Industrial policies, broadly defined as policies that shape a country’s or region’s industry structure by either promoting or limiting certain industries or sectors, have been widely used in developed and developing countries. Historic examples include the U.S. and Europe after World War II, Japan in the 1950s and 1960s, South Korea and Taiwan in the 1960s and 1970s. Today, industrial policy in the form of protectionism is once again at the forefront of economic policy in both the East and the West.

Despite the prevalence of industrial policies in practice and the contentious debate about their efficacy, there are remarkably few empirical studies that directly evaluate the costs and benefits of these policies. This is because of two important issues. First, government subsidies to industries are notoriously difficult to detect and measure. Indeed, partly because international trade agreements prohibit direct and in-kind subsidies, “systematic data are non-existent” (WTO, 2006) and thus the presence and magnitude of industrial subsidies is often unknown. Second, assessing the consequences of industrial policy requires a quantitative prediction of what the world would look like without it.

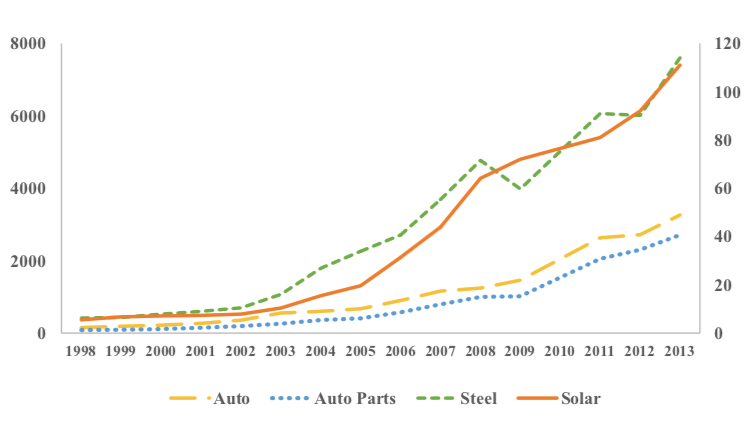

Our recent work attempts to fill this gap: we measure industrial subsidies and assess their impact on industrial evolution, focusing on China, where governmental guidance has allegedly turned its industries into world leaders and where the “invisible hand” of the state is gaining ground by the day. In the past two decades or so, Chinese firms have extremely rapidly dominated a number of capital-intensive industries, such as steel, auto parts, solar panels and shipbuilding; see Figure 1. In recent years especially, the government is explicitly targeting sectors with the goal of turning its firms into world leaders (e.g. “Made in China 2025” plan). In our work, we focus on the shipbuilding industry as a typical case study.

Figure 1. Total output: bill RMB

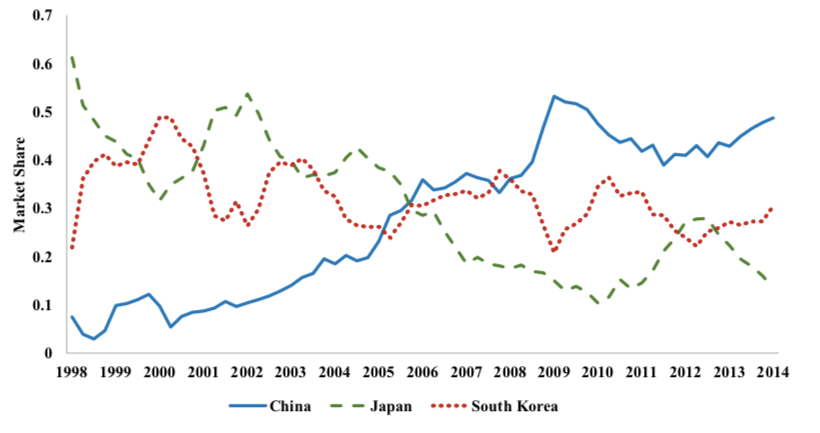

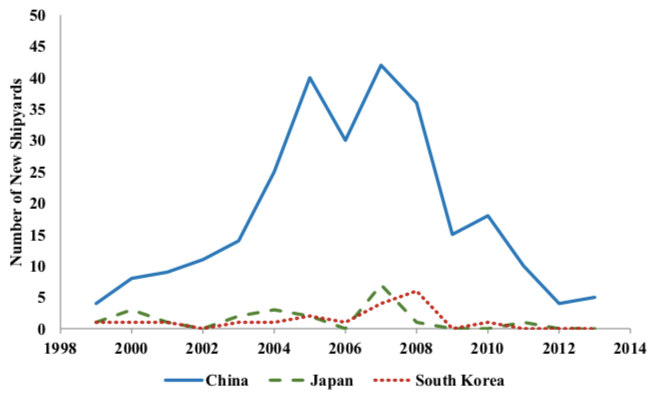

Shipbuilding is often seen as a “strategic industry” and is thus one of the major recipients of subsidies globally, along with e.g. the steel, mining and automotive industries. Beginning with its 11th National 5-year Economic Plan 2006-2010, China introduced a number of policies to develop the country’s infant shipbuilding industry to be the largest worldwide. The policies set specific output and capacity goals and as such involved a mix of production, investment and firm entry subsidies. Production subsidies include input material and export credits, buyer financing, etc. Investment subsidies take the form of low-interest long-term loans. Finally, reduced processing time and simplified licensing procedures, as well as heavily subsidised land prices greatly lower the cost of entry for potential shipyards. The industry’s rapid expansion is depicted in Figures 2 and 3.

Shipbuilding is often seen as a “strategic industry” and is thus one of the major recipients of subsidies globally, along with e.g. the steel, mining and automotive industries. Beginning with its 11th National 5-year Economic Plan 2006-2010, China introduced a number of policies to develop the country’s infant shipbuilding industry to be the largest worldwide. The policies set specific output and capacity goals and as such involved a mix of production, investment and firm entry subsidies. Production subsidies include input material and export credits, buyer financing, etc. Investment subsidies take the form of low-interest long-term loans. Finally, reduced processing time and simplified licensing procedures, as well as heavily subsidised land prices greatly lower the cost of entry for potential shipyards. The industry’s rapid expansion is depicted in Figures 2 and 3.

Figure 2. China’s market share expansion

Figure 3. Entry of new shipyards

How does one gain insight on the governmental support offered to firms when the measures applied are a secret? In recent work, I use modern techniques that combine available data on firm choices and an economic model to detect the presence of subsidies (Kalouptsidi, 2018). In particular, my approach aims at uncovering a “gap” between the observed firm choices (in this case production) and the choices the economic model would imply. To do so, I estimate the cost function of potentially subsidised firms, i.e. the function that relates output to operating expenditures, and I examine its behaviour around 2006. I am particularly interested in whether this cost function exhibits a “break” in 2006 in China, i.e. an abrupt change that makes Chinese shipyards produce as if their costs are all of a sudden lower.

The cost function obtained from this analysis exhibits a significant drop for Chinese producers equal to about 13-20 per cent of the cost per ship, or a total of 1.5 to 4.5 billion US dollars between 2006 and 2012 for the case of Handysize vessels. There is also evidence that Chinese shipyards are less efficient than their Japanese and South Korean counterparts; thus, the business stealing that occurred constitutes a misallocation of global resources. The intuition for the estimated cost decline is simple: it is practically impossible to explain the rapid increase in China’s market share observed with other economic mechanisms consistent with this model. Simply put, Chinese firms are “over”-producing, compared to our theoretical prediction.

In subsequent work we perform a welfare analysis of the retrieved subsidies (Barwick, Kalouptsidi and Zahur, 2019). We find that the subsidies boosted China’s domestic investment and shipyard entry dramatically, and enhanced its world market share across different types of ships (container ships, oil tankers, bulk carriers). However, the policies created sizeable distortions, generating only mediocre net profit gains to domestic producers and worldwide consumer surplus. In other words, as the estimated subsidies for all ship types were very high, their net return was quite low. The policies attracted a large number of inefficient producers, exacerbated the extent of excess capacity, and did not translate into significant higher industry profit over the long run.

Turning to the various components of the industrial policy, the effectiveness of different policy instruments is mixed. Production and investment subsidies can be justified based on output considerations, but entry subsidies are extremely wasteful and lead to increased industry fragmentation and idleness. Welfare distortions induced by these policies are “convex”, in that the combination of all policies yields considerably lower return compared to each policy in isolation.

Finally, our analysis suggests that the effectiveness of industrial policy is significantly affected by the presence of the industry cycles and heterogeneity in firm efficiency. A counter-cyclical policy would have out-performed the pro-cyclical policy that was actually adopted, by a large margin. This is partly due to a composition effect (more high-cost firms survive during a boom than during a bust) and partly due to capacity constraints that render increases in production more costly during the boom. In a similar vein, had the government targeted subsidies towards a more efficient set of firms, the policy distortions would have been considerably lower.

♣♣♣

Notes:

- This blog post is based on the author’s paper Detection and Impact of Industrial Subsidies: The Case

of Chinese Shipbuilding, and “China’s Industrial Policy: An Empirical Investigation”, with Panle Jia Barwick and Nahim Zahur (coming soon). - The post gives the views of its author, not the position of LSE Business Review or the London School of Economics.

- Featured image by Yoshi Canopus, under a GNU Free Documentation or CC-BY-SA-3.0 licence

- When you leave a comment, you’re agreeing to our Comment Policy.

Myrto Kalouptsidi is the Stanley A. Marks and William H. Marks assistant professor of economics at Harvard and the Radcliffe Institute. She received her PhD in economics from Yale University in 2011 and was also an assistant professor at Princeton University, 2011-2016. Kalouptsidi specialises in applied microeconomics, with a particular emphasis on industrial organisation and international trade. Her work has focused on industry cycles and the role of investment costs and uncertainty, the impact of industrial policies on global allocation and welfare, as well as the efficiency properties of transportation and its impact on world trade.

Myrto Kalouptsidi is the Stanley A. Marks and William H. Marks assistant professor of economics at Harvard and the Radcliffe Institute. She received her PhD in economics from Yale University in 2011 and was also an assistant professor at Princeton University, 2011-2016. Kalouptsidi specialises in applied microeconomics, with a particular emphasis on industrial organisation and international trade. Her work has focused on industry cycles and the role of investment costs and uncertainty, the impact of industrial policies on global allocation and welfare, as well as the efficiency properties of transportation and its impact on world trade.

Nice very detailed and logical guide to how a country can nurture its captive capacity at macro economy policy level for core strategic sector , this even without being best in trade.