Climate change will seriously impact trade and development in Latin America, and the status quo is unlikely to help regional economies leap forward, which calls for a major rethinking of policy strategies to seize the “Green Windows of Opportunities” that arise from the global energy transition. In that sense, a Latin American Green Deal, based on regional coordination, could also be the way forward, writes Amir Lebdioui (SOAS / LSE Latin American and Caribbean Centre).

The impact of climate change will be more devastating in Latin America than in most parts of the world and will influence the region’s ability to trade. Precipitation patterns are shifting, temperatures are rising, and some areas are experiencing changes in the frequency and severity of weather extremes such as floods and droughts. By 2050, it is estimated that climate change damage could cost USD 100 billion annually.

The increasing frequency of extreme meteorological events has already devastating effects on production, tourism, and trade infrastructure. At the same time, expected precipitation fluctuations also threaten the long-term productivity of several agricultural outputs, which many countries in the region (specifically, Argentina, Brazil, Chile, Ecuador, and Uruguay) depend on as a source of exports for food security. A few examples include climate change poses a serious risk to salmon farming in Chile, coffee production in Colombia, and cacao production in Ecuador.

Implications of decarbonisation for fossil fuels and mining

The global push toward decarbonisation also has important implications for the region’s trade prospects, bringing about both challenges and opportunities. On the one hand, several oil producers (such as Bolivia, Colombia, and Venezuela) face uncertainty as the demand for fossil fuels is expected to drop in the medium to long term. The global transition to a decarbonised economy will have profound effects and cause the loss of over 360,000 jobs in fossil fuel extraction and fossil fuel-based electricity generation in the region.

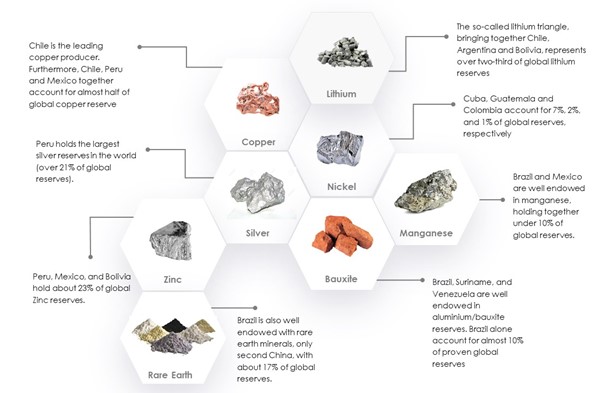

On the other, several Latin American countries are poised to benefit from their large endowment of minerals that are essential to the production of low carbon technologies. For instance, Latin America holds vast reserves of lithium, copper, silver, as well as bauxite, zinc, manganese, and nickel.

However, even for countries dependent on these so-called ‘minerals of the future’, the long-term outlook is still dominated by high levels of uncertainty and risks of technological disruption. There are copious amounts of resources invested in research and development (R&D), especially in China, Japan, and the USA, to generate alternative electric battery technologies (such as solid-state batteries or hydrogen-based batteries) that rely on substitute minerals and raw materials.

In addition to the region’s direct productive vulnerability to climate change, Latin American firms will have to adapt as consumer demand shifts towards more sustainable products in key markets. The growing popularity of Green New Deal proposals in the United States and the European Union will inevitably bring regulatory changes that will reshape consumption patterns. In general, Latin American and developing countries need to anticipate these “green” trade regulations and standards, shifting their productive capabilities towards the export of lower carbon goods and services.

Several Latin American countries (especially Costa Rica, Chile, and Uruguay, among others) are showing increasing high climate ambitions and impressive successes in clean energy deployment and pioneering biodiversity conservation initiatives. But there’s still a lot more to reap the full potential that clean transitions can provide in Latin America and compensate for the expected income and job losses in the fossil fuel sector.

Renewable energy

Renewable energy deployment has been a great success in Latin America, with renewables that are already the lowest-cost source of new power generation and renewable energy capacity per capita that is twice the world average.

Although considerable benefits (such as very high savings costs) should arise from an unrestricted cross-border trade of electricity in Latin America, such trade operations have remained limited. Apart from some notable exceptions, such as the biofuels and wind energy sectors in Brazil, most countries are inserted in low value-added segments of renewable energy value chains, such as the production of primary commodities (such as copper, lithium, balsa wood, iron ore) and supply, installation, and maintenance activities.

Because of the volatility of demand and unstable energy politics, operations in Ecuador, Mexico, Brazil, Colombia, and Argentina have experienced considerable fluctuations from year to year, making expansions of manufacturing capacity difficult. This is why promoting a more stable renewable energy market, with a clearer roadmap in the medium and long term and a stronger regulation plan, will be essential for providing investor trust in local renewable energy-related manufacturing capabilities.

Latin American countries could also take advantage of cheap and clean energy sources to decarbonise electricity generation and as feedstock to develop competitive value-added low carbon services and industries, such as green hydrogen production, low carbon data centres, cloud services and low carbon mining.

Biodiversity conservation for value-added trade

Latin America’s biodiversity and unique natural ecosystems can act as a transformative force in the region’s sustainable development. The whole world benefits from a range of ecosystem services (such as carbon storage, watershed protection, and conservation of fauna and flora) that can only be found in this part of the planet. But traditional conservation approaches have often missed opportunities to provide benefits and compensation to the people living in the region. Therefore, better-coordinated policy efforts are needed to leverage the trade value of biodiversity.

For instance, increasing attention is devoted to carbon markets and carbon pricing as a way forward for generating trade value from biodiversity protection. Putting a price on pollution can be an important source of government revenue: in 2019, governments globally raised USD45 billion this way. Mexico, Chile, and Colombia have begun to use – or are considering using – carbon pricing and emission trading systems as part of a broader strategy to decarbonise their economies. But to act as effective trade tools, existing carbon emissions trading systems will need to cut across country and continental boundaries.

Ecotourism has also become a popular strategy to align conservation with the growth of tradable services. But over-reliance on such activity poses significant risks, especially given the vulnerability of nature-based tourism to climate change and high levels of revenue volatility and exposure to external shocks. The Galapagos Islands in Ecuador have suffered these consequences.

Though the biodiversity-based innovation sector has been in nascent stages in most countries, in Costa Rica, we may witness useful efforts towards bio-innovation (mainly through bioprospecting). That constitutes a promising and emerging area for future investments, start-ups, and venture capital.

Governments need to step up their policy efforts with measures that include skills development plans and green industrial policies. They must think about financing to attract private investments and venture capital to nurture start-up ecosystems around low carbon services. Authorities can promote circular economy initiatives to manage scarce resources and trade waste material to reduce the lifecycle of emissions in various industries.

Towards a Latin American Green Deal?

The idea of a Latin American Green Deal becomes relevant when thinking about the multiple policies and the regional coordination needed to promote a swift towards global warming in the region. If designed carefully, such a programme could generate considerable positive impacts across many economic sectors, including energy and agriculture, carbon emissions trading, and the bioeconomy.

Each country has different comparative strengths, from a variety of (complementary) critical minerals that are spread across the region (e.g. Chile, Cuba, Peru, Suriname) to manufacturing capacity (e.g. Brazil, Costa Rica) and renewable energy potential (e.g. Mexico, Paraguay) as well as proximity to important trade routes (Panama). If appropriate resources and policy tools are used and coordinated, all these assets can be part of the plan to develop an efficient regional industrial ecosystem around low carbon technologies.

The design and implementation of such a programme hinge on overcoming several challenges, especially on the funding and political fronts. However, such an objective is achievable, and perhaps even necessary, and requires a significant shift in policy, investment, and vision.

Although several countries are showing increasing high ambitions, launching several green economy plans, and recently signed agreements that promise major implications for the shift to more sustainable trade, regional governments and their international trade and investment partners, need to take bolder steps that are appropriate to the significant opportunities and challenges for the future of Latin American trade.

Notes:

• The views expressed here are of the author rather than the Centre or the LSE

• This post is based on the report Latin American Trade in the Age of Climate Change: Impact, Opportunities, and Policy Options, launched at the LSE in London

• The Canning House Forum is a partnership between the LSE Latin American and Caribbean Centre and Canning House that aims to promote research and policy engagement around the overarching theme of “The Future of Latin America and the Caribbean”

• Please read our Comments Policy before commenting

• Banner image: Aerial photo of river in amazon rainforest jungle in Peru / Shutterstock