In the wake of the Great Recession, anxiety over monetary and financial systems is the highest it has been since the 1930s. Concerned with the lack of creativity of modern solutions, Michael Kumhof reexamines a monetary reform proposal from the 1930s called “The Chicago Plan.” He argues that it contains six advantages to the current system and few disadvantages, making it worthy of serious consideration.

In the wake of the Great Recession, anxiety over monetary and financial systems is the highest it has been since the 1930s. Concerned with the lack of creativity of modern solutions, Michael Kumhof reexamines a monetary reform proposal from the 1930s called “The Chicago Plan.” He argues that it contains six advantages to the current system and few disadvantages, making it worthy of serious consideration.

Concern about individual countries’ and the world’s monetary and financial system is currently greater than at any time since the Great Depression. Given the accumulated experience and scientific progress of recent decades, one would have thought that today’s monetary reform proposals would be far superior to those of the 1930s. But surprisingly almost the exact opposite is true: Nothing in today’s mainstream economics comes even close to the depth of understanding evident in the monetary reform proposals of Frederick Soddy, Frank Knight, Henry Simons and Irving Fisher. To demonstrate this, Jaromir Benes and I have simulated these proposals when applied to the current U.S. economy, in our paper “The Chicago Plan Revisited”.

It is striking that, while Fisher and his fellow economists fully understood the central role of banks in causing economic cycles, financial crises, and excessive debt, in modern macroeconomic theories banks have been almost completely absent for decades. Even recent attempts to remedy this reflect a fundamentally incorrect understanding of banks as intermediaries of pre-existing funds, rather than their critical role as creators of new funds. It is a simple fact that banks create their own funding in the act of lending, an extraordinary privilege not enjoyed by any other type of business. This fact, as well as its implications, seems to elude many modern students of monetary matters. Many also continue to think in terms of the mythical deposit multiplier of economics textbooks, where narrow monetary aggregates are exogenously determined by the central bank, and broad monetary aggregates are endogenously determined as a result. This turns the actual money creation mechanism on its head, and has been refuted in several studies. With this deficient theoretical understanding it is hardly surprising that many of today’s mainstream analyses and proposals amount to little more than tinkering with the plumbing of the existing system, rather than designing an alternative system free of many of the problems we are facing today. In stark contrast, the monetary reformers of the 1930s thought beyond the confines of their existing monetary system, and designed an alternative one.

Their proposal, which later became known as the Chicago Plan, calls for the separation of the monetary and credit functions of the banking system. For money, it requires 100% backing of deposits by government-issued currency, combined with a strict money growth rule to control inflation. The government is therefore fully in charge of controlling the broad money supply, but private financial institutions would remain in charge of determining the credit supply. But because today’s deposit creation out of nothing would be made illegal, the financing of new bank credit could only take place through banks retaining earnings or borrowing funds in the form of government-issued money.

There is nothing inflationary or destabilizing in such monetary arrangements. Inflationary pressures arise when the public owns an excess of bank deposits relative to goods. But the Chicago Plan leaves bank deposits completely unchanged; it only alters what they represent, from private loans to government-issued money. Even the notion of “backing” is in fact a misnomer, because money, being a creature of the law (a fact that has been recognized at least since Aristotle), does not need to be “backed”, it represents equity in the commonwealth of the nation rather than a debt of the nation. And that is exactly how treasury-issued coin is treated in U.S. accounting.

The historical experience also supports the view that full government control over money issuance is generally not inflationary or destabilizing. To the contrary, financial crises only became a regular phenomenon after states had given up this sovereign right to private banks. It would be a serious logical mistake to treat the inflationary experiences of the last century as a counterargument to this, because during this period sovereigns have only ever been in charge of creating cash and bank reserves, which represent only a fraction—and in most cases a very small fraction—of the overall money supply. Given that banks were in charge of creating a very large share of the money supply, these experiences would in fact suggest that their activities have been partly responsible for recent inflationary experiences. The German hyperinflation of 1923, as explained by Hjalmar Schacht in “Magie des Geldes” (1967), is precisely consistent with this account.

Irving Fisher, one of the preeminent economists of the twentieth century and a fervent supporter of the Chicago Plan, claimed that it had four major advantages. Our work not only finds strong support for all of these, but identifies two additional advantages:

First, preventing banks from creating and destroying their own funds during sentiment-driven credit booms and busts would allow for a much better control of business cycles. Second, 100% reserve backing would completely eliminate the possibility of destabilizing bank runs. Third, allowing the government to issue money directly at zero interest, rather than forcing it to borrow that same money from banks at interest, would lead to a dramatic reduction in the interest burden on government finances. It would also make net government debt negative, because under the Chicago Plan the government would acquire a very large interest-bearing claim on banks. This claim would be created when banks borrow to pay for their previously non-existent reserve backing.

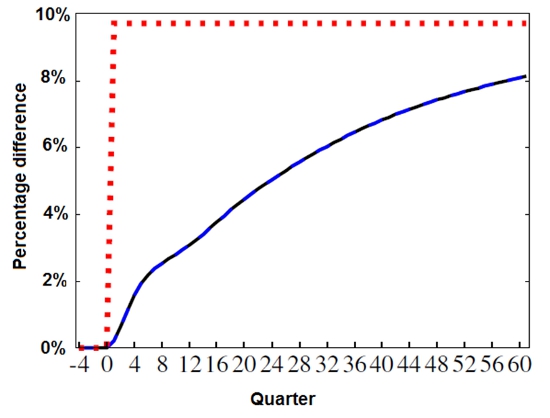

Fourth, given that money creation would no longer require simultaneous debt creation, the economy could also see a dramatic reduction of private debts, in our simulation to less than half their previous level. This would evidently contribute to reducing economy-wide financial fragility. Fifth, the Chicago Plan would generate large longer-term output gains (as Figure 1 illustrates), because lower debt and higher non-inflationary seigniorage revenues would lead to large reductions in real interest rates, distortionary taxes, and credit monitoring costs.

Figure 1 – GDP growth under the Chicago Plan

Note: Red dotted line indicates long-term level of GDP. Blue solid line indicates actual transition path.

Sixth, liquidity traps would become a thing of the past, because broad money would be directly under government control while the interest rate controlled by policy would not face a zero lower bound. This would also make it much easier to reduce average inflation to zero.

A proper cost-benefit analysis should therefore recognize that the advantages of the Chicago Plan are many and large. We can think of only one serious disadvantage, namely that the transition could be complicated and risky. But earlier thinkers, including Milton Friedman, did not share this concern, and the risks would have to be enormous to justify not giving the Chicago Plan very serious consideration.

Michael Kumhof gave a public lecture entitled “The Chicago Plan Revisited” at the LSE on Tuesday 12 November 2013. More information and a video of his talk can be found here.

Please read our comments policy before commenting.

Note: This article gives the views of the author, and not the position of USApp– American Politics and Policy, nor of the London School of Economics or those of the IMF or IMF policy.

Shortened URL for this post: http://bit.ly/1i8hhm9

_________________________________

Michael Kumhof – International Monetary Fund

Michael Kumhof – International Monetary Fund

Michael Kumhof is the deputy chief of the modeling division at the research department of the International Monetary Fund (IMF). His recent work has focused on the role of banks in the macroeconomy, the role of income inequality in causing economic crises, and the impact of potential fossil fuel supply limitations on the world economy.

to get a virtuous proposal like this through congress, you have to ensure that congressional candidates are evenly funded via the public purse, for only then can they serve the public with their conscience. If wealthy lobbyists dislike the possibilities, then they will simply fund the opponents of those who would support the above ideas. The current ‘Kenesian’ economics is a bleedin racket.

As a non-economist social entrepreneur (and the son of an LSE graduate, 1949) I am grateful for this re-introduction to and re-imagination of the purpose and structure of money. It is unfortunate that The Great Depression thinking that birthed The Chicago Plan has been successfully ignored for the better part of the last century. The cyclical patterns of the saeculum (a long life 80-100 years) suggest that we are due for a major transition. There have been 3 saecular turnings since Adam Smith wrote that it is the duty of all nations to accrue as much wealth and power as possible, which turned the ‘divine right of kings’ (seigneurage) into a sophisticated method to ensure that capital and the ownership of wealth in its many forms that have existed since the hunter-gatherers began settling down in communities close to water, would and should be concentrated in the hands of the few – emperors, kings, queens, theocracies, nations, institutions, organizations and in the hands of the 1% today. The end of the Pax Americana on February 24, 2022 may be perceived as an Archduke Ferdinand type catalyst for the next significant turning of the cycles of time, a new saeculum and more likely a “Macroshift”. It is possible, I hope, that the adoption of The Chicago Plan will emerge triumphant as part of the evolutionary shift of humanity from exploiter and hoarder of the commonwealth, into a new paradigm as caretakers of the world doing good “For the Good of All, NOW!”

Very interesting, thank you. Would be equally interesting if the author or experts on the field can go beyond theoretical ideas and provide an idea of how to start this change in practice: Can be an entrepreneur who fund such first ‘limited purpose bank’? or it can only happen with government taking the first step abolishing all currently existing ‘unlimited purpose banks’ business models? is one government enough to start the change? Try to explain how to start such a change would be as refreshing as the idea of change itself and can inspire actions of new generations/goverments or visionary entrepreneurs.