On Friday 16 February, Jack Newnham, director at PwC and lead for their private sector development work, delivered a talk about the role business can play in international development.

Development Management students, Charis Yeap Khai Leang and Joelle Yeo, both passionate about the potential of the private sector to do good, reflect on the lecture.

As international development students, we all agree that the private sector has the potential to play a large role in development. Jack Newnham, an entrepreneur turned accountant, and current Director at Price Waterhouse Coopers gave us his insight about what he thought could enable businesses to do more. The beginning of the lecture was interactive audience participation based on a question activity Jack had prepared, to understand the general-consensus of the room’s perception of the role of business. The audience unanimously agreed that not only should businesses be encouraged to go beyond “business as usual” to have more societal impact, but also that capitalism needs to change in order to survive. The audience shared their thoughts about collaboration, diaspora, innovation, incentives, as well as risks. He bounced around audience members’ ideas and followed on with the several points that affect a business.

Jack continued to say something that I thought summed up the relationship between profit driven businesses and development quite well, and this is that, “consumers who want to buy and save the world, at the same time, give a very strong incentive.” This resonated with me because as a business graduate turned development student, I had always felt that pure business philanthropy came across as wishful thinking. Businesses are mostly driven by the changes in supply and demand. Thus, there will always be a strong dependence on a change in customer attitudes toward an equal trade-off between sustainability and cost, for businesses to go beyond their bottom line mentality. Then, Jack continued to touch on the challenges that businesses face in consideration to engaging with development causes. He shared his previous experiences in projects around the world including donor work in Kenya and accountancy in Malawi. Following with several video clips promoting challenge funds, market system approaches, and impact investing.

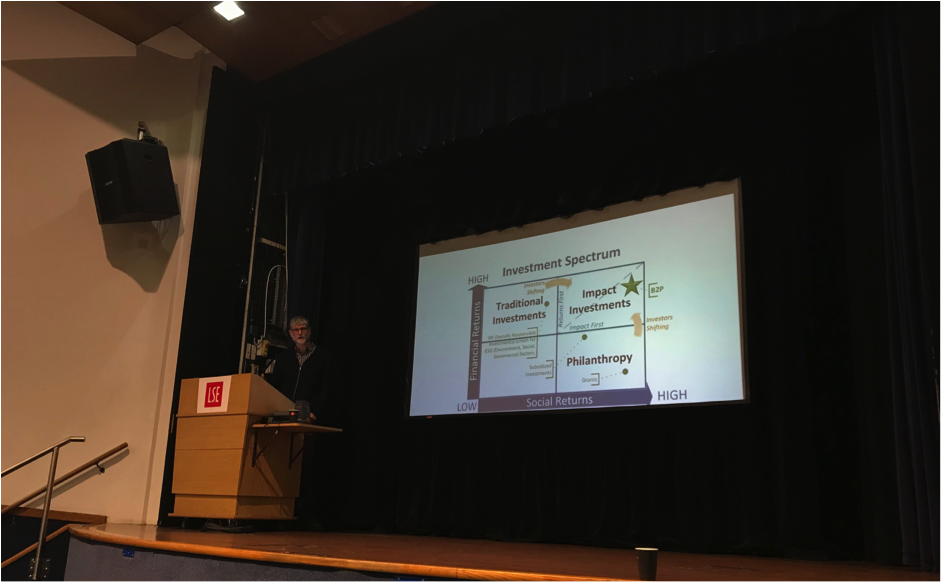

With a lack of time due to active audience participation, Jack cruised through his slides on previous donor programmes, what was learned, and the future of business in development. Within those slides were several interesting grids and scales that compared financial returns versus social impacts. Upon our very own Teddy’s encouragement, Jack went back to elaborate the ten lessons about business and development he considered “standard-ish”, but effective. Several of those were familiar to many of us in Development Management, from my understanding, these were that: evidence evaluation is difficult; engage with the right stakeholders; tackle the risks; find passionate people; failure is acceptable; and as Dani Rodrik pointed out, there is no one size fits all. One last point is that throughout the easy-going lecture, Jack seemed to stress one takeaway: investors, not donors, hold the key.

Charis Yeap Khai Leang is an MSc in Development Management student from Malaysia. She graduated with a Bachelor of Business Administration majoring in Finance and Marketing from Hult International Business School. Charis has previous work experience in government positions, charitable organisations, and consultancy. Her research interests include corruptions, migration, and ICT for development.

______

Coming from an undergraduate degree in Business, I have always been interested in the potential of Business to do good in society, which was precisely the topic of Jack Newnham’s lecture – “The role of business in development: How best to enable business to do more”. Jack was definitely well-placed to give the lecture, having spent nearly 20 years working in the private sector in a range of roles, from being Jack the Inventor, to Jack the Accountant and now Jack the Development Consultant. I was definitely not alone in my opinion that businesses possess the power to do good. As Charis mentioned, there was a strong consensus in the audience on the expectation of businesses to go beyond “business as usual” to have more of a societal impact.

So, what can businesses do? Apart from Challenge Funds and using a Market Systems Approach, Jack also passionately highlighted the potential of Impact Investing, all possible options for how capital can be leveraged for development.

I’m sure by now everyone of us has heard of the term “Impact Investment” but what exactly does it mean? According to the Global Impact Investing Network (which is the authority in this space), impact investments are investments made into companies, organizations, and funds with the intention to generate social and environmental impact alongside a financial return.

Together with Blended Finance, Jack sees this as the future area for growth simply because of the potential to earn single/ double digit positive returns from investments instead of a 100% loss (as in the case of grants), enabling funds to be “recycled” for greater impact. He also highlighted the growing interest from both traditional and philanthropic investors e.g.: JP Morgan and various foundations. Nonetheless, as with such trends, one should be wary of “impact-washing”; akin to the trend of Corporate Social Responsibility and greenwashing.

I thought that one interesting distinction that Jack made was between impact investing in developed countries and in developing countries. In countries such as the UK, there is a large focus on social enterprises, where social impact is very much a concern of both investors and business owners. In contrast, in developing countries, the concern about “impact” lies largely within the domain of investors, with the business owners predominantly concerned about survival, gaining access to opportunities and the value chain.

To effectively tackle the SDGs, large amounts of financing are needed, and impact investing may just be the missing piece of the puzzle.

P.S.: As there were quite a lot of people interested in PwC and doing the type of work that Jack does, I thought I’ll also just share what Jack said to some of us after the lecture. The department that he works in: International Development, is part of PwC’s Sustainability and Climate Change (S&CC) consulting service, where graduates are typically recruited from the six-week summer internship that occurs every year. You can find out more about the internship and PwC’s S&CC department here and here!

______

Joelle Yeo (@elleycatz) is a MSc Development Management student at LSE. She graduated from a Bachelor’s in Business at Nanyang Technological University, Singapore and has worked in both the public and the private sector. She is highly passionate about harnessing the power of business to create a positive societal impact, especially in the international development and environmental sustainability arena.

The talk was part of the Cutting Edge in Development series, hosted by the Department of International Development.

The views expressed in this post are those of the author and in no way reflect those of the International Development LSE blog or the London School of Economics and Political Science.