Much of the 2016 referendum debate focused on the costs involved in a potential Brexit. The ‘fatalists’ claimed that the losses would be huge and felt immediately after the UK had taken the decision to leave the EU. As time progressed, a more ‘moderate’ view prevailed postulating that the costs would not be instantly perceptible, but would crystallise only over the medium-run. However, according to Eddie Gerba (LSE), the reality is much more complex and the degree of uncertainty in estimating the true economic costs has been much higher than any of the sides in the debate were ever willing to admit.

As a matter of fact, estimating the costs surrounding a future stochastic event (or structural break) is as easy as predicting next year’s weather. Financial mathematicians know this matter better than anyone. Considering that there has not been a previous exit from the European Union (nor in any highly integrated economic area), estimating the full costs was never going to be possible. The attempts that were made prior to the referendum involved many and heavy assumptions, including strong premises regarding the reaction of the other economies and trading partners within the EU, and beyond. Moreover, the issue involves a multitude of aspects beyond those strict trade-related, such as productivity and competitive edge, labour mobility, education, firm complementarity across borders, macroeconomic interdependence, (macroeconomic) policy alignments, financial interdependence, financial market flexibility, financial innovation, liquidity, systemic risks and financial stability, or prudential policy effectiveness.

Yet despite this cloud of uncertainty, there are some insights from the literature that we can use to make the challenge more manageable, specifically when it comes to the macro-financial aspects at the heart of Brexit. The first and maybe most obvious is the competitive edge of the financial services sector, and the status of London as a financial ‘hub’. There has been a lot of discussion on the potential costs from the loss of a privileged access to EU financial markets (the so-called EU passport). While that is true, and there may be some considerable (opportunity) costs from that, the bigger cost is the lost opportunity to take part (and advantage of) the EU’s banking and capital markets union. In particular, the flexibility, innovation, unique regulation, and privileged access to financing and counterparties from the other EU member states would have been highly beneficial for the UK financial system.

That said, we must remember that the ‘Big Bang’ in the UK financial system occurred during the mid-80’s, and well before the EMU, integration of capital markets, and the opening up of financial markets in the rest of Europe. Relocation of European (investment) banks and other financial institutions to London was, at large, prior to any of those events. Moreover, the competitive advantage of the UK financial sector goes much beyond the EU market access. Not only is there a level of expertise and specialisation in market financing in London that is not comparable to any other European city, but there is a well developed global stock market (the other LSE), a whole network of legal services and juridical expertise to support financial transactions and services, a renown higher-education system with strong links to the City, and a physical-technological infrastructure that backs the hub. Considering that it took quite a long time to build and cultivate these components, it is hard to imagine that simply because of an exit (or a rearrangement in the relation between the UK and EU), financial institutions will relocate to other European destinations where some (or all) of these components are lacking. That is why there is little evidence for many of the costs related to the ‘end of the UK dominance’ in financial services that has sometimes been claimed.

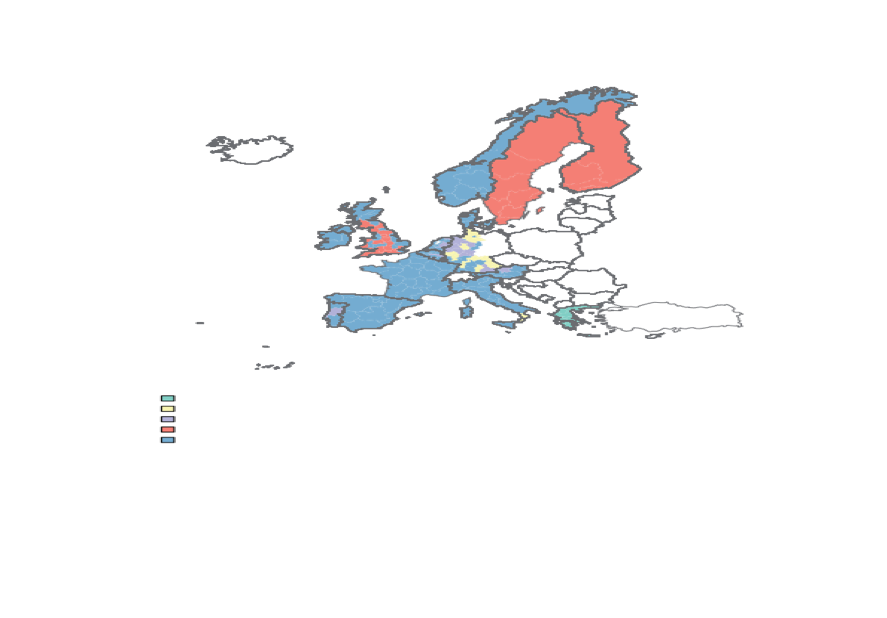

Another important aspect of the divorce is the issue of macroeconomic costs. Roughly speaking, the more synchronized the business cycles, the higher is the cost of a divorce since many adjustments will be required to break that harmony. Moreover, the sources of volatility will be similar in that case, which will require policy alignment to counter them. As a result, the divorce will be costly as this alignment of policies will be broken. However, the recent empirical literature has shown that UK regions are less synchronized with the Euro Area than the rest of the European Union (Bandres et al, 2017, Barrios et al, 2002). Moreover, the first study shows that amongst the regions of EU-16, the majority of the UK’s (and in particular England’s) is synchronized with those of Sweden and Finland only (Figure 1). Considering this, the macroeconomic costs, including those of policy misalignment may be very limited.

Figure 1: The clusters in the synchronicity of the business cycles across EU-16 regions. The colours represent the different clusters. As can be seen, the majority of the UK regions are clustered into those of Sweden and Finland (cluster 4). See Bandres et al (2017).

Source: Banco de Espana Working Paper No. 1702.

Source: Banco de Espana Working Paper No. 1702.

The area that has possibly received the most attention in terms of economic costs of a Brexit is related to trade, and the disintegration from the common goods-and labour market (I leave services aside since the level of integration in services remains very low). A priori, the costs of a divorce seem to be highest here. On the demand-side, the costs arise from a loss of access to a major consumer market with more than 300 million consumers, as well as from a potential drop in foreign direct investment (FDI). On the supply side, the costs originate from a break in supplier relations, cease in access to skilled workforce, and a drop in productivity spillovers and human capital exchange. The magnitude of the costs, however, is not clear since it depends on a number of factors. First and foremost, it is contingent on the exit trade deal (and bill) that the UK will reach with the EU. Currently, there is a high uncertainty regarding this (or any other form of) deal. Hence, not much can yet be said on this aspect.

Secondly, it will depend on the ability of the UK to redirect the trade flows towards new partners, new deals, and new multilateral agreements in order to compensate for some of the losses generated from the EU divorce. Finally, the cost will greatly depend on the ability of UK to innovate. Because, as history has shown, the economies that best survive structural breaks are those that adjust and innovate. And to do that, you need to look firmly ahead and have a flexible production sector that can quickly switch to new partners and trade models. In this regard, Germany’s quick adjustment in export strategy during the Great Recession might be the inspiration that is currently required.

Whatever the outcome of the negotiations, it will take quite some time before we know the extent of the final Brexit bill. At the moment, all the efforts should be devoted to envisioning a new model for the UK beyond the EU. Because the ability to adapt to the new ‘normal’ will be the decisive factor in tipping the balance between the success or failure of a Brexit, beyond the short-term costs that are inevitable in any structural breakup.

This article gives the views of the author, not the position of LSE Brexit or the London School of Economics.

Eddie Gerba (PhD) is a Distinguished Affiliate at the CES Ifo Institute in Munich. He is also a Visiting Fellow at the European Institute and has previously held the position of Fellow in Macroeconomics there.

Economists have their own version of not being able “to see the wood for the trees”. It is not being able to see what is going on for the equations and the statistics. The economy is more than what goes on in finance and banking.

After 2008 we would be ill advised to depend entirely on the financial sector for our economic health and it would be foolish to damage the trade relations on which the remaining industrial part of our economy depends.

We are endlessly told that we are the sixth largest economy (it was the fifth before the Brexit slowdown knocked us down the rankings) but if that status is based on something as volatile and unstable as the financial sector then we should not necessarily be re-assured by this.