This volume examines the origins, growth, and business practices of European banks in Asia, and the development of Asian (notably Japanese and Hong Kong) banks, and their operations on an international stage. Drawing on archival documentation of the main British, French, and Japanese banks involved, it aims to provide analysis from a range of historical viewpoints, including global banking strategy, monetary regimes, financial markets, international trade, labour immigration, and the development of communication tools. Recommended to those with a firm understanding of finance, writes Merlin Linehan, the authors successfully maintain a narrative to stimulate the reader throughout.

The Origins of International Banking in Asia. Oxford University Press: The Nineteenth and Twentieth Centuries. Shizuya Nishimura, Toshio Suzuki & Ranald Michie. September 2012.

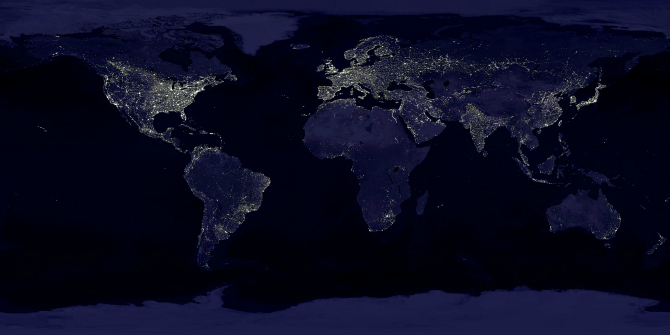

This history of international banking in Asia takes the reader on a journey through the peaks and troughs of the 19th and 20th centuries: the booms, the world wars, and the slumps. It also provides the reader with some useful context on the recent ascent of Asian financial centres. This book is particularly significant when we consider that the world’s economic weight is shifting towards the Pacific basin, and cities such as Singapore, Shanghai, and Hong Kong are challenging London and New York to become the world’s premier money markets.

Across ten chapters, eight authors find focus on individual subjects, such as how London financial markets were key to the development of Asian financial institutions, to the decline and fall of the once powerful but now forgotten Oriental Banking Corporation (OBC).

The origins of Asian banking very much lie in the City of London. The opening chapter discusses the British influence and sets the scene for the rest of the book, charting how London-based institutions acted as a hub for Asian Banks. When the Yokohoma Specie Bank set out to finance Japan’s overseas trade in the late nineteenth century after years of isolation, the establishment of a branch in London was the key to accessing the money markets there in order to facilitate trade: “Whether it was Japanese silk exports to the United States and France or raw cotton imports from India, the sterling bill drawn on London provided the means of finance” (p.25). The book recognises that London has lost ground to New York and Asian financial centres throughout the 20th Century, but also that London has retained much of its importance to Asia in the present day, complementing rather than competing with Asian cities.

The fate of the OBC is a salutary reminder that major banking collapses are not a new phenomenon. In the middle of the nineteen century the OBC was the biggest UK-controlled bank in Asia, yet by the 1880s the bank had staggered into unsustainable debts and was wound up in 1884. The authors show how the Bank, in an attempt to expand its services beyond trade facilitation, clashed with the all-powerful East India Company, which in those pre-munity days was still very much ruling the sub-continent. The beginning of the end for OBC came in the downturn of the 1870s. Toshio Suzuki pulls off a strong narrative of how it all went wrong for the Bank, including how the ruinous effect of bad debts in South Africa and Ceylon hit OBC’s reserves, leading to a major retrenchment in its branch network.

The chapter also covers technological change with the introduction of fast steamships and telegraphic cables which damaged OBC’s balance sheet through the reduction of usance times. This reviewer feels that the text could have provided an analysis of the benefits for the bank from the telegraph and steamship, as there must have surely been some.

Another blow came with the long term decline in the value of silver. The book excels in persuasively linking an economic trend (the fall in the value of silver) to the downward trend in OBCs’ bottom line. Because OBC had placed a great deal of its assets in the silver standard area in order to maintain sufficient capital in its branches, the falling value of silver effectively trapped the bank.

The story of OBC is a classic example of how poor business decisions, unforgiving economic conditions, and technological change ruined a bank, and the book deftly explains the economic scenario at the time while also detailing the specific dealings of the bank, but without dulling the reader’s senses with reams of excess figures and information.

The shadowy beginnings of the Russo-Chinese Bank remind us that finance has always had a role to play in the tussles between great powers. The Bank was set up by the French and Russian Governments, with significant German and Belgian interests, to help manage the debts incurred by the ailing Qing Empire following its defeat in the Sino-Japanese war. Through telling the story of the bank, the chapter sheds light on the ambitions of the Tsarist Empire and the French in China at the end of the nineteenth century, and how the bank financed and managed parts of the Trans-Siberian railway. Meanwhile the Chinese government put in capital but had no say in the management of the bank, an indication of Chinese weakness at the time and an interesting contrast to the present day.

Kazuhiko Yago provides an excellent analysis of the bank’s balance sheets over the years; the charts demonstrating how over time the Russian government took more control over the institution as France abandoned its ambitions in the North and focused on Southern China. The bank shifted from being a primarily an international bank, dealing in Chinese loans and trade, to one which was focused on the Russian domestic loan market.

Even when leavened with history and politics, reading about the dry world of ledgers, bills, and exchange banking drafts can be daunting even to those familiar with financial jargon. The authors should take credit for successfully treading the fine line between describing details and maintaining a narrative to stimulate the reader throughout. That said, this book is not to be recommended to readers a basic understanding of finance and banking procedures.

——————————————————–

Merlin Linehan is currently writing a book on trade and investment between rising powers and previously worked as a financial analyst and consultant in the fields of SMEs, clean energy and donor finance for the European Bank for Reconstruction and Development. Merlin holds an MSc in Finance and Financial Law from SOAS. Merlin blogs on South –South trade at the thekularingtradeblog.com and tweets @MerlinLinehan. Read more reviews by Merlin.