In this blog, Hanwei Huang, Thomas Sampson and Patrick Schneider (LSE) analyse the economics of Scottish independence by looking at its impact on trade. Independence would put a new border between Scotland and the rest of the UK, introducing new trade costs. They find that since the rest of the UK is Scotland’s largest trading partner, the impact of independence would be 2-3 times greater than that of Brexit, and rejoining the EU wouldn’t make up the difference.

In 2014, Scotland voted against independence from the UK in what was to be a ‘once in a generation’ referendum. But the question is back on the table. A majority of Scots now support independence, after Brexit and the handling of the Coronavirus pandemic have diminished the lustre of government from London. And the Scottish National Party is pledging to hold a new vote if they win a mandate in the 2021 Scottish Parliament elections. In recent work at the Centre for Economic Performance, we ask (and answer) three important questions about the implications of independence for Scottish trade and income.

How important is the rest of the UK as a trading partner for Scotland?

The rest of the UK is Scotland’s largest trading partner, by far. Scotland’s economy is very open. Exports and imports are both close to 60 per cent of Scottish GDP, and the majority of this trade is with the rest of the UK. This means that Scotland trades far more with the rest of the UK than the EU (four times as much).

Even if Scotland weren’t part of the UK, we would expect a lot of trade between the two countries – they’re very close together, share a common language and are physically contiguous, all of which are factors known to increase trade.

But the Scotland-rest of UK relationship goes well beyond this. In a gravity model of trade, we found that Scotland-rest of UK trade is six times the level we would expect, after controlling for these factors. This shows how supportive being in an economic and political union can be.

What would be the economic impact of independence, relative to Brexit?

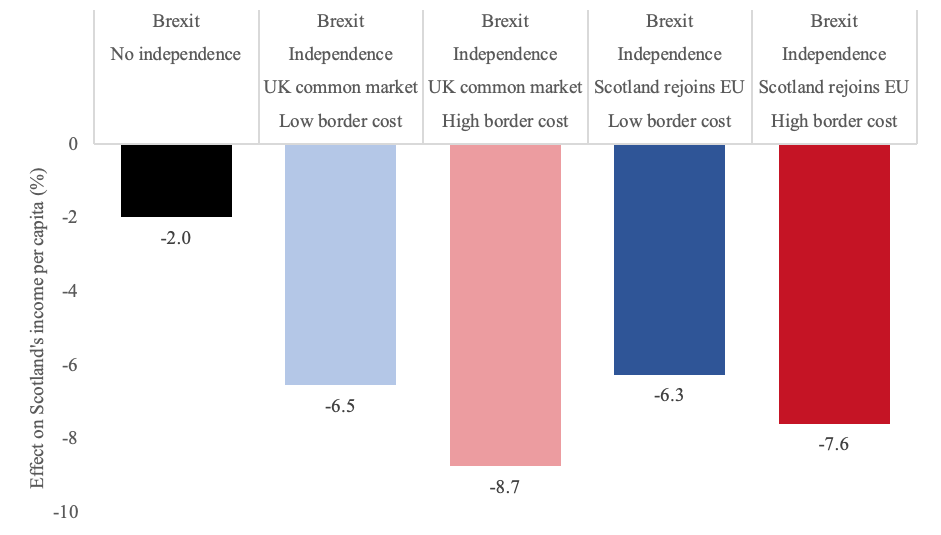

The combination of independence and Brexit would reduce income per capita by at least 6 per cent; the impact of independence is 2-3 times greater than that of Brexit. Independence would impose a new border between Scotland and the rest of the UK. Various academic studies have estimated the effects of borders on trade. Although there is no consensus on the exact number, borders are usually estimated to have large negative effects (e.g. here, here, here, and here). Based on this literature we analyse an optimistic low-cost scenario where independence increases trade costs with the rest of the UK by 15 per cent, and a pessimistic high-cost scenario, with a 30 per cent increase.

To estimate the effect of these increased costs, we use an updated version of the Centre for Economic Performance model of trade. This takes into account the links between four regions (Scotland, the rest of the UK, the EU, and remaining countries) and the structure of each of their economies (27 industries and their links to each other). The model estimates how changes in trade costs affect trade and how this impacts income in various scenarios – Brexit, then Brexit plus independence, then Brexit plus independence and rejoining the EU. In each case, we analyse both the high and low border cost scenarios.

Our results are summarised in the chart below. In a nutshell, the rest of the UK is currently a much more important trade partner than all other countries combined. As a result, the trade costs imposed by independence will cause a substantial reduction in Scottish trade and income.

If Scotland remains in the UK, we estimate it will suffer a 2 per cent reduction in income per capita from Brexit. If Scotland then gains independence but remains in a common market with the UK, trade with the UK will decline due to the new border. In the low (high) cost scenario, the total effect of independence and Brexit is to reduce Scottish income per capita by 6.5 per cent (8.7 per cent). Even assuming a close, ongoing relationship with the rest of the UK, the losses from independence are 2-3 times larger than from Brexit.

Would an independent Scotland be better off inside or outside the EU?

Re-joining the EU cannot make up for the income lost to independence. We can use the same model to assess whether an independent Scotland would benefit from re-joining the EU. Note that re-joining dismantles the barriers created by Brexit, only to erect them again at the border with the rest of the UK.

We find that the net effect of re-joining the EU is slightly positive in the low trade cost scenario (+0.2 per cent income per capita), and more so in the high trade cost scenario (+1.1 per cent). Re-joining does provide some boost to Scottish incomes, albeit nowhere near enough to recover the loss from independence.

The deeper mechanism behind this result is quite simple. Because re-joining moves a set of barriers from one border to another, the net impact can only be positive if they are dismantled at the more important border. Paradoxically, re-joining the EU only benefits an independent Scotland if independence has so hurt trade with the rest of the UK that the EU becomes Scotland’s largest trading partner. And the more independence reduces trade, the greater its economic costs.

We estimate that independence will eventually lead to the rest of the UK and the EU being of similar importance for Scottish trade. However, it is important to note that our model estimates long-run effects, which will likely take a generation to emerge. As such, given the incredibly close starting relationship, the rest of the UK will probably remain Scotland’s largest trading partner in the short to medium term.

Our analysis only looks at the impact of independence and rejoining the EU on trade costs, and the implications these have for trade and income. In reality, Scottish independence has many other economic dimensions – which currency to use, fiscal arrangements to make, and what the long-run investment and productivity impacts will be – as well as other political and legal considerations. If there is a referendum, voters will have to weigh all of these factors against each other. We hope that this work helps inform one part of the decision.

This article gives the views of the authors, and not the position of LSE Brexit, nor of the London School of Economics.

I would like to see a new LSE blog on the proposed Scottish independence referendum where articles like this could be posted, but here I think it is off-topic.

Although I do not want the United Kingdom to break up, this is not mainly for economic reasons. Likewise I think Scottish nationalists are unlikely to be much deterred by the fear of a hard border with the UK. Many, I suspect, just want to “get the Tories out of Scotland”.

If pro-independence parties win a majority at the next Holyrood elections, which seems extremely likely, I think the UK government should consent to a second independence referendum. The people of Scotland have a fundamental right to self-determination which I think cannot be denied, nor can it be postponed for another 30 years as the Prime Minister has suggested. However before any second referendum there needs to be prolonged cross-party discussion about how to organise it so that the result is accepted by all sides, to avoid a repeat of the chaos after the 2016 Brexit vote. My preferred date would be summer 2024, which would allow about three years (which would certainly be needed) to set the ground rules. My hope as someone who wants Scotland to remain part of the UK is that Brexit issue will have less salience by then and that the people of Scotland will be swayed by economic arguments like those above. But if not, at least the date I suggest would (presumably) be closely followed by Westminster elections and the people of the rest of the UK will get the chance to choose who should represent them in negotiating the separation.

In any case, this issue is not going to go away in the near future so LSE, please set up a blog for it. It’s important and I value the (mostly) informed and intelligent quality of discussion here.

Hi

How about responding to the criticisms that the analysis is wholly undermined by the quality and questionable nature of the data. See here: https://bellacaledonia.org.uk/2021/02/03/if-you-start-with-the-answer-the-question-is-brigadoon/

And here:

https://www.taxresearch.org.uk/Blog/2021/02/04/the-lse-report-on-the-increased-costs-in-trade-for-an-independent-scotland-is-based-on-unsubstantiated-data-and-absurd-assumptions/?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+org%2FlWWh+%28Tax+Research+UK+2%29

A pile of crock then?

LOL You think a Nationalist supporting Blogger and an English attention seeking Tax Advisor think they actually know better than the LSE who are highly respected ?.Googling Richard Murphy will expose his BS bluster many times and at other times simply plain wrong. Selling nice stories to gullible people keeps his Blog getting clicks though and thus keeps him feeling important. The LSE’s other previous Blog on Brexit by the same people was praised by many at the top of the SNP yet this one isn’t , strange that 🙂 You could look up some other sources and make your mind up for yourself. The head of the SNP’s Growth Commission omitted paying for this list in a recent article in the Financial Times can you work out why ? https://chokkablog.blogspot.com/2021/01/whats-7-billion-between-friends.html also Dicky Murphy appears in this film clip https://www.scottishparliament.tv/meeting/economy-jobs-and-fair-work-committee-september-19-2017?clip_start=11:07:40&clip_end=12:05:33

And so it begins. As the establishment starts to panic, the independence-negative campaign starts up. I am perfectly sure that an article putting the other side of the argument would come to an equally positive conclusion. So really, this is just propaganda.

The truth is that Scotland after London is the richest part of the UK – so we are off to a good start. Furthermore, Ireland, which is was in the same position 100 years ago was given similar forecasts that they could never prosper outside the Empire – they seem to be doing OK now!

Scotland, compared to other medium sized countries such as Denmark, New Zealand, Ireland, Greece, etc. world would do equally as well as they do. Unless the author is saying that being located next to England is actually a disadvantage?

Here is some more information:

Scotland in the UK

Population % of the UK 8.4%

% UK Natural Resources 34%

% UK Wind/Tidal Energy 25%

% UK Food/Drink Exports 21%

% Surplus in International Trade over rest UK 100%

On a per person basis Scotland’s economy is £900 larger than Englands. Scotland is one of the world’s most naturally wealthy nations. It has Europe’s most educated population, exports more goods per head than the rest of the UK, and tourism, food and drink, IT, biotech and many other sectors are flying.

Scotland is the only UK nation to have internationally exported more goods than it has imported every year since records began. In 2018 Scotland’s surplus in international trade in goods was £4.94 billion whilst the rest of the UK ran a deficit of £134.98 billion.

https://www.businessforscotland.com/scotland-the-brief/

England doesn’t pay for Scotland.

With 8.2% of the uk population , we supply 9.6% of the revenue excluding oil/mineral wealth etc , and receive 9.3% of the funding back with our own money , giving Westminster a net subsidy from Scotland excluding oil etc.

Per head of population Scotland exports more than twice what England does , we have 96% crude oil production where all the revenue goes to london , we have 60% gas , 62% of seafood landings , 90% of the uk freshwater , and 40% of the uk wind wave and solar energy production.

Scotland is also paying 8% of the interest of Westminsters massive 1.8 trillion debt .

Since 2012 alone, Scotland , a country with almost no borrowing powers , has paid £16.5 billion in Westminster debt interest.

All with 8.2% of the population.

I don’t know who the english taxpayer is subsidising , but it certainly isn’t Scotland.

Currently Scotland is forced to contribute above eu15 average 2% defence spending for the UK.

We pay roughly 3.5 billion , and if we became independent and paid the same 2% as the EU 15 nations do , we would immediately save £1.5 billion.

Scotland has an international trade surplus of £15 billion , while the UK has a trade deficit of £496 billion.

Per head of population our tourism income is 8% larger than Englands.

Scotlands exports to 500 million europeans are growing far faster than our exports to 59 million in the rump uk.

For every £1 of spirits we export to the rUK, we export £3 to Europe.

The UK Treasury has received £937 billion in Scottish revenue , but only given Scotland back £511 billion to spend

Well thats a bit embarrassing for you . most of what you have posted is meaningless propaganda, i;m afraid

You need to actually work out how much Tax Revenues each item provides as the margin profit on say Oil is very small and the Tax revenues raised are smaller still . I presume you don’t have any background in economics at all but read lots of Nationalist blogs ? Any idea with the problem there ?

Meaningless propaganda? You seem to have a strange relationship with facts, if that’s all you can garner from my post. And what are your qualifications for your unfounded and propagandistic assertions? Because that’s what they are – just bluster unsupported by any actual facts. Seems a bit embarrassing for you, really. Maybe go back to your manager and get some better insights?

I have a question about the data/insight going into this post, to arrive at these conclusions? Can the authors clarify what those were?

If this is based around (in part) data from the GERs reports how confident can we be of the accuracy of it given they are a) viewed through the lens of Scotland as part of the UK, b) in many ways extrapolations as no concrete data truly exists at the Scotland level and c) would not take into account the amount of exports that travel to other parts of the UK to them be exported? Surely those exports would be treated as UK exports alone?

Scott I’m afraid not much of what you state is true , you can find the SNP’s own Economist here with several useful points on the GERs numbers which the SNP themselves chose for the 2014 White Paper and their own Growth Comission Report .

https://www.scottishparliament.tv/meeting/economy-jobs-and-fair-work-committee-september-19-2017?clip_start=11:07:40&clip_end=12:05:33

This is also a useful place to start researching GERS , they have many such articles and can be trusted.

https://fraserofallander.org/back-to-school-for-gers-2019/

Your copy and pasted list IS just meaningless invented propaganda , especially as its clear you don’t even understand it yourself anyway . Trade surplus’s and GDP are meaningless numbers to quote because what pays for Scotlands actual public services are Tax Revenues levied on profits and you can have a big trade surplus or GDP but actual profits are very small if they exist at all and if they are small then actual tax revenues produced are even smaller still. (Business for Scotland is a known fake propaganda unit if thats where you obtained that drivel from)

Better insights ? Like the information actually published by your own Scottish Government you mean that shows Scotland spent nearly £15bn more than it raised from all its own taxes as found here https://www.gov.scot/publications/government-expenditure-revenue-scotland-gers-2019-20/

An explanation of the GERS numbers here from the SNP’s own Senior Economist https://www.scottishparliament.tv/meeting/economy-jobs-and-fair-work-committee-september-19-2017?clip_start=11:07:40&clip_end=12:05:33

More on Scotlands finanncial numbers here from the Scottish Governments own advisors https://fraserofallander.org/gers-2020-socially-distance-yourself-from-the-myths-and-furore/

One years numbers here which can all be checked on the Scot Govs own Website

https://chokkablog.blogspot.com/2019/12/how-much-of-scotlands-tax-revenue-does.html

You won’t get “facts” from Nationalist Social Media fantasy bloggers , try looking up and quoting trusted sources of information as explained and offered by the Scottish Governments own Advisors here

https://fraserofallander.org/back-to-school-for-gers-2019/

My goodness this article is way off base it ignores community funding, ignores the trading strength of Scottish

products, renewable energy, ignores the benefits of autonomy and self management. They claim to be economists, but they can’t see the world in front of their nose. According to their argumentation small countries like Denmark are

not economically viable.

I was shocked to read that you have created a report on the costs to trade for Scotland from three academics including yourself, that is so conflated and full of assumptions as to make it wholly worthless as either an academic piece or a usefull analysis.

To explain what i mean, within the report the word assume or a derivative such as asumption is used 23 times, estimate a staggering 62 time and uncertain 4 times. to give context reliable, accurate and certain are mentioned a total of zero times each.

I think Steven you should pay attention to the SNP’s own economist of how predictions and esitmates can be made and the calculations used to make sure they are very accurate indeed . Can i ask what qualifications you have to question respected financial analysts ?

https://www.scottishparliament.tv/meeting/economy-jobs-and-fair-work-committee-september-19-2017?clip_start=11:07:40&clip_end=12:05:33

https://fraserofallander.org/next-weeks-gers-numbers-part-1/

https://fraserofallander.org/next-weeks-gers-numbers-part-2/

Well apart from business degree and more than 30 years experience, I can read. And when I read assumption 62 times in a 30 odd page report I’m smart enough, to now that amount of variables makes the report meaningless drivel. This can proven mathematically. When variables have inaccuracies they multiply up with each inaccurate variable. Within this report there are virtually no accurate variables. This means the outcomes derived have standard deviations that are so high as to make the results meaningless.

Couple this with reports from far more experienced academics from the LSE who have written reports that contradict this report and perhaps even someone such as yourself can see my point.

Sorry it was estimate 62 times and assumption was only 23 times.

I doubt very much you have any business degree or else you would already understand the matters on Estimates and the use of “Confidence Levels ” properly, all you are trying to do is trash the excellent work the LSE have done on this that you really don’t like because it shows how damaging the Nationalist project really is to Scotland. You can see what the SNP’s own Senior Economist says about “Estimates” here 🙂 https://www.scottishparliament.tv/meeting/economy-jobs-and-fair-work-committee-september-19-2017?clip_start=11:07:40&clip_end=12:05:33

And more explanation of “Estmates” and “confidence levels” can be found here https://fraserofallander.org/next-weeks-gers-numbers-part-1/

FAI who advise the Scottish Governent also published this quite recently too https://fraserofallander.org/gers-2020-socially-distance-yourself-from-the-myths-and-furore/

Seeing as how you’ve seen fit to censor my previous post here, I’ll try again. And if this one doesn’t appear, I will publicise your censorship as widely as I can.

As I said before, this is just the start of a new ‘Project Fear’, inspired no doubt, by Westminster/tory pressure to combat Scottish independence, driven by the increased popular support for this in Scotland. With regard specifically to the above article, it is obvious that given the will, an equally credible case could be made for Scottish independence being entirely successful. So the above really proves nothing without further comparison and debate.

Meanwhile: the data below has been sourced from the “Business for Scotland’ web site, and further information can be found there.

Scotland in the UK

Population % of the UK 8.4%

% UK Natural Resources 34%

% UK Wind/Tidal Energy 25%

% UK Food/Drink Exports 21%

% Surplus in International Trade over rest UK 100%

On a per person basis Scotland’s economy is £900 larger. than the rest of the UK. Scotland is one of the world’s most naturally wealthy nations. It has Europe’s most educated population, exports more goods per head than the rest of the UK, and tourism, food and drink, IT, biotech and many other sectors are flying.

Scotland is the only UK nation to have internationally exported more goods than it has imported every year since records began. In 2018 Scotland’s surplus in international trade in goods was £4.94 billion whilst the rest of the UK ran a deficit of £134.98 billion.

https://www.businessforscotland.com/scotland-the-brief/

England doesn’t pay for Scotland.

With 8.2% of the uk population , we supply 9.6% of the revenue excluding oil/mineral wealth etc , and receive 9.3% of the funding back with our own money , giving Westminster a net subsidy from Scotland excluding oil etc.

Per head of population Scotland exports more than twice what England does , we have 96% crude oil production where all the revenue goes to london , we have 60% gas , 62% of seafood landings , 90% of the uk freshwater , and 40% of the uk wind wave and solar energy production.

Scotland is also paying 8% of the interest of Westminsters massive 1.8 trillion debt .

Since 2012 alone, Scotland , a country with almost no borrowing powers , has paid £16.5 billion in Westminster debt interest.

All with 8.2% of the population.

I don’t know who the english taxpayer is subsidising , but it certainly isn’t Scotland.

Currently Scotland is forced to contribute above eu15 average 2% defence spending for the UK.

We pay roughly 3.5 billion , and if we became independent and paid the same 2% as the EU 15 nations do , we would immediately save £1.5 billion.

Scotland has an international trade surplus of £15 billion , while the UK has a trade deficit of £496 billion.

Per head of population our tourism income is 8% larger than Englands.

Scotlands exports to 500 million europeans are growing far faster than our exports to 59 million in the rump uk.

For every £1 of spirits we export to the rUK, we export £3 to Europe.

The UK Treasurey has received £937 billion in Scottish revenue , but only given Scotland back £511 billion to spend

Your previous comment has been approved, we monitor these twice a week.

Davy ..Embarrasing stuff, i feel for you though.

Hi

I have posted a comment on this article which you haven’t yet published despite the fact I have confirmed my email address. Please contact me and explain why.

We have nothing on our system from you. Please post again.

More information at:

https://www.nowscotland.scot/truth_behind_lse_report

https://www.taxresearch.org.uk/Blog/2021/02/04/the-lse-report-on-the-increased-costs-in-trade-for-an-independent-scotland-is-based-on-unsubstantiated-data-and-absurd-assumptions/

John…Do you know what propaganda Blogs are ?

https://www.scottishparliament.tv/meeting/economy-jobs-and-fair-work-committee-september-19-2017?clip_start=11:07:40&clip_end=12:05:33

If this is a truly independent report, why was the strategy advisor of “Better Together” thanked in the report for “discussions”?

Obviously because “Better Together had a large degree of input, or possibly even financed or initiated this load of blatant propaganda, which I’m glad to say has been comprehensively refuted by a number of sources.

I’m afraid saying “refuted by a number of sources ” doesn’t make them meaningful though.

Perhaps gain knowledge from the SNP’s Economist ?

https://www.scottishparliament.tv/meeting/economy-jobs-and-fair-work-committee-september-19-2017?clip_start=11:07:40&clip_end=12:05:33

Yes Davy – and I feel for you too, as your own propaganda organisation (whichever one it is) is not feeding you with any data to back up your assertions. A bit of advice -0 just saying something, without any factual back-up – is just wind. Maybe you should go into the Renewable Energy business?

Whichever decision the people of Scotland might make in the proposed independence referendum, I hope they will feel less confused than I do after reading the above. Is sober impartial academic analysis without name-calling anywhere to be found, or is the referendum going to be of a similar quality to the Brexit referendum in 2016?

I would advise the supporters of Scottish independence to cool down on the rhetoric and stop assuming academics (however much they may disagree with them) are automatically enrolled in some mysterious Tory Project Fear conspiracy. If the facts are in your favour, argue the facts. If you disagree with the article above because it has had to make assumptions about trade flows between Scotland and England, surely you should be campaigning for statistics to be collected before the referendum so that the people of Scotland can make a decision on the best basis possible?

Sober academic analysis is most welcome, but there is much suspicion that this report does not qualify. The considered criticism from taxresearch.org (linked above) and others seems valid, as does the question of influence (why were Better Together representatives involved and why is it not clearer that the funding for the research came from a UKGOV funded organisation?)

“The considered criticism from taxresearch.org” A lot of the criticism on this page falls into the category of “disagree[ing] with the article above because it has had to make assumptions about trade flows between Scotland and England” which I mentioned above. I’m too much of a layman to be able to judge whether Richard Murphy in his critique of the LSE analysis is correct or not, but all he really seems to do is to demonstrate that the LSE analysis may be false, not that it is. Surely the people of Scotland should if possible have a better basis, if possible, before choosing independence. Unlike Richard Murphy I don’t think that means “the very obvious fact that the only realistic thing to do at this point was, to be polite, to give up”, at least not give up on Scottish independence, but it would make sense to try and get more facts if possible. If you are driving along and your windscreen is misted up, you don’t drive on as before because you don’t know whether there is a wall in front of you, you either slow down or you get out and wipe the windscreen ….

“why is it not clearer that the funding for the research came from a UKGOV funded organisation?” The paper says “This research was funded by the Economic and Social Research Council under grant ES/M010341/1.” If we are going to assume any academic research funded by research councils run by either the Scottish or UK government is suspect, we have a problem, because academics have to live. But in any case, on the basis of my limited experience of academia, I think it at least unlikely that support by the ESRC turns every recipient into a government mouthpiece. After all, one doesn’t really get the impression that LSE social scientists are all blue-rinse Tories.

Why were Better Together representatives involved?

AR: “Why were Better Together representatives involved?” The easy answer “I don’t know, ask the authors”.

But if you want a longer answer, here it is. First I want to nit-pick, you say “representatives”, earlier A. Reid said just the “strategy directory”. Was it one or multiple representatives? Was another one discovered? Please clarify.

I would however agree that it was unfair if Better Together was consulted but not Scottish Nationalists, though I don’t think it would be unfair if both were. The article mentions with three individuals. Do we have any information about the affiliation of the other two?

Richard Murphy was waved goodbye too from the Labour Party for “having little macro economic knowledge” he is a self propagandist that thrives on waffle , he hasn’t said any of the LSE report is wrong because he knows very well that it isn’t and therefore will not produce any actual evidence of it being wrong because that would then demonstrate him as a fool, what he produces is just “whatabouterry” and diversion to try to keep himself in the limelight. When Murphy can’t get real economics to work for him he resorts to just making up his own.

https://www.prospectmagazine.co.uk/economics-and-finance/nonsense-economics-the-rise-of-modern-monetary-theory

https://chokkablog.blogspot.com/2017/08/i-see-professor-richard-murphy-has-been.html

https://order-order.com/2010/12/06/more-left-wing-tax-hypocrisy-from-richard-murphy/

https://chokkablog.blogspot.com/2017/09/another-example-of-murphys-flaw.html

Still just making empty assertions then instead of backing them up with actual real financial knowledge gained from sources that actually advise the Scottish Government themselves ?

https://fraserofallander.org/next-weeks-gers-numbers-part-1/

https://fraserofallander.org/next-weeks-gers-numbers-part-2/

You could even look up the Scot Gov’s own Website and learn from this document here how your own SNP

Scottish Government obtain all their own tax revenues , all the different taxes raised can be found on the Index

further down the page here https://www.gov.scot/binaries/content/documents/govscot/publications/statistics/2020/08/gers-detailed-methodology-2019-20/documents/gers-detailed-revenue-methodology-2019-20/gers-detailed-revenue-methodology-2019-20/govscot%3Adocument/GERS%2B2019-20%2B-%2BDetailed%2BRevenue%2BMethodology.pdf

You can also check all the other versions the SNP themselves designed since they were elected on this link here

https://webarchive.nrscotland.gov.uk/20191010063153/https://www2.gov.scot/Topics/Statistics/Browse/Economy/GERS/Methodology

Don’t miss out on the SNP’s own Economist stating to you GERS numbers are good numbers that that SNP have full control of themselves here https://webarchive.nrscotland.gov.uk/20191010063153/https://www2.gov.scot/Topics/Statistics/Browse/Economy/GERS/Methodology

Thank you for this analysis of the potential losses to the Scottish economy if Scotland gained its independence and rejoined the EU.

It is noticeable that in your study you have not taken into account the potential for Scotland to become the link for Irish-continental trade under the EU umbrella. This link would of course become even greater should Ireland reunite – a real possibility after the Stormount assembly elections in 2022.

Such an arrangement should significantly stimulate trade between the two celtic nations and the Continent. It might also draw trade northwards from the Midlands and Northern England, providing an alternative logistics corridor to the (over) popular London-Dover-Continent route. English traders might also find it more conducive to enter the EU via Scotland in terms of geography and language.

Therefore adding an Irish-Scottish-EU corridor scenario to your analysis is highly to be recommended.

Hi Alastair, thanks, I think that’s a perfectly reasonable comment and the sort of criticism Scottish independence should be making. I will add another one: it seems to me perfectly possible that Scotland after independence and with EU membership would become an attractive destination for companies wanting a base in the EU with easy access to the rest of the UK.

On the other side, I think the timescale to EU membership would be quite long. Assuming a vote for independence is in 2024, as I suggested. Then I find it hard to believe the EU would even start considering a Scottish accession application until independence has actually been achieved and Scotland has control over its internal market. We saw that with Brexit it took 4 1/2 years from the referendum to when the UK achieved control over its internal market. I don’t see why Scotland should manage it much faster; in some ways the situation is more complicated since you would need a constitutional convention followed by the election of a government capable of speaking for Scotland. (Appointing Nicola Sturgeon dictator would not really be fair.) But let’s be optimistic and assume Scotland has a government in control of its trading affairs in 2027.

How fast would accession take? I don’t think there’s any particular reason to suggest the EU would fast-track this. A parallel would be with Iceland. There are details of the Icelandic accession negotiations here: https://en.wikipedia.org/wiki/Iceland%E2%80%93European_Union_relations#Application_for_membership . The Althing voted to apply for membership in 2009. Initial negotiations began in mid 2010. Formal negotiations in 2011. In 2013 after elections, negotiations were suspended. So Iceland was still negotiating, 4 years after the application was made. Assuming it took that long for Scotland, Scotland would join the EU in 2031 at the earliest.

After writing that, I found the following article. https://blogs.lse.ac.uk/europpblog/2020/02/05/what-would-it-take-for-scotland-to-rejoin-the-eu-as-an-independent-state/ I was pleased to see that the suggested timescale is not very different from mine, though I think the article is over-optimistic about how long it would take to set up Scotland as an independent state and I don’t think the EU would be willing to start negotiations until they had a constitutional authority in Edinburgh to negotiate with.

Of course the people of Scotland are perfectly entitled to vote for independence on the basis of achieving EU membership 7 years later. But they should know what they are doing. The SNP shouldn’t pretend that EU membership would be achieved as soon as the referendum party hangover has cleared up.

Also consider this. Assume that being outside the EU is as bad as many Remainers (including the SNP I presume) say, then pressure will grow within what remains of the UK to rejoin. Presumably Boris Johnson would resist this, but there will be at least two elections by 2029 and it seems very likely that one of them will result in either a Labour government led by Keir Starmer or a Labour-Liberal Democrat coalition. (Though losing the Scottish MPs wouldn’t exactly help here.) In either case a referendum followed by an application by the rest of the UK to rejoin would presumably follow. In that case, it would make a lot of sense for the EU to treat the accession applications by the rest of the UK and Scotland in parallel (to avoid a new hard EU border). The people of Scotland would then find themselves rejoining the EU but doing so at exactly the same time they would have done so anyway. All speculation of course, but if Brexit is that bad, sooner or later that should become clear South of the border.

I don’t expect to convince hard-line Scottish nationalists with that kind of argument, for whom the disruption caused by the separation would be a small price to pay for getting the Tories out of Scotland and who like Jacob Rees Mogg with Brexit, no doubt think it worth doing even if you don’t see the benefits for 50 years. But the other people of Scotland will have to decide if they see it that way too.

anyone who thinks the UK will rejoin needs professional help.

andrew neil faced off with the SNP policy convener on you tube, andrew wilson.

you would be advised to watch it.