The rising demand for electric vehicles is changing the geopolitical landscape, as the world pivots away from fossil fuels towards the materials critical to the EV supply chain. As manufacturers and countries race to secure the supply of raw materials for EV batteries, new opportunities and geopolitical risks are emerging. Benjamin Jones, Viet Nguyen-Tien, Robert Elliott and Gavin Harper write about the implications of the race for battery-critical resources.

The rising demand for electric vehicles is changing the geopolitical landscape, as the world pivots away from fossil fuels towards the materials critical to the EV supply chain. As manufacturers and countries race to secure the supply of raw materials for EV batteries, new opportunities and geopolitical risks are emerging. Benjamin Jones, Viet Nguyen-Tien, Robert Elliott and Gavin Harper write about the implications of the race for battery-critical resources.

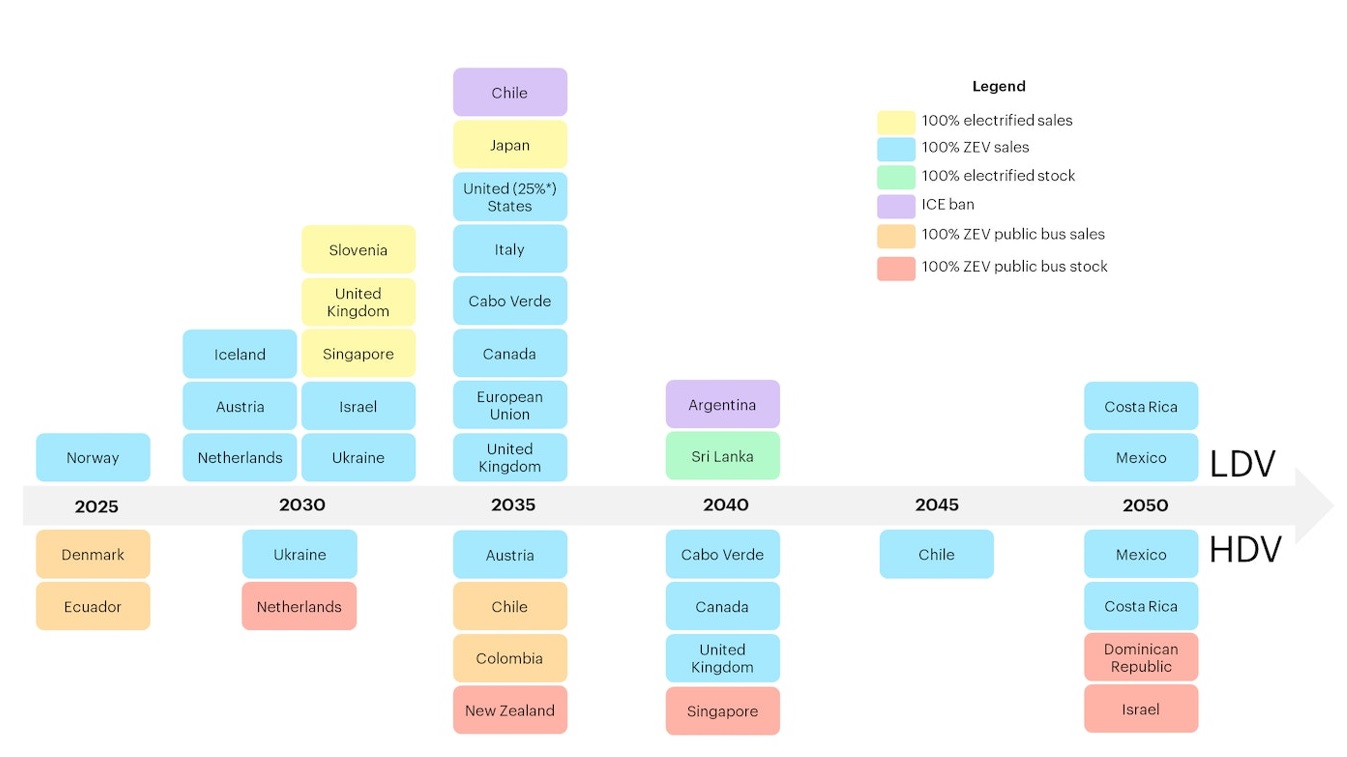

The global automotive industry, if it was to be considered a country, would rank sixth in economic size. It generates around three trillion dollars in annual revenue and directly employs around 14 million workers. However, the automobile sector faces increasing pressure to adapt to a world of electrified transport driven by net-zero policies and a rapidly changing technological landscape. This is driving rapid electrification of both light- and heavy-duty vehicles (LDVs and HDVs) as shown in Figure 1. A strategic focus is growing among policymakers and industry on how to secure the associated economic benefits and develop the necessary supply chains.

Figure 1 – Global zero-emission vehicle mandates and internal combustion engine bans

Source: IEA (2023)

The green subsidy race in the Global North

Globally, EV sales are growing rapidly, with the number of EVs sold surpassing 10 million in 2022 when sales penetration rates reached 14%, nearly triple the market share in 2020. As demand has increased, so has competition. For example, despite remaining the most valuable EV company, Tesla experienced a decline in market capitalisation of around $870 billion as incumbents in the West and new entrants, primarily from China, have developed footholds in the market. Currently, the EV sector consists of established players in the internal combustion engine market, such as Volkswagen, GM, Toyota and others whose market share has fallen from 55% to 40%, and the entry of Chinese companies such as BYD and Geely who are growing rapidly. New entrants from Turkey (Togg), and Vietnam (Vinfast), have also seized the opportunity to leapfrog the old technologies and enter the EV field with ambitions to expand into the United States and Europe.

With such high economic stakes and the future of technological leadership in the balance, governments are having to vigorously compete for leadership in the future of transport. China’s success, for example, can be attributed to active industrial policies since the 2000s that have bolstered domestic production and stimulated demand along the entire EV supply chain. More recently, the United States introduced the $369 billion Inflation Reduction Act 2022, while the European Union responded with the €250 billion Green Deal Investment Plan both of which include funding to strengthen the EV supply chain. Such massive and sophisticated green subsidy initiatives have highlighted what some have called green protectionism. For instance, accessing US subsidies for EV manufacture depends not only on the local content of the vehicles but also the source of battery components and associated critical materials such as nickel, lithium and cobalt. Similarly, the EU’s Net Zero Industry Act includes various regulatory measures and incentives such that 90% of the EU’s annual demand for batteries is sourced from battery manufacturers located within the bloc. In the UK, concerns over the rules of origin regulations after Brexit remind us that global supply chains are not frictionless, even between longstanding partners.

The inter-regional competition between the US and the EU in the industrial policy space will also need to grapple with the current dominance of East Asia (Japan, Korea and in particular China), in the production of components and related intermediates needed for the manufacture of EVs. China, for example, currently controls over three quarters of the global lithium-ion battery cell capacity, and accounts for nearly half of the global lithium carbonate and cobalt refining capacity. Within the next decade, the global battery market (the most important component of an EV) is projected to increase ninefold. Figure 2 shows that planned gigafactory projects in the US and Europe will only meet around a quarter each of the global manufacturing capacity by 2030.

Figure 2 – Lithium-ion battery cell capacity by region, 2020 (actual) and 2030 (planned)

Sources: CRU (as of August 2022) redirected from Jones, Nguyen-Tien and Elliott (2023).

When materials become ‘critical’

Mined raw materials are the anchor of all manufacturing value chains. In the case of automobiles, EVs typically require three to four times more copper than conventional cars and is causing a surge in demand for minerals such as lithium, nickel, cobalt, manganese, graphite (essential for batteries), and rare earth elements (crucial for electric motors). Rapidly expanding demand, coupled with global supply chain constraints, have fuelled a significant run up in prices for a number of these key materials.

The potential future imbalance between supply and demand is a concern. Some critical materials are used in multiple emerging technologies, and as these technologies are being rapidly adopted, the demand for these materials is growing exponentially. For example, the global demand for lithium is expected to increase by up to 89 times current demand by 2050. However, meeting this demand involves long lead times, averaging around 16.5 years according to the IEA. Hence, supply shortages and price volatility in the short and medium terms are likely. In addition, extracting minerals from lower-grade ores means higher economic and environmental costs.

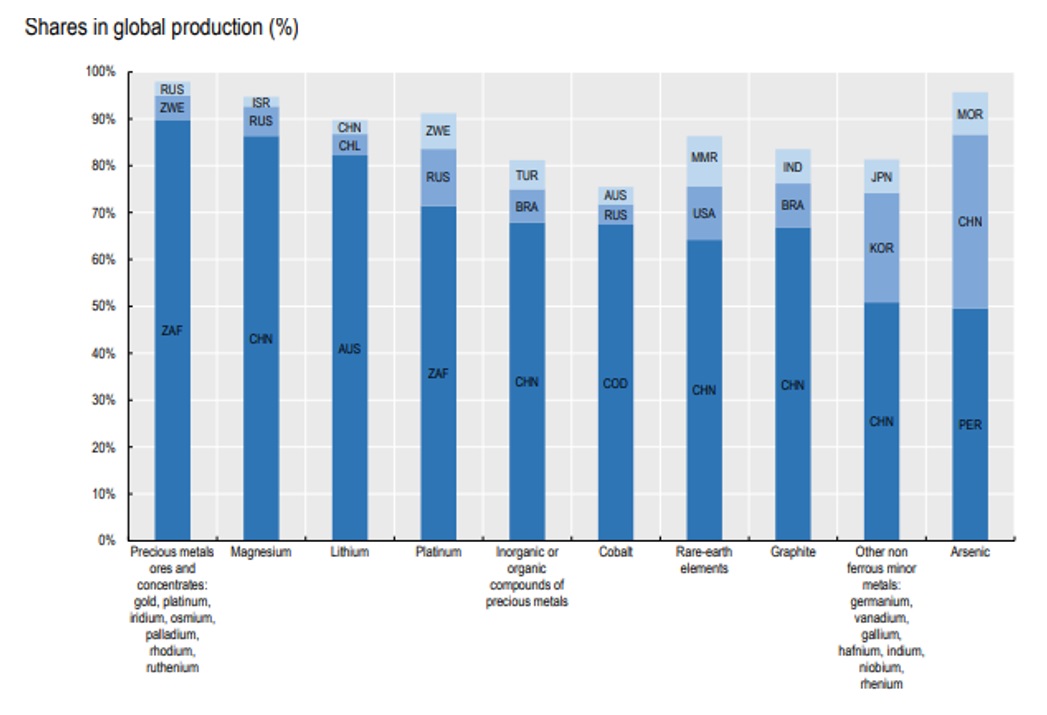

The governments of resource-importing countries are also concerned with the high concentration of critical raw material production in certain countries or regions. Figure 3 shows that many EV related commodities are among the most production-concentrated, with China, Russia, Australia, and African countries having significant shares.

Figure 3 – Top 3 producers of the top 10 most production-concentrated critical raw materials

Source: OECD (2023). Note: AUS – Australia; BRA – Brazil; CHN – China; CHL – Chile; COD – Democratic Republic of Congo; ISR – Israel; KOR – Korea; MAR – Morocco; MMR – Myanmar; MOZ – Mozambique; PER – Peru; TUR – Türkiye; RUS – Russian Federation; ZAF – South Africa; ZWE – Zimbabwe.

Opportunities for the Global South

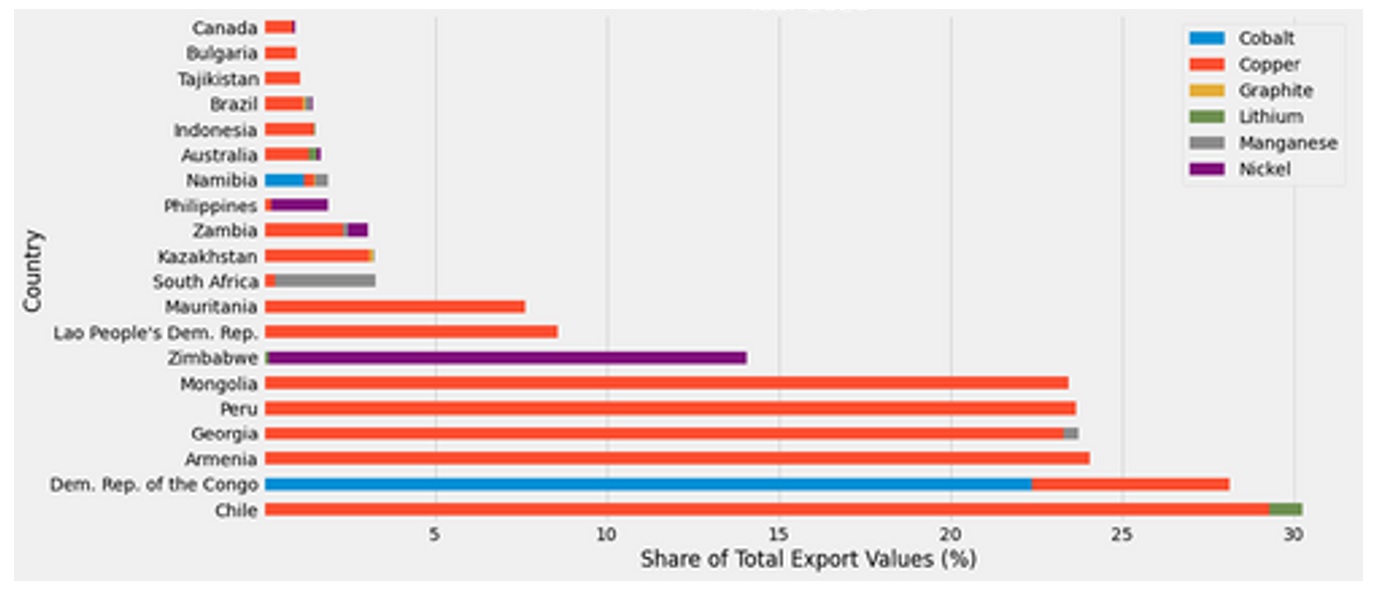

The boom in critical material demand has created significant opportunities for developing countries rich in these resources as these global value chains scale up rapidly. However, it is important that other segments of the resources industries maybe more adversely impacted, such as the production of platinum group metals (an economically critical sector in South Africa, for example), which are principally used in auto catalysts. As such, the EV revolution would result in winners and losers in the global south. Figure 4 shows the top resource exporting countries that are likely to benefit from that revolution.

Figure 4. Top 20 countries by the export values of EV-related commodities as a proportion of total exports in 2020

Source: Jones, Nguyen-Tien and Elliott (2023).

So how should developing countries with battery related resources prepare for a critical material boom? One solution is to build institutional capacity to help the domestic industries adapt to changes in global demand. For example, enhancing revenue forecasting due to a changing tax base (and an analysis of the impact and risk from different policies), and investing in geological research and information platforms to better understand the existence of any commercially viable deposits). From a strategic perspective, the potential value uplift, as well as broader economic spillover benefits from enabling private investment in intermediate processing and manufacturing should be better understood. However, strong access to major demand centres, as well as high quality energy, logistics and broader infrastructure will be critical for commercial success and tend to be enablers that are scarce in many developing countries.

Towards enhanced ESG standards

Finally, it has been recognised that a surge in the mining activity associated with EVs poses significant environmental, social, and governance (ESG) risks. The extraction of cobalt in the Democratic Republic of Congo (DRC) for example reveals a high degree of environmental damage and human rights abuses related to artisanal mining and the use of child labour, unsafe working conditions, and forced displacement of communities. Similarly, the production of lithium from brines puts strain on scarce water resources, particularly in water-scarce regions such as the Atacama Desert in Chile.

In response, buyers, producers, and traders are increasingly prioritising responsible sourcing. For example, since 2018 the London Metal Exchange made it mandatory for all traded cobalt to undergo audit assessments for compliance with OECD due diligence guidance . Major buyers such as Apple, VW, and Tesla have also reformed their purchasing rules and Huayou Cobalt, China’s largest cobalt producer, stopped buying from artisanal producers in 2020.

Addressing these challenges requires robust governance frameworks, enhanced transparency and sustainable practices to promote ESG standards and to decarbonise commodity supply chains. The DRC has focused on organising artisanal cobalt miners into larger-scale operations and introduced traceability mechanisms. The Chilean government has also implemented production quotas for major lithium miners and insisted that producers compensate local communities for damages caused by competition for water.

Conclusions

The EV revolution has reached mainstream acceptance among consumers and governments around the world but brings with it significant challenges and opportunities for both developed and developing countries. To understand who stands to benefit and lose from the EV revolution requires a careful understanding of how global value chains are organised and managed. As mining, processing, and manufacturing tend to take place in different geographical locations with different regulatory environments, the challenge is how to navigate such a rapidly changing geopolitical landscape. To understand the implications of such rapid changes requires timely and careful interdisciplinary research spanning economics, geography, procurement, development, sociology, engineering and chemistry.

- This blog post first appeared at LSE Business Review.

- Featured image by JUICE on Unsplash

- Please read our comments policy before commenting

- Note: The post gives the views of its authors, not the position USAPP– American Politics and Policy, nor of the London School of Economics.

- Shortened URL for this post: https://bit.ly/46ETaqb

A huge increase in EV production is the next economic and environmental problem. Good luck world.