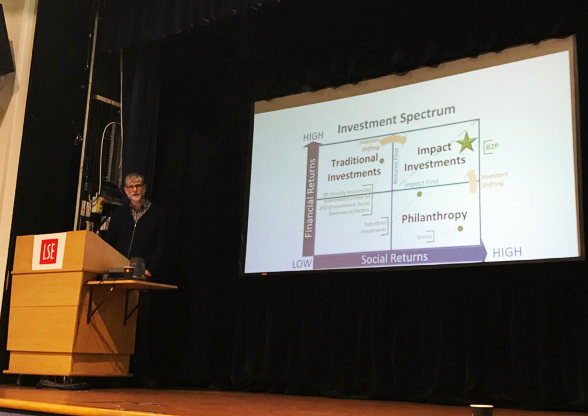

On 5 December 2019, José Antonio Ocampo, delivered a public lecture (listen again) at LSE, which looked at the different dimensions of IMF reform: the role of the international monetary system, global macroeconomic cooperation, prevention and management of crises, and the governance of the system. MSc Local Economic Development student, Wingyan Yip, reflects on the talk.

I first learnt the word “neoliberalism” when I was in Argentina, a country resentful of the International Monetary Fund’s (IMF) support for an unsustainable exchange rate regime that led to an economic breakdown in 2001. It thus became a moment of connection when Professor José Antonio Ocampo, a prominent voice not only for Latin America but also for the rest of the developing world, came last Wednesday to give a talk on “An IMF for the 21st Century”.

Prof. Ocampo’s advocacy was clear – the IMF needs to be reformed to help developing countries build more resilience against external shocks. While based on his book Resetting the International Monetary (Non)System published in 2017, Prof. Ocampo’s talk was mainly focused on the structural biases faced by developing countries in the current reserve system and how the IMF should help. In between macroeconomic jargons, the speech was peppered with wisecracks on the use of Western-centric language. The 2008 global crisis, for instance, was referred to as an “North Atlantic Crisis”.

Prof. Ocampo’s emphasis on the instability of a US-dollar dependent reserve system and its needed reform merits special attention. The reliance on the US dollar as the main international currency create an asymmetrical adjustment problem and a Triffin dilemma that remained even after the collapse of Bretton Woods system. Keynes [1] considered the global reserve system asymmetric as it favours countries with a balance of payments (BOP) surplus and forces countries with BOP deficit to adjust. Deficit-prone countries therefore have to shore up foreign reserves as a precautionary measure. In today’s context, these are mainly developing countries which have liberalized their capital accounts and are vulnerable to speculative capital flows. Such foreign reserves could have well been invested in infrastructure or education.

On the other hand, the Triffin dilemma observes that the world has a strong demand for the US dollar as “safe” foreign exchange reserves. To fulfill the demand for extra reserves, however, the United States must run a trade deficit. Even if the US experiences a crisis, capital flowing out of the country would still seek to hold the dollar as a safe store of value. This explains why the US can get access to cheap credit in normal times and carry out expansionary macroeconomic policies in times of crisis. The excessive indebtedness of the world’s biggest economy, as a result, puts the global economy in a precarious position.

Prof. Ocampo proposed two alternative reform routes – a multi-currency standard and a Special Drawing Rights (SDR)-based global reserve system. The former aims to diversify countries’ foreign exchange reserve assets, while the latter combats the system’s asymmetry and addresses developing countries’ need to access liquidity.

The benefits of a multi-reserve currency arrangement, he argues, is still likely to be captured by developed countries. Prof. Ocampo believes that China’s Renminbi can only have a limited role as a reserve currency from a developing country because of Chinese government’s control on capital accounts. Neither will the new arrangement be free from instability as major reserve currencies can then face enhanced volatility.

Rather, Ocampo prefers an SDR-based system. SDR was created in the 1960s as a supplementary international reserve asset in the Bretton Woods system. The use of SDR as a global reserve asset has declined because of the replacement of Bretton Woods with floating exchange rate regimes. Ocampo envisions the IMF acting as a quasi central bank in this SDR-based system so as to overcome the Triffin dilemma and control liquidity in a counter-cyclical way. In other words, under this system no single country will dominate the creation of international reserve assets and make the world susceptible to changes in its monetary policies. Developing countries which are vulnerable to short-term capital inflows will also receive conditional liquidity in times of balance of payments crisis.

Such an arrangement, however, shifts the reliance from decisions made by the reserve-issuing country (the US) to those made by the IMF. Given the track record of the IMF, most notably in Russia’s liberalization during the 1990s after the collapse of the Soviet Union and the East Asian Crisis in 1997, how much can we entrust the plumbing of the global reserve system to a top-down approach as such?

The implication is not lost on Prof. Ocampo, who also suggested a multi-layered architecture. A network of regional reserve funds in such framework can encourage participation by all countries and facilitate dialogues in macroeconomic policies. This can also give regions a greater sense of ownership to improve the international power balances. Meanwhile, the recent case of Argentina points to the potential risks of a bottom-up approach, where an arrangement of 35.4 billion SDR ($50 bn) was disbursed in June 2018 as the largest package ever in IMF history. This project aligns with the “ownership” narrative that the Fund has embraced since it came under attack for its market fundamentalist approaches in the 1990s. Yet, the Argentine government has been pouring IMF’s monetary assistance onto propping the peso, which ultimately made little progress in reducing inflation and fostering economic recovery. Does giving ownership to countries help in cases such as Argentina where fiscal discipline proves wanting?

Of course, it is a tightrope to walk and the stakes are high. Rather than reiterating the decade-old criticism of IMF’s neoliberal conditionalities, Prof. Ocampo’s talk was an important reminder of the need to strengthen support for developing countries in an asymmetric system. The backdrop of a low interest rates market and the rise of protectionism worldwide only makes this need more imminent.

[1] Keynes, John Maynard, Johnson, Elizabeth, and Moggridge, D. E. The Collected Writings of John Maynard Keynes Volume 26. Activities 1941-1946: Shaping the Post-War World: Bretton Woods and Reparations. Cambridge: Cambridge UP, 2012. The Collected Writings of John Maynard Keynes. Web.

Wingyan Yip is a MSc Local Economic Development student at LSE with a bachelor’s degree from Yale-NUS College in Singapore. Wingyan is passionate about the political economy of Latin America and Asia, as well as data science and machine learning.

The views expressed in this post are those of the author and in no way reflect those of the International Development LSE blog or the London School of Economics and Political Science.