Having triggered Article 50 of the EU Treaty, the British government officially kicked off the Brexit negotiations on March 29. Until today, both parties pretended not to give in and instead promised a tough negotiation strategy. Game theory offers one way of testing the reliability of these claims and allowing the negotiations to be seen for what they are: a strategically driven, tactical game in which each side attempts to realise their own interests, write Berthold Busch, Matthias Diermeier, Henry Goecke, and Michael Hüther.

Having triggered Article 50 of the EU Treaty, the British government officially kicked off the Brexit negotiations on March 29. Until today, both parties pretended not to give in and instead promised a tough negotiation strategy. Game theory offers one way of testing the reliability of these claims and allowing the negotiations to be seen for what they are: a strategically driven, tactical game in which each side attempts to realise their own interests, write Berthold Busch, Matthias Diermeier, Henry Goecke, and Michael Hüther.

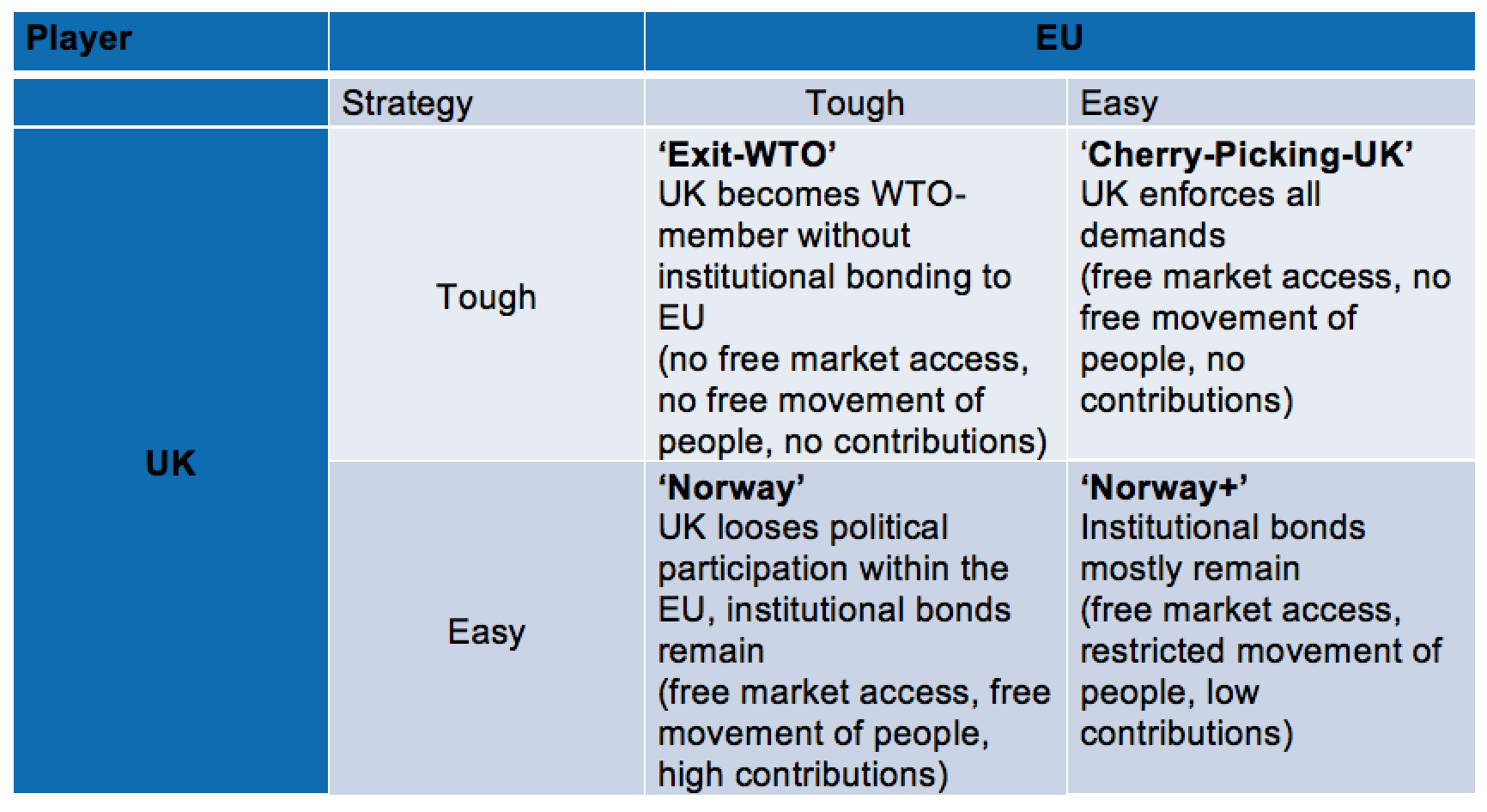

From the perspective of game theory, the search for the optimal negotiation strategy for the UK’s exit from the EU can be stylised as follows: both players, the UK and the EU, simultaneously choose between only two negotiation strategies – one compromising and the other uncompromising. This limitation is plausible in view of the fundamental need for each negotiating partner to describe a starting position. Here there are only the two corner solutions: ‘unwillingness to compromise’ and ‘willingness to compromise’. Furthermore, we assume that the negotiations will be mainly conducted on the following three topics:

- Access to the European single market

- Free movement of people

- Payments to the EU

The negotiations on the payments to the EU include contributions to the EU budget as well as EU claims against the UK – for example, arising from previous British commitments to contribute to EU employees’ pensions.

What are the stylised outcomes?

The different negotiation strategies and topics result in the game theory table that is shown in Figure 1 with the four possible results:

- World Trade Organisation (WTO) exit: If both the British and Europeans are uncompromising, then the British will completely lose access to the European single market. Economic cooperation would then be organised in the same way as it is with other WTO members. In this case, the British would not have to grant EU citizens free movement of people or make payments to the EU. The most clearly touted goals of Brexit advocates would be achieved, but the price would certainly be high: a complete loss of economic integration with a status as a WTO member that would still have to be negotiated.

- Cherry picking: On the other hand, if the UK conducts tough negotiations and the EU is willing to make concessions, the UK could have its demands fully met. In the case of this ‘cherry picking’, the EU would grant its partner full access to the single market without the need to impose the free movement of people or demand payments in return.

Figure 1: Brexit negotiations as a strategic game

Source: Busch et al. (2016)

Source: Busch et al. (2016)

- Norway: A Norway-style deal would result if the British are willing to compromise and the EU unyielding. Norway grants EU citizens full freedom of movement and makes payments to the EU. In return, the country has access to the EU single market, but it does not have any say in political decision-making. Norway’s contribution to economic and social cohesion policy in the EU between 2014 and 2021 amounts to almost €400 million per year. Given that Britain’s GDP is six to seven times the size of Norway’s, this would mean a hypothetical contribution of around €2.5 billion per annum. Based on the population size, the UK could even end up with payments of €5 billion per annum. That would be a high price: Britain’s average net contribution between 2010 and 2015 was around €9.4 billion per annum. According to a Commons study, the British contribution to a ‘Norway’-style deal could be even higher (House of Commons Library, 2013).

- Norway+: If both parties were willing to compromise in the negotiations, a so-called ‘Norway+’ deal could result. Britain would then be in a similar but more comfortable situation than Norway is today. It would have to contribute less financially, would not have to guarantee the full freedom of movement of people and would have unlimited access to the EU single market, but it would have no say in political matters. The EU would accept virtually all of Britain’s wishes and a new understanding of European integration. The negotiations would be purely technical in order to implement the British stipulations.

The long-term payoffs

In the ‘WTO exit’ solution, the EU and Britain would each lose an important free trade partner with which they currently carry out a great deal of seamless trade. Minis produced in Oxford, for example, would have a whopping surcharge of 10% imposed on them when they are imported into an EU country. According to a statement by the Director-General of the WTO, British exporters would have to fork out up to £5.6 billion annually. Furthermore, the search for the best staff in Europe would be increasingly complicated and bureaucratised. In British industry, one in every ten employees is currently from the EU, even more than in the international financial sector. Moreover, in the event of the ‘WTO exit’ solution, the latter would be faced with the loss of important banking licence rights that currently allow British banks to offer financial services in EU countries without any bureaucratic obstacles (passporting). According to a study by the City of London, this would lead to a direct loss of some 70,000 jobs in the London financial sector (Wyman, 2016).

In the long term, the British would probably conclude free trade agreements with third countries, but the new frictions on the markets for goods, services, employees and capital would remain in place. Ultimately the British would lose free access to at least 27 national economies, while EU countries would only lose free access to one. The EU’s tough negotiating tactics, as well as the negative economic consequences, would reduce the incentives for Brexit copycats in the long term.

The implications of the ‘cherry picking solution’ are entirely different. The smooth trading of goods and services could continue, the passporting rights of Britain’s financial industry would not be in danger and the Treasury could use the net payment to the EU of almost €9.4 billion per year for different purposes. Only restrictions on the free movement of people would have a negative impact on Britain’s potential in the long term: however, given the current discussion, no short-term mass layoffs of EU workers are to be expected. If the British government could achieve such a negotiation outcome, it would probably be revered at home. Having access to the single market without the free movement of people and no further payments to the alleged bureaucrats in Brussels would mean the ‘Brexiteers’ had achieved all their demands. While the single market may be secured in a more limited economic understanding (Pisani-Ferry et al. 2016), renouncing the four fundamental freedoms – the European standard since the 1957 Treaty of Rome – would represent a gambling away of the political idea of European integration to simple economic reasoning.

In the ‘Norway’ solution, the British would have to accept what they voted to end: the free movement of people. One of the most popular slogans of the Leave campaign – ‘take back control of immigration” – was based on the fear of migration flows. A ‘Norway’ solution would prove these promises illusory. Furthermore, payments of between €2.5 billion and almost €5 billion could continue to flow towards Brussels. According to a study by the Treasury, the growth prospects would in the long term decrease by around 0.2 to 0.3 percentage points annually in a favourable scenario similar to the ‘Norway’ solution (HM Treasury, 2016). Moreover, European legislature would act without any British participation. For the EU’s economies, this would have hardly any direct economic implications.

If both players were willing to compromise, the UK would end up with a ‘Norway +’ solution. In the long term, the British could significantly reduce their annual net contribution to the EU budget of around 0.5% of GDP. Combined with the approximate 0.2 to 0.3 percentage point decline in GDP growth, the overall effect for Britain would be roughly neutral (HM Treasury, 2016). In addition, this negotiation outcome would probably attract a number of individual imitators. The threat of uncompromising negotiations on the EU’s part would still be credible when compared to ‘cherry picking’. The Europeans have shown themselves to be open to compromise, but only in response to a similar willingness on the part of the British. The EU could always claim to opt for an uncompromising bargaining position if Britain proves to be unwilling to compromise during the negotiations. It is unlikely that many countries would trade political dependency without any participation for slightly restricted freedom of movement and a discount on contribution payments. However, countries like Norway would be predestined to negotiate better conditions.

Image (Wikimedia Commons), licenced under Public Domain.

Game theory equilibria: on the way to Norway

The game theory approach shows that the optimal response for the EU in the long term would be an uncompromising negotiation strategy, irrespective of the negotiating position taken by the British government: the EU would be better off with the ‘WTO exit’ solution compared to the others. The uncompromising negotiation approach is, therefore, a so-called dominant strategy, which would be rational for the EU to follow in the long term.

Regardless of the EU’s strategy, in the long term, it is always better if there is willingness to compromise. The long-run Nash equilibrium model therefore equates to the ‘Norway” deal. This settlement does of course run contrary to the wishes of Brexit advocates, and would lead to vehement reactions within the UK. One can also argue that the EU’s red line for a possible compromise outweighs Britain’s own red line, because the British are ultimately more dependent on the EU than vice versa. The asymmetry, which already existed before the negotiations, is clearly evident here.

The extent to which economic interests play a role in the negotiations is difficult to assess – political motives could overshadow the economic ones. However, in the long run allowing a soft Brexit with cherry-picking could inspire others to follow suit. The threat of uncompromising EU negotiations would have been proven to be an empty one and other countries would seek a similar result. After a potential departure of an important member state like France or the Netherlands, the EU would come to an end, signalling the failure of the European project. There would be massive economic upheaval in the EU, as well as in the UK. Allowing the UK to cherry-pick its way into a privileged institutional setting with the EU – although it might seem economically reasonable in the short-run – is unfeasible for the cohesion within the community of states, and therefore also for the British.

The achievements of the EU cannot be sacrificed for short-term economic interests. It is not about punishment or revenge, but about stone-cold sober calculations. The EU has to play a tough game and hope for a British Norway.

This essay is based on a paper first published in Wirtschaftsdienst, Volume 96, 12, page 883-890; an English version was published in IW Policy Paper 18, and it gives the views of the author, and not the position of LSE Brexit, nor of the London School of Economics.

Dr Berthold Busch is a senior economist at the Cologne Institute for Economic Research`s (IW Köln) research unit International Economics and Economic Outlook

Matthias Diermeier is a personal scientific assistant to the director of IW Köln

Dr Henry Goecke is a personal scientific assistant to the director of IW Köln

Prof. Dr Michael Hüther is the director of IW Köln

The flaw in this article is that there is no consideration to the costs to the EU of the WTO option (which exceed those for the UK) and the political impossibility of the British government not accepting the outcome of the referendum which rejected freedom of movement, EU law and the jurisdiction of the ECJ.

Game theory suggests that WTO MFN terms will be the end-game, with Uk then concluding FTAs with the US and others including EFTA.

As one who predicted Brexit and who believes that the bureaucracy of the EU is busy destroying the organisation, I believe there are many different forms of association that the tattered remnants of the EU and the UK can adopt. So a simplistic game theory is not what will happen. For example, Germany will not want to lose close economic, moral, military and political ties with the UK. Nor will Poland, but for different reasons. So expect national interests to overwhelm the centralized bureaucracy as it should have done years ago. With the UK’s contribution no longer feeding into the massive subsidization programme .countries will seek to leave the Euro – which was a daft idea from the beginning since it limited individual countries’ ability to adjust and compensate their economic programmes and policies. So there will be a wider “end game” being played out in Europe behind the scene of the Brexit negotiations.

Australasians have long held out that their model of international association – CER – is a far better way of moving forward to closer integration. Why the ECC tried to follow the USA model in the first place still puzzles. A great idea perhaps, but… The EU has been stuttering along for years, developing slowly and with an immense and unproductive overhead of foolish governance and executive organisations.

You state that the UK may face 10% tariffs. So what? Minor improvement to productivity can more than compensate for such barriers. Tariffs damage the importing country much more than the exporting country. And now the UK will be free of impediments to free trade. It may also become free of economy-distorting subsidies. Other countries have abandoned subsidies and thrived: New Zealand and Singapore are examples. The USA still has agricultural subsidies, but these are minor in the big picture of the immense US economy.

I would recommend that the UK takes a tough stance, but recognise the right of existing EU residents to stay in the UK since they are too valuable to kick out. And allow the UK to pick and choose who enters, as all sensible countries do at present. Free trade deals with African countries (who, on the whole, are growing their economies extremely quickly) will more than compensate for loss of free entry into a bunch of misguided, moribund, and anti-free trade countries.

So, what should the UK have as its basic negotiating position? No contributions beyond exit. Control over its borders. Free trade offers to all European countries who want it.Free trade negotiations with non-EU members who want it (US, Africa, Australasia, Japan, China). Immediate non-acceptance of EU laws and regulations. Active defence of its territory. Etc. Try to separate the bureaucrats from their masters – the governments. Brexit has been an outstanding success so far, but it can be much, much more. Now success depends on the British, not the Europeans. And finally, the UK should join the international movement of free and willing harmonisation of regulations coupled with movements towards free trade. The rest of the world is flourishing by doing this while Europe is wallowing in an economic morass.

While shaking off the EU (though not necessarily Europe) be as proactive as possible towards the rest of the world. Good luck, though you won’t need it.

As a final note, game theory suffers from being too deterministic – much can happen during the playing of game. Just ask any football team.

In fact, we specified several of the issues you mention in an extended version of this article (see link below). A clean-cut WTO outcome might seems probable as both players would respect their red lines – no free movement of people on the UK side and no access to the EU-single market given the UK implemented migration restrictions on the EU side. However, economically speaking it would be rational for the British negotiation party to prefer “Norway” over “WTO”. Hence, “WTO” is no Nash equilibrium. Additionally, the British rejection of free movement of people might be dominated by weakened growth perspectives – maybe even during the lengthy negotiation period.

The game theoretical approach, in this case, should be seen as a workhorse model to structure the economically feasible negotiation strategies. It cannot satisfy holistic demands and incorporate the countless political questions at play – especially within the two negation blocks. For a detailed discussion of these issues, again I would like to refer to the complete article below.

https://www.iwkoeln.de/en/studies/beitrag/berthold-busch-matthias-diermeier-henry-goecke-michael-huether-brexit-and-europe-s-future-a-game-theoretical-approach-319461?highlight=diermeier

It seems to me that there are several key problems with the arguments advanced here. (And I speak as a mathematician familiar with game theory.) Firstly, if both parties are too ‘uncompromising’ or ‘hard’ during the Article 50 negotiations then there is a significant risk that the UK will ‘crash out’ of the EU without an agreement under Article 50, in mid-2019. (Lord Kerr, one of the authors of Article 50, recently estimated the chance of this at 45%.) This could do severe damage to the economies of both the UK and the EU27, it would probably lead to the UK refusing to pay a ‘divorce bill’ of significant size, and it would also damage the EU’s foreign policy standing in the long term. In the light of the European Council’s core negotiating principle no. 2 (‘nothing is agreed until everything is agreed’), it could also leave 4.5 million UK and EU27 citizens at risk of losing basic rights, such as the right of residence, the right to work, the right to access social security and the right to access healthcare – short of ’emergency’ unilateral guarantees by both sides, which would anyhow lack a mechanism for enforcement.

The set of 4 possible outcomes also seems misleading. Theresa May stated on 17th January in her landmark speech on Brexit that ‘we will get control of the number of people coming to Britain from the EU’ (i.e. an end to freedom of movement), and ‘what I am proposing cannot mean membership of the Single Market’ – i.e., she accepted the EU27 demand that the UK cannot remain within the Single Market/EEA if it refuses to accepting free movement of people. The Goverment White Paper of 2nd February even ruled out the UK’s continued membership of the customs union, on the basis that the UK should be able to negotiate free trade deals with non-EU states, and would not be able to do so if it remained within the customs union. It would therefore seem that the bottom-left option (‘Norway’) is not a possible outcome. It should also be noted that Canada and the EU have a (pending) trade agreement, CETA, which will elimiate 98% of tariffs if it is ratified by Canada and all EU member states, whereas Canada is not subject to free movement rules and does not pay into the EU budget. I do not see why the UK should not eventually be able to agree a Canada-style trade agreement with the EU27, as well as with ‘third countries’. Why is the ‘Canada option’ missing from the discussion? Finally, the article talks about long-term outcomes; one they do not seem to have considered is that the EU27 decide of their own accord to change free-movement rules because of problems independent of the UK.

How strongly does the EU prefer Norway over Norway+

How about WTO vs Norway+

Suppose the UK were in some way able to tie its hands and only give the EU the options of Norway+ or WTO which would the EU choose rationally?

Of course all this discussion suggests that finances carry weight in the negotiation positions, if we purely consider political considerations then it would appear that WTO is the only possible outcome – for a UK-EU negotiation. Individual EU countries may start to undermine the EU position in this case where finances are impacted.

http://www.bbc.co.uk/news/uk-politics-41733429