There seems to be a strong convergence of interests between the Greek government, the European Commission and Eurozone Member States (and the IMF): they all want a clean exit from the Third Economic Adjustment Programme for Greece. Lorenzo Codogno explains that political motivations may well collide with the need to reduce risks and favour a smooth and successful return to normality with a post-programme in place.

Clean exit: Different meanings for different actors

For a change, there seems to be a strong convergence of interests between the Greek government, the European Commission and Eurozone Member States (and the IMF). Now, they all want a clean exit from the Third Economic Adjustment Programme for Greece.

For the Greek government, it is not just a matter of pride. It would be the demonstration that it has been able to steward the country out of its troubles, which started with previous administrations. It would also be a launch pad for the next elections, which need to be held before 20 October 2019 (they may be brought forward). For the current European Commission, a clean exit would demonstrate that the recipes and the approach followed so far have eventually borne fruit. For European leaders, it would be a way to move on and close an uncomfortable chapter, which has taken so much energy and effort in Brussels, and has produced so many problems in the discussions back home in national parliaments and in the electorate, to the point of risking further slippage towards populist anti-establishment movements.

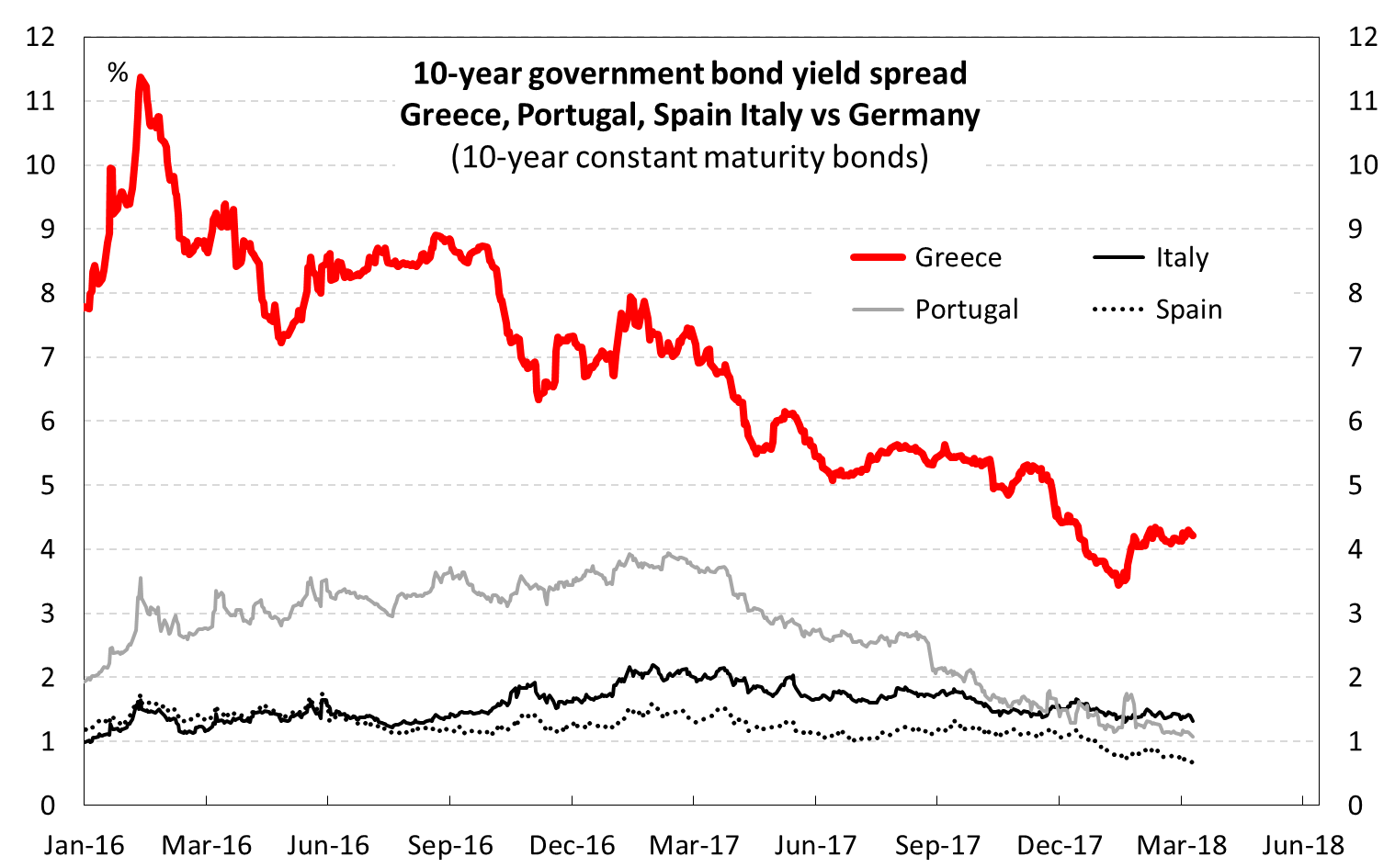

Greece has successfully demonstrated an ability to tap financial markets for funding, but the 7-year bond issuance for €3bn in February was unfortunate as yield spreads have sharply widened since then, highlighting how risky the situation still is. There is not only a risk of a possible rolling back of domestic policies, but also of fluctuations in the global risk appetite beyond the control of the Greek government.

A look at the economy

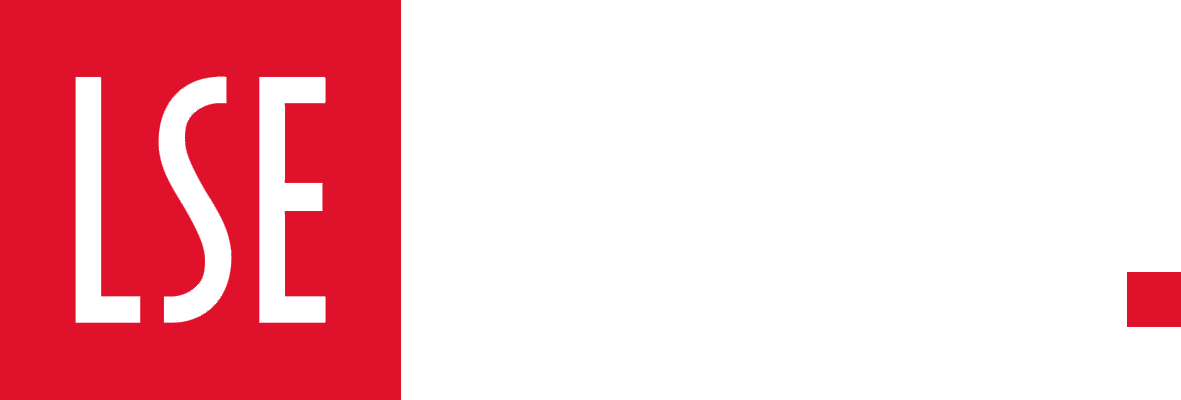

Economic developments turned out to be more favourable than was projected in summer 2015, when the third financial assistance Programme was agreed. The country’s GDP growth has improved steadily since then. However, not only is there no indication of any catching up following the crisis, but also the pace of growth remains below the Eurozone’s (Figure 1). Private consumption remains the weak spot, and this is not surprising. Gross investment as a percentage of GDP fell to about half versus pre-crisis levels, with a decline in the stock of capital. Now, confidence is improving, but actual output figures in manufacturing are somewhat short of confidence figures. The labour market keeps improving at a slow pace, with overall unemployment still above 20%.

Figure 1: Greece’s GDP: No catching-up even on growth

Source: Thomson-Reuters Datastream, Eurostat, LC-MA calculations.

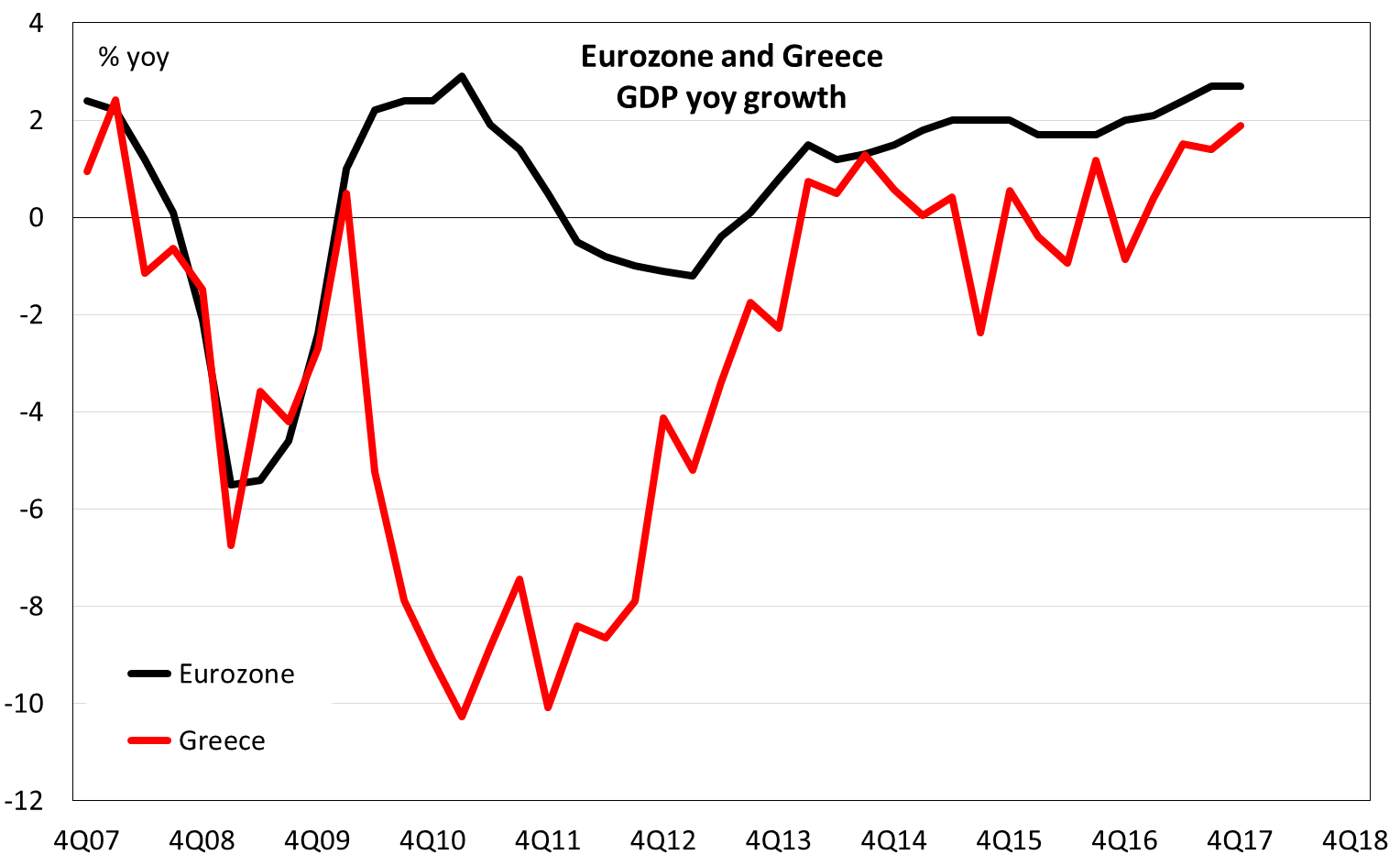

Figure 2: Greece’s fiscal outcomes exceeding expectations

Source: Thomson-Reuters Datastream, European Commission, LC-MA calculations; 2018 and 2019 = projections.

The external position has improved sharply, although more because of weakness in domestic demand than strength in export activity. Export performance remains underwhelming.

Greece has outperformed Programme budget targets (Figure 2). According to the Hellenic Fiscal Council, Greece may have reached a 3.5% primary surplus in 2017 already, versus a target of 1.75%. There are reasons to be optimistic about Greece meeting the fiscal targets in 2018 as well. Maintaining a 3.5% primary surplus also in the years to come appears feasible. On balance, the overall improvement of the fiscal situation is impressive.

There are also risks, however. Direct tax revenues are not performing very well. The high rate of social contributions has probably increased the area of tax evasion. The composition of the fiscal adjustment may become even less growth-friendly (reduced public investment) than it is now.

The banking sector is gradually improving, also courtesy of strong recapitalisation, but the stock of Non-Performing Exposures (NPEs) remains very high. According to the Bank of Greece, it declined by 4.8% in December 2017 compared to September 2017, driven by write-offs and sales, and it reached €94.4bn or 48.6% of total exposures. Total write-offs and sales for the whole of 2017 reached €6.5bn and €3.6bn respectively. The NPE ratio was 43.4% for residential, 49.3% for consumer and 41.8% for the business portfolio at the end of 2017. The reduction target for this year is €14.4bn, a very ambitious one. Credit growth is still weak. According to the Bank of Greece, the annual growth rate of credit to the private sector stood at -1.0% in February, and that of credit to corporations at 0.2%.

Electronic auctions appear now to be working, and the sale of loans is speeding up, but repairing the balance sheet remains a major challenge. It is not guaranteed that the four major Greek banks will get the green light in the forthcoming banking stress tests. Overall, the Greek economy is gradually healing, but a return to a sustainable pace of growth cannot be taken for granted.

Fourth review to be completed by June (or July)

On 12 March, the Eurogroup welcomed the completion of the remaining prior actions by Greece, as required under the third review of its Programme, including necessary actions in the field of privatisation, public revenue collection, tax policy and resolution of Non-Performing Loans (NPLs). It effectively paved the way for the release of the fourth tranche of financial assistance.

On 27 March, the Board of Directors of the European Stability Mechanism (ESM) approved the fourth tranche of €6.7bn of ESM financial assistance for Greece, with the first disbursement of €5.7bn already delivered. After the disbursement, ESM financial assistance for Greece reached €45.9bn, out of a total programme volume of up to €86bn. Together the ESM and the European Financial Stability Facility (EFSF) have so far disbursed €187.8bn to Greece. The tranche will be used for debt service, domestic arrears clearance and for establishing a cash buffer.

Subject to another decision by the ESM Board of Directors, a further disbursement of €1bn may be carried out after 1 May 2018. It is dependent on Greece making progress in reducing its stock of arrears and improving the effectiveness of the e-auction system.

There will be some informal discussions on the fourth and final review of the Programme as early as the next Eurogroup meeting in April. A staff-level agreement is expected in May or early June, with a final decision at the Eurogroup on 21 June. Some officials have recently pointed to the risk of a small delay to July, due to the fact that the Greek government is behind schedule in completing key deliverables. At any rate, a decision on the closure of the Programme and disbursement must come early enough to allow sufficient time for closure of the Programme by August.

A political decision on debt relief in April already?

There is an ongoing discussion on debt relief, again to allow enough time to deliver everything by August, and a political decision may be taken already in April.

Conditionality here is the buzzword. The IMF and the ECB are pushing for only limited conditionality to allow Greece to be back on its feet sooner rather than later. However, for debt relief, some form of conditionality is inevitable and probably desirable. For instance, the bond-buying Securities Markets Programme (SMP) profits in the hands of the ECB are effectively money owned by the Member States, and it would be inconceivable for them to authorise payment without some strings attached. Finally, especially ahead of elections, there is a risk of slippage on the part of the Greek government in case conditionality is not strong enough and there are always risks of external shocks. Striking the right balance between a ‘super-clean exit’ and keeping some form of conditionality with contingent financing is what negotiators will have to agree.

Even the IMF may come back into the Programme, in case debt relief delivers significant enough changes to allow for a profound revision of the Debt Sustainability Analysis (DSA). This could happen in April already should debt relief be delivered at the same time. While this would take place just a few months away from the end of the Programme, making IMF participation mostly symbolic, it would be essential for the IMF’s involvement in any post-programme initiative. For this, the week between the Spring Meetings of the IMF in Washington (21-22 April) and the Eurogroup meeting (27 April), will be crucial. Negotiators will not miss the opportunity to address the issue face to face in Washington. The IMF staying on board would be important for countries like the Netherlands and Germany and facilitate a positive conclusion.

Post-programme and contingency funding

The need for a post-programme arrangement is clear. The relaxation of capital controls will not be implemented by June, and it will take at least a year for full liberalisation to avoid any risk of sudden capital outflows. Moreover, despite sharply reduced financial needs, access to financial markets is not granted, as suggested by the poor performance of the bond recently issued. Finally, the ECB waiver will expire at the end of the Programme in August. Therefore, a credit line as liquidity backstop would be helpful for Greece.

One option would be to go for a precautionary credit line, which is part of the still-unused toolkit of the ESM. A precautionary credit line aims to support sound policies and prevent crises, and it appears especially suitable for the Greek situation. It would help Greece to maintain access to market financing by strengthening the credibility of its macroeconomic performance even after the end of the Programme, likely complementing the building up of cash buffers.

There are two possible forms. The first is a “Precautionary Conditioned Credit Line” (PCCL), which is available to a Member State whose economic and financial situation is deemed to be fundamentally sound, as determined by six eligibility criteria, such as public debt, external position or market access on reasonable terms.

The second form would be the so-called “Enhanced conditions credit line” (ECCL). It is available to Euro Area Member States whose economic and financial situation remains sound, but who do not comply with the eligibility criteria for a PCCL. This may well be the case for Greece. The ESM Member is obliged to adopt corrective measures addressing such weaknesses and avoiding future problems in respect of access to market financing. The ESM Member has the flexibility to request funds at any time during the availability period. When an ECCL is granted, the ESM Member is subject to enhanced surveillance by the European Commission. Surveillance covers the country’s financial condition and its financial system. The credit line could also be used for the recapitalisation of banks.

The problem with this route is political will. The Greek government would have to ask for the credit line, and it is not clear whether there is any such intention. In fact, it would not be perceived as a ‘clean exit’. It would still require conditionality and surveillance. As demonstrated by the premature tapping of financial markets, the Greek government is in a hurry to show it is back on its feet.

Moreover, such a credit line would have to pass approval in some national parliaments, such as in Germany, the Netherlands and Finland. Needless to say, there is little appetite for that in these countries and much fatigue in dealing with Greek issues. The bottom line is that no one seems to be pushing for such a liquidity backstop, leaving aside possibly the ESM. The Eurogroup will likely decide on this contingent credit line on 21 June.

Another option would be to have “enhanced surveillance” according to the so-called Two-Pack, but this would be a very intrusive option, and politically very delicate. It would need a letter of intent by the Greek government, which would be a sort of Memorandum of Understanding. It would imply quarterly monitoring, and it would overlap with the procedures of the European Semester. However, Member States would not have to ask for approval by their national parliaments.

What is going to be good for Greece?

Volatility and lack of depth continue to be key features of the Greek government bond market, and this makes investors somewhat reluctant to stay engaged. Any small international trigger could translate into significant losses, and a sharp widening of yield spreads.

The deeper the debt relief in favour of Greece is going to be, the better for Greek financial assets. Also, the more comprehensive the post-programme and the contingency funding, the less risky it becomes to continue to invest in Greece. In fact, after the summer, a new uncertain phase will emerge ahead of forthcoming political elections, with the risk of backsliding on reforms already introduced.

Figure 3: Yield spreads remain well above those for other Eurozone countries

Source: Thomson-Reuters Datastream, LC-MA calculations.

To sum up, the short-term and the medium-term outlook will depend on the important decisions that will be undertaken by the summer on debt relief and the post-programme monitoring regime. Political reasons seem to be at odds with the need to reduce risks and favour a smooth and successful return to normality with a post-programme in place.

Note: This article was originally published on the EUROPP – European Politics and Policy Blog. It gives the views of the authors, and not the position of Greece@LSE , of EUROPP or the London School of Economics.