A country’s growth rate is often viewed as a key indicator of its economic health, but should this be the case? Dietrich Vollrath writes that growth is currently slower in many developed states because of several policy successes which have led to lower fertility rates and shifted spending away from goods and toward services.

A country’s growth rate is often viewed as a key indicator of its economic health, but should this be the case? Dietrich Vollrath writes that growth is currently slower in many developed states because of several policy successes which have led to lower fertility rates and shifted spending away from goods and toward services.

We’re accustomed to looking at the growth rate of GDP to evaluate the health of our economy. Which is why the recent slowdown in growth appears so troubling. In the US, GDP growth for 2019 was 2.3%, meaning it has been nineteen years since growth hit 4%, and nearly as long since it touched 3%. For the UK the story is similar, as it has been fifteen years since growth hit 3%. In the Eurozone as a whole, growth last came close to 4% in 2000. These slowdowns across developed economies predate the financial crisis, and lead to natural questions: what went wrong with the economy, and how do we fix it?

But the slowdown we’re observing isn’t something we can fix – or that we would want to fix – because the slowdown was never a consequence of things that went wrong. Instead, as I show in my new book, the slowdown is a consequence of things that went right.

From a simple accounting perspective, there are two main factors behind slower growth: the fall in fertility during the 20th century, and the shift of our expenditures away from goods and towards services. And both of those explanations can be traced back to economic success.

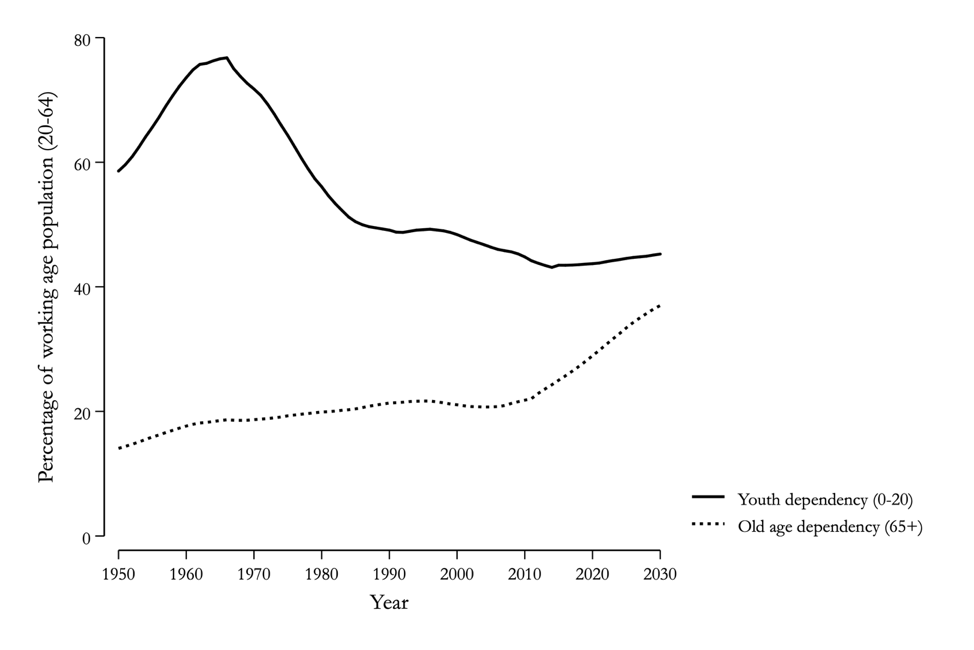

The fall in fertility has had a significant impact on economic growth for decades, particularly in the US. The baby boom generated a one-time wave of human capital that hit the economy during the middle of the 20th century. As those new workers hit the workforce, the proportion of workers to population rose substantially, as evidenced by the fall in the youth dependency ratio between 1960 and 1980 (see Figure 1). Combined with the relatively high educational attainment of the baby boomers compared to prior generations, this provided a substantial boost to the growth rate, increasing it around 1.25 percentage points in 1990 compared to immediately after World War II.

Figure 1: Age dependency ratios in the US

Note: For more information, see the author’s book, Fully Grown: Why a Stagnant Economy Is a Sign of Success (University of Chicago Press, 2020).

Note: For more information, see the author’s book, Fully Grown: Why a Stagnant Economy Is a Sign of Success (University of Chicago Press, 2020).

As that wave of human capital receded, so did the growth rate. Starting in the early 2000s, the old age dependency ratio started to rise (see Figure 1) the inevitable consequence of the drop in youth dependency back in the 1960s and 1970s. As workers aged out of the workforce – and continue to do so – this dragged down the growth rate of the aggregate economy. That 1.25 percentage point boost during the 20th century disappeared in the 21st, explaining most of the slowdown in the US.

But why should we see these demographic shifts as a success? The drop in fertility after the baby boom which explains the shifts was driven by several successes. Expanded access to college education pushed back the age at which people were willing to marry. The opening up of many professions to women, along with growth in overall wages, meant that it made sense for many women to delay marriage. Finally, advances in contraceptive technology meant it was possible for women to take advantage of the new educational and professional opportunities that arose. The growth slowdown today is a consequence of family decisions made decades ago in response to rising living standards and the expansion of women’s rights.

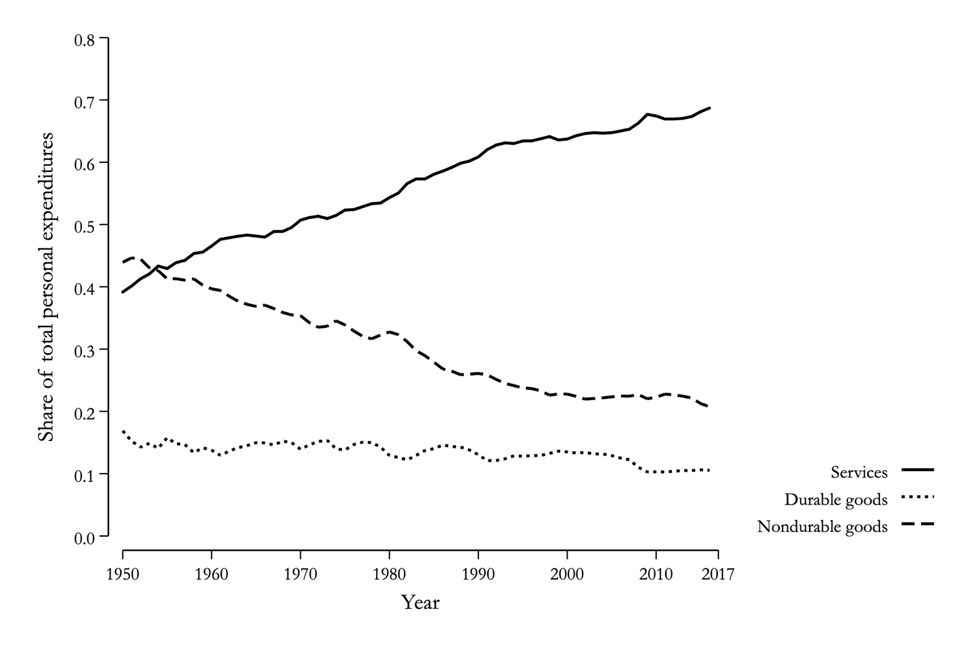

The second source of the slowdown, the shift from goods towards services, was also driven by success. In the past one hundred years we became incredibly efficient at producing goods like clothes, food, furniture, and computers. The consequence was a steady reduction in the price of those goods relative to services. We could have used that reduction to buy even more goods than we did, but instead we took advantage of the savings to purchase more services like education, healthcare, and travel. Therefore the composition of our expenditures shifted away from goods and towards services (see Figure 2). We still consume more goods than before; it is just that they got so cheap that their share of our total expenditure fell relative to services.

Figure 2: Expenditure shares in the US

Note: For more information, see the author’s book, Fully Grown: Why a Stagnant Economy Is a Sign of Success (University of Chicago Press, 2020).

This had a consequence for overall economic growth, however. Productivity growth in services is lower than for goods. That wasn’t a failure of services in the last few years. It appears to be an inherent quality noted by economist William Baumol in the 1960s. If a restaurant – a service – tried to operate with half their normal staff, you’d complain about the slow service and lack of attention. In comparison, if a manufacturer produced a laptop – a good – with half as much labour, you’d never know. This makes productivity growth harder for services than for goods. As we shifted expenditures towards services, aggregate productivity growth was thus bound to fall. Between the middle of the 20th century and today, that probably shaved another 0.2 to 0.25 percentage points off of the growth rate. But note that this only happened because of the productivity growth we experienced in the first place, a success.

Relative to the successes in the demographic shifts and spending shifts, the usual suspects are not capable of explaining the growth slowdown. Tax rates fell right as the slowdown started, and evidence from across states and industries shows that, if anything, more regulation was associated with faster growth, not slower. Trade with China exploded in the last twenty years, but evidence suggests that this had little effect on growth for the economy as a whole, even though individual regions and industries saw booms or busts. Economy-wide measures of the mark-up of price over cost rose, but it turns out that this didn’t lower growth. The shift of activity to high mark-up industries kept economic growth rates from falling even further than they did, as it meant we produced more valuable products.

If you’re still uncertain that the growth slowdown is a consequence of success, ask yourself what you’d give up to bring growth back to 4%. We could destroy half of all our goods: cars, couches, TVs, laptops, houses, trampolines, and so on. That would lead to a massive shift of spending towards goods as we scrambled to replace everything, and we’d see a jump in productivity growth. Alternatively, we could roll back contraceptive rights and women’s participation in the workforce in the hopes of starting a new baby boom. Wait twenty years and we’d have another surge of human capital into the economy. Would either of those be worth it just to see growth hit 4% again, perhaps not until 2040? Assuming the answer is “no”, that tells us the growth slowdown happened because of things that went right, things we would not sacrifice.

The idea that the growth slowdown is a consequence of success doesn’t mean we should be complacent about the economy, or that issues surrounding inequality, market power, regulation, or trade are trivial. Rather, the slowdown is evidence that we have the capacity to tackle those issues. We should not squander the chance to address the things that are wrong in our economy by fretting over the growth lost because of the things that went right.

For more information, see the author’s book, Fully Grown: Why a Stagnant Economy Is a Sign of Success (University of Chicago Press, 2020)

Please read our comments policy before commenting.

Note: This article first appeared on our sister site, LSE Business Review. It gives the views of the author, not the position of EUROPP – European Politics and Policy or the London School of Economics. Featured image by Dimhou, under a Pixabay licence

_________________________________

Dietrich Vollrath – University of Houston

Dietrich Vollrath – University of Houston

Dietrich Vollrath is a Professor of Economics at the University of Houston, where he has been since 2005. He has a BA in economics from the University of Michigan, and a PhD in economics from Brown University. His research interests are in growth and development, with a focus on structural transformation, agricultural productivity, and urbanisation. He has published articles in a number of leading economics journals and is the co-author (with Charles I. Jones) of a textbook on economic growth, Introduction to Economic Growth. He teaches courses in economic growth and macroeconomics at the undergraduate and graduate level. He is the author of the Growth Economics blog.

Interesting. I’ll forward to my prosperity degrowth feeds.

However, an additional explanation for the growth stagnation is the rising costs of surplus energy, that is the rising costs of extracting and processing fossil fuels. Since the economy is essentially an energy system, the rising costs of surplus energy will filter throughout the economy which has a deteriorating effect on discretionary income.

https://surplusenergyeconomics.wordpress.com/2020/01/13/162-the-business-of-de-growth/