Developing countries compete to attract multinationals to induce development. Becoming suppliers to multinationals could improve domestic firms’ technology and managerial practices, and the host country’s economy could benefit. However, evidence to support this has been scarce. Using administrative data on firm-to-firm transactions from Costa Rica, Alonso Alfaro-Urena, Isabela Manelici and Jose P Vasquez find that first-time suppliers to multinationals in manufacturing and services tend to experience substantial, long-lasting performance improvements.

Governments worldwide compete fiercely through costly public programmes such as tax holidays or subsidised industrial infrastructure to attract multinational firms. They expect that multinationals benefit not only the receiving sectors, by pushing their technological frontier, but also the whole economy, by inducing productivity catch-up. This latter prospect is particularly appealing for developing countries, where domestic firms are smaller and less productive and thus have greater potential for improvement. A World Bank Report from 2018 showed that 72 per cent of developing countries offer tax incentives to multinational firms, and these incentives have become more generous over the past decade. A better understanding of the overall effects of multinational firms on developing economies and the mechanisms involved is critical for assessing whether these expenses are justified.

Scholars and policymakers view direct supply chain linkages as the most promising pathway for the performance gains attributed to multinational firms. Becoming a supplier to a multinational could generate productivity spillovers via the sharing of technology and managerial practices. However, the empirical evidence to support this theory has been scarce.

There are three interrelated reasons why finding credible evidence has proven elusive. First, it has been exceedingly difficult to obtain the type of data necessary to observe direct business linkages between domestic suppliers and multinational buyers. Second, without observing actual linkages, it is difficult to tease out the direction of causality between supplying to multinationals and changes in firm performance. Although improvements in firm performance may be a result of the entry of multinational affiliates, it is also possible that the improving performance of potential suppliers is what attracted the multinational firms to the country in the first place or that a third unknown factor caused both occurrences concomitantly. Third, the same inability to directly observe suppliers has limited previous research from painting a complete picture of the relevant effects.

In our research, we leverage a rich collection of administrative data on firm-to-firm transactions from Costa Rica, where we observe direct linkages between suppliers and buyers. This data allowed us to address the challenges mentioned above and shed light on the comprehensive benefits of starting to supply to a multinational buyer. We find that first-time suppliers to multinationals experience substantial and long-lasting improvements in firm performance. Four years after their first sale to a multinational buyer, domestic firms have on average 33 per cent higher sales, 26 per cent more employees, and 22 per cent more net assets. Although suppliers to multinationals tend to be larger and more productive than other domestic firms to begin with, we find no evidence of suppliers being selected by multinational corporations based on past firm growth. This suggests that the performance gains that we observe are indeed a result of the newly formed relationship with these multinational buyers and not just due to reverse causality or selection bias.

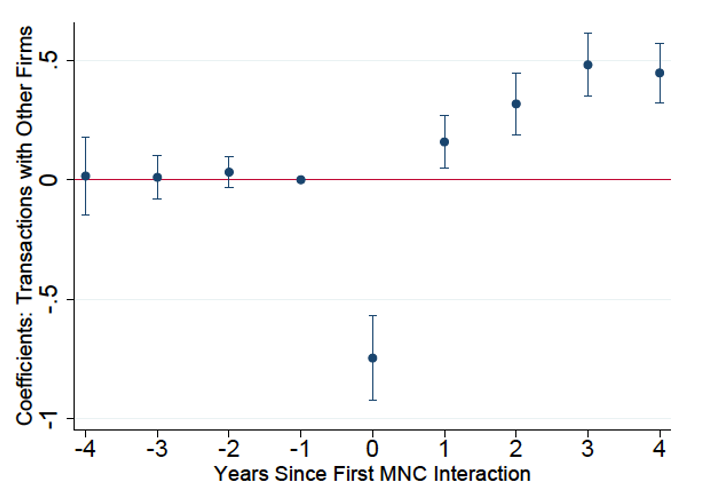

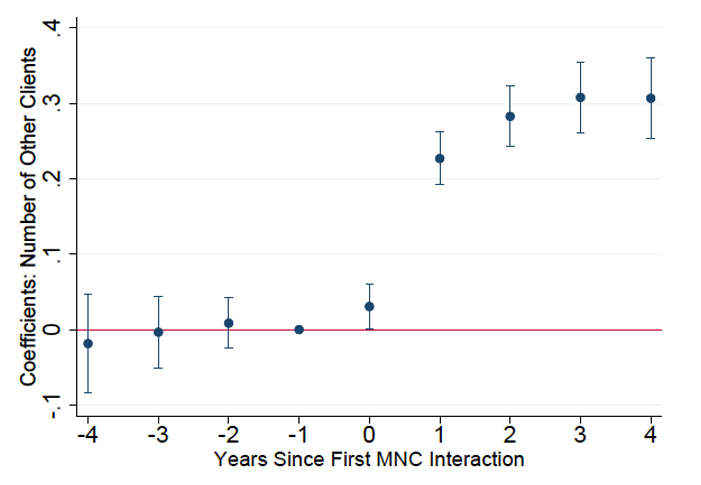

One natural concern is that the growth of these suppliers may be purely mechanical, with no further impact beyond the size increase directly owed to transacting with the first multinational buyer. To address this point, we study the effects of becoming a first-time supplier to a multinational on the domestic firm’s sales performance with all their other buyers. As Figure 1 shows, we first find that in the short run, domestic firms are capacity constrained and need to downsize their business with their other buyers. However, four years after starting to supply multinational enterprises, domestic firms see an increase of 45 per cent in their sales to all their other buyers. The increase in sales is reflected in both the extensive and intensive margins of sales, with a 36 per cent increase in the number of buyers, as shown in Figure 2, and a 14 per cent increase in the average sales per buyer.

In addition to these increases in firm size, we also find a positive effect on different standard measures of total factor productivity (TFP), a variable that indicates the efficiency with which firms use their inputs. Domestic firms see their TFP increase by six to nine per cent after the first sale to a multinational buyer, signaling improvements in their production processes. Taken together, these results are informative about changes in the suppliers’ appeal to other potential buyers. They indicate that the multinational buyers have a more profound effect on their new suppliers than just the initial increased demand.

Figure 1. After becoming a first-time supplier to a multinational, domestic firms increase their sales to other buyers

Figure 2. After becoming a first-time supplier to a multinational, domestic firms increase their number of other buyers

One interpretation of the wide-ranging improvements in firm performance documented above is that domestic firms have production processes with increasing returns to scale, and any order as large as that coming from the first multinational buyers would have yielded the same effects. Put differently, the multinational nature of these buyers may not have been the driver of the positive effects we find. To test this hypothesis, we studied the effects of similarly large demand boosts from other non-multinational large buyers in Costa Rica – the government, a large domestic buyer, or a domestic exporter. We show that the effects of these other demand boosts are not as large and long-lasting as those of demand boosts from multinational buyers. Multinational buyers do seem to offer learning opportunities and reputational gains with benefits above and beyond the demand boost.

While the above findings already paint a clear picture of multinationals’ positive impact on first-time suppliers, there are still important features of these relationships that cannot be directly documented using administrative data. To make additional progress, we surveyed managers in 164 domestic suppliers and multinational buyers to gain further insights into the benefits of supplying to multinationals. Both multinational buyers and their domestic suppliers agreed that multinational buyers help new domestic suppliers in three ways: the sharing of blueprints or details about the expected product or services, visits of the supplier to the multinational to learn about the processes using their input, and visits of the multinational to the supplier to carry out audits and offer advice on improvements.

Moreover, we surveyed domestic firms about the changes that they experienced after their first supply relationship with a multinational firm. Around 62 per cent of the domestic respondents mentioned having expanded their product scope, particularly in terms of higher-quality goods and services. When asked whether it was easier to find more multinational buyers after the first such buyer, 78 per cent responded positively. Similarly, their improved visibility in the domestic market helped with securing new domestic buyers. Overall, domestic firms experience several interrelated changes as a consequence of becoming suppliers to multinational buyers, including better managerial and organizational practices, expansions in product scope with higher-quality products, and improved reputation. Our surveys support the hypothesis that becoming suppliers to multinational firms is transformative for domestic firms.

In sum, multinational affiliates that source locally not only provide increased demand for the goods supplied by domestic firms but also provide valuable learning opportunities and improved credentials. Domestic firms in developing countries particularly stand to benefit from joining the supply chain of a multinational firm. There are two caveats to this optimistic set of findings. First, multinational affiliates tend to be heavy importers, which limits the opportunities for domestic firms to start supplying to these multinationals and experience the benefits documented in our research. More research is needed into the extent to which multinational affiliates actually rely on local supply chains, the reasons behind their low reliance, and the scope for policymakers to intervene to increase this reliance. Second, it is noteworthy that not all supply relationships with multinational buyers lead to performance improvements for domestic firms. For instance, it is most beneficial to supply multinationals in manufacturing and services, and multinationals whose headquarters’ country has a higher GDP-per-capita and better management practices. This finding is a note of caution regarding the type of multinational affiliates and linkages to these firms that governments might want to support.

- This blog post is based on The Effects of Joining Multinational Supply Chains: New Evidence from Firm-to-Firm Linkages, Quarterly Journal of Economics.

- The post represents the views of its author(s), not the position of LSE Business Review or the London School of Economics.

- Featured image provided by Shutterstock.

- When you leave a comment, you’re agreeing to our Comment Policy.