The effects of the COVID-19 pandemic across the US have also included falling revenues for cities and municipalities. Using data from counties in Florida, Hai (David) Guo and Can Chen have developed a new forecasting model which predicts municipal revenues. They find that Florida’s municipal governments are likely to see a more than $5 billion fall in their revenues over the next three years.

The effects of the COVID-19 pandemic across the US have also included falling revenues for cities and municipalities. Using data from counties in Florida, Hai (David) Guo and Can Chen have developed a new forecasting model which predicts municipal revenues. They find that Florida’s municipal governments are likely to see a more than $5 billion fall in their revenues over the next three years.

What is the most significant fiscal challenge for US municipal governments facing the unexpected outbreak of the COVID-19 pandemic? It is no surprise that Florida city managers placed the forecasts for the pandemic’s impact on local revenues as their top priority, as local governments are revenue-driven entities. The tradeoff between revenue growth and stability has always been a concern for local governments. With procyclical – reducing spending during times of growth – fiscal policy, local governments usually face abrupt revenue shortfalls and high demand for public service during recessions. The COVID-19 pandemic-induced recession is no exception. Furthermore, there is tremendous uncertainty regarding just how long the pandemic will last, the magnitude and requirement of federal government aid, and how the public’s behavior will change.

Collaborating with the Florida League of Cities (FLC), we endeavored to provide a simple and practical revenue forecasting strategy to help cities in the state plan and prepare for the potential impacts of the COVID-19 pandemic on their budgets. We started reviewing the revenue structures of all municipalities in Florida from 2008 to 2018 and considered how recessions exert different impacts on each revenue source. Revenue structures varied greatly among the 411 municipalities we examined. Whether the revenue structure is diversified or concentrated on specific revenue sources may result in different fiscal impacts and various fiscal responses to the COVID-19 pandemic.

Examining changes to cities’ revenue over time

The challenge of simplicity and practicality has two folds—an easy-to-understand model and easy-to-access data. The unemployment rate drastically increased as cases of COVID-19 surged, which continued in news media headlines. The National League of Cities (NLC) forecasted the aggregated revenue changes in response to the rise in the unemployment rate following the Upjohn Institute model. We adapted this approach to a broader range of 21 municipal revenue categories and controlled for the trend over time to provide our forecast.

Photo by Martin Sanchez on Unsplash

Furthermore, since applying the Florida statewide or municipal unemployment rates may not differentiate regional differences, we instead calculated the revenue responsiveness coefficient in response to the county unemployment rate. Our analysis reveals that municipal government revenue responds more to the county unemployment rate change rather than the municipal unemployment rate. Although using the county unemployment rate provides variability, it requires an extra step of calculating the county unemployment rate based on the forecast of the Florida state unemployment rate. Based on the real monthly updates on the Florida state and county unemployment rates in 2020, we estimated each county’ unemployment rate in 2021 and 2022 to forecast the revenue impact for FY 2022 and FY 2023.

COVID-19 will continue to have significant effects on the revenue of Florida’s municipalities

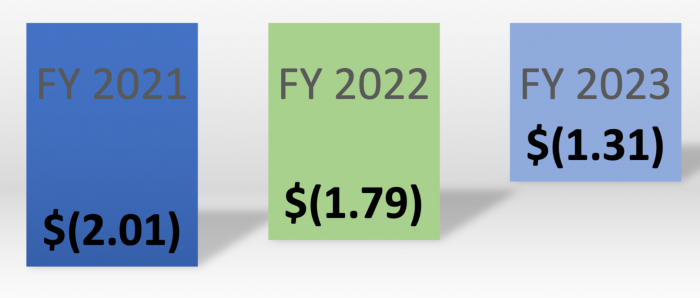

Our headline finding a forecast of a $5.11 billion total reduction in revenues for Florida municipalities, from 2019 pre-pandemic levels, in the fiscal years 2021 through 2023.

Figure 1 – Total forecasted revenue impacts for Florida municipal governments (billions)

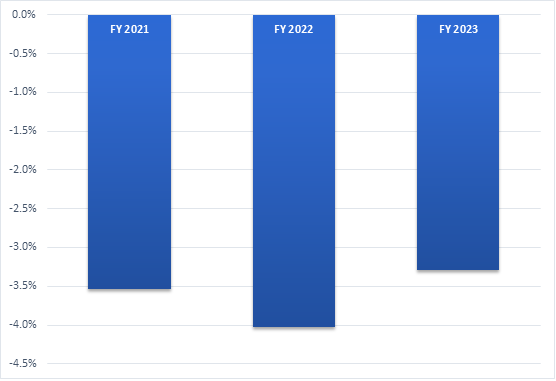

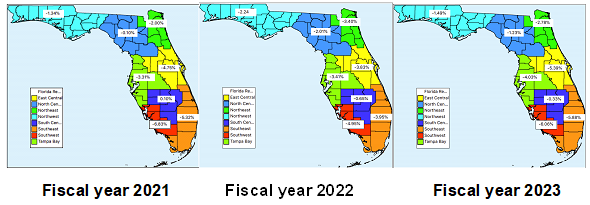

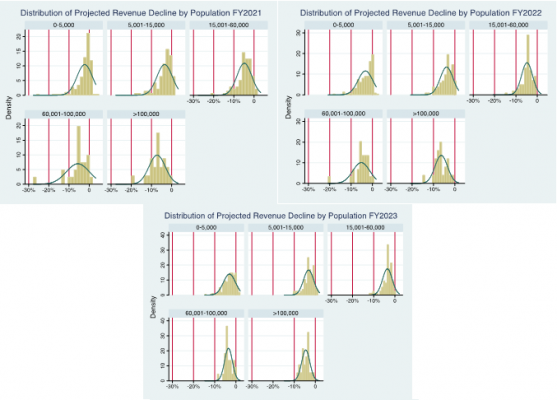

Even with a rebounding economy, we forecast that Florida municipal government revenues will be significantly less than their pre-pandemic levels for at least the next three fiscal years. As Figure 2 shows, for FY2021, the percentage revenue decline for Florida municipalities is forecasted to be 3.54 percent. The decline in FY2022 is forecasted to be 4.02 percent and in FY2023 to be 3.29 percent. We predict that these revenue impacts will also vary by region (Figure 3), and that cities with populations greater than 100,000 will experience the largest revenue declines (Figure 4).

Figure 2 – Mean annual revenue decline for Florida municipalities FY 2021-2023

Figure 3 – Regional revenue impacts due to COVID-19 FY 2021-2023

Figure 4 – Distribution of projected revenue decline by population FY 2021-23

The importance of municipal revenue structure

A key takeaway from our research is the importance of the revenue structure in a city’s resilience to economic shocks. A crisis offers an opportunity for local governments to assess whether their revenue structures are aligned with their economic structures. The COVID19 pandemic is not fully over yet; its fiscal impact will be enduring.

Another lesson learned while conducting our research is how to deal with the uncertainty in revenue forecasting. On the one hand, we can be creative in utilizing available data and making plausible assumptions to produce practical and straightforward revenue forecasting models. On the other hand, our model needs the flexibility to accommodate alternative scenarios as the key economic indicator changes.

Our forecasts will be helpful to local governments choosing their policies to address revenue shortfalls, requesting state and federal support, and, more importantly, to adjust their revenue structures to enhance their revenue-generating capacity. Although the residential housing market continues to be hot, commercial property might be a concern in the future because of the possible change in revenue structure.

A continuing effort is needed to examine the revenue structure and fiscal relationship with upper-level governments. This presents a challenge to both scholars and local government professionals to align municipal revenue structures with the changing economic environment and achieve fiscal resilience in times of crisis.

- This article is based on the paper, “Forecasting Revenue Impacts from COVID-19: The Case of Florida Municipalities” in the State and Local Government Review.

Please read our comments policy before commenting.

Note: This article gives the views of the author, and not the position of USAPP – American Politics and Policy, nor the London School of Economics.

Shortened URL for this post: https://bit.ly/3t0FSDg

About the authors

Hai (David) Guo – Florida International University

Hai (David) Guo – Florida International University

Hai (David) Guo is an associate professor of public administration at the Department of Public Policy and Administration, Steven J. Green School of International and Public Affairs at Florida International University. His scholarship focuses on state and local public finance, budgeting and financial management. His publications and ongoing research fall into four interrelated tracks: 1) budgetary institutions and fiscal policy outcomes; 2) public engagement in the budgetary process; 3) local government financial management under fiscal stress; and 4) Local government strategic interaction and fiscal competition. Please click here for more information on his research or email him at haguo@fiu.edu

Can Chen – Georgia State University

Can Chen – Georgia State University

Can Chen is an associate professor in the Department of Public Management and Policy, Andrew Young School of Policy Studies at Georgia State University. His core research agenda is developing and promoting innovative, efficient, and effective infrastructure financing to support critical infrastructure that is sustainable and resilient in its financing and funding, use, performance, and maintenance. His substantive research topic interests include infrastructure (transportation) finance and policy, disaster finance, fiscal transparency, and financial accounting. He can be reached via cchen64@gsu.edu