While much of the debate and discussion on how to address inequality has been focussed on the role of the federal government, state governments also have a role to play. In new research, Thomas Hayes and D. Xavier Medina Vidal find that states which have higher levels of cash assistance and unemployment compensation and higher corporate tax revenues have lower levels of inequality.

While much of the debate and discussion on how to address inequality has been focussed on the role of the federal government, state governments also have a role to play. In new research, Thomas Hayes and D. Xavier Medina Vidal find that states which have higher levels of cash assistance and unemployment compensation and higher corporate tax revenues have lower levels of inequality.

Scholarship examining U.S. policy at the national level has found a limited response to the recent trends of rising inequality and widespread poverty. There are, however, many layers of government at which policymakers can respond to problems in a federal system. States also have wide authority to influence economic and social policy, which has increased since the 1990’s.

In recent research, we examine the extent to which state governments (through fiscal policy measures) influence economic inequality—by not only examining state-level inequality, but also the average family incomes of various economic groups. Using a large database of state fiscal policymaking tools between 1976 and 2006 we examine the effects of taxing and spending on state level inequality as well as the average incomes of families in different economic groups.

We find states (through taxing and spending) are able to affect economic inequality and can significantly influence the incomes of different economic groups. Thus, our results show that state fiscal policies can have a real impact on both reducing inequality as well as aiding the incomes of the poorest citizens.

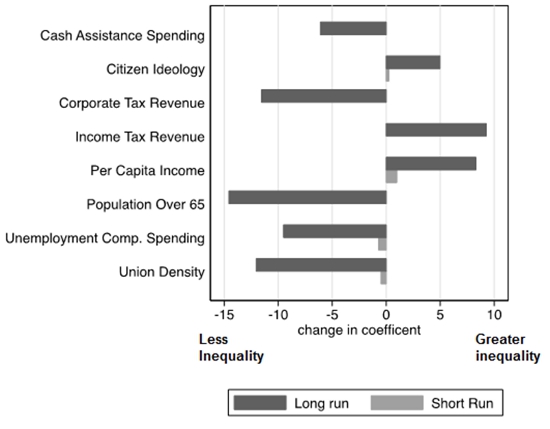

In terms of state level inequality, our main findings are shown in Figure 1 below. This figure shows the expected change in the Gini Index going from the minimum to maximum of each significant predictor in our model for both the short (lightly shaded bars) and long run (darkly shaded bars). Many long run predictors have clear effects for reducing state inequality. In terms of the taxing and spending variables, the largest effect we observe is for Corporate Tax Revenue. Moving from the smallest to largest values, there is an expected decrease of about 12 points on the state Gini Index for Corporate Tax Revenue. This effect is about the same as other significant predictors such as Union Density. The variables measuring Unemployment Spending and Cash Assistance also show a significant reduction in state inequality in the long run, with the magnitude of the effect slightly lower than that of Union Density. The figure also shows that, in the long run, revenue from the Income Tax is associated with increases in inequality.

Figure 1 – Expected Change in Gini Index with a Change from Minimum to Maximum Values for Significant Predictors

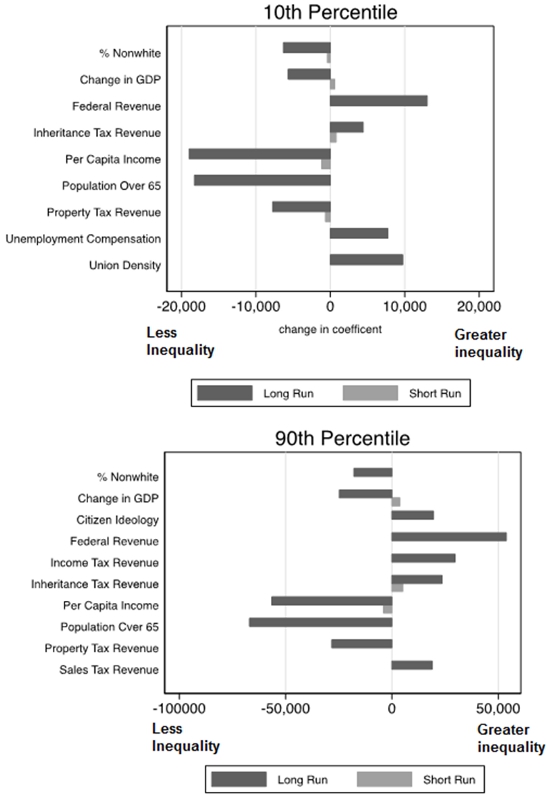

Figure 2 below illustrates the expected change in family income for a low-income group (the 10th percentile, P10) and highest (90th percentile, P90) income families with a change from the minimum to maximum value. The figure shows that moving from a state with the lowest to highest Unemployment Compensation spending increases incomes of the 10th percentile quite substantially. The figure further illustrates that both Federal and Inheritance Tax Revenue have a positive impact on the incomes of the 10th percentile in the long run as well, as moving from the minimum to maximum value of each variable yields a large upward shift in incomes. Property Tax Revenue negatively affects the incomes of the 10th percentile in both the short and long run. The upper-income groups seem to be the primary beneficiaries of Sales Tax revenue, as these are the only groups for which this variable obtains statistical significance. Revenue from the Inheritance Tax positively influences the incomes of top earners in the long run. Property Tax Revenue has a statistically significant and negative impact on incomes for the 90th percentiles in the long run.

Figure 2 – Expected Change in Family Income (P10 & P90) with a Change from Minimum to Maximum Values for Significant Predictors

Taken as a whole, our results indicate a key role for state governments in influencing inequality as well as affecting families in different economic circumstances. In terms of spending, higher levels of cash assistance and unemployment compensation work to decrease state level inequality (Gini). In terms of spending on social programs (such as unemployment) we find that states are able to influence both inequality and the incomes of people in different economic circumstances are important, given that these are areas that states are increasingly responsible for.

Similarly, for state tax revenue, we find income and corporate taxes to impact state level inequality in the long run. We find a positive relationship between income tax revenue and state level inequality, but a negative relationship for corporate tax revenues. States with higher levels of revenue raised through corporate taxes seem to have lower inequality. This is likely because corporate taxes limit the earnings of the wealthiest earners (e.g. the Top 1%). However, in examining the effect of corporate tax revenue on different income groups, it is not clear the degree to which this money is redistributed toward those in the lower classes. We found revenue from this tax largely benefits those in the 40th and 60th income percentiles.

Further, we find all income groups benefit from inheritance tax revenue gained by states in both the short and long term. Given that the inheritance tax (or “death tax” to opponents of the policy) is levied on only the wealthiest families (top 2 percent) it is not surprising that revenue gained from this source would benefit most income groups. There seems to be a clear redistributive effect, at least in terms of average family incomes.

In conclusion, we find that state governments are able to influence the level of inequality within a state and the economic fortunes of families in different economic circumstances through a variety of taxing and spending tools. While we find a role for state governments in influencing inequality, this effect is likely not as large as the potential impact of the federal government, which has wider authority over redistribution. Certainly the federal government has more power and resources to address widespread problems like poverty and growing economic inequality.

Yet the importance of state government fiscal policy making should not be taken lightly, as our results demonstrate tools such as Cash Assistance and Unemployment Spending as well as Corporate Tax Revenue can significantly reduce income inequality and aid the incomes of families in different economic circumstances in the states.

While previous research finds policies such as the minimum wage can influence inequality, our results find a much wider array of policy tools available to state policy makers can influence state level inequality. In a system of shared power, and one in which states have increasing control of welfare policy, the role of states and redistribution is an area that researchers must continue to examine. Political decisions made in the state legislatures and by governors in each state can have a profound impact on state level inequality.

This article is based on the paper, ‘Fiscal Policy and Economic Inequality in the U.S. States: Taxing and Spending from 1976 to 2006’, in Political Research Quarterly.

Featured image credit: mSeattle (Flickr, CC-BY-2.0)

Please read our comments policy before commenting.

Note: This article gives the views of the author, and not the position of USApp– American Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: http://bit.ly/1CMYMct

_________________________________

Thomas J. Hayes – University of Connecticut

Thomas J. Hayes – University of Connecticut

Thomas J. Hayes is an Assistant Professor at the Department of Political Science at the University of Connecticut. He specializes in the fields of American politics and political behavior, with an emphasis on economic inequality. His current research projects examine the degree to which institutional decisions influence attitudes toward disadvantaged groups, the factors that lead states to adopt an income tax, the electoral components that lead to unequal representation, and the reasons that states adopt voter identification laws.

Xavier Medina Vidal – University of Arkansas

Xavier Medina Vidal – University of Arkansas

Xavier Medina Vidal is Diane D. Blair Professor of Latino Studies at the University of Arkansas. He studies Hispanic/Latino political thought and behavior, Mexican politics, race and ethnic politics, and state politics and policymaking.