In an article originally published by the Center for Global Development, Bernat Camps Adrogué (MSc Political Economy of Late Development alum 2021) and Mark Plant call for the IMF to step up lending for countries in need while they wait for the loss and damage fund discussed at COP27 to come to fruition.

The Global North can make an immediate down payment on the promises made at COP27 to increase financing for emerging markets and developing countries (EDMCs). EDMCs need not wait for a loss-and-damage fund (a mere proposal is due in a year!). Nor need they queue for a Just Energy Transition Partnership (JETP), destined for a select few countries but with at least a year’s gestation period.

How can countries ensure that funding starts to flow now? By pushing the limits of the funding mechanisms already in place.

For example, let’s look at the IMF’s support for the poorest countries in Africa, whose finances have been drowned in the wake of COVID-19 and Russia’s invasion of Ukraine. Many of these countries also face enormous investment costs to adapt to climate change, for which they bear no responsibility.

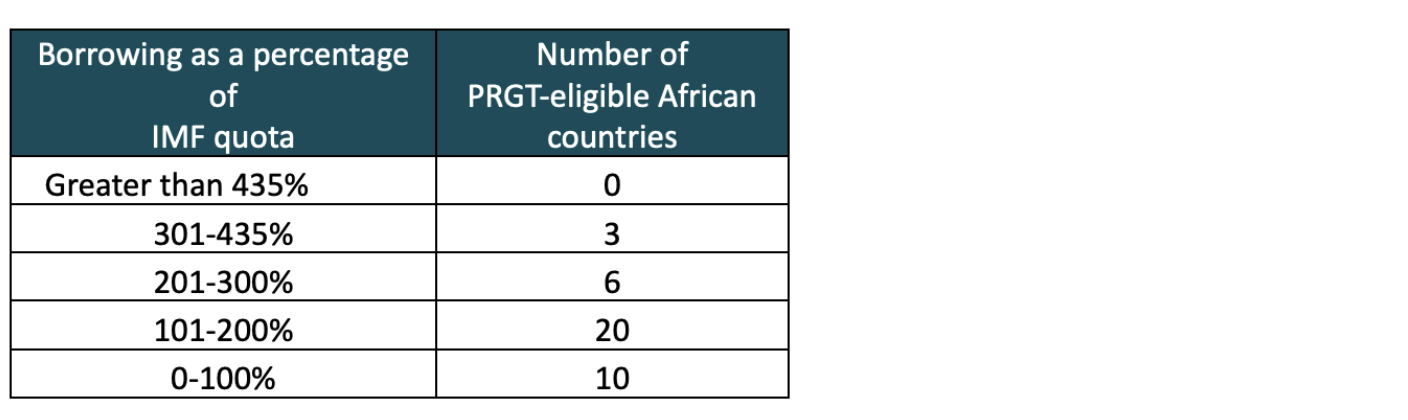

The 39 sub-Saharan African countries eligible to receive loans from the IMF’s pool of concessional money, the Poverty Reduction and Growth Trust (PRGT), currently have credit outstanding of about $16.5 billion. The IMF has some self-imposed standards on how much a country can borrow annually and cumulatively (see the details here). These are calibrated as a percentage of the country’s shareholding in the IMF, or IMF quota; the overall cumulative limit is 435 percent of quota. Here’s where the 39 PRGT-eligible countries stand:

Table 1. Current borrowing of PRGT-eligible African countries

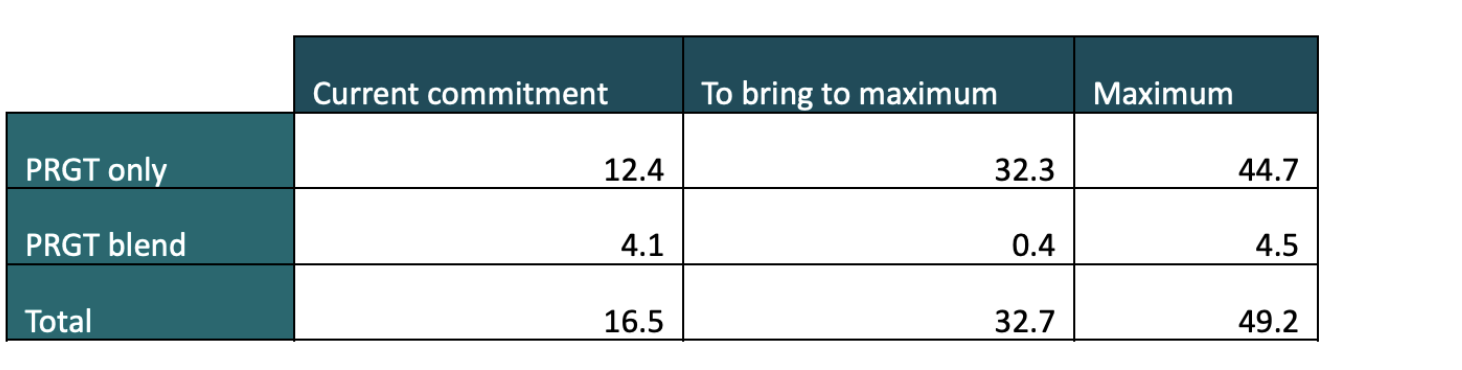

If we brought all the countries to their maximum borrowing from the PRGT, it would increase lending by $32.7 billion, bringing total lending to $49.2 billion (table 2). (Blend countries borrow from the PRGT and the IMF’s General Resources Account, or GRA—we bring those countries to their PRGT limit. This also includes loans to some countries whose policies may not currently be sufficiently strong to gain IMF support, but we were after a ceiling figure and did not want to make judgments here about the merits of any country’s policy stance.)

Table 2. Current and potential PRGT commitments in billions of $US

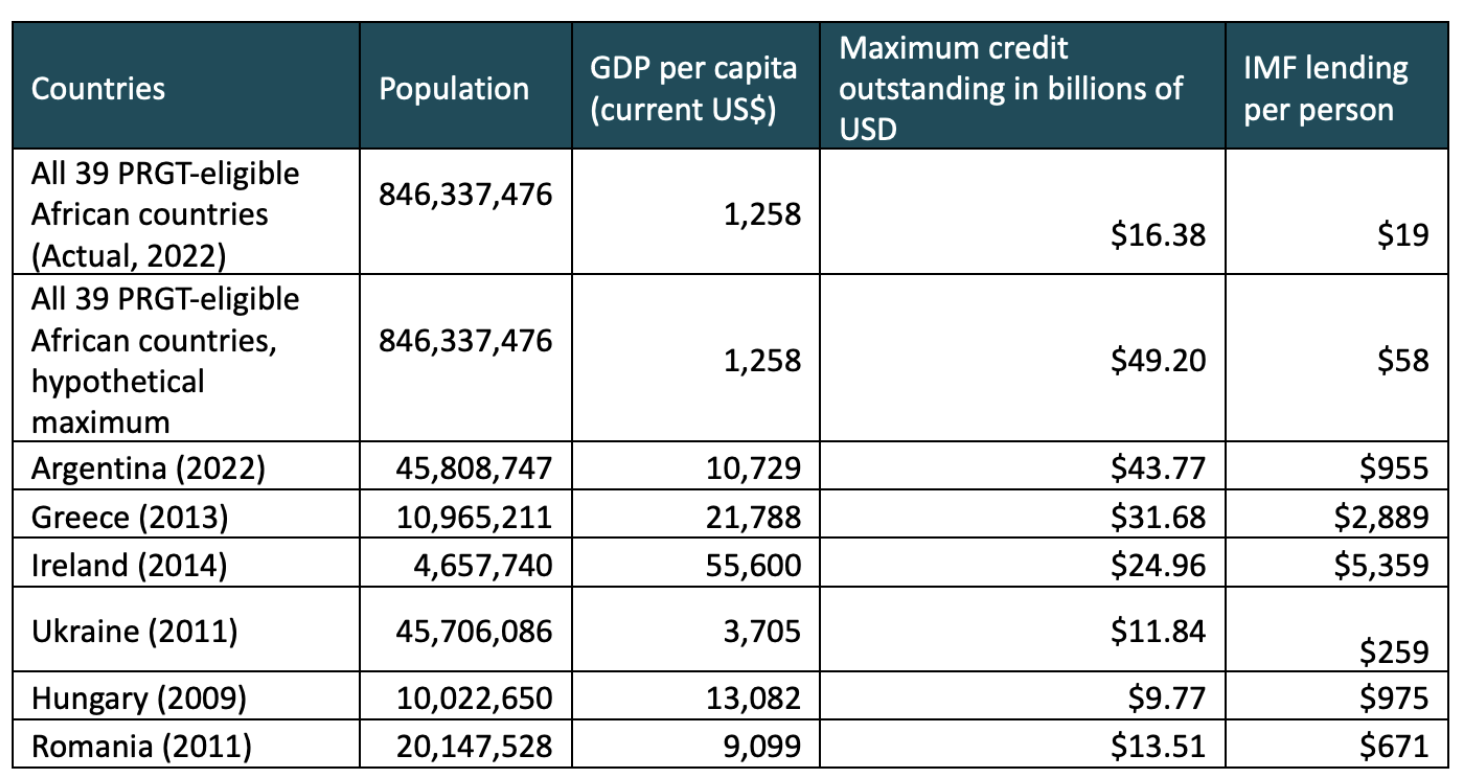

How does this compare to other lending efforts by the IMF? Table 3 gives some perspective. Perhaps the most pertinent example is the current loan to Argentina from the IMF’s GRA—the loan was for $43.8 billion (about 1,000 percent of its IMF quota) to benefit 45 million Argentinians. While per capita lending is not the right metric for IMF support, the contrast is nonetheless stark.

Table 3. Some IMF loans (population and GDP per capita in the year of the loan)

We noted earlier that many African countries are in or near debt distress, which some give as a reason for limiting IMF loans. But this can be wrong-headed as PRGT loans (0 percent interest, 10-year maturity, 5-year grace period) are often cheaper than much of the financing currently on countries’ books and certainly more affordable than going to the market. And loans from the IMF’s new facility, the Resilience and Sustainability Trust (RST), are even cheaper for PRGT-eligible countries. Paying off more expensive loans with PRGT or RST financing could be a good deal. And could tide countries over while they wait for the oft-promised but as-yet-undelivered grant financing to support the transition.

Does the IMF have room to lend at these levels? According to our latest figures, the PRGT has about $27.3 billion more in lending capacity. So the IMF would need at least $5 billion more in loanable funds. The G20 committed to recycling $100 billion of the SDRs they received in August 2020. At least $35 billion have yet to be allocated to any use, so why not expand the PRGT, which is an easy way to recycle SDRs? Increased lending will also require some shoring up of the PRGT’s finances. As suggested in an earlier paper, the PRGT is not in immediate danger of default, and it is easy to put it back on a sustainable basis if the IMF starts now. And RST lending can complement PRGT lending too.

The estimates above come from pushing the PRGT to its limits—probably not a good idea for a handful of African countries that are poorly governed or in deep debt distress. But advanced countries can do more to jumpstart the promises made at COP27. Shareholders need to do three things:

- Give the nod to staff to lend more: while not relaxing prudential standards, pushing the envelope for those countries that can benefit from more IMF lending, either from the PRGT or the RST.

- Get more loanable funds to the PRGT and RST by SDR recycling or hard currency loans.

- Start the five-year process of putting the PRGT on a sustainable basis.

Why not use the facilities and funds and pools of money we have more aggressively, at least until some of the COP27 promises start to be delivered?

The views expressed in this post are those of the authors and do not reflect those of the International Development LSE blog or the London School of Economics and Political Science.

Main Image Credit: Dieter Telemans via Climatevisuals.org.