Non-fungible tokens (NFTs) have risen and fallen at lightning speed. They are now trading at a small fraction of their historical high, a surprising development given the many promises of the technology in films, music, gaming, and fashion. Terence Tse and Mark Esposito write that this doesn’t mean that NFTs will slip into oblivion, but the path to recovery may be hampered by the illegal practice of wash trading—buying and selling the same asset repeatedly to manipulate trading volumes.

Non-fungible tokens (NFTs) were not supposed to turn out like this. However, as repeatedly shown in the past, many novelties frequently see their spectacular rise in popularity matched by a quick decline soon after. Indeed, if the Gartner Hype Cycle is to be applied, it can be expected that the “trough of disillusionment” immediately follows the “peak of inflated expectations”. The questions are often how swift the fall is and whether a technology can ever move to the next stage of the cycle – the “slope of enlightenment”.

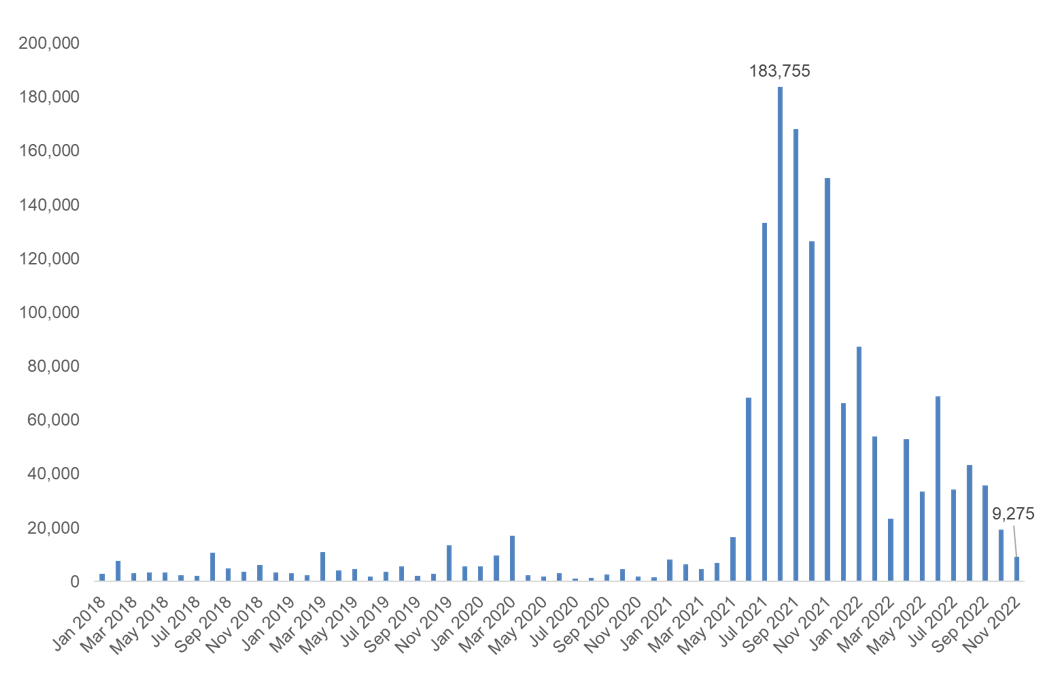

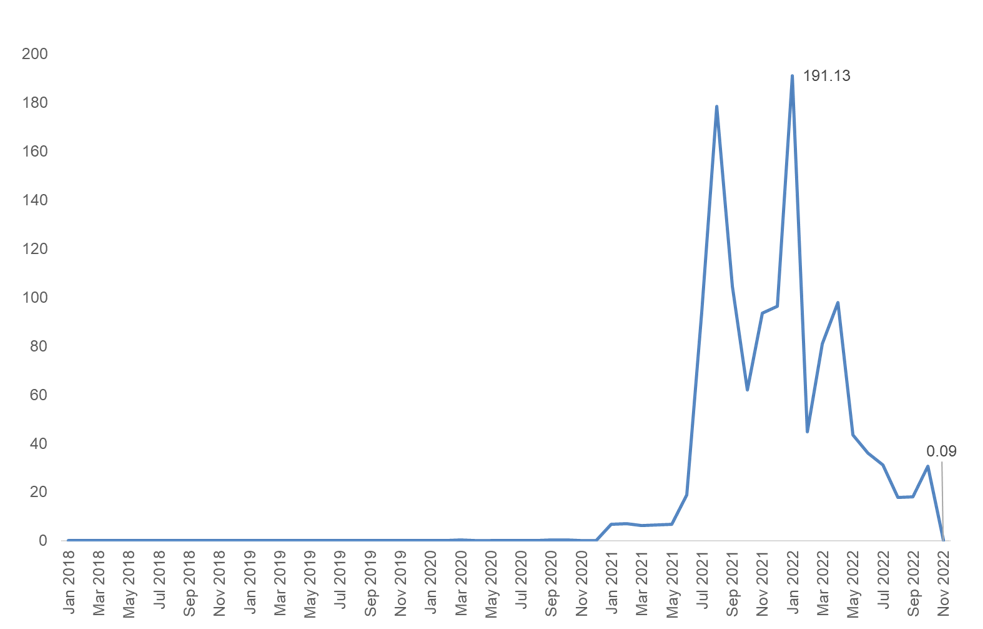

These questions are really relevant and timely. Once a darling for many investors, NFTs may have lost their appeal, according to data drawn from Statista. Figures 1 and 2 show that NFTs are now trading at a small fraction of their historical high, in terms of both number and value of sales. So, where are NFTs going? They could be going back on the rise or on a further decline.

Figure 1. Number of sales (daily average)

Figure 2. Sales value (daily average, in USD million)

Data source: Statista

Rise: a new use for NFTs

Such a drop in popularity is rather unexpected, considering that there was no shortage of speculation about the use of NFTs in real life. Films, music, gaming, and fashion have all been identified as areas where the use of NFTs could become widespread and popular. However, up to now at least, such speculations have yet to turn into reality. This of course doesn’t mean that NFTs will slip into oblivion. New services to assemble and distribute NFTs are still being introduced. For example, Meta has just rolled out features that enable creators to sell NFTs on Instagram. Indeed, the technology may now have found another new application: restaurants. The Flyfish Club in New York is scheduled to open this year. In its own words, it is a “member’s only private dining club where membership is purchased on the blockchain as NFT and owned by the token-holder to gain access to our restaurant and various culinary, cultural and social experiences”. Essentially, NFTs have now turned into a tradable and digital membership card.

Others, such as NFTable, allow the NFT owners to be “on the list” and have “their own table” for every visit at partnered restaurants. Or like Front of the House, which helps restaurants sell “digital collectibles” (i.e., NFTs) that grant holders special access. So, instead of having to put up with queuing or booking way in advance for very sought-after restaurants, one can pay $1,000 for the privilege to book once a week with only 24 hours’ notice. In effect, owners of these NFTs are paying to jump the queues.

Decline: wash trading

Despite the emergence of new NFT use cases, the path for the technology to regain popularity may be hampered by wash trading. Wash trading is the illegal practice of buying and selling the same asset repeatedly to manipulate trading volumes. The goals of wash traders are twofold: to create the impression that there is demand for an asset when there isn’t; and to inflate the asset’s value. A prospective buyer will be more inclined to pay top money for an NFT based on an active transaction history. The result: the manipulator makes a profit, while the buyer ends up with an ordinary, over-priced NFT.

This has become common practice. As much as 58% of all NFT trades in 2022 were thought to be wash trades. Indeed, January 2022 saw wash trading accounting for 80% of total NFT trading volume. Perhaps this should not be surprising, given that wash trading is found to be rampant in unregulated cryptocurrency exchanges. Recent research has suggested that 70% of the reported volume of these exchanges were the result of wash trading.

Wash trading is a lucrative business: it is estimated that in 2021, 110 wash traders collectively made nearly US$ 8.9 million in profit from unsuspecting buyers who believed that the NFTs they were purchasing had been growing in value, and had been sold from one distinct collector to another.

Buyers (sellers and artists) beware

Wash trading has serious consequences. Not only do buyers lose out, but the whole industry is likely to be negatively affected. Potential buyers will tend to become more cautious, which could lead to lengthier decision-making processes and also lower trading volumes. Artists and NFT users such as restaurants often depend on the data embedded in their NFT smart contracts to track their reputation and credibility over time, a process based on transparency. Wash trading is likely to have deleterious effects on credibility over time. Indeed, compounding with the collapse of FTX, cryptocurrencies as a whole – a market that relies heavily on trust – is probably going to get an even colder reception from potential investors and the general public in the near future. This, in turn, would only make it even more difficult for this already struggling blockchain industry to expand beyond speculation and leverage, let alone going mainstream.

It remains to be seen where NFTs are heading but they are undoubtedly facing stronger headwinds. Reaching the “slope of enlightenment” phase is in all likelihood going to take much longer.

♣♣♣

Notes:

- This blog post represents the views of its author(s), not the position of the European Commission, LSE Business Review, or the London School of Economics.

- Featured image by pinguino k, under a CC-BY-2.0 licence

- When you leave a comment, you’re agreeing to our Comment Policy.

I think there is some merit to stats and information you have provided…but it’s hard to make this kind of statement about NFTS when it is literally still in it’s infancy. Most people still don’t know what an NFT is even though they may have heard of it. There are also more and more ‘Giants’ (big name companies) getting in on the game which will in turn create more intertest in what NFTS are and what they are capable of being.