Whereas digital platforms function as intermediaries, the metaverse enables peer-to-peer transactions without intermediaries, increasing the number of feasible transactions and reducing costs. Marvin Hanisch, Curtis M. Goldsby and Vasileios Theodosiadis write that this business model is based on the partial removal of intermediaries, efficiency gains, direct network effects, strong growth patterns and the interoperability of technology standards that enable the seamless transfer of actors, assets and payments across digital spaces.

Ever since Mark Zuckerberg announced the renaming of Facebook to Meta in 2021, the idea of the metaverse has attracted widespread attention. According to McKinsey & Company (2022), investments in metaverse initiatives surged to over $120 billion in the first five months of 2022, far surpassing the $57 billion invested in the entirety of 2021.

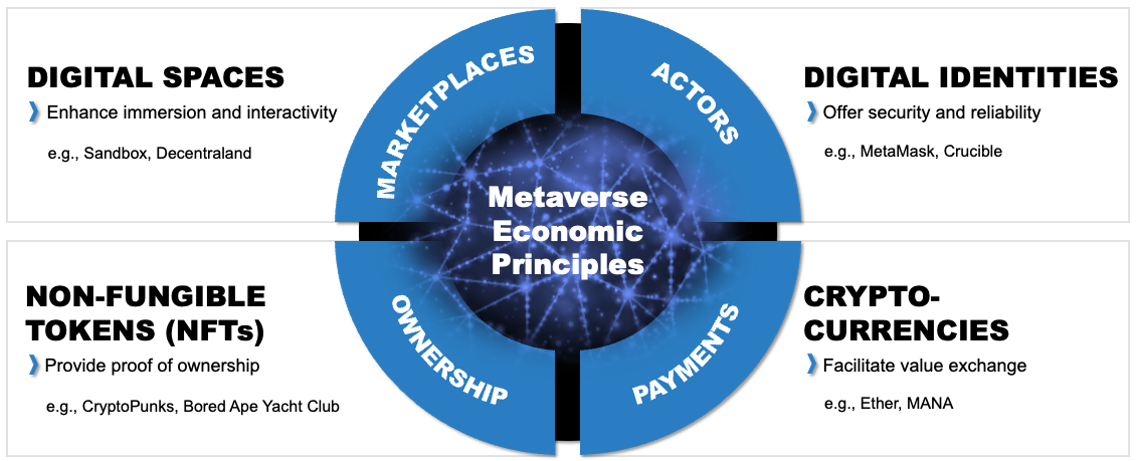

In principle, the metaverse is an online, interactive, and shared digital space. In this article, to understand the underlying mechanisms more precisely, we distinguish between four economic principles that make up the metaverse: digital spaces (marketplaces), digital identities (economic actors), non-fungible tokens / NFTs (ownership certificates), and cryptocurrencies (payment methods). Clearly, these technologies rely on appropriate hardware, such as powerful server infrastructures as well as fast and reliable Internet connections, but our focus lies on the aspects that differentiate the metaverse from the current digital business world including platform-based business models such as those of Facebook, Alibaba, Airbnb, and Uber. Figure 1 summarises the four economic principles that serve as the baseline for future business models in the metaverse.

Figure 1. The four economic principles of the metaverse

Digital spaces as marketplaces

It is important to realise that the metaverse is not a single space, but rather a distributed system with many virtual spaces that are partly connected and partly separated. The benefits of such digital spaces are a higher level of engagement and immersion through the interactive 3D environment compared to a relatively rigid 2D environment, as is the case with most online applications today. In addition, digital spaces can be temporary (such as for the duration of a meeting), are easily scalable (for instance, to fit the number of participants), allow new uses of space (such as participants floating in the air), can be duplicated (as is the case with two parallel sessions of the same talk), and are generally less costly to provide than physical locations.

Digital identities as economic actors

Actors are represented as digital avatars in the metaverse. However, these avatars are initially only empty shells. At the core, there are digital identities that make the avatars unique and tamper-proof. Currently, digital identities are usually federated, managed by central providers such as Facebook, Google or Apple. However, an alternative option is to store digital identities in a decentralised manner via a blockchain network, where personal data is not stored on a server, but only secured locally and shared selectively and for a limited time for the purpose of exchange.

Digital identities differ from regular identity proofs such as a passport, in that they allow multiplicity and multitenancy. Multiplicity means that a single person can have multiple digital identities. For example, companies could operate in the metaverse through digital identities representing their digital presence in the virtual space. They also enable the logical opposite of multitenancy, where a single digital identity can be owned and used by multiple individuals, organisations, or institutions. For example, a company’s digital customer service agent could be operated by different employees in different time zones to provide 24-hour service to customers.

Non-fungible tokens as ownership certificates

Non-fungible tokens (NFTs) are the digital equivalent of ownership titles in the physical world. NFTs register the identifier of the associated item in a digital ledger, providing a publicly verifiable proof of ownership or certificate of authenticity. When an NFT-protected item is transferred (say, when they are sold or temporarily loaned), the digital ledger is automatically updated to provide a complete and continuous record of the item’s transaction history. Through NFTs, ownership of digital items can be transferred seamlessly, securely, and at much lower costs compared to notary services.

In the broader business context, NFTs can be used to protect all sorts of digital items, including brand names, logos, music, and registered colors. Content creators can sell and license digital objects, such as branded clothing for digital avatars, and even offer more complex items such as digital vehicles (for example, a branded car with customised sound options), digital spaces for work (such as a conference room) and play (think of a room for a party), engineering blueprints, and computer codes. In addition, digital spaces can be equipped with NFT-backed digital items such as pictures and furnishings, similar to the physical world. Owners of such digital items can collect, lend, and sell them as they could with physical objects, creating an entirely new market for digital items. NFTs allow users to create highly configurable personal spaces that are digitally secured much like the lock on an apartment door.

Cryptocurrencies as payment methods

Payments in the metaverse are facilitated by blockchain-backed cryptocurrencies, such as Ether and MANA, which are circulated on public blockchain networks. Cryptocurrencies offer several advantages, including secure and direct transactions between actors without the need for intermediaries like traditional banks, as well as the prevention of double spending by ensuring that multiple digital identities cannot make parallel transactions. When combined with digital identities, cryptocurrencies make transactions secure, transparent, and store immutable proof of payment for future reference. Cryptocurrencies can also transform traditional currency exchange, as national borders are replaced by fluid boundaries between digital spaces that can each accept different currencies, with some currencies perhaps becoming a universal means of payment.

Business models in the metaverse

The idea of the metaverse represents the basis of a new generation of business models. While the last two decades were dominated by the emergence of digital platforms that function as intermediaries and bring users together in a concentrated network, the metaverse reverses this logic and enables new forms of peer-to-peer transactions without intermediaries, in a distributed network. The possibility of seamless peer-to-peer interactions in distributed and interoperable networks increases the number of feasible transactions, while reducing transaction costs that would occur if intermediaries were included in the exchange. The business model logic of a blockchain-powered metaverse is thus based on the partial removal of intermediaries and the associated efficiency gains, the realisation of direct network effects and the resultant strong growth patterns, and the interoperability of technology standards that enable the seamless transfer of actors, assets and payments across digital spaces.

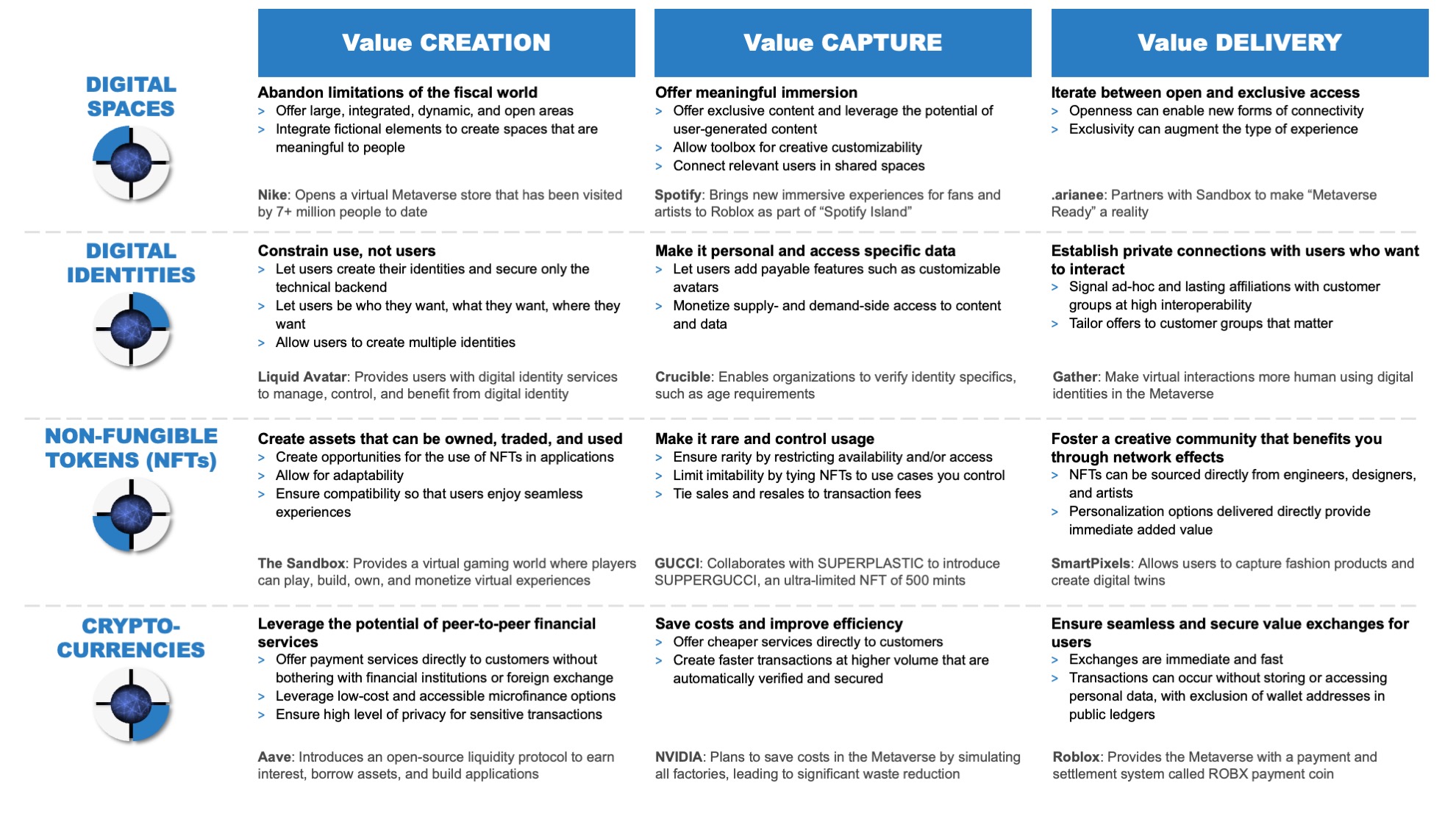

Figure 2 summarises how this business logic of the metaverse creates new business model opportunities, particularly in terms of its main pillars: value creation, value capture, and value delivery.

Figure 2. Business model opportunities in the metaverse

Conclusion

We highlight that the metaverse is much more than just an immersive world. Its breakthrough difference lies in its new economic logic based on blockchain-powered peer-to-peer transactions that render classic intermediaries obsolete and enable new ways of doing business in digital spaces. Specifically, we show how marketplaces become digital spaces, actors are embodied by digital identities, ownership moves to non-fungible tokens, and payments are supported by cryptocurrencies. By analysing the business implications of metaverse technologies, we provide first inspiration as to how firms can create, capture, and deliver value. In doing so, we also pave the way for new lines of exciting metaverse research that balances its business model logic with technologies at the bleeding edge.

- This blog post represents the views of its authors, not the position of LSE Business Review or the London School of Economics.

- Featured image provided by Shutterstock

- When you leave a comment, you’re agreeing to our Comment Policy.