The rise of private equity may be a reason why fewer firms choose to participate in stock markets, write Kathleen Kahle and René M. Stulz.

The rise of private equity may be a reason why fewer firms choose to participate in stock markets, write Kathleen Kahle and René M. Stulz.

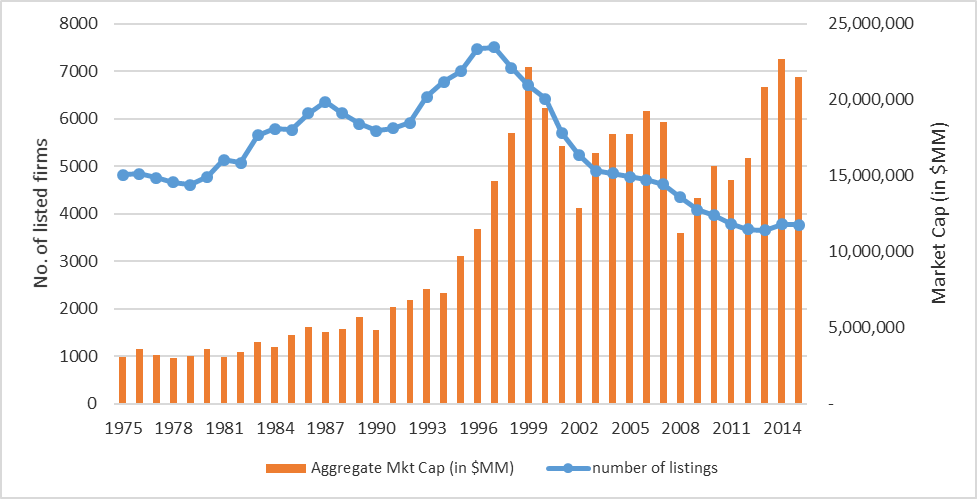

In his famous Harvard Business Review article titled “Eclipse of the public corporation,” Jensen (1989) argues that public corporations are inefficient organizational forms because private firms can resolve agency conflicts between investors and managers better than public firms. His prediction initially appeared invalid. As shown in Figure 1, the number of public firms increased sharply in the first half of the 1990s. However, the number of listed firms peaked in 1997 and has since fallen by half, such that there are fewer public corporations today than 40 years ago (Doidge, Karolyi, and Stulz, 2017). Does this fall vindicate Jensen’s (1989) argument? Is the public corporation in trouble?

In Is the American Public Corporation in Trouble?, we examine the evolution of US public corporations over the last 40 years by comparing snapshots in 1975, 1995, and 2015. We begin by examining the number and size of public firms. There were 4,819 publicly listed US corporations in 1975. That number increased to 7,002 in 1995 and peaked at 7,507 firms in 1997. By 2015, only 3,766 listed firms existed. In contrast to the sharp rise and fall in listings, the market capitalization (in 2015 dollars) of listed firms fluctuated over the last forty years. The aggregate market capitalization of public corporations was seven times larger in 2015 than in 1975. The end result of the these trends is that there are fewer public corporations, but the ones that remain are much larger. This increase in size was accompanied by a striking increase in the concentration of assets. In 2015, 35 corporations accounted for half the assets of public corporations. In 1975, 94 firms did.

Figure 1 – The number of US public firms vs. aggregate market capitalisation 1974-2015

There has also been a dramatic shift in how firms invest – firms spend more on research and development (R&D) and less on capital expenditures. Average capital expenditures (as a percentage of assets) falls in half from 1975 to 2015. In contrast, R&D increases fivefold. Whereas in 1975 the average public corporation spent almost seven times more on capital expenditures than R&D, by 2015 R&D had surpassed capital expenditures. Since firms invested less in tangible assets, property, plant, and equipment (PPE) represented a smaller fraction of the assets in 2015. At the same time, the fraction of assets held in cash and liquid assets more than doubled.

The average profitability (defined as operating income before depreciation minus interest and taxes, divided by assets) of public firms has decreased over time. A substantial proportion of this decline is related to the rise of R&D. Accounting rules dictate that R&D is expensed while capital expenditures are not. Even after adjusting for this, however, profitability has declined. Although performance has declined for the average firm, the winners have done well. In 1975, 109 firms earned 50 percent of the total earnings of public firms; by 2015, 30 firms earned 50 percent of aggregate earnings. Moreover, the earnings of the top 200 firms by earnings exceeded the earnings of all listed firms combined in 2015, indicating that the aggregate earnings of firms not in the top 200 were negative.

We also examined how corporations finance themselves. Compared to 1975, public firms have less debt on average. Perhaps the best measure of financial health is net leverage, defined as the ratio of debt minus cash over total assets. In the first half of our sample, the average net leverage ratio was 12.1 per cent; since 1995, it has been 0.7 per cent. This ratio was negative in most years from 2003 to 2014, indicating that firms had more cash than debt in those years. If we examine asset-weighted averages, which weight large firms more heavily, the asset-weighted averages of leverage and net leverage in 2015 were approximately the same as in 1975, i.e., leverage has not declined for large firms.

Finally, we examined changes in payouts to shareholders. Average dividends per dollar of assets were lower in 2015 than in 1975, in spite of the fact that dividends have increased by a factor of three since 2000. Share repurchases are much higher now than either twenty or forty years ago. Since the late 1990s, public corporations paid out more in repurchases than in dividends. Because of this increase in repurchases, more net income was paid out to shareholders in 2015 than in any other year in our sample.

Jensen’s key argument in his forecast of the demise of the public firm is that public firms are beset by agency problems. The fact that public firms pay out more to shareholders now than at any time since 1975 seems inconsistent with the agency view that managers are prone to retaining resources internally instead of paying them out to shareholders.

However, Jensen’s prediction of the rise of private equity has proven true. The rise of private equity may be a contributing factor to why fewer firms choose to participate in the public markets. The firms that remain public are survivors. A small number of firms account for most of the market capitalization, net income, cash, and shareholder payouts of public firms. At the industry level, revenues are more concentrated, so there are fewer public firms competing for customers. A large fraction of firms are unprofitable every year, especially at the end of our sample period.

The increase in unprofitable firms indicates that many public firms are fragile and helps explain the high level of delistings. While it may be in the best interests of shareholders for firms to behave this way, the end result leaves us with fewer public firms, which gradually become older, slower and less ambitious. Fewer new private firms are born, as the rewards for entrepreneurship are not as large. And those firms that are born are more likely to lack ambition, as they aim to be acquired rather than conquer the world.

- This blog post is based on the authors’ paper Is the US Public Corporation in Trouble?, Journal of Economic Perspectives, Summer 2017 and first appeared at the LSE Business Review.

- Featured image credit: NASA Image of the Day, by the New York Stock Exchange, Public domain, via Wikimedia Commons

Please read our comments policy before commenting.

Note: This article gives the views of the author, and not the position of USAPP– American Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: http://bit.ly/2yWc6El

_________________________________

About the authors

Kathleen Kahle – University of Arizona

Kathleen Kahle – University of Arizona

Kathleen Kahle is the Thomas C. Moses Professor in Finance at the University of Arizona. She has also taught at the University of Pittsburgh and the University of Georgia, and was an Economic Fellow at the U.S. Securities and Exchange Commission. She holds a PhD in Finance from Ohio State University, and has published in a number of leading academic journals.

René M. Stulz – The Ohio State University

René M. Stulz – The Ohio State University

René M. Stulz is the Everett D. Reese Chair of Banking and Monetary Economics and the Director of the Dice Center for Research in Financial Economics at The Ohio State University. He has also taught at the MIT, the University of Chicago, and the University of Rochester. He received his Ph.D. from the MIT. He was awarded a Marvin Bower Fellowship from the Harvard Business School, a Doctorat Honoris Causa from the University of Neuchâtel, and the Risk Manager of the Year Award of the Global Association of Risk Professionals. In 2004, the magazine Treasury and Risk Management named him one of the 100 most influential people in finance. Reuters includes him in its list of the world’s most influential scientific minds. He is a past president of the American Finance Association and of the Western Finance Association, and a fellow of the American Finance Association, the European Corporate Governance Institute, the Financial Management Association, and the Wharton Financial Institutions Center.