Carbon pricing offers development banks like Mexico’s NAFIN a way to encourage organisations to reduce emissions through adoption of improved technologies and practices. But these positive effects could be further reinforced by encouraging companies to adopt shadow prices, writes Cesar Espinosa García (Nacional Financiera).

Carbon pricing offers development banks like Mexico’s NAFIN a way to encourage organisations to reduce emissions through adoption of improved technologies and practices. But these positive effects could be further reinforced by encouraging companies to adopt shadow prices, writes Cesar Espinosa García (Nacional Financiera).

A recent estimate by the Union of Concerned Scientists calculated that Mexico is responsible for about 1.4 per cent of global CO² equivalent (CO²e) emissions. For a large, industrialising, oil-producing nation this figure might not seem unduly high. Indeed, Mexico contributes far less CO²e than China (28%), the USA (15%), India (6%), Russia (5%), or Japan (4%), and slightly less than the 2 per cent of Canada, Germany, and South Korea.

But successive governments have nonetheless become increasingly ambitious in setting targets to reduce CO² emissions in the medium to long term. In 2015, Mexico signed up to the COP21 Paris Accord, pledging reductions in CO² emissions of 22 per cent by 2030 and 50 per cent by 2050. The 2012 General Climate Change Law had also already targeted achieving 35 per cent of power generation through clean energy by 2024 and a net zero rate of carbon loss through a zero net deforestation rate by 2030.

What role for development banks?

As discussed in a previous blog, development banks have a potential role in generating new resources in order to fund “green” projects. In 2015, Nacional Financiera (NAFIN) became the the first Mexican financial institution to issue a dollar-denominated green bond, soon followed in by a peso-denominated bond in 2016.

These funds have supported a number of sustainable projects, including 11 wind farms, three photovoltaic plants, and two mini hydro plants, while a new credit line also offers support for geothermal projects. The performance of NAFIN’s sustainable portfolio has signalled to commercial banks the profitability and reduced risk associated with “green finance”, prompting an increase in private lending.

In the short to medium term however, even a potential increase in development and commercial bank lending faces a limited number of potential investable projects, which even with prompt operationalisation will have only a minimal impact on emissions.

Another highly promising mechanism to address greenhouse gas emissions is carbon pricing, which aims to set a price for environmental damage caused by firms, institutions, or individuals so that this externality can be identified, quantified, and addressed. The more greenhouse gases are released, the more their producer should pay, creating an incentive to cut emissions. If the carbon price is high enough, it can motivate a switch from high- to low-carbon or more efficient technologies, better waste management, or revised project assessments.

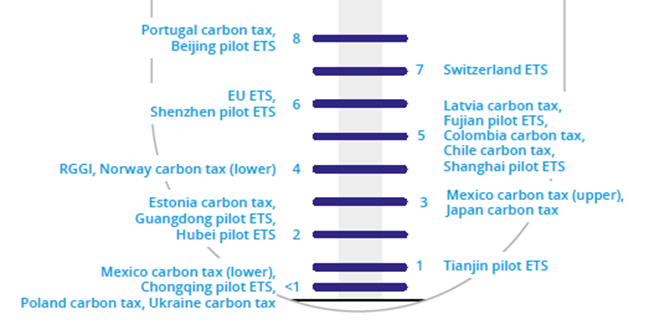

The critical point is how to set the price. A 2017 report issued by The High-Level Commission on Carbon Prices (HLCCP), co-chaired by Nobel Prize laureate Joseph Stiglitz and LSE’s Nicholas Stern, suggested a carbon price of $40 to $80 per ton of CO² equivalent by 2020, rising to $50-$100 in 2030. But as shown below (click to enlarge), actual carbon prices vary significantly, with Mexico employing a price far lower than the Commission’s recommendation.

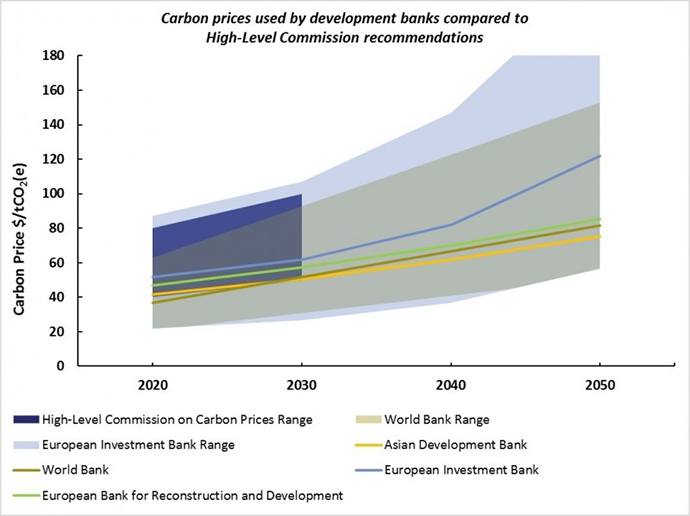

Despite growing acceptance of carbon pricing amongst development banks – the International Finance Corporation started using carbon pricing in January 2017 and began to mainstream the concept in 2018 – these institutions currently adopt prices in the mid- to lower range of those recommended by the High-Level Commission (see below).

Implementing carbon pricing in Mexico

There are two popular options when implementing a carbon price: establish a carbon tax or set up an emissions trading system (ETS).

Mexico implemented a carbon tax in 2013, but its low level means that it does not provide sufficient incentive for companies to transition to more environmentally friendly practices.

Emissions trading requires a platform dedicated to the trading of carbon allowances between companies. Traded permits sanction specific quantities of greenhouse gas emissions, whereas exceeding the allowance triggers a charge (essentially a carbon price). Companies that save their permits can trade these to over-polluting companies. Ideally, revenue from the sale of permits should then be invested in new eco-technologies to create a virtuous circle.

Mexico’s first emissions trading system, known as MexiCO2, was piloted in 2017 with the support of a number of institutions, including the Mexican Stock Exchange, the United Nations Environment Programme, and the Ministry of Environment and Natural Resources (SEMARNAT). But it experienced problems like those found in the European Union Trading System.

Since 2005, the EU’s trading system has operated across 31 states, covering about 11,000 large installations that produce almost half of the total greenhouse gases in Europe. Between 2008 and 2012, prices reached a peak of €30 per tonne, but with the economic crisis reducing industrial activity, expected pollution levels fell far below the allowance, which in turn produced a surplus of permits that dragged prices down to between €4 and €8 per tonne in 2016 and 2017.

An ETS depends on a market that is widely understood and robustly regulated. But even then an ETS alone will not be enough to change behaviours in sectors where firms are reliant on fossil fuels and established technologies or in those sectors offered exemptions and special treatment for carbon taxes as a form of political appeasement.

Shadow carbon pricing as an opportunity for development banks

In the absence of effective carbon prices and taxes, governments may feel the need to impose stricter regulation on high-emission sectors. Given this possibility of regulatory change, potentially including restrictions on outputs or higher carbon taxes, organisations may wish to internalise a hypothetical carbon price in their business models.

Such “shadow” carbon prices operate as a hedge for future risk. For governments their adoption represents an easier win, as the independent adoption of carbon price measures requires less institution-building and is less disruptive in terms of industry interests and capabilities.

For these reasons shadow carbon prices have caught the attention of development banks. In December 2017, the World Bank Group committed to applying a shadow carbon price to the analysis of all International Bank for Reconstruction and Development and International Development Association projects in key high-emission sectors. But development banks could go further by, for example, adopting higher shadow prices in credit assessments as a means to promote the benefits of a transition.

The more general use of shadow prices could also inspire new kinds of “green” projects, though they would need to remain realistic if they are to gain finance first from development banks and later from commercial banks. These projects will also encounter a new “carbon risk” stemming from the fiduciary duty of the financial services industry to accelerate the greening (or decarbonisation) of their portfolios.

As Christiana Figueres, Executive Secretary of the United Nations Framework Convention on Climate Change, put it in 2014:

[today’s investment decisions] need to reflect the clear scientific evidence, and fiduciary responsibility needs to grasp the intergenerational reality: namely that unchecked climate change has the potential to impact and eventually devastate the lives, livelihoods and savings of many, now and well into the future.

Slowly, pension fund investors, insurers, and banks in the United States have recognised “carbon risk”, decarbonising at least $100 billion of institutional equity investment.

Carbon pricing in Mexico and beyond

In order to meet their commitments to reduce greenhouse gas emissions, national governments are expected to increase the mobilisation of financial resources dedicated to “green projects”. Although the total equity capital of multilateral development banks is relatively modest – roughly $680 billion, with total annual lending of $70 billion – these too will play an important and growing role in meeting climate change goals.

For Mexico’s NAFIN, meeting national and international commitments through conventional financing of “green” projects is clearly worthwhile, but it may prove insufficient in the medium term. Attention to carbon pricing offers development banks like NAFIN a way to encourage organisations to reduce emissions through adoption of improved technologies and practices. But these positive effects could be further reinforced by encouraging companies to adopt the idea of shadow prices wherever possible, from project credit assessments to external advocacy and training.

Notes:

• The views expressed here are of the authors and do not reflect the position of the Centre or of the LSE

• This article draws on the author’s working paper Shadow Carbon Pricing and the Role of Development Banks

• Please read our Comments Policy before commenting

The greenhouse effect on Earth is as old as the planet itself and is one of the causes of life in it. If the Earth were not able to retain certain gases around it, life as we know it would be impossible. Moreover, the very existence of the Earth’s atmosphere is linked to the greenhouse effect. So talking about the greenhouse effect or global warming is as old a subject as the planet we inhabit. The fundamental question is whether only the action of men will be able to modify the temperature in such a high amount that the hecatomb that some predict or if there are other factors outside the intervention of man will be caused. https://planckito.blogspot.com/2018/08/el-efecto-invernadero-y-el-cambio.html