In an environment with low migration costs and relevant tax rate differentials among countries, the net balance of top-income individuals’ flow is a crucial policy issue. For a single country or region, depending on people’s sensitivity to tax differentials, setting higher taxation rates may originate a leakage of highly productive workers, with a related reduction in fiscal revenue. On the other hand, fostering fiscal competition with lower general taxation or favourite schemes may induce a classical rat race where all the players end up in a suboptimal outcome.

To assess how sensitive are the migration choices of top-incomes to the tax burden, we focused on the European football market, analysing data regarding footballers’ career, overall top tax rates (henceforth, top MTR), and favourite tax schemes in 16 countries between 2007 and 2016. Our choice is motivated by the fact that not only are European footballers top income-earners, but they are even likely to provide an upper bound to individuals’ tax-induced mobility, mainly because athletes have a shorter-than-average work horizon (15-20-year max). A third motivation is related to the availability of good data: those from the OECD, Eurostat, and national archives for tax rates at the national and local levels, and special rules aimed at attracting foreigners with preferential tax schemes. The transfermarkt.com site for data on football players and national leagues is one of the most important online communities of football supporters providing various detailed information on players and teams.

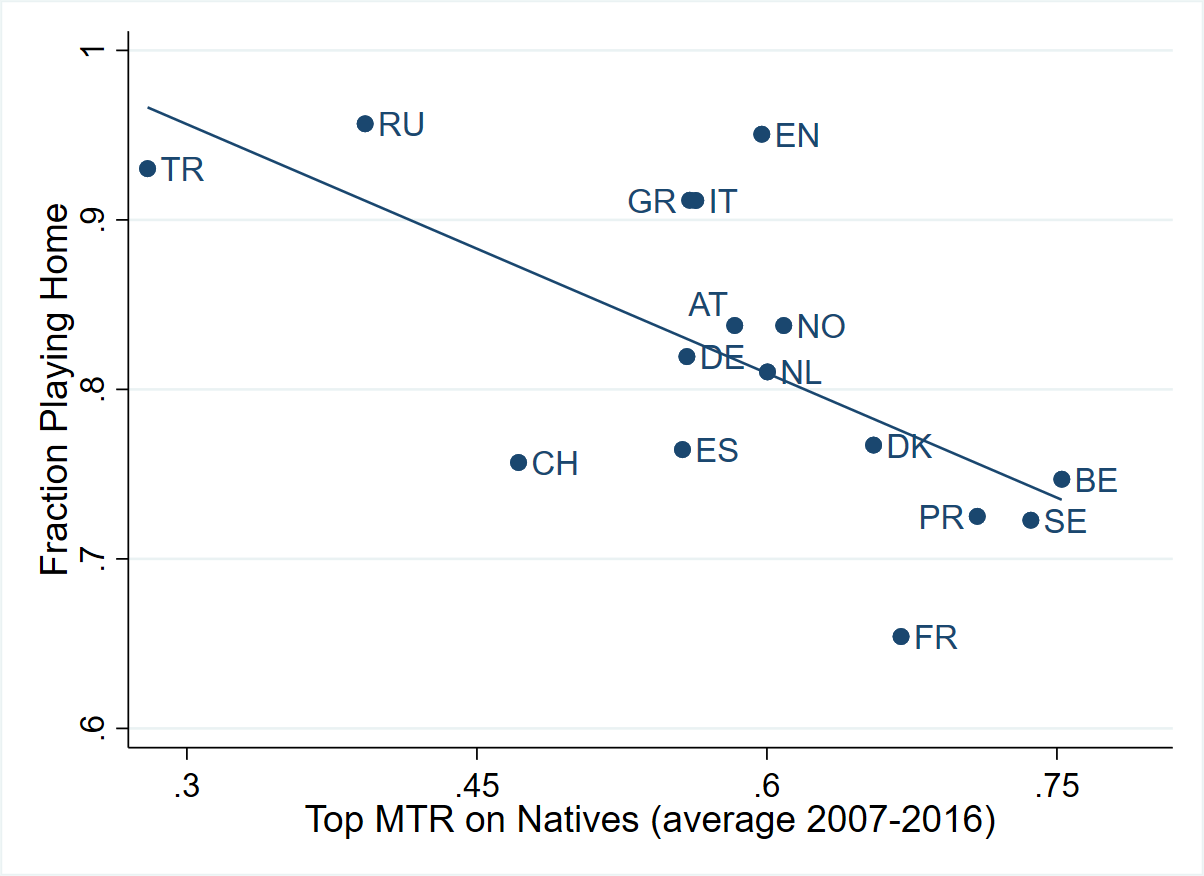

We have found evidence of two composition effects for which top income taxation is likely to have had an impact. The first one is illustrated in Figure 1, which plots the share of footballers working (i.e., playing) in their own country against the top MTR. As can be easily seen, the higher the top MTR, the lower the share (and, implicitly, the absolute number) of domestic players. It is worth remembering that this simple bivariate analysis is not informative of whether the relationship is mainly driven by moving abroad, being displaced by incoming foreigners, or simply leaving the market.

Figure 1. The relationship between players nationality and top tax rates in Europe

Source: authors’ elaboration

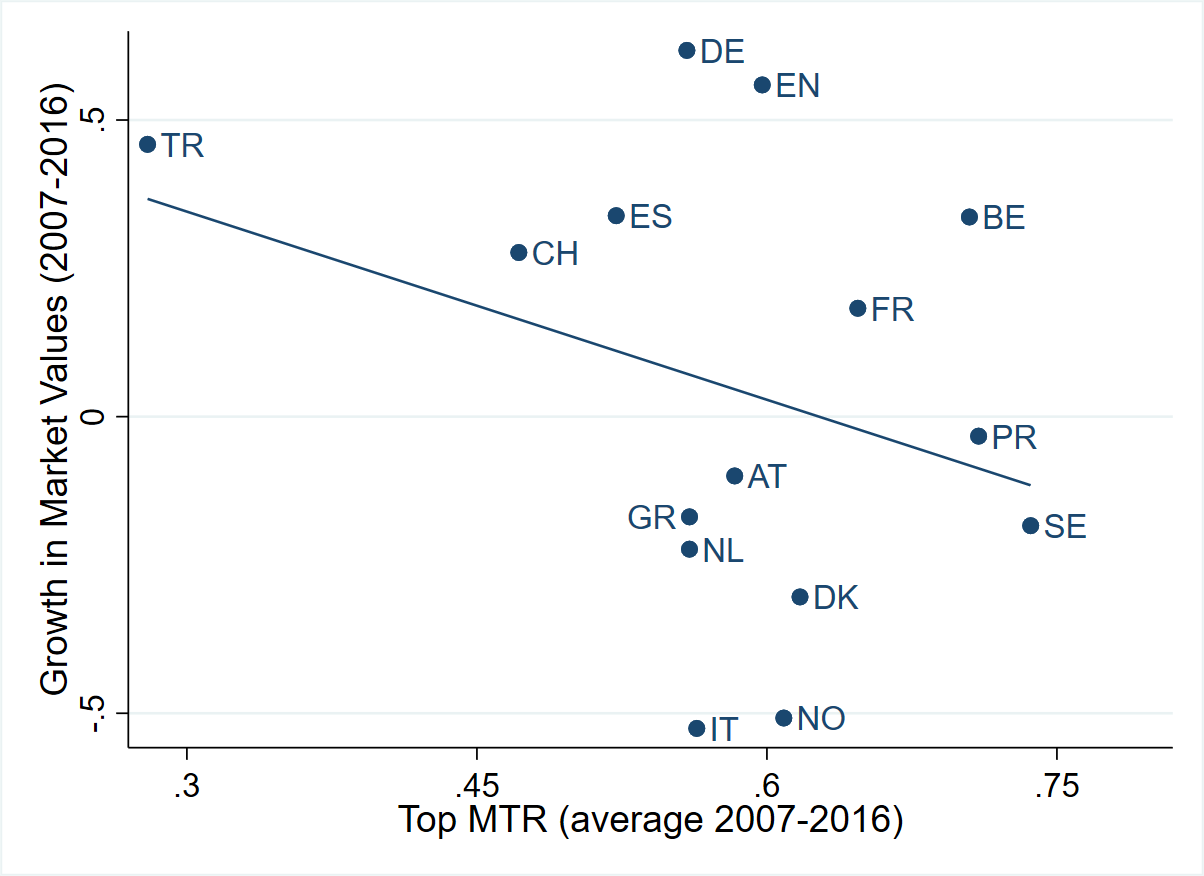

The second composition effect is made explicit thanks to the exploitation of one crucial information provided by transfermarkt.com, namely, the ‘market value’ of footballers (as inferred from the evaluations of the community of users). This variable represents a good guess of a player’s position in the income bracket. Indeed, distinguishing between 1%, 0.1%, or 0.01% may be very informative (e.g., Saez and Zucman, 2016). Figure 2 sheds light on the evolution of the cross-country distribution of the market value (once merging all players and teams for each country) in its relationship with the top tax rate. In the period considered, a clear negative relationship arises between the growth rate of the national level market values and the average MTR in the country. The higher the MTR, the lower the growth of market value, meaning countries with higher taxation on top incomes have worsened their relative position vis-à-vis countries with lower taxation.

Figure 2. The relationship between the evolution of national leagues market values and top MTR in Europe

Source: authors’ elaboration

Some deeper inspection

Top income employees (even of a peculiar type) do not decide where to work independently. They need an employer hiring them! In other words, migration is the by-product of the changes in the net benefits that teams and players jointly obtain from their matches. Lower tax rates can improve leagues’ overall quality by attracting more top-quality players. At the same time, this may displace low-quality ones, inhibiting them from avoiding high taxation rates. In an ongoing research project, we are dealing with this issue by applying the Maximum Score Matching, an econometric method that permits to account explicitly for employers’ role (here, football teams) in the mobility of employees (here, football players). Each observed team-player match is considered the outcome of a matching process where agents compete to match their preferred partners. This technique is robust to lack of information on wages and agent-specific characteristics and allows us to simulate various scenarios with different assumptions regarding the dimension and nature of the labour demand, namely whether the number of jobs is fairy fixed or completely flexible (elastic demand).

The role of marginal taxation incentives is confirmed within this context where demand and supply match. In an elastic labour demand scenario, a 1% reduction in tax rate increases players’ numbers by around 0.2%. The effect is highly heterogeneous: a) foreigners are much more sensitive than natives (up to five times); b) top players (which presumably are top earners) are more sensitive than low-quality ones. Especially in a context of rigid demand (UEFA and national regulations may limit the maximum number of players that can be enrolled on a yearly base), the combination of the two effects can entail that a reduction in tax rate may improve the average quality of the league, by attracting top players who displace low-quality ones.

An equilibrium migration of 0.2% for a 1% increase of the MTR entails a revenue maximising tax rate of 82%. It turns out that substantial taxation of top incomes may be effective even in a context with poor international tax coordination. However, this is likely to be achieved at the expense of someone captive to the local economy (“not very top” and “natives”). Future research effort can be devoted to different environments and markets such as CEOs and academic professors’ recruitment, or inventors’ residence choices.

♣♣♣

Notes:

- This blog post is based on TAX-INDUCED MIGRATION OF TOP INCOMES: Evidence from the market for European footballers, presented at the European Economic Association’s Annual Congress, August 2020.

- The post expresses the views of its author(s), not the position of LSE Business Review or the London School of Economics.

- Featured image by Connor Coyne on Unsplash

- When you leave a comment, you’re agreeing to our Comment Policy

Rinaldo Brau is a professor of public economics in the department of economics and business at the University of Cagliari; CRENoS.

Rinaldo Brau is a professor of public economics in the department of economics and business at the University of Cagliari; CRENoS.

Cristian Usala is a postdoctoral researcher at the University of Cagliari and CRENoS.

Cristian Usala is a postdoctoral researcher at the University of Cagliari and CRENoS.