Guest Post by Alex Cobham

Guest Post by Alex Cobham

Alex Cobham is a research fellow at the Center for Global Development in Europe. His research focuses on illicit financial flows, effective taxation for development, and inequality. Recent work includes a proposal, with Andy Sumner, for a new policy measure of inequality, the ‘Palma’. You can follow Alex on twitter @alexcobham.

A range of estimates of illicit financial flows confirm that the problem facing Africa is large, and has grown substantially. Annual losses in recent years range as high as $100 billion, and for many countries the long-term average has exceeded 10% of recorded GDP. Even allowing for substantial uncertainty in estimates of flows of which the defining characteristic is that they are hidden, the order of magnitude is dramatic – and so too is the potential damage.

The last week of April saw Ethiopia host the 3rd Tana High Level Forum on Peace and Security in Africa. The forum, set up by the late Prime Minister Meles Zenawi to bring together African leaders and experts to consider policy responses to major challenges to security, this year took as its theme the dangers of illicit financial flows.

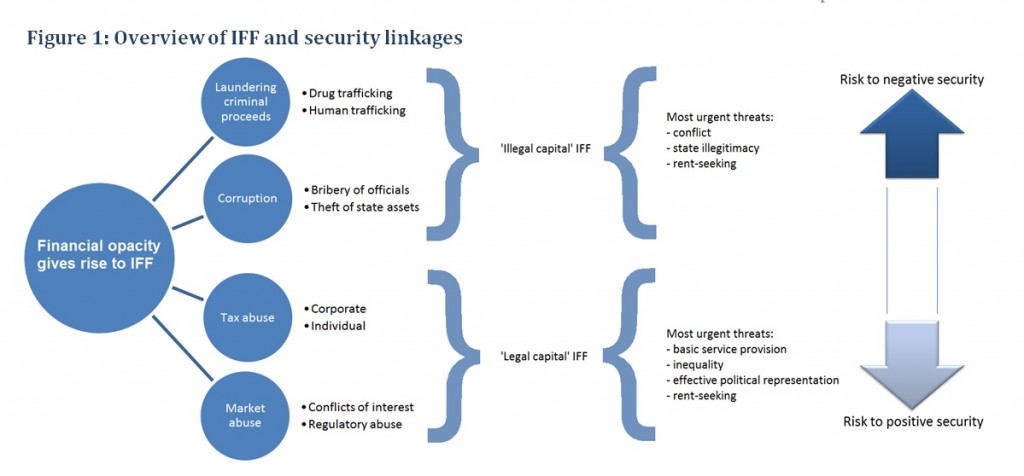

My background paper distinguishes two types of illicit financial flow (IFF): those involving illegal capital (criminality, corruption and the theft of state assets), and those where the capital may be legal but the transactions are illicit (corporate and individual tax abuse, and the abuse of market regulations such as those against monopoly positions and against political conflicts of interest). Together, these IFF pose a major threat to effective states.

Each type is linked to both positive security (the ability of states to provide secure conditions for human development progress, including e.g. health and education) and negative security (the ability of states to safeguard against threats to security at the personal, community and political levels); but the linkages are likely to be strongest between illegal capital IFF and negative security, and between legal capital IFF and positive security.

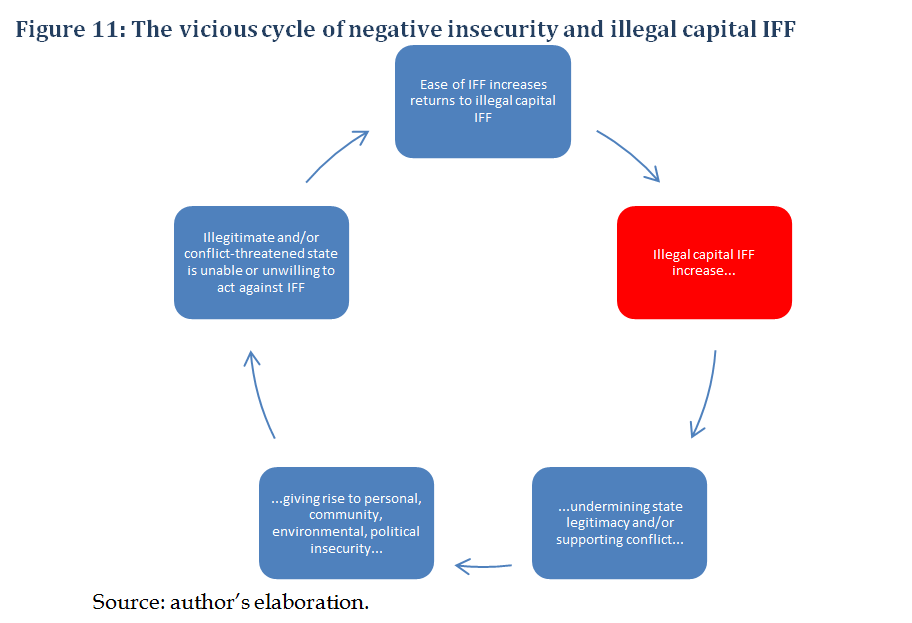

Illegal capital IFF will tend to undermine both the immediate effectiveness of institutions, and confidence in them to provide fair and effective rules for markets and for politics – peeling away the layers of institutional resilience that can provide a bulwark against conflict when pressures arise. Greater illegal capital IFF characterise an economy in which rent-seeking plays a major part; and conflict can arise over control of the state and the associated (criminality and corruption) rents.

In the other direction, conflict undermines the institutions which can curtail IFF, and drives uncertainty which increases the expected returns to rent-seeking behaviour relative to that of long-term economic investment. These linkages together create the possibility of a vicious cycle, in which IFF exacerbate conflict and vice versa, with institutional state weakness as both cause and effect.

Legal capital IFF undermine revenues and the ability of states to address inequalities, as well as weakening channels of political representation – not least, through the damage done to the tax system and in turn to trust and citizen-state relations.

The potential scale of effects is dramatic. To take just one example, extrapolating from IFF losses to GDP it is estimated that a two-thirds reduction in under-five mortality from the 1990 baseline (the target of the fourth Millennium Development Goal) could have been achieved, in a sample of 34 sub-Saharan countries, by 2016 rather than the current estimate of 2029 – implying millions of lives may be lost unnecessarily.

This type of mechanical calculation may actually understate the scale of IFF damage, however. The grave threat that IFF push an economy towards rent-seeking and away from productive activity, away from the ‘developmental state’ ideal, was emphasised powerfully in the early address by Zenawi’s successor, Hailemariam Desalegn. Without the revenues and institutional capacity to provide effective security, both positive and negative, states are fragile indeed.

A later session with Tana Forum chair Olesegun Obasanjo, and his one-time financial crime lead Nuhu Ribadu, inevitably triggered much discussion of Nigeria, then and now. Nigeria risks becoming the poster child for the linkage between illicit financial flows and insecurity. A state that struggles, even in the presence of massive resource wealth, to raise the revenues and to maintain the institutional effectiveness to prevent negative and positive insecurity, risks a crisis of legitimacy.

I had blogged three weeks earlier – and a week before the mass kidnapping of schoolgirls – on the rebasing of Nigeria’s GDP. While the media coverage focused on the economy now being measured as Africa’s largest, I wrote instead that the resulting tax/GDP ratio of lower than 4% “reveals the depth of state weakness”.

Whether the world media and political attention now on #BringBackOurGirls will help in the immediate situation of urgency is uncertain. And it is far from clear that it will support the state’s legitimacy over the longer term. There are no quick fixes to illicit financial flows, and the associated challenges of a rent-seeking economy. Major transparency initiatives are underway, and there is much that Nigeria’s government could quickly put in place; but as the Tana Forum discussed at length, the road is a long one and the need for far-sighted political leadership is great indeed.