UK Prime Minister Theresa has begun to set out her vision for Brexit. She was clear that the UK will be leaving the Single Market, but she also alluded to a possible sector-by-sector approach to trade negotiations with the EU.

Presumably this will focus on sectors of great economic relevance. The financial and automotive industries have already received much attention, and various sectors have been analysed. However, one key sector has so far slipped largely under the radar: the creative industries.

In this blog we show that the creative sector is important for the UK, in terms of both employment and share of exports. We compare the relevant numbers with those of the financial sector. The financial sector is already understood to be of crucial importance to the UK economy and vulnerable to the consequences of Brexit. But how important are the creative industries, and what Brexit risks do they face?

If the UK leaves the Single Market, we see three main “unknowns” that will define the impact on the UK creative sector. First, will it still be able to tap into foreign talent for employment purposes? Second, will it still be able to export as much as it has done, or will it lose access to EU markets? And third, will the creative sector still have access to European funds?

The creative sector is systemically relevant to the UK economy

The creative sector is defined in the UK Government’s 2001 Creative Industries Mapping Document as: “those industries which have their origin in individual creativity, skill and talent and which have a potential for wealth and job creation through the generation and exploitation of intellectual property.”

The formal definition is based on the UK Standard Industrial Classification (SIC) of 2007 and includes advertising and marketing activities, architecture, crafts, design, film, TV, radio and photography, IT, software and video games, publishing, museums, galleries and libraries, music, performing and visual arts.

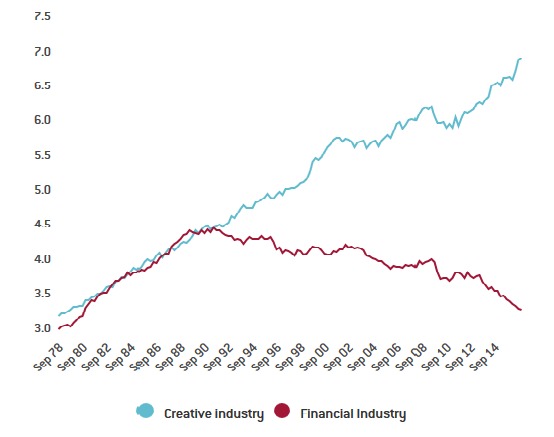

At the end of 2015 employment in creative industries represented about 7 per cent of total UK employment, compared to 3.5 per cent for the financial industry. Figure 1 below shows that the industry has grown constantly over the last 40 years, even during the years of the financial crisis that started in 2007. In fact, the creative sector is one of the fastest-growing sectors of the UK economy, as reported in the latest Brexit report from the Creative Industries Federation.

Figure 1. Share of UK employment

Source: Office for National Statistics, based on 2 digits SOC classification

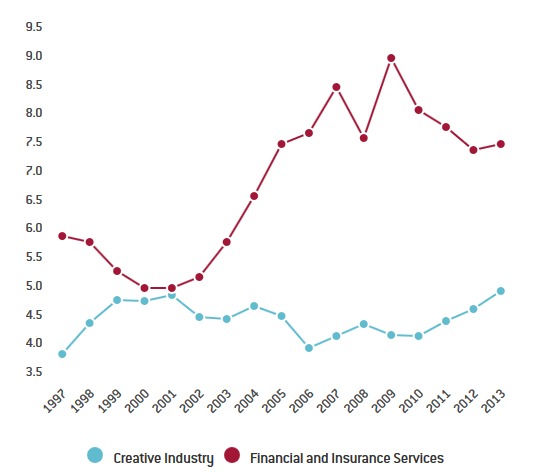

The creative sector also makes a large contribution to UK economic output. Its production, captured as gross value added (GVA), amounts to £84 bn per year in 2013. This is around 5 per cent of the UK’s total GVA, and the share is growing (figure 2). In this case, the financial sector industry is larger, producing about 8 per cent of UK total GVA. That finance generates a greater proportion of GVA, despite employing far fewer workers, shows the large differences in remuneration between the sectors.

Figure 2. Sector’s contribution to the total Gross Value Added

Source: Office for National Statistics and Eurostat

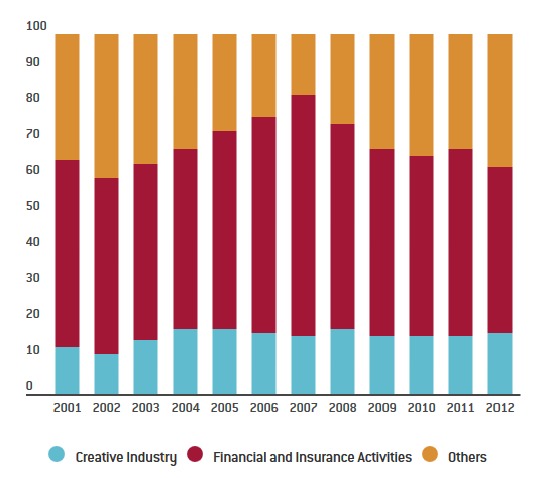

The creative sector is also a major exporter. Figure 3 shows that the creative industries accounted for 17 per cent of total service exports in 2012, the last year for which we have data. The corresponding number for the financial industry is considerably higher at 46 per cent.

Figure 3. The share of the industry’s exports in total exports

Source: Office for National Statistics

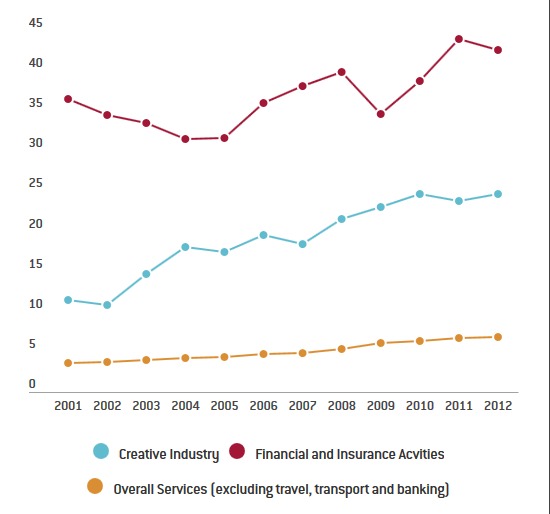

Both the creative and financial sectors are intensive exporters: a considerable amount of what is produced in the UK is exported. Figure 4 shows that in 2012, exports accounted for 24 per cent of the creative sector’s total GVA, while the financial industry exported 43 per cent of its GVA. Both sectors are much more export-oriented than the service sector as a whole. It thus follows that a “hard Brexit” which is not accompanied by a good trade agreement, at least for these two sectors, will have adverse implications for their economic output and employment generation.

Figure 4. How much does the sector export?

Source: Office for National Statistics and Eurostat

The unknowns: employment, exports and funding

Based on the last Brexit report from the Creative Industries Federation, 6.1 per cent of the creative sector’s workforce is EU nationals, which is similar to the 6 per cent level of EU nationals employed in the financial industry, and the 6.6 per cent share of EU nationals in the workforce as a whole. A further 5 per cent of the creative industry workforce originates from outside the European Economic Area.

As the report shows, businesses are already reporting an impact on recruitment. Successful candidates from the EU are turning down job offers because of uncertainty over their future status in the UK. There is a real risk that businesses dependent on non-UK workers will relocate operations if changes to UK visa laws restrict recruitment.

This risk is compounded by the potential loss of easy access to EU markets. The EU is as an important destination for UK creative sector exports, with just under half of the industry exports going to the EU. Multinationals are especially likely to shift production, which could bring significant losses to GVA and jobs in the UK creative industries.

For example, after a hard Brexit an advertising and marketing company might find itself unable to employ a talented designer from Spain. It could also face tariffs when exporting its services to Germany. Lower quality and higher prices are both a risk to that company’s ability to win business, and this may lead it to slow expansion or scale back employment. As the Creative Industries Council reports, “UK advertising and marketing created £13.3 billion of Gross Value Added (GVA) in 2014 – up from £8.35 billion in 2008”.

Access to EU funding is another question for the UK creative sector. European programmes like Creative Europe and Horizon 2020 have played a significant role in encouraging UK creative companies to export. Indeed, they have represented an important overall source of finance for the industry in recent years.

Britain has been a major recipient of EU funding both from designated culture schemes and general funds for regional and social development, innovation and business support. The UK was one of the main beneficiaries of funding through Creative Europe, and it is second only to Germany in the amount it receives from Horizon 2020 (an £80bn pot of research and innovation funding). It seems probable that a hard Brexit would deprive the UK creative industries of this funding, affecting the viability of investments and employment.

Conclusion

The Creative Industries Federation expressed concerns about the effects that Brexit may have on the ability of the UK creative sector to produce and grow. Our analysis shows that the impact on employment, exports and the sector’s funding for growth might be significant. In effect, a hard Brexit risks slowing down one of the UK’s most consistently growing sectors over the last decades.

Indeed, the sector appears remarkably in agreement in fearing Brexit. 96 per cent of the Federation’s members voted to support the remain campaign in a survey run prior to the referendum.

Prime Minister May’s speech pointed in the direction of a hard Brexit, favouring controls on immigration over trade and investment. If such a vision becomes reality, there will be an impact on the UK creative sector and its ability to create welfare. However, if there is to be a sector-by-sector approach to EU-UK trade arrangements, then the creative industries have a strong case to be on the government’s radar.

♣♣♣

Notes:

- This blog post appeared originally on Bruegel.

- The post gives the views of its authors, not the position of LSE Business Review or the London School of Economics.

- Featured image credit: Clothes Show Live at the NEC (Birmingham,) by Liton Ali, under a CC-BY-2.0 licence

- Before commenting, please read our Comment Policy.

Maria Demertzis is Deputy Director at Bruegel and a visiting professor at the University of Amsterdam. She has previously worked at the European Commission and the research department of the Dutch Central Bank. She has also held academic positions at the Harvard Kennedy School of Government in the USA and the University of Strathclyde in the UK, from where she holds a PhD in economics. She has published extensively in international academic journals and contributed regular policy inputs to both the European Commission’s and the Dutch Central Bank’s policy outlets.

Maria Demertzis is Deputy Director at Bruegel and a visiting professor at the University of Amsterdam. She has previously worked at the European Commission and the research department of the Dutch Central Bank. She has also held academic positions at the Harvard Kennedy School of Government in the USA and the University of Strathclyde in the UK, from where she holds a PhD in economics. She has published extensively in international academic journals and contributed regular policy inputs to both the European Commission’s and the Dutch Central Bank’s policy outlets.

Fabio Matera, an Italian citizen, works at Bruegel as Research Intern in the area of Energy markets. Before joining Bruegel, Fabio worked as Online Specialist at Arvato Financial Solutions in Dublin and as Business Analyst in Milan. He holds a BSc and a Master of Science in Economics from the Catholic University of Milan. The subject of his graduate dissertation was a statistical analysis of a data set, collected through a customer satisfaction survey launched by a leading Italian financial institution, in order to identify the main determinants affecting the level of customer satisfaction. Fabio’s research interests include empirical microeconomics and energy markets. He is fluent in Italian and English.

Fabio Matera, an Italian citizen, works at Bruegel as Research Intern in the area of Energy markets. Before joining Bruegel, Fabio worked as Online Specialist at Arvato Financial Solutions in Dublin and as Business Analyst in Milan. He holds a BSc and a Master of Science in Economics from the Catholic University of Milan. The subject of his graduate dissertation was a statistical analysis of a data set, collected through a customer satisfaction survey launched by a leading Italian financial institution, in order to identify the main determinants affecting the level of customer satisfaction. Fabio’s research interests include empirical microeconomics and energy markets. He is fluent in Italian and English.

Two key points on freedom of movement:

> in the creative sector you can’t equate salary levels with talent. A traditional visa system like Tier 2 will not work for it.

> there is a very high level of self employment. Again a traditional visa Tier 2 system will not work.

There is also a supply chain in the CCIs. For example in the film/TV sector across the UK/Ireland border where people, services and equipment flow on the same project.