The rate of capital accumulation in the USA has fallen markedly in recent decades. The financialization and shareholder value literatures argue that the cause is a diversion of profits from productive investment towards financial markets and investments. Shannon Williams and Andrew Kliman show that such arguments are not supported by the data and that the fall in US corporations’ rate of profit explains why the rate of capital accumulation fell.

The rate of capital accumulation in the USA has fallen markedly in recent decades. The financialization and shareholder value literatures argue that the cause is a diversion of profits from productive investment towards financial markets and investments. Shannon Williams and Andrew Kliman show that such arguments are not supported by the data and that the fall in US corporations’ rate of profit explains why the rate of capital accumulation fell.

During the past several decades, the rate of capital accumulation by corporations (net investment in fixed capital assets) has fallen, and economic growth has slowed down as a result. At the same time, companies increased their financial investment in relation to their productive investment and paid out larger sums to financial markets in the forms of interest, dividends and stock repurchases. Appealing to these phenomena, heterodox economists and sociologists in the financialization and shareholder value traditions suggest that profit has been diverted from productive investment towards financial uses.

However, we argue that such diversion did not take place; the rise in financial purchases and payments did not take place at the expense of productive investment. Neoliberalism and financialization did not produce a fall in the share of profits that was productively invested. The falling rate of capital accumulation is therefore due, instead, to a relative decline in the profit available for investment—that is, to a fall in US corporations’ rate of profit.

The importance of borrowing

Corporations’ increasing involvement in financial markets did not constitute a diversion of profit from production to finance, because increases in financial acquisitions and payouts were essentially funded by additional borrowing. If profits were the only source of funds for financial and productive investment, a rise in the former would necessitate a fall in the latter. But since borrowed funds are also available, financial investment can (and did) rise as a share of total investment without depressing the share of profit that is productively invested.

The following facts are noteworthy:

- As a source of funds for non-financial corporations’ financial expenditures, profit was substantially more important between 1947 and 1967, before the rise of financialization, than during the four decades that followed.

- To cover their new acquisitions of financial assets, corporations did not need to tap into profits. New acquisitions were in effect fully paid for out of borrowed funds.

- Increases in the share of profits paid out in dividends did not reduce the share devoted to productive investment.

- There was a strong association between borrowing and productive investment, and an extra dollar of borrowing led, on average, to approximately one extra dollar of investment.

Trends in productive investment

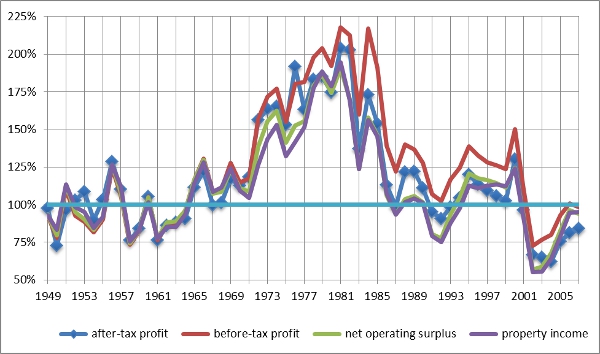

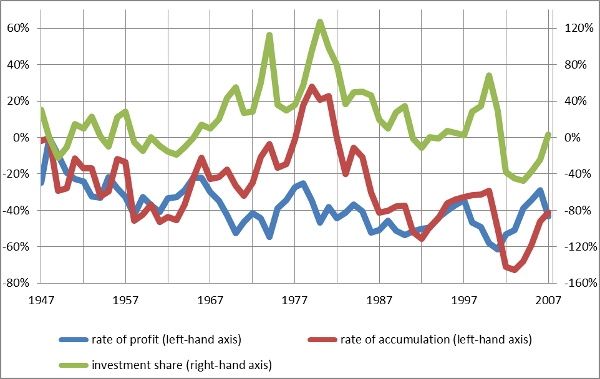

To assess whether profit was diverted from production, Figure 1 looks at the share of profit that was invested in production and considers four different definitions of profit. During the first 21 years of neoliberalism in the US (1981-2001), all four investment shares of profit were at least as great as the pre-neoliberal investment shares. Although the investment share declined after the early 1980s, this occurred because it had become abnormally and unsustainably high–more than 100% of after-tax profit—and it returned to normal levels, not subpar ones. Between 1986 and 2001, all four investment shares were at least as great as those of the 1949–71 period.

Figure 1 – Investment Shares of Profit, U.S. Corporations

Note: As percentages of 1949–1971 average; net investment as percentage of profit two years earlier.

A sharp decline in investment and a large, though temporary, spike in profitability occurred after 2001. As a result, three of the investment shares for the neoliberal period as a whole—including the post-2001 period–fall short of the averages for the 1949–80 period. However, this fact cannot be attributed to neoliberalism, since the investment share was not inferior to the pre-neoliberal share during the first 21 years of neoliberalism. It then plummeted suddenly (see Table 1).

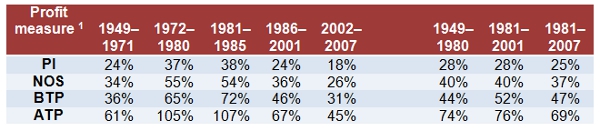

Table 1 – Investment Shares of Profit, U.S. Corporations (net investment as percentage of profit two years earlier)

1 PI = property income; NOS = net operating surplus; BTP = before-tax profit; ATP = after-tax profit

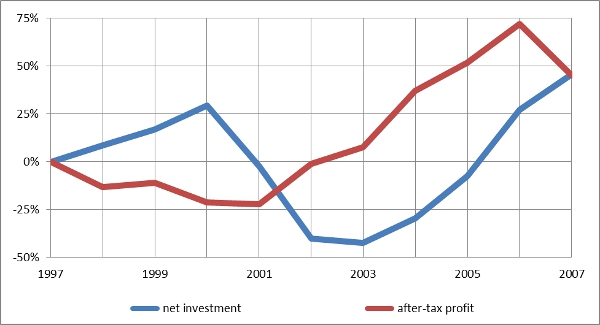

The post-2001 decline in the investment share seems to have been a temporary response to events such as the bursting of the dot-com stock market bubble that began at the end of 2000, the sharp decline in the rate of profit between 1997 and 2001 and the terrorist attacks of 11 September 2001. As Figure 2 shows, the investment share rebounded sharply after 2004.

Figure 2 – Net Investment and After-Tax Profit, U.S. Corporations

Note: Percentage differences from 1997 levels.

Moreover, once one adjusts for changes in the rate of depreciation (by measuring investment and profit inclusive of depreciation), the average investment share of profit is a good deal greater during the neoliberal period, even when the post-2001 years are included, than in the period that preceded it, as Table 2 shows. Thus, the fall in the investment shares over the whole 1981–2007 period, relative to their 1949–80 averages, are attributable to a rising rate of depreciation, not to neoliberalism and/or financialization.

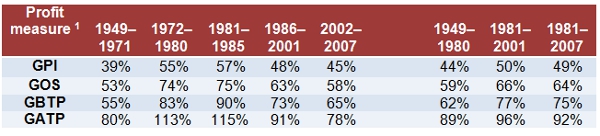

Table 2 – Gross Investment Shares of Gross Profit, U.S. Corporations (gross investment as percentage of gross profit two years earlier)

1 GPI = gross property income; GOS = gross operating surplus; GBTP = gross before-tax profit; GATP = gross after-tax profit

The falling rate of accumulation

Since the rate of accumulation is, by definition, the product of the investment share of profit and the rate of profit, the percentage change in the rate of accumulation is approximately equal to the sum of the percentage changes in the investment share and the rate of profit. Using this relation, we find that:

- Between 1979 and 2001, roughly 55% of the decline in the rate of accumulation is attributable to the decline in the rate of profit, the rest to the decline in the investment share.

- Between 1948 and 2007, the 41% fall in the rate of accumulation is attributable to the 43% fall in the after-tax rate of profit, which was only offset by the 3% rise in the investment share (see Figure 3). In the long term, then, the fall in corporations’ rate of profit, not diversion of profit from investment, explains the entire fall in their rate of accumulation.

Figure 3 – U.S. Corporations’ Rate of Accumulation, After-Tax Rate of Profit, and Investment Share of After-Tax Profit

Note: Percentage differences from 1948 values

Falling profits led to the trend towards dis-accumulation

Some authors have recently argued that diversion of profit from production is a major underlying cause of the recent financial crisis and Great Recession. In addition to freeing up funds for speculation, such diversion supposedly depressed investment and economic growth, which in turn boosted the debt burdens of households and government. This line of argument suggests that macroeconomic policies that reverse the diversion of profit from production are crucially important to prevent a recurrence of the recent crisis (Duménil and Lévy 2011, p. 301). However, our findings suggest that inasmuch as such policies are a solution to a non-existent problem, they are not likely to be effective. Since a long-term slump in profitability, not diversion, is what led to the trend towards dis-accumulation, it is unlikely that the trend can be reversed in the absence of a sustained rebound of profitability.

This article is based on the paper “Why ‘financialisation’ hasn’t depressed US productive investment,” in the Cambridge Journal of Economics 2014, where readers may find full references to others’ works, data sources and procedures.

Featured image credit: Matt Katzenberger (Flickr, CC-BY-NC-SA-2.0)

Please read our comments policy before commenting.

Note: This article gives the views of the author, and not the position of USApp– American Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: http://bit.ly/1yaQAnO

_________________________________

Shannon Williams – University of Tennessee

Shannon Williams – University of Tennessee

Shannon Williams is a PhD student at the Department of Sociology, at the University of Tennessee. His research interests include Political Economy & Globalization.

_

Andrew Kliman – Pace University

Andrew Kliman – Pace University

Andrew Kliman is a professor of economics at Pace University and the author of Reclaiming Marx’s “Capital”: A Refutation of the Myth of Inconsistency (2007) and The Failure of Capitalist Production: Underlying Causes of the Great Recession (2012).

Shouldn’t the title be “Fallen” or “Law”, rather than “Falling” Profits ….? Since the suggestion is not that the rate of profits had been falling since the 1970s, only that it has not risen since then? Ot it?