One criticism leveled at President Obama’s signature healthcare reform, the Affordable Care Act (or ‘Obamacare’), was that people were often unable to continue with their existing health insurance plans, despite promises to the contrary. But could ‘inertia’ in health insurance plans actually cost people more? By studying the health insurance choices of 8,000 employees in one company Ben Handel determines that, by not readjusting their plans based on their circumstances, people lose out on more than $2,000 every year. Surprisingly, he also finds that if this inertia was reduced through the better provision of information, then the health insurance market would ‘unravel’, with few people then choosing to enroll in comprehensive coverage.

One criticism leveled at President Obama’s signature healthcare reform, the Affordable Care Act (or ‘Obamacare’), was that people were often unable to continue with their existing health insurance plans, despite promises to the contrary. But could ‘inertia’ in health insurance plans actually cost people more? By studying the health insurance choices of 8,000 employees in one company Ben Handel determines that, by not readjusting their plans based on their circumstances, people lose out on more than $2,000 every year. Surprisingly, he also finds that if this inertia was reduced through the better provision of information, then the health insurance market would ‘unravel’, with few people then choosing to enroll in comprehensive coverage.

Is it always better for a regulator to try to help consumers make better choices? Typical economic analysis in a “normal” product market would say yes: the more informed consumers are the better off they will be, given the current market environment (e.g. current prices). Moreover, if the population overall makes better choices, those choices provide “signals” to the market that lead to lower prices and better products for consumers in the long run.

In recent research, I show that this typical logic does not necessarily hold in health insurance markets. In insurance markets, having consumers that are better informed and make better decisions for themselves can be both good and bad, instead of just good. Health insurance markets are different than “normal” markets because insurer costs are directly linked to who enrolls in their plan. In a typical market, such as for automobiles, it doesn’t matter what types of consumers buy from a given manufacturer, the costs to that manufacturer will be the same regardless. In health insurance this is not true: if an insurance plan enrolls mostly sick consumers, its costs will be high and, hence, its premiums (prices) will be high. Consequently, when sicker consumers enroll in an insurance plan (or market overall) costs for healthy consumers increase, and those consumers either exit the market or are forced to pay more for insurance. This phenomenon is termed adverse selection, and it can lead to an inefficient under provision of insurance, even in a competitive market.

So why does this mean that better informed, more savvy consumers could be a bad thing from a social perspective? If some healthy consumers make mistakes by over-insuring, effectively subsidizing sick consumers, this causes the average costs of more comprehensive insurance coverage to decrease, and thus the premiums for that coverage to decrease in a competitive (or partially competitive) market. Crucially, this makes more comprehensive insurance cheaper from the perspective of all consumers: now some healthier consumers, even those who are rational, will find more comprehensive insurance to be a better deal, and switch to purchasing more coverage. This will lead to even lower costs and premiums, restarting this cycle. Having healthy consumers mistakenly choose more insurance can keep prices for that insurance down, and make it more available to all other consumers, including those healthy consumers who really value having that additional coverage.

So why does this mean that better informed, more savvy consumers could be a bad thing from a social perspective? If some healthy consumers make mistakes by over-insuring, effectively subsidizing sick consumers, this causes the average costs of more comprehensive insurance coverage to decrease, and thus the premiums for that coverage to decrease in a competitive (or partially competitive) market. Crucially, this makes more comprehensive insurance cheaper from the perspective of all consumers: now some healthier consumers, even those who are rational, will find more comprehensive insurance to be a better deal, and switch to purchasing more coverage. This will lead to even lower costs and premiums, restarting this cycle. Having healthy consumers mistakenly choose more insurance can keep prices for that insurance down, and make it more available to all other consumers, including those healthy consumers who really value having that additional coverage.

I looked at the link between decision-making adequacy and adverse selection in practice by studying detailed data on insurance choice and utilization for approximately 8,000 employees of a large American firm (in the U.S. large employers often provide insurance to employees in a market-like setup). I examined consumer inertia, one specific type of consumer choice inadequacy. Inertia leads to consumers enrolling in lower value insurance options over time, because they do not reconsider their choice each year or because switching plans in and of itself is costly.

My first key finding establishes is that inertia matters for the insurance choices of the employees in the study. While it is usually difficult to distinguish between whether staying in an insurance plan over time is due to inertia, or just due to the fact that people really like their current insurance plan, my research is able to disentangle inertia from “persistent preferences” because of a “natural experiment” that occurs in the data. Right in the middle of the six years of choices and claims observed in the study, the employer substantially changed the set of insurance options that employees could choose from. As part of this change, the employer required all employees to make an active choice for that year. This means that employees could not just continue in their incumbent health insurance plan as a default option if it were even still available, which most were not. Instead, employees had to actively elect a choice from a mostly new set of plans.

So, from the choices employees made in this “active enrollment” year, we can observe what they prefer in the absence of inertia and in the absence of a default option (their previously chosen plan). In the years following this change, consumers did have their previously chosen plan as a default option. In addition, due to initial selection into this new menu based on health risk, consumer premiums for the new plans changed substantially over time. Taking all of this into account yields an ideal scenario to quantify inertia: we know what consumers want because of their “active” choices and then see how frequently they switch afterwards in an environment with much different premiums for the same plans.

To make sure that persistence in choices is not simply from strong preferences for certain plans, my analysis implemented several tests. First, it investigated new employee behavior at the firm over time. New employees make active plan choices when they start working for their employer: as a result, when relative premiums for more comprehensive coverage increase by $2,000 in the second year after the employer insurance change, new employees in that year will take that premium change into account. Employees who were new in the prior year may not take the higher premiums into account, since they have a default option of their previously chosen plan. Empirically, the difference between these two cohorts of new employees is stark: new employees for the year when premiums rise are much less likely to choose comprehensive insurance, now with higher premiums, than employees who were new in the prior year, many of whom have comprehensive insurance as a default option in the new year (these two cohorts have about 1,500 employees each and are almost identical demographically).

In the context of an empirical model that takes into account (i) consumer health risk (ii) risk aversion and (iii) inertia, my research finds that consumers in our environment forego, on average, $2,032 annually due to inertia. This is because people don’t re-adjust to choose their optimal plan, which can change over time, and in this empirical setting often does.

So what about adverse selection? I used estimated inertia, health risk, and risk aversion in the population to ask the question what would happen if inertia were reduced by some proportion. One can think of inertia being reduced by a variety of measures, including salient information provision, consumer education about insurance plan options, or more sophisticated “target default options” (among many possible policies to reduce inertia). To this end, the research takes the insurance environment “as is” and asks how consumer enrollment and prices would adjust if inertia were reduced from an impact of $2,032 to something lower.

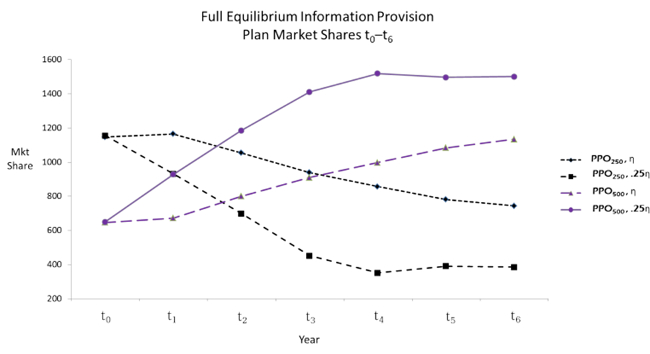

My empirical result is surprising: reducing the impact of inertia by 75%, e.g. through better information provision, leads to substantially increased adverse selection and, consequently, a decrease in consumer and social welfare equivalent to 8% of mean premiums paid (over $100 per family per year). In the case with more inertia many more people enroll in comprehensive coverage over time. When inertia is reduced by 75%, the market mostly “unravels” and very few people enroll in comprehensive coverage. Figure 1, below, shows the additional adverse selection that occurs when inertia is reduced and that enrollment in more comprehensive insurance (with lower deductibles) declines faster over time. The reason is simple: plan premiums are linked to average costs in the prior year (typical in insurance markets) and when consumers have low inertia they rationally sort based on health status given premiums over time. With high inertia, consumers make an initial choice, and their choices over time also reflect initial premiums from that active choice as well as premiums in each year. In our setting, where premiums during the employer insurance change / forced active choice year were relatively close together, inertia reduces adverse selection and “holds the market together” over time as premiums for comprehensive insurance rise. These results are similar in other scenarios, e.g. when the impact of inertia is reduced by 50%, or 100%.

Figure 1 – Impact of Reduced Inertia on health insurance choices

Note: PPO250 and PPO500 represent different preferred provider organization (PPO) health insurance plans, where 250 and 500 are the individual-level deductible amounts. Both lines with the 25ŋ variable illustrate the predicted impact on the market share of each plan when the inertia level is reduced to 25% of the original.

Though this analysis suggests that there are certain cases where “keeping consumers in the dark” could be socially beneficial, in practice society may not want to actively encourage or implement this kind of obfuscation. One key potential reason is that there could still be a benefit of active consumer choice from greater insurer competition, on both price and quality, if the market is not perfectly competitive. This research still has important implications, even for the case where society wants to encourage consumers to make more informed, better, choices. In that case, insurance market regulators should be aware of the potentially strong relationship between choice adequacy and adverse selection, and note that adverse selection could increase a great deal if consumer education policies (such as those under the Affordable Care Act) are very effective. In those cases regulators should be cognizant of this downside, and work to implement other policies that reduce adverse selection, such as (i) insurer risk-adjustment transfers and (ii) higher subsidies for comprehensive coverage.

This article is based on the paper ‘Adverse Selection and Inertia in Health Insurance Markets: When Nudging Hurts” in the American Economic Review Publication.

Please read our comments policy before commenting.

Note: This article gives the views of the author, and not the position of USApp– American Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: http://bit.ly/1dLmOOh

_________________________________________

Ben Handel – University of California at Berkeley

Ben Handel – University of California at Berkeley

Ben Handel is an Assistant Professor of Economics at the University of California at Berkeley specializing in health care economics, industrial organization, and consumer decision-making. His recent research investigates the impacts of limited information, inertia, and choice adequacy for consumers in health insurance markets and relates these choice frictions to market performance and regulation. During the course of his research, Professor Handel has worked with numerous private companies and public partners in the health care sector to study economic issues related to health insurance and health care delivery.