“This industry is going through a tremendous transformation. We used to have a pretty good idea of what future needs would be….That world has ended.” – Steve Holliday, CEO National Grid

The way we generate, transport, store and use energy is changing: the centralised system of large emissions-intensive, often state-owned power plants that send electricity to consumers using inflexible tariff structures is changing into one that is distributed, cleaner and flexible. Like the telecoms revolution before it, the transformation of the energy sector is an opportunity for companies to gain market share with innovative technologies and new business models, and threatens slow-moving incumbents.

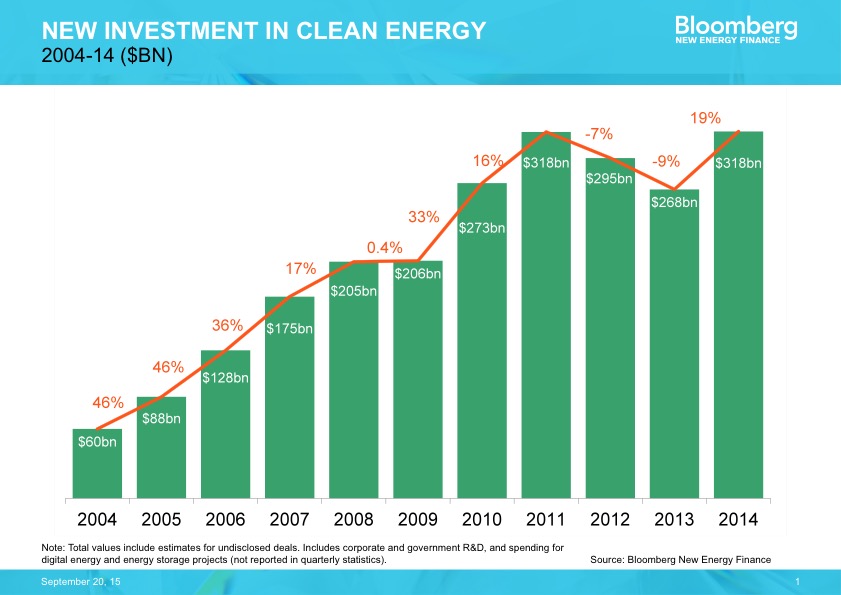

The main driver of this change is renewable energy, the rise of which has been remarkable both in its pace and extent. Policy objectives spanning climate change, energy security and public health have helped push more than US$2.3 trillion into the sector since 2004. Investment has risen an average of 28 percent year on year in the period. The bulk of those funds have gone to generation assets such as wind and solar, which now attract more investment in terms of net capacity additions than conventional fossil fuels like coal and gas.

In 2004, there were only around 4 Gigawatts (GW) of solar capacity deployed world-wide. Five years later there were 25 GW, and by 2014 there were a staggering 191 GW. Wind power – a more mature technology than solar – reached 191 GW back in 2010. By 2014 it had almost doubled to over 360 GW. Both continue to grow. In Germany, renewables (excluding large hydro) now make up 48 percent of capacity – up from 17 percent ten years ago. In Denmark, wind farms regularly power the entire national grid. At times they produce more than enough electricity to cover national demand and the excess is exported to neighbouring countries. Although Europe remains a major centre of activity, it has been the US, Japan and most importantly China that have seen the bulk of recent activity. In 2014, China added around 35 GW of new wind and solar capacity, making it the clear world leader in renewable energy deployment.

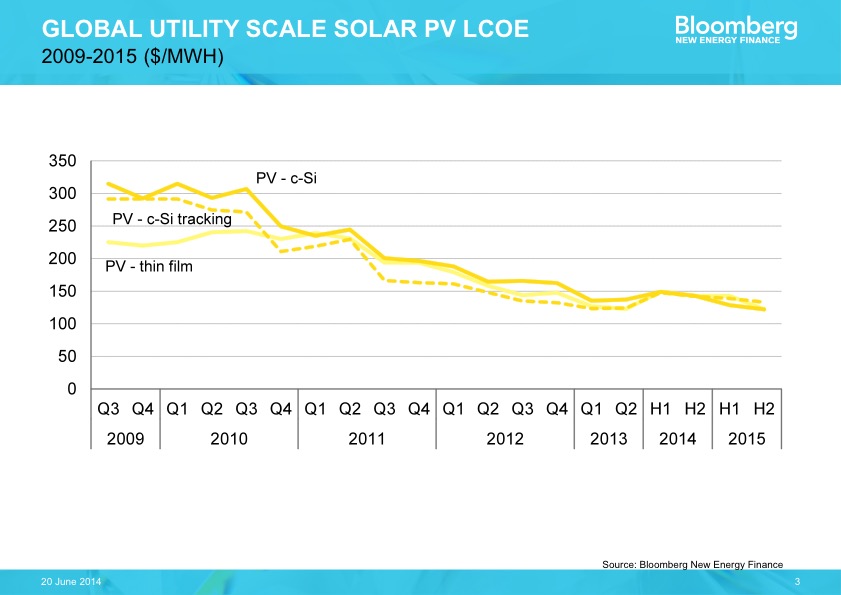

The scaling up of renewable energy capacity has dramatically lowered costs. The standout example is solar photovoltaic panels (PV), where module prices have fallen 66 percent since 2010. Wind energy has become cheaper to develop as well, falling 25 percent over a similar period. Solar PV, which is suitable for small-scale applications as well as traditional centralised generation, is being deployed by more and more households and businesses to offset eye-watering power bills. Germany – not particularly known for its sunshine – has added an average of 3.8 GW per year over the past five years, the US 1.5 GW, China 1 GW and Australia 800 MW. Rooftop solar has all the hallmarks of a consumer industry that will grow exponentially in markets where cost and penetration thresholds are met.

So the power sector is definitely changing, but is it changing fast enough to help prevent dangerous climate change?

To help answer this question we can turn to Bloomberg New Energy Finance’s annual New Energy Outlook (NEO) – our forecast for how the world’s electricity sector will change over the next 25 years. As electricity makes up around a third of global emissions, it’s a good way of seeing what trajectory we are on.

There is little doubt that technology costs will continue to fall – both solar and wind follow established experience curves that show cost reductions over time. For solar PV, module prices have fallen by around 24 percent for every doubling of capacity. For wind the drop is more like 14 percent. Bearing this in mind, we expect utility-scale solar PV costs will be in the range of $33-82 per Megawatt hour (MWh) by 2040 on a levelised basis (i.e., not including subsidies), while onshore wind will be at $37-76 per MWh. That is much more competitive than coal and gas, at $65-123 per MWh and $62-141 per MWh, respectively.

In our NEO forecast, we strip out clean energy subsidies from 2020, leaving only established carbon prices and some strategically significant industry subsidies as in the case of offshore wind and nuclear. This enables us to see how the economics alone will play out.

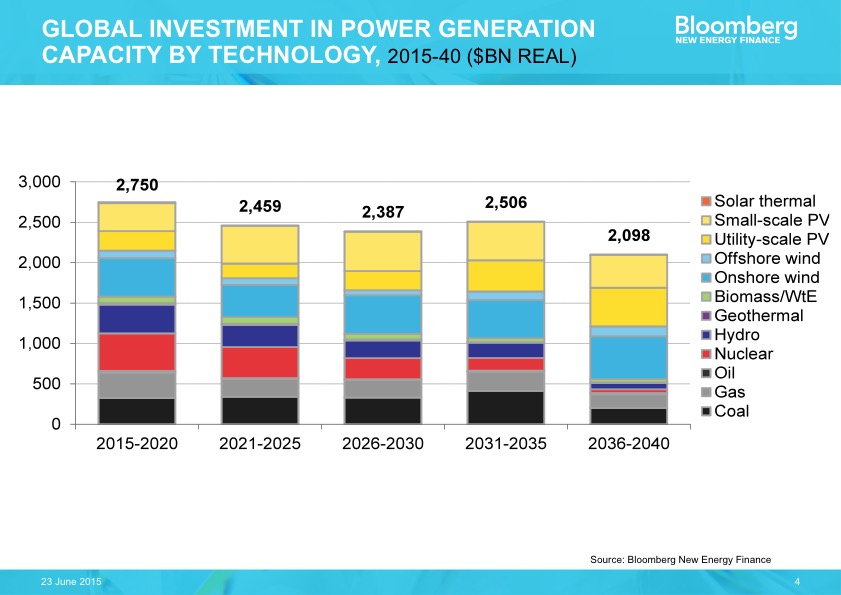

Over the next 25 years we expect renewable energy to attract over US$8 trillion, or around two thirds of all investment in new power sector capacity. Solar will be the big winner, attracting US$3.7 billion – about 60 percent of that roof-top, small-scale PV. By 2040, 64 percent of global installed capacity will produce zero emissions, up from 35 percent today.

In Europe, a combination of more competitive renewables, rising carbon prices, tougher pollution regulations, weak or negative electricity demand growth and smarter ways of matching supply and demand, will mean coal and even gas-fired power are increasingly forced out of the supply mix. As this happens, emissions will continue to fall, such that by 2040 power-sector emissions will have fallen by 82 percent from 2014 levels.

In the US, we see cheap gas and the shale revolution giving way to a dramatic uptake of rooftop PV. As in Europe, weak demand and pollution regulations, plus an increasingly toxic market for coal-fired power means emissions will fall at around 1 percent per year for the next 25 years, and that’s before we consider President Barack Obama’s new Clean Power Plan.

Even in China, which has added 46 GW of coal-fired power on average per year for the past five years, coal consumption in the power sector will probably peak around 2021, as first wind, then solar, become more cost-effective options in the presence of a moderate carbon price.

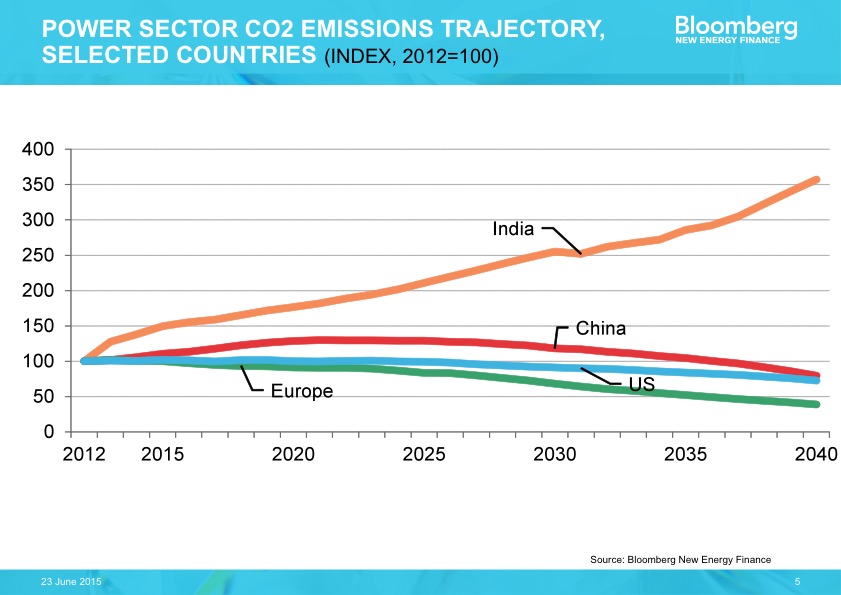

But will this be enough to curb temperature rises? There’s a compelling economic case that cheap renewable energy could potentially get us close to the two degrees target. But even with the cost reductions we foresee, global emissions are likely to continue to rise. The combination of strong electricity demand growth, abundant low-cost local sources of fossil fuels and a dearth of pollution and emission controls in energy-hungry developing economies will bring a significant amount of new carbon-intensive coal and gas generation into play. In India, emissions from coal-fired power alone may well increase 40 percent by 2040. In South East Asia, emissions could climb 48 percent, and in Turkey they may rise 28 percent.

On balance, if we expect cheap renewable energy to prevent dangerous climate change, we’re likely to be disappointed. All considered, global power-sector emissions don’t peak until 2029, as growth in fossil fuel generation in developing countries overwhelms reductions elsewhere. Looking out to 2040, power sector emissions will still be 13 percent higher than today. For a policymaker staring at a warming world, that’s clearly unacceptable. As Steve Holliday has said – this industry is going through a tremendous transformation. My bet is that this transformation will accelerate further before it starts to slow down.

Featured Image Credit: Kai Lehman CC-BY-2.0

Seb Henbest is Head of Europe, Middle East & Africa at research firm Bloomberg New Energy Finance (BNEF) in London. He is Lead Author of its annual New Energy Outlook. He tweets at @SebHenbest.