Costas Milas explains why sharp interest rate rises are not a given, despite inflation being on the rise and real incomes retreating.

Costas Milas explains why sharp interest rate rises are not a given, despite inflation being on the rise and real incomes retreating.

Central banks like the Fed or the Bank of England have been slow in their response to rising inflation. Throughout 2021, both banks argued that inflation pressures were far from existent because rising inflation was ‘transitory‘ and (primarily) caused by global supply-side bottlenecks.

But as inflation took off (to reach almost 8% in the US and just over 6% in the UK), and with more inflation pain yet to come, Central Banks reconsidered their position. By March 2022, the Bank of England raised its policy rate to 0.75%. Financial markets now expect the Bank of England to raise its policy rate to almost 2% by the end of 2022. The Fed decided, in March 2022, a target rate of between 0.25% and 0.50% for its federal funds rate and also signalled that US rates will also rise to almost 2% by the end of the year. At the same time, real household disposable incomes in the UK are expected, thanks to inflation, to fall at their fastest rate since the mid-1950s. As inflation bites and real incomes take a hit, there are rising concerns of recession risks both in the UK and the US.

So, with inflation on the rise and real incomes retreating, are we going to see interest rates reaching 2% by the end of 2022? In my view, everything depends on what happens to the so-called output gap. The output gap measures the excess demand or excess supply in the economy. When output is above potential (in which case there is excess demand), inflation is on the rise; when output moves below potential, there is downward pressure on inflation. When interest rates go up, excess demand in the economy is reduced and so is inflation.

But is monetary policy the only driver of output gap movements? Before answering this, it is important to note that the output gap is notoriously difficult to estimate. Indeed, the output gap measures the gap between actual GDP and potential GDP. Actual GDP is revised as more economic data becomes available. Potential GDP is also revised. Notice also that potential GDP is difficult to proxy depending on how one wants to measure the potential strength of the economy.

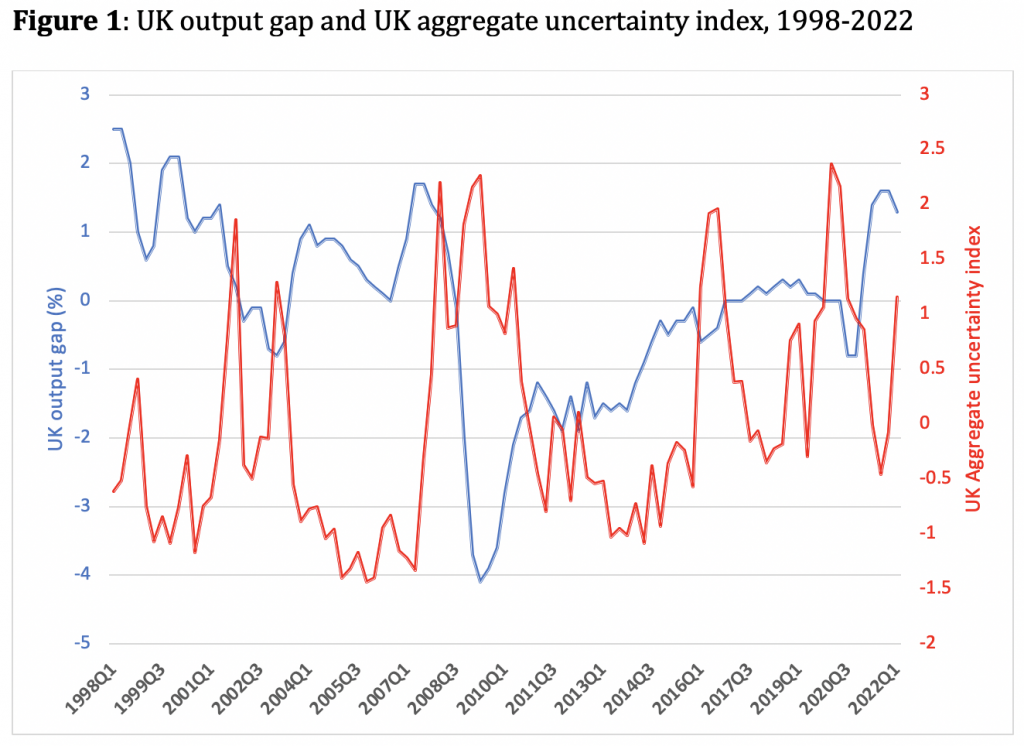

Figure 1 plots the UK output gap. This measure is constructed by the Office for Budgetary Responsibility. Figure 1 also plots an aggregate index of UK uncertainty (the latter is a standardised measure with mean zero and a unit standard deviation). Rising uncertainty is an important driver of economic developments because it suppresses economic growth. Indeed, as uncertainty increases, consumers and businesses become more cautious by spending less and delaying investment projects, respectively. This very behaviour of consumers and firms reduces, to some extent, the need of large interest-rate rises.

I have constructed the aggregate measure of UK uncertainty by pooling information from four relevant measures. The first one is a measure of economic policy uncertainty, which monitors how many UK newspaper articles contain various relevant terms such as ‘uncertainty’, ‘economic’, and ‘deficit’. The second one is a measure of financial stress, which monitors the volatility in the pound and in the UK stock and bond markets. The third one is a measure monitoring stock-market volatility based on pandemic disease developments. The fourth one measures global geopolitical risk. In particular, it counts the number of newspaper articles related to adverse geopolitical events such as war threats, military buildups, nuclear threats, terror threats, beginning of war, escalation of war and terror acts.

Notice, from Figure 1, that uncertainty rose significantly during the 9/11 terrorist attacks, the 2007-2009 global financial crisis, and following the UK’s decision to leave the EU in 2016. It rose further during the early stages of the pandemic in 2020, and is rising again following the war in Ukraine.

The linear correlation between the UK output gap and uncertainty is just -0.36. This masks, to some extent, the fact that firms and consumers behave more cautiously during periods of high uncertainty. My own quantitative calculations suggest that the negative impact of aggregate uncertainty on the output gap is twice as strong during periods of high uncertainty as opposed to periods of low uncertainty. This occurs over and above the impact of monetary tightening.

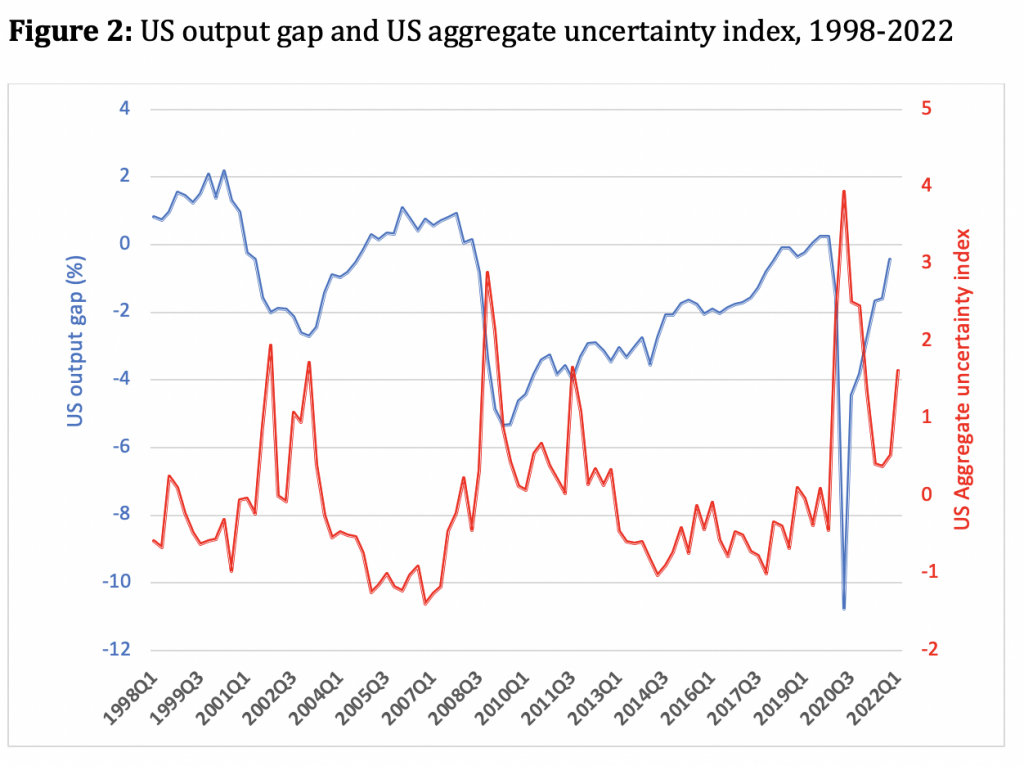

Figure 2 plots the US measure of output gap (as published by the Federal Reserve Bank of St. Louis) together with an aggregate index of uncertainty in the US. The latter is again compiled by pooling information from four components. The first one is a measure of economic policy uncertainty, which monitors how many US newspaper articles contain various relevant terms of economic uncertainty. The second one is a measure of financial uncertainty, which measures market expectations of near-term volatility conveyed by stock index option prices. The third and fourth components are the same ones I used in order to construct the UK aggregate index.

Notice that the Fed takes the view that the COVID-19 pandemic has ‘hit’ the US output gap badly in 2020. In fact, the hit is much more severe than the one estimated by the OBR for the UK economy. This confirms, to some extent, what I noted earlier: that the output gap is notoriously difficult to measure. Notice that the linear correlation between the US output gap and US uncertainty is quite high and equal to -0.62. My calculations suggest that the negative impact of US aggregate uncertainty on the US output gap is indeed very strong and statistically significant. It also occurs over and above the impact of US monetary tightening on the US output gap.

What is the implication of all of the above? Although higher interest rates are needed in order to halt and, indeed, reduce inflation, sharp and rapid increases in interest rates are, in my view, far from certain. Central Banks should continue with interest rate rises. However, they should also monitor movements in aggregate measures of uncertainty and their impact on output gaps. To the extent that uncertainty remains elevated or even rises further, the reasonable action would be to proceed cautiously with monetary tightening.

_____________________

Costas Milas is Professor of Finance at the University of Liverpool.

Costas Milas is Professor of Finance at the University of Liverpool.