The UK’s vote to leave the EU has generated fears that UK firms are moving investment abroad because of Brexit. For example, media reports have documented that both large UK companies such as Barclays, HSBC and EasyJet, and smaller companies such as Crust & Crumb, a Northern Irish pizza maker, have invested in the EU27 in response to Brexit.

Has the threat of reduced access to the EU market after Brexit pushed British firms into setting up shop in the remaining EU member states, rather than serving those markets from the UK?

In new research (Breinlich et al. 2019), we study whether the anecdotal evidence is representative of a wider pattern. We measure new FDI activity through a count of announced greenfield and M&A (mergers and acquisitions) transactions. Greenfield activity refers to investments that create new establishments or production facilities from scratch, for example setting up a new factory. M&A transactions refer to the acquisition of existing facilities. Our analysis focuses on the period from 2010 to 2018, during which we observe around 100,000 transactions in total.

The doppelgänger method

We employ the ‘doppelgänger method’ to analyse the impact of the Brexit vote. This is a way to estimate how UK FDI to the EU27 would have evolved after the June 2016 referendum if the UK had not voted for Brexit.

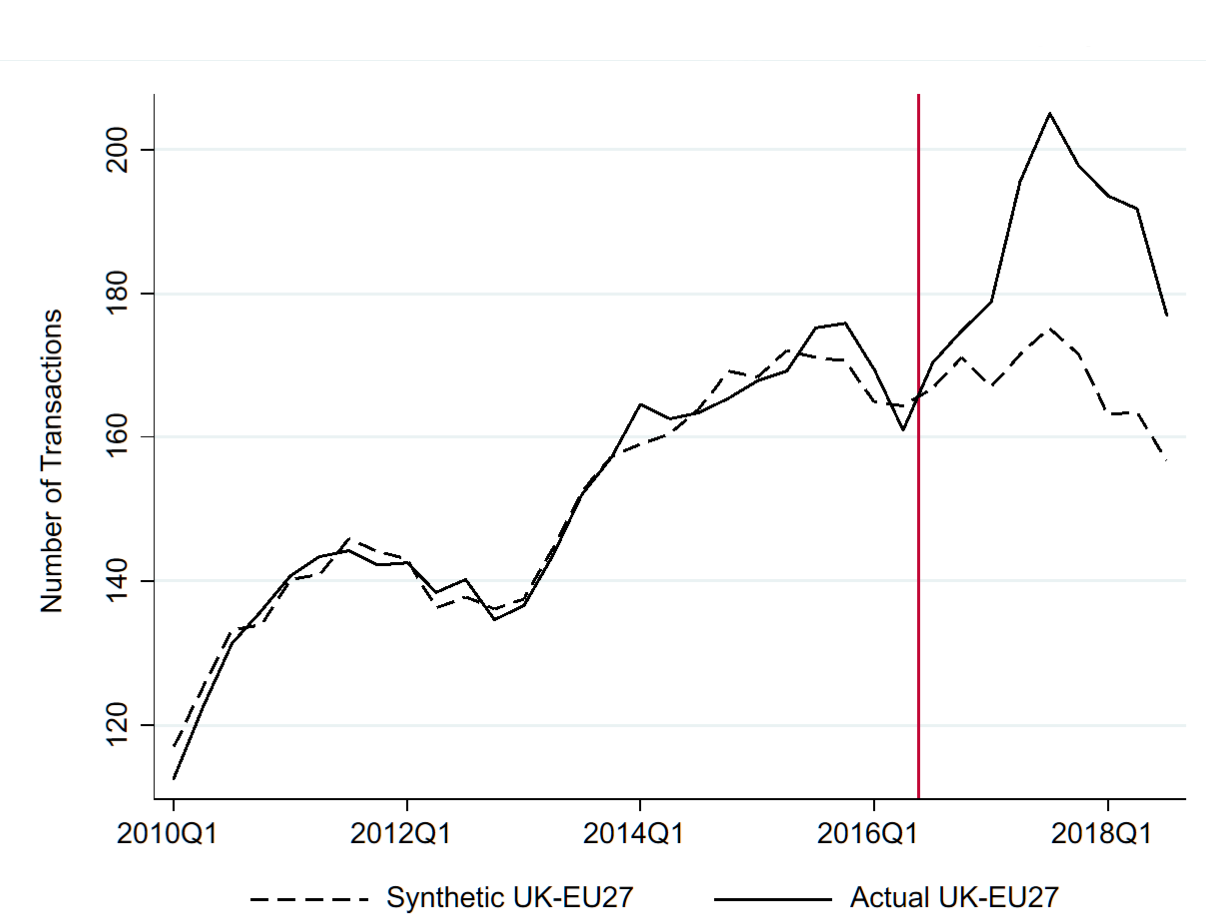

We construct a doppelgänger for UK FDI as a weighted average of FDI transactions between other developed countries, with FDI into the EU27 from Switzerland and the United States receiving the biggest weights. If the referendum outcome had no discernible impact on UK FDI, then the doppelgänger and the actual series should be similar not only before, but also after the referendum.

The referendum increased foreign investment from the UK to the EU27.

Figure 1 shows our results. The number of FDI transactions from the UK into the EU27 goes up substantially after 2016 Q2 compared to the synthetic doppelgänger, which remains at 2014 and 2015 levels.

Figure 1. UK-EU27 FDI counts (actual vs. doppelgänger)

Notes: This plots the actual count of FDI transactions from the UK to the EU27 (solid line) and the corresponding doppelgänger series (dashed line). Source: fDi Markets, Zephyr and authors’ calculations.

In terms of the cumulative difference, we find that 181 greenfield and M&A transactions from the UK into the EU27 had taken place by 2018 Q3 that would not have occurred in the absence of Brexit. This represents a 12 per cent increase in new FDI projects by UK firms in the EU27.

In further analysis we find that the increase in outward FDI from the UK to the EU27 is entirely driven by the services sector. This result is consistent with the view that the UK government has prioritised the interests of manufacturing over services in the Brexit negotiations by focusing on reducing customs frictions, while ruling out membership of the EU’s single market.

In terms of value, we estimate that these additional FDI outflows from the UK to the EU27 are worth approximately £8.3 billion in total by 2018 Q3. Moreover, the persistence of the gap in Figure 1 shows that the referendum effect has not yet died away, meaning the increase in outward FDI due to Brexit is likely to grow further as more data becomes available.

As a note of caution, we stress that the FDI outflow can only be interpreted as ‘lost investment’ for the UK under the assumption that the investment transactions would have taken place in the UK, instead of the EU27, were it not for the leave vote. It could also be that the referendum outcome simply triggered additional investment by UK firms in the EU27. We therefore regard £8.3 billion as an upper bound on lost investment.

No ‘Global Britain’ effect

Is the increase in FDI from the UK specific to the EU27 as a destination, or do we observe similar changes in UK investment flows to other countries? To evaluate this possibility, we construct a doppelgänger for UK investment into non-EU OECD countries.

In contrast to the EU27 as a destination, we do not observe an increase in UK investment activity into these non-EU OECD countries. That is, UK investment in advanced economies outside the EU27 has not experienced a post-referendum surge. In other words, we find no sign of a ‘Global Britain’ effect.

Finally, we show that increased outward investment in the EU27 has been accompanied by lower investment coming into the UK from the EU27. We estimate that the referendum reduced the number of new EU27 investments in the UK by 11 per cent, amounting to £3.5 billion of lost investment.

Conclusion

We show that the Brexit vote has led to a 12 per cent increase in the number of new investments made by UK firms in EU27 countries. We find no such increase in UK investment in countries outside of the EU.

Although it is not possible to be certain about the reasons behind firms’ investment decisions, our results are consistent with the idea that UK firms are offshoring production to the EU27 because they expect Brexit to increase barriers to trade and migration, making the UK a less attractive place to do business. In the event of a no-deal Brexit, more firms are likely to activate contingency plans for moving production abroad, accelerating the outflow of investment from the UK.

♣♣♣

Notes:

- This blog post appeared originally on LSE Brexit. It’s based on the authors’ Voting with their Money: Brexit and Outward Investment by UK Firms, Brexit Analysis N. 13 of LSE’s Centre for Economic Performance.

- The post gives the views of its author, not the position of LSE Business Review or the London School of Economics.

- Featured image by PublicDomainPictures, under a Pixabay licence

- When you leave a comment, you’re agreeing to our Comment Policy.

Holger Breinlich is a research associate in the trade group of the Centre for Economic Performance, LSE. He is also a professor at the University of Surrey and a research fellow at the Centre for Economic Policy Research.

Holger Breinlich is a research associate in the trade group of the Centre for Economic Performance, LSE. He is also a professor at the University of Surrey and a research fellow at the Centre for Economic Policy Research.

Elsa Leromain is a research officer in trade at the Centre for Economic Performance, LSE.

Elsa Leromain is a research officer in trade at the Centre for Economic Performance, LSE.

Dennis Novy is an associate in trade at the Centre for Economic Performance, LSE and an associate professor of economics at the University of Warwick.

Dennis Novy is an associate in trade at the Centre for Economic Performance, LSE and an associate professor of economics at the University of Warwick.

Thomas Sampson is an associate professor of economics at the LSE and a CEP trade research programme associate.

Thomas Sampson is an associate professor of economics at the LSE and a CEP trade research programme associate.

Why can’t the Brexiteers see what an impact this all has on our economy and future. Very informative article, thank you.