Inflation fears have raised their head again. While central banks are keeping money loose, many observers are warning that Covid-19 induced supply and demand shocks have produced upward price pressures for the first time in three decades. Bob Hancké takes a(nother) critical look at the data and the arguments.

The chorus is swelling, like in a Verdi opera. Inflation has now officially been declared public enemy number one (well, number two, after the Delta variant). Even usually level-headed observers seem to be lying awake at night wondering how to address this. Well, they can sleep soundly: it’s all much ado about nothing. Here’s why.

Too few observations?

First, one data point does not an inflation make. Inflation is a persistent rise in the price level. By definition, one observation cannot be a persistent rise. Obviously, one rise now can mean many rises in the future. But it can also mean a drop in prices in the future – much of it depends on your underlying theory of inflation (see below) and how that sits with the basic facts.

Second, it turns out that most of the inflation that everyone gets so worked up about is concentrated in a few sectors that are usually not known for their inflationary pressures, such as second-hand cars (in the US) and air travel (almost everywhere). But the evolution of prices in both of these, which account for a large part of consumer price increases today, are fluke events.

The first is a second-order effect of the problems with semi-conductor supply chains originating in East Asia. Because no cars were sold (where would you go during lockdown?) but many computers and televisions were (that’s where you went during lockdown), semi-conductor factories in China and Taiwan, quite sensibly, redirected more of their production to chips for the latter than they would otherwise have done (the number of chips in cars has gone up tremendously in the last few years).

All other things being equal, now that the rich economies are waking up again, cars are in demand but not in supply and the effect is that people’s irresistible desire for wheels has led them to buy used cars now rather than new cars tomorrow. Prices of used cars rise in response. While those temporary fluctuations in supply and demand lead to a higher price now, that is not (yet) a persistent rise in price levels: Covid-19 has not suddenly produced a structurally strong second-hand car market.

Airlines, then: this is probably, with telecoms, one of the few big sectors where competition has forced consistent price drops over the last three decades. The only reason prices are now rising is that many people are trying to get on a (still reduced number of) plane(s). In fact, there is some evidence that supply restrictions have become a business strategy for airlines: because of the Covid-19 related uncertainties on travel they are limiting supply to increase prices, while gradually adding more flights shortly before the date to cash in on last-minute tickets. This rent-seeking is unlikely to last very long.

The pitfalls of measuring inflation

Third, the arbitrariness of our measurements makes things look considerably worse than they are, even though the risks are probably still on the downside. A part of this is the ‘base effect’. When Covid-19 hit the western world in early 2020, the big screech you heard was not just of economies grinding to a halt overnight but also of the inflation monster morphing into deflation (or something close to that). In the US and the EU, average consumer prices fell by one or two percentage points in the spring of 2020, and from an already low (below 2%) level.

Since we conventionally measure inflation annually, it now looks as if prices really did shoot up between May 2020 and May 2021 (the latest month for which figures are available at the moment of writing). But the comparison with the average for 2019 (the latest more or less normal year, with very low inflation) suggests that we are simply catching up a bit of ground. In fact, measured as a three-year moving average, inflation remains well below the 2% level.

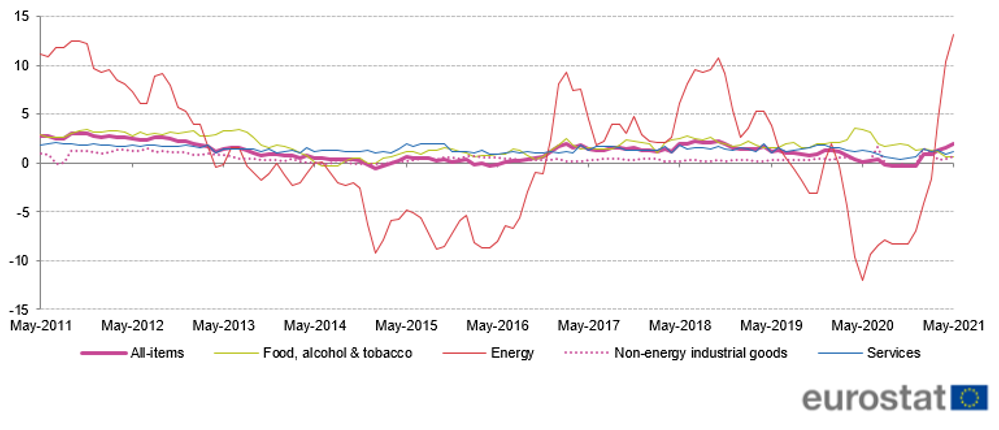

Figure 1: Euro area annual inflation and its main components (%), May 2011-May 2021 (estimated)

Source: Eurostat (online data code: prc_hicp_manr)

Then there is what is called a ‘composition effect.’ The graph in Figure 1 leads to two conclusions. One, most prices are relatively stable, even today; two, energy prices are emphatically not – they fluctuate a lot in general but especially from May 2020 to May 2021, when they varied between -10% and +10%. Since energy accounts for about 10% of the basket of goods that we use to measure the evolution of consumer prices, they alone account for about 2 percentage points of the current rise in prices.

Or, in other words, without them, the dramatic sounding almost 5% year on year price rise in the US would be slightly below 3%, still relatively high but hardly the stuff of nightmares. If we don’t know what energy prices will do tomorrow (and we can, at best, take only a guess about rising demand and supply in that sector), and whether their eventual rise will become embedded in wage settlements, we know very little about future inflation.

Nothing is as practical as a good theory

Finally, how do we make sense of all this? Many economists used to joke about political scientists that they mistook anecdotes for data. That critique was always a bit over the top – for many important questions we simply don’t have many hundreds, let alone thousands, of random data points, and such an obsession with data purity also implies that you will often limit your questions to those where such data exist.

But when it comes to inflation, economists seem happy to rely on one-off, and far from systematic, observations. They do so, because they claim to have an iron-clad theory to explain all individual facts: ‘Inflation is always and everywhere a monetary phenomenon’, in the words of inflation guru Milton Friedman. Note the ‘always and everywhere’, which seems to offer a blank cheque to comment even on individual data points. But, as Martin Wolf pointed out in the FT recently (and Milton Friedman and Anna Schwartz imply in their monetary history of the US), inflation is, in fact, ‘always and everywhere a political phenomenon’: it responds primarily to policy and not to monetary aggregates.

Without a proper theory of mechanisms underlying inflation, these data points therefore remain anecdotes and the proclamations prejudices. But New Keynesians actually have a theory: if wage rates systematically exceed labour productivity, businesses pass on their losses to consumers. While under normal circumstances wages usually do not rise above productivity, it can happen, for example, in very tight labour markets or when cost-of-living-adjustment clauses import inflation into collective bargaining. At the moment, labour markets are, with a few short-term (and, in the UK, Brexit-induced) exceptions, not particularly tight and trade unions are relatively weak everywhere. That might change, true, but that’s crystal ball stuff, not serious evidence-based policy advice.

Inequality and bad policy are the worries – inflation is a side show

Overall, therefore, no reason to get excited, in the other Nobel laureate Bob Dylan’s immortal words. Instead of chasing consumer price inflation, what should concern us more is the way a combination of excessive and increasing inequality on the one hand, and policy on the other is driving up asset prices. The rich have done well these past 18 months and the trickle-down effect is now felt in the rising value of assets. Linked to a very permissive policy (such as the stamp duty holiday in the UK), this development has forced housing prices up at high speed.

Those are not ‘secular’ inflation effects, though, that follow from too much money in the system, as the inflation Cassandras would have it. They are effects of choices that we as societies, and our leaders as politicians, have made in the recent past. Returning the inflation genie into its bottle is a futile waste of time. Reversing those policies would do a lot more for economic stability.

Note: This article gives the views of the author, not the position of EUROPP – European Politics and Policy or the London School of Economics. Featured image credit: Erik Mclean on Unsplash