The government has been trying to kick start lending to small and medium sized enterprises (SMEs) in a bid to get the economy moving. Research carried out by Hiba Sameen and colleagues shows that it is the innovative small firms, the minority that drive growth, that experience the greatest difficulties in obtaining finance. Government policy must prioritise the needs of these innovative small firms.

The government has been trying to kick start lending to small and medium sized enterprises (SMEs) in a bid to get the economy moving. Research carried out by Hiba Sameen and colleagues shows that it is the innovative small firms, the minority that drive growth, that experience the greatest difficulties in obtaining finance. Government policy must prioritise the needs of these innovative small firms.

Since the 2008 financial crisis there has been a significant tightening in UK credit conditions and a dramatic reduction in bank lending to small firms. A number of new policy initiatives, such as the British Business Bank, have focused on addressing this problem. However, as last week’s numbers for the ‘Funding for Lending’ programme revealed, lending continues to fall.

A consensus has emerged within policy circles that access to finance for small and medium sized enterprises (SMEs) is one of the key factors holding back the economy. However, most small firms have little impact on job creation. Only a minority will actually drive the economic recovery, specifically those introducing new products, processes or business models. These ‘innovative’ SMEs are most likely to create new markets, achieve rapid growth, and help the economy recover.

Yet as the Big Innovation Centre’s latest report shows, it is precisely these innovative small firms that experience the greatest difficulties obtaining finance. They may have risky business models, which are important for new markets but difficult for banks to value. And they are often more reliant on intangible assets, which are difficult to value and hard to use as collateral compared to physical property.

Despite the focus of policy and the media on access to finance, up to now there has been little evidence on whether access to finance for innovative small firms has changed since the crisis. Our paper, Credit and the Crisis: Access to finance for innovative small firms, addresses two important questions that remain unanswered in the current literature: Do innovative small firms find it harder to access finance? And how has this changed since the crisis?

The report investigates these questions using three waves of the Small Business Survey – a survey of almost 12,000 SME employers. We investigate whether innovative small firms – defined as those which have introduced an entirely new product or process in the previous 12 months – find it harder to access finance, and whether these problems have worsened since the financial crisis. We separate the sample into firms which were surveyed before the financial crisis (2007/8), and those after it (2010 and 2012).

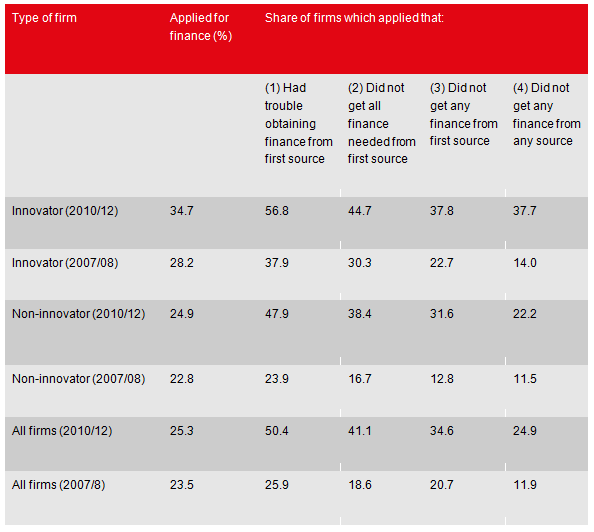

The findings suggest that while innovative firms are more likely to apply for finance, they find it harder to obtain it relative to all other firms. For example, in 2010/12, of those innovative small firms seeking finance, over one in three (37.7%) did not obtain any of the funding they needed. This compares to a figure of one in four (24.9%) for all small firms. In addition, we find that since the recession it has become harder for all firms to obtain finance. In 2007/8, 25.9% of firms that applied for finance had trouble getting it from the first source, compared to 52.2% in 2010 and 48.8 per cent in 2012. This suggests there are systemic issues in the banking system that have made access to finance worse for all firms after the crisis.

Credit conditions have worsened for all firms over this period of time, even controlling for whether they are innovative or not. This reflects the cyclical impact of the crisis. However, the figures indicate that innovative firms are less likely to be impacted by this: owing to higher adjustment costs, they smooth their spending over the business cycle. Nevertheless, relative to other firms, they remain significantly more likely to encounter problems.

Table 1. Has access to finance worsened for innovative SMEs?

Figure 1. Has access to finance worsened for innovative SMEs?

Overall, our evidence suggests that a clear structural market failure exists in the provision of finance to SMEs due to asymmetric information between the lender/investor and the business. These effects are likely to disproportionately affect innovative and young firms compared to other SMEs because of the lack of information available about such firms and the difficulty of valuing their business models.

Whilst there has been a clear policy focus on this area, we would like to see this going further. The British Business Bank is taking steps in the right direction by promoting alternative sources of finance for SMEs, but its current scope and scale are too small to make a big difference in the finance gap. The government needs to increase its scale by dedicating more capital to the bank, but also increase its scope by facilitating access to public corporate bond markets for SMEs.

In a time of limited resources, government policy must prioritise the needs of these innovative small firms, firms which bring new products and processes to market and which are most likely to grow.

Note: This article gives the views of the author, and not the position of the British Politics and Policy blog, nor of the London School of Economics. Please read our comments policy before posting.

Hiba Sameen is a researcher at the Big Innovation Centre, an initiative of The Work Foundation and Lancaster University.