The ‘Bank of Mum and Dad’ is now among the top ten lenders in the country. But research by LSE London, led by Kath Scanlon, shows how little it operates like a bank. The report, ‘The Bank of Mum and Dad: How it really works‘, emphasises that for most families the process is very informal, and people find it very difficult to talk about money. Often it is not clear whether there is to be interest paid or indeed whether the money involved is a loan or a gift; very little thought is given to what happens if circumstances change – particularly if the children split up or parents need care in old age. Nor do most families take professional advice about legal, financial or tax implications. This is a totally different situation from when you take a loan from a financial institution which involves a massive set of regulations which addresses all these issues and many others.

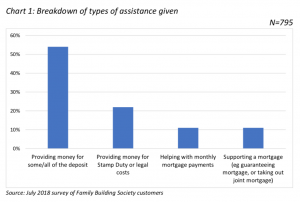

For this research project, we surveyed customers of the Family Building Society – who are mainly older and relatively well-off and mostly from the South of England – not a cross-section of society, but a good reflection of those who lend to their children. We analysed 795 responses. Most said they had given some kind of help to family members to buy a home. Of those who had given help, 92% two percent said the beneficiaries were their children. Other beneficiaries included grandchildren, parents, nieces, nephews, and siblings. Over half of respondents said they provided money for some or all of the deposit (Chart 1 shows the range of assistance provided). Almost 70% of respondents said the money came mainly from their savings, while 14% said the funds had come from an inheritance. Only 8% of respondents reported having used funds from a pension, equity release or re-mortgaging their own home.

Parents were generally happy to help – although many felt that government had let this generation down. Most were concerned about being even-handed among their children and some worried about how secure their child’s circumstances were. But there was very limited discussion of future financial arrangements.

We also spoke to a small number of recipients. Some said parental support had enabled them to buy a bigger or better-located home than they otherwise could have purchased; others said they would not have been able to buy at all without assistance. Several said they felt very fortunate, and that their friends and peers with less wealthy parents had little expectation of being able to buy their own homes.

The report also notes that those now aged 50+ may be one of the last generations of parents that can afford to give generous help. Future generations are less likely to pay off their own mortgages or to accumulate so much housing wealth, and few will have final salary pensions.

We interviewed a range of professionals from the finance market, regulation and policy making: several said they felt that the ‘Bank of Mum and Dad’ was worsening the wealth gap and housing inequality and that government policy must provide more targeted assistance. They also emphasised that there were important trade-offs that parents and children should take into account between paying their own way with regards to health and social care as compared with helping the next generation.

Overall, while informality works well when everyone is comfortably on the same page, the reality is that problems often do arise. The report therefore recommends that a simple checklist be developed to help ensure some basic planning and documentation. And Family Building Society has now taken up this challenge.

***

Click here to access our report for The Family Building Society.

Our work on this aspect of housing is covered under one main research themes: Finance. Click on the corresponding link to view our blog entries, reports, and events covering this theme.