Despite the COVID-19 pandemic, the UK has been continuing its preparations to leave the EU by the end of 2020. COVID-19 has had a huge negative impact on the UK economy and Brexit will present another profound change in circumstances for UK businesses. Analysing real-time business survey data from the UK, this column shows that sectoral impacts of COVID-19 and Brexit are very different. Sectors that have suffered less during the lockdown are the ones that are exposed to bigger negative impacts from Brexit, as measured by actual effects since the Brexit vote and predicted effects from higher trade barriers with the EU, write Josh De Lyon and Swati Dhingra (LSE).

As the world economy experiences its biggest downturn for a century (Gopinath 2020), it is widely agreed that the policy response to COVID-19 must be decisive and coordinated (Baldwin and Weder di Mauro 2020). Meanwhile, in the UK, where 50% of companies reported a fall in business in April 2020 relative to the past three months, the government continues to negotiate its exit from the EU – its biggest trading partner – aiming to complete the transition by the end of the year.

Both COVID-19 and Brexit will have a profound impact on economic activity in the UK, but there may be big differences in terms of which sectors they affect. In this column, we show new evidence that the sectors that have been initially most negatively affected by COVID-19 are generally different to those that are affected more by Brexit (De Lyon and Dhingra 2020).

To measure the effects of COVID-19, we use firm-level survey data for April 2020 made available to us through the Confederation of British Industry (CBI). We aggregate this to the sector level to compare with measures of the economic effects of Brexit across UK sectors taken from previous work.

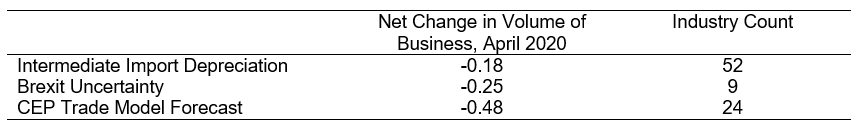

Table 1 shows that there is a negative, if any, correlation between changes in business volumes in April 2020 and the ongoing and expected impacts of Brexit as captured by three different measures. This means that generally, the sectors hit by COVID-19 in the first month of lockdown have been different to those expected to be affected by Brexit. This is true regardless of which Brexit measure is used, despite each varying in the time period covered and nature of the specific effect caused by Brexit.

The first of the Brexit measures captures each industry’s exposure to the sharp depreciation in the value of the pound on the night of the EU referendum in June 2016. The world trading system has developed over recent decades so that now the majority of world trade is in intermediate goods and services that are used as inputs into production by businesses. Therefore, the devaluation of the pound meant that companies with a high share of imported inputs faced increasing costs to production (Costa et al. 2019). This measure, therefore, captures effects of Brexit that occurred immediately following the referendum.

The second measure – Brexit uncertainty – captures business responses to the Decision Maker Panel conducted by the Bank of England concerning uncertainty due to Brexit and the ongoing negotiations in the period following the referendum (Bloom et al. 2019). This measure is contemporary and broad, although it is restricted to highly aggregated industry categories.

The third measure is the outcome of a state-of-the-art trade model and captures the predicted long-term impact of the expected trade relationship between the UK and EU after Brexit (Dhingra et al. 2017). It ignores adjustment effects and focuses only on trade – omitting other factors such as foreign investment and migration. It is similar in nature to the government’s own economic model but, crucially, contains more detailed industry predictions, allowing for a more thorough comparison with the effects of COVID across sectors.

Table 1 Correlation coefficients for changes in business volume in April with three measures of the current and future effects of Brexit

Notes: The net change in volume of business is the percentage of businesses reporting an increase in volumes in April 2020 relative to the past three months minus the percentage reporting a decrease. The measure is then de-trended by subtracting the corresponding measure for 2019 to account for pre-existing trends. Responses are weighted by firm-size according to employment. We correlate this variable with three measures of Brexit effects. First is the intermediate import value-weighted measure of depreciation on the night of the referendum (Costa et al. 2020). Second is the long-term industry-level forecast of the CEP trade model (Dhingra et al. 2017) and third is the measure of Brexit uncertainty reported by firms (Bloom et al. 2019). Correlations are weighted by industry size and use the relative rankings of each industry. In all cases but one, the weighting and de-trending of the COVID measure does not affect the sign of the correlation.

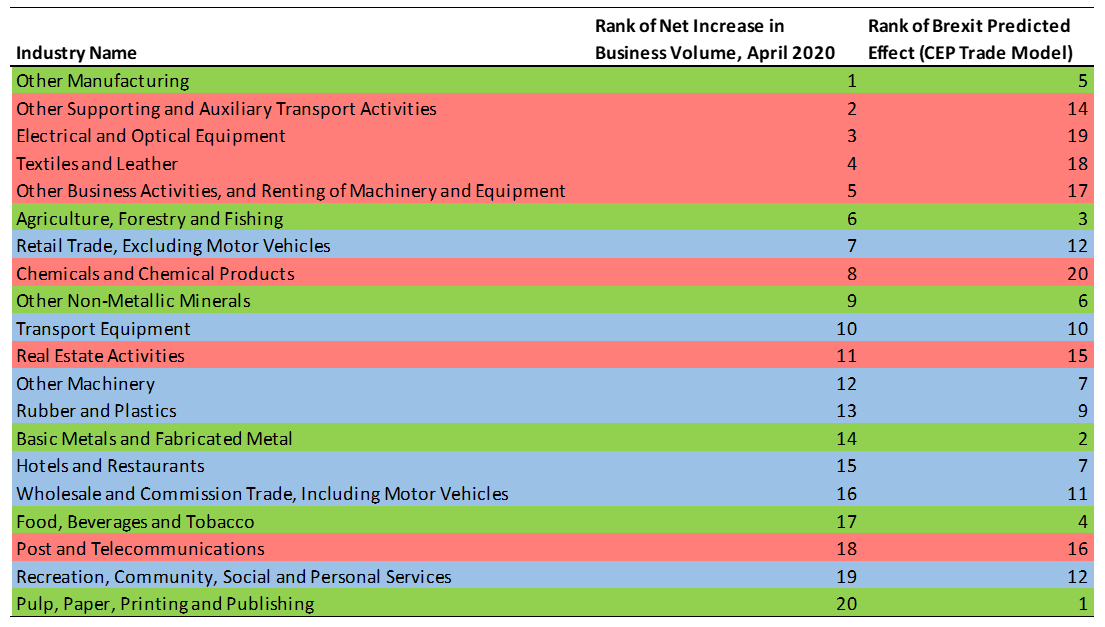

To explore these cross-industry correlations in detail, Table 2 presents the full ranking of industries according to how positively (top) or negatively (bottom) they have been performing in April 2020 relative to the past three months and their trend of business volumes a year before. We colour each row according to the predicted long-term effect of Brexit – with green being the least negatively (or positively) affected sectors and red being most negatively affected with blue being those in between.

One obvious difference that emerges from the list is that COVID has hit hard domestic services such as recreation, hotels and restaurants, which are a large employer in any developed economy, while these are less likely to be directly affected by Brexit policy except through knock-on changes in demand and labour services. Most manufacturing sectors and transport have been less negatively affected, although again there are exceptions within these sectors. The table highlights the double impact that Brexit and COVID can have on the economy. Sectors that have not yet been hit by the lockdown are generally expected to be hit negatively by Brexit.

Table 2 Change in business volume in April and predicted effect of Brexit by industry

Notes: Industries are ranked in terms of net increase in business volume in April 2020 (see notes of Figure 1 for details on this variable). The rows are shaded according to the predicted long-term effect of Brexit (Dhingra et al, 2017): green for top, blue for middle, and red for most negatively affected. Sectors with fewer than 5 businesses in the data in April 2020 are omitted. Industries are ranked from least negatively affected (1) to most negatively affected (20).

In many ways, this is not surprising. The rapid spread of COVID-19 has caused countries across the world to enter lockdown. This has had a huge impact on the functioning of economies on both the demand and supply sides (del Rio-Chanona et al. 2020). Some sectors, such as in-person services, have ceased completely while others, like distribution and some manufacturing, have needed to step in to meet urgent needs arising from the pandemic.

Brexit, on the other hand, will mainly affect the UK economy and will introduce new barriers to trade, migration, and investment with the EU, and a change in its relationship with other countries outside the EU (Baldwin 2016). Tariff and non-tariff barriers that may arise in sectors like automotive, food and professional and financial services could significantly affect the structure and size of the UK economy in the long run, as well as create costly short-term adjustments.

Our analysis highlights the importance of granular economic analysis during these extraordinary times.

As early as 2017, the government had announced that Brexit negotiations would be guided by granular impact assessments across sectors. Sound impact assessments are crucial for good policy design and this is what the government had rightly put forward. Yet the most detailed quantitative impact analysis available from the government to date gives details for just ten broad sector categories.

For example, all of services is split into just three categories. This makes the evidence too scant to adequately guide policymaking and it isn’t a surprise that the new policies that the government has announced in its Brexit plans, such as the tariff schedule published recently, have little justification on why certain policy objectives have been chosen.

The changed circumstances due the pandemic make the need for detailed sectoral analysis even more important. It is clear that some sectors are going to see a reduction in market access after the UK’s exit from the EU. While they may have withstood a bit of a setback in trade with the EU, a much harder hit at a time of a national and a global slowdown may push them towards being unviable. The current conditions in these industries will be useful in drawing up Brexit plans that are informed by existing circumstances.

The large negative hit from the pandemic has reduced the capacity of the UK economy to take further shocks. The UK is highly integrated with Europe and these linkages are likely to be even more important throughout the pandemic (Baldwin and Freeman 2020). The slowdown of the world economy has also cast another shadow on the idea of a global Britain making up for reductions in EU market access by pursuing opportunities outside the EU.

Our analysis shows that the sectors that will be affected by Brexit and those that are suffering from the COVID-19 pandemic and lockdown are generally different from each other. Rushing Brexit through this year without a new deal in place would, therefore, broaden the set of sectors that see worsening business conditions.

The EU’s Brexit negotiator Michel Barnier has suggested that an extension to the transition period would be possible. The UK government should think carefully about its policy priorities now; adding Brexit to the table only increases the importance of getting these policies right. Beyond the economics, the EU offers opportunities to help deal with the spread and response to the virus, such as the large-scale scheme to obtain personal protective equipment, which the UK reportedly missed the opportunity to join on three occasions.

As the COVID impacts continue to become clearer over time, the government must move beyond its broad assessment of Brexit impacts to much more finely tuned plans that account for the differences in market conditions and constraints faced by UK businesses in the biggest slowdown of our lifetime.

This post represents the views of the authors and not those of the COVID-19 blog or LSE. It also appeared on voxeu.org. Image by Ivan Radic, Some rights reserved.

References

Baldwin, R (2016), Brexit Beckons: Thinking ahead by leading economists, a VoxEU.org eBook, CEPR Press.

Baldwin, R and R Freeman (2020), “Trade conflict in the age of Covid-19”, VoxEU.org, 22 May.

Baldwin, R and B Weder di Mauro (2020), “Introduction”, in Mitigating the COVID Economic Crisis: Act Fast and Do Whatever It Takes, a VoxEU.org eBook, CEPR Press.

Bloom, N, P Bunn, S Chen, P Mizen, P Smietanka and G Thwaites (2019), “The Impact of Brexit on UK Firms”, NBER Working Paper 26218.

Costa, R, S Dhingra and S Machin (2020), “Trade and Worker Deskilling: Evidence from the Brexit Vote”, CEP Discussion Paper.

De Lyon, J and S Dhingra (2020), “How is Covid-19 affecting businesses in the UK?”, LSE Business Review, 7 May.

del Rio-Chanona, R M, P Mealy, A Pichler, F Lafond and F Doyne (2020), “Predicting the supply and demand shocks of the COVID-19 pandemic: An industry and occupation perspective”, VoxEU.org, 16 May.

Dhingra, S, H Huang, G Ottaviano, J P Pessoa, T Sampson and J Van Reenen (2017), “The costs and benefits of leaving the EU: trade effects”, Economic Policy 32(92): 651–705.

Gopinath, G (2020), “The Great Lockdown: Worst Economic Downturn Since the Great Depression”, IMG blog, 14 April.

2 Comments