In Portfolio Society: On the Capitalist Modes of Prediction, Ivan Ascher explores how the abstraction and securitisation of risk in financial markets have had a profound influence on economic and social relations, with a particular focus on the aftermath of the global financial crisis. The book underscores the extent to which much of the ‘value’ generated by the contemporary economy results from financial engineering or extractive practices, writes Jenny McArthur.

Portfolio Society: On the Capitalist Modes of Prediction. Ivan Ascher. MIT Press. 2016.

In Portfolio Society: On the Capitalist Modes of Prediction, Ivan Ascher argues that financial markets have reshaped the contemporary economy, extending Karl Marx’s theory of labour to consider how the abstraction and securitisation of risk in financial markets have profound influence on economic and social relations. The text adds to a growing body of critical literature from various disciplines – including Mariana Mazzucato’s The Value of Everything, Nick Silver’s Finance, Society and Sustainability and Daniel Cohen’s The Infinite Desire for Growth – that scrutinises the 2008 global financial crisis and the contradictions it revealed in the nature of our economies and financial systems.

The book is a concise 192 pages, structured across five chapters that explore the development of financial markets, primarily in the UK and the USA, through the lens of Marx’s Capital. It examines the current financial system (Chapter One) and the development of financial securities that speculate on risk and uncertainty (Chapter Two). Looking inside the black box of prediction in financial markets (Chapter Three), the text shows how the transformation of finance in the US is accompanied by fundamental changes in the conceptualisation and measurement of risk. Through the rolling back of comprehensive social insurance schemes for health insurance and pension funds and the creation of credit scores, financialised risks become embedded within social relations, recasting the individual in society as ‘homo probabilis’: possessing a quantifiable risk profile that can be abstracted, pooled and exchanged in financial markets (Chapter Four). The final chapter returns to the aftermath of the 2008 crisis and reflects on what may lie ahead.

Image Credit: (Pixabay CCO)

Image Credit: (Pixabay CCO)

While it draws heavily from Marx’s Capital, Portfolio Society is not strictly a Marxist analysis – rather, it extends theories from Capital to argue that risk has now outranked labour power as the central source of value in contemporary capitalism. Examining the current financial system and its crises, it explores the supporting narratives and implicit power relations that shape specific modes of prediction and protection in the economy: characterised by Ascher as a ‘portfolio society’. Taking the 2008 crisis as a point of departure, the text tracks the emergence of the portfolio society through a long-term process of financialisation, starting in the 1970s. A key question is when, and how, speculation became a generalised feature of society. The central critique is that this not only affects financial markets and the tendency towards collapse, but how we can envisage the future:

What Marx did not say, but what can be presumed, is that a world where people decide together on what is to be produced is also a world where people decide together on what possibilities are to be pursued, what dangers are to be avoided, what risks are worth taking (59).

Portfolio Society draws from a wide variety of sources to elaborate this argument. The story of former Goldman Sachs trader Fabrice Tourre – one of the few people to be prosecuted following the 2008 financial crisis – draws a common thread throughout the text. Extracts from Tourre’s email exchanges with his girlfriend are telling, showing contradictions revealed through everyday conversation, as even the highly-trained quants responsible for structuring financial products openly admit their ignorance:

Seul surviving potentiel, the fabulous Fab […] standing the middle of all these complex, highly leveraged, exotic trades he created without necessarily understanding all the implications of those monstruosities [sic]!! (19).

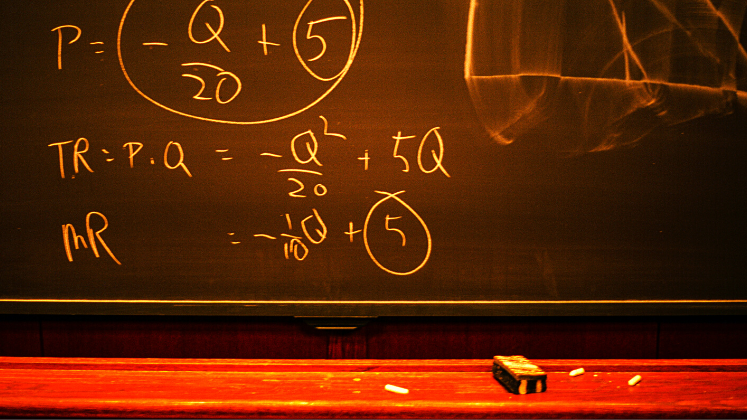

Ascher also traces the historical development of portfolio theory by economists Harry Markowitz, William Sharpe, Fischer Black and Myron Scholes. This historical analysis shows the building blocks of the financial economic theory that underpins financial models, portfolio selection and investment decisions. It shows how the interplay between the generation of new ideas in economics and wider political shifts shaped the financial system we have today. Markowitz’s theory pointed out that investors weren’t solely concerned with the expected return on an investment, but also the uncertainty or variance of this return. Therefore, selection of financial assets for a portfolio jointly considered the value and variance of returns. Markowitz’s student Sharpe extended this, positing the existence of a dominant factor that could explain overall shifts in asset values, providing a benchmark to assess the relative volatility of any single investment. Scholes and Black advanced this further to create a model for the price fluctuations of financial instruments, which enabled the pricing of options (bets on the future prices of assets). A fundamentally speculative logic underpinned these new ideas in economics: it was not just about the actual return on investment but ensuring variance in the volatility of asset prices to balance overall portfolio risk. This enabled individual investors to seemingly eliminate risk – however, Ascher points out that this sort of financial engineering only creates a façade of low-risk investment. In reality, risk is not eliminated – it is rendered systemic to the financial system.

Ascher makes liberal use of metaphor to evoke his ideas, conjuring images of horror stories, zombies, vampires, Robinson Crusoe, casinos and horse races. This provides powerful insight where Ascher compares financial markets to horse races, to critique the resulting class divisions:

It is not a division that separates “borrowers” from “creditors” [… it] separates those who are free to run a race and those who are free to bet on its outcome […] those whose lives keep placing them at risk and having thus to seek protection (say in the form of a loan or an insurance policy) and those whose position of relative security, by contrast, gives them the opportunity to take risks – say, by lending to others or betting on their probability of default (124)

However, other metaphors conceal important features of the portfolio society that we need to understand better to develop alternatives. Characterising financialisation as a zombie evades the critical question of what impels it forward, and how that may be changing ten years on from the last crisis.

Overall, Portfolio Society makes an important contribution to theorising the contemporary economy, although it would benefit from greater attention to the detail of financialisation processes and how they are mediated through political and economic systems. The book does not capture enough of the variation in financialisation processes and contestation between economic actors to avoid reducing the entire thesis to deterministic relations between risk and financialisation. Focusing on economic systems beyond advanced economies, namely those of the US and UK, could also support a more robust empirical basis for the analysis. It does, however, show the durability of Marx’s distinction between use value and exchange value to problematise the contemporary economy and reveal how much of the apparent ‘value’ generated is indeed fictional, resulting from financial engineering or extractive processes.

Jenny McArthur is a lecturer at UCL Department of Science, Technology, Engineering and Public Policy. Jenny has a background in civil engineering and economics and her research focuses on urban infrastructure governance, policy and finance. Twitter @jen_m_mcarthur. Read more by Jenny McArthur.

Note: This review gives the views of the author, and not the position of the LSE Review of Books blog, or of the London School of Economics.

Find this book:

Find this book: