2022) ‘Growing Clean’. Analysis builds on Ralf Martin and Dennis Verhoeven (2022) ‘Knowledge Spillovers from Clean and Emerging Technologies in the UK’, CEP Discussion Paper No. 1834.

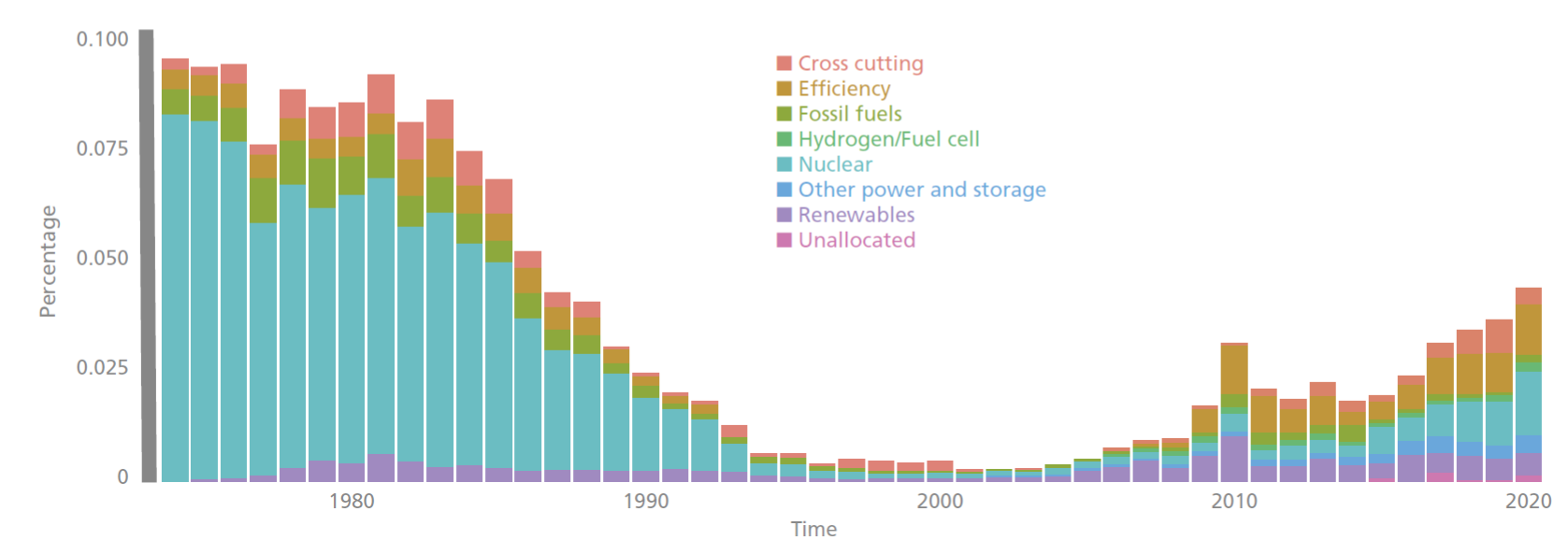

Figure 2. UK government energy R&D spending as share of UK GDP

Source: Author’s calculations based on IEA (International Energy Agency) data.

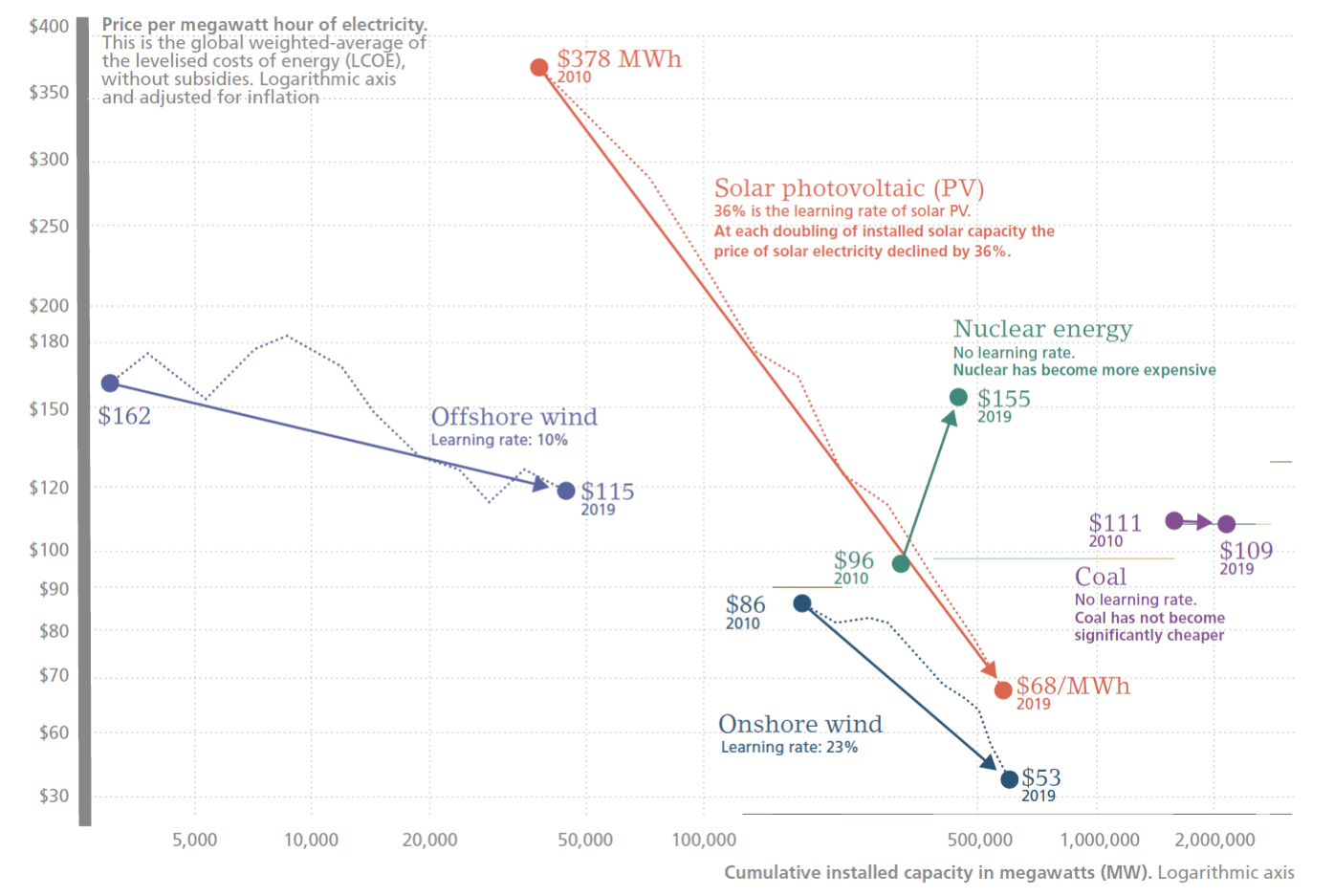

Figure 3. Electricity from renewables became cheaper as we increased capacity – electricity from nuclear and coal did not

Notes: IRENA 2020 for all data on renewable sources: Lazard for the price of electricity from nuclear and coal – IAEA for nuclear capacity and Global Energy Monitor for coal capacity. Gas is not shown because the price between gas peaker and combined cycles differs significantly, and global data on the capacity of each of these sources are not available. The price of electricity from gas has fallen over this decade, but over the longer run it is not following a learning curve. Source: OurWorldinData.org – research and data to make progress against the world’s largest problems. Licenced under CC-BY by the author Max Roser.

Renewable energy technologies have a track record of exceeding expectations

We find that investments in clean R&D will have high (above average) returns in low productivity regions even if those investments are undertaken in high productivity regions. In other words: the government supporting clean innovation in Oxford or Cambridge (say) is most likely be more beneficial for rest of the UK than investing in non-clean R&D in, for example, Newcastle. This is because clean innovations in the leading places generate vastly more knowledge spillover flows everywhere in the country.

Plugging on

UK government energy R&D spending has been rising in recent years. That said, the level of spending is less than 0.05% as a share of GDP – still far below the levels we saw in the early 1980s during the various oil price shocks. (see Figure 2) Also, whereas in the early 2000s R&D spending went up primarily due to funding of renewable energy projects and energy efficiency research, the surge in recent years was primarily driven by expanding support for nuclear energy.

Is this a good idea? Certainly not on the basis of our returns and spillover analysis, where nuclear technology consistently produces below average returns. But perhaps nuclear technology is a crucial part of achieving net zero? Possibly, but there are some serious question marks. It is now evident that renewable energy technologies, particularly wind and solar will be the cheapest ways of producing electricity – provided that the wind blows and the sun is shining. This requires back up technologies that can flexibly be switched on at short notice. Nuclear technology is not well suited for this task (see Hirth et al, 2015). It also has a unique track record of having received historically the lion’s share of public energy R&D while not delivering on many of its promises as recent cost trends illustrate (Roser, 2020). By contrast, as shown in Figure 3, renewable energy technologies have a track record of exceeding expectations with both dramatic cost reductions in solar and wind despite receiving relatively modest public support in historical context (Roser, 2020).

Explore our dedicated hub showcasing LSE research and commentary on the state of the UK economy and its future.

♣♣♣

Notes:

- This article appeared first at CentrePiece, the magazine of LSE’s Centre for Economic Performance (CEP). It summarises ‘Knowledge Spillovers from Clean and Emerging Technologies in the UK’ by Ralf Martin and Dennis Verhoeven, CEP Discussion Paper No. 1834

- The post represents the views of its author(s), not the position of LSE Business Review or the London School of Economics.

- Featured image by Martin Sanchez on Unsplash

- When you leave a comment, you’re agreeing to our Comment Policy.