Economic policies practised after the financial crisis are alleged to have led to a rise in the incidence of zombie-firms. Zombies refer to weakly performing firms that are unable to cover their debt servicing costs from current profits over an extended period. The persistent survival of these poorly performing zombies are considered to be a drag on the economy, as they congest markets for healthy firms and dampen productivity growth. The usual suspects behind the rise of zombies are low interest rates, evergreening (subsidised credit), and government subsidies to firms, all considered to provide these distressed firms with life-support.

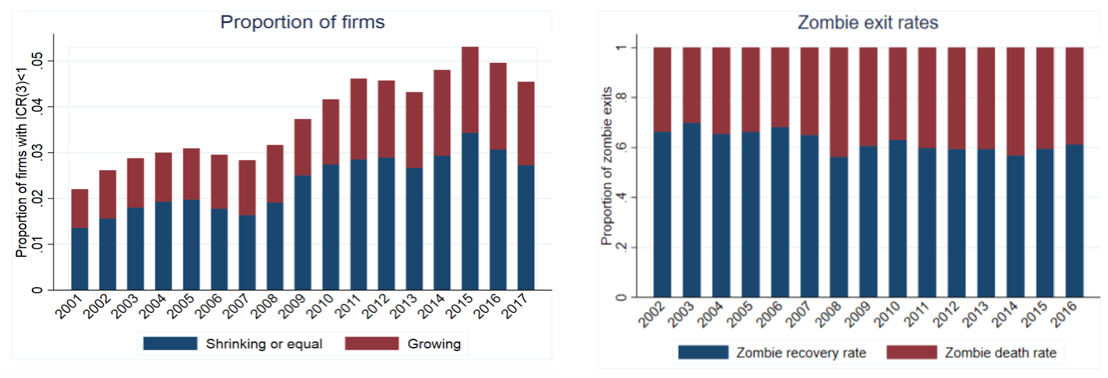

In Nurmi, Vanhala and Virén (2020) we perform an ‘autopsy’ of zombies and show that the fear for zombies may be largely unfounded. A closer look into firm-level data from Finland reveals a striking finding: one third of these allegedly distressed firms are in fact growing companies and two thirds recover from zombie status to become healthy firms again. Zombie-labelled firms (commonly defined as firms having an interest coverage ratio less than one for three consecutive years) are thus often not truly distressed firms but rather growing companies with temporarily weak performance measures. For policy recommendations, the true nature of firms labelled as zombies is important: providing life support (e.g. subsidies or low interest rates) to death-ripe firms is harder to justify than supporting temporarily unprofitable but recovering firms.

Zombie-firms became an object of interest in the stagnating Japanese economy of the 1990s, where living-dead firms survived persistently in the market due to evergreening by financial institutions. Seminal studies by Takeo Hoshi, Ricardo Caballero and others showed that zombie-dominated industries exhibit more depressed restructuring, characterised by more depressed job creation and destruction and lower productivity.

There has been a renewed interest in the presence and consequences of zombie firms in the aftermath of the Great Recession. The decline of productivity growth in OECD countries has raised interest in rising productivity dispersion within industries, declining reallocation and business dynamism. Recent studies have documented a rise in the proportion of zombies in the firm population across OECD economies since the financial crisis. Focus has been on resource misallocation and congestion effects of zombies on healthy firms and ultimately on the negative effects of zombie firms on growth and employment.

To better understand the rise of zombies and its consequences, we study in depth the entry and exit of firms into and out of zombie status using firm-level data from Finland (1999-2017). Going a step further, we decompose the zombie exit margin into exits out of the market (firm death) and exits to becoming healthy firms (recovery). We also consider another dimension, namely firm growth during zombie spells. Furthermore, we have access to firm-level information on public subsidies to firms, allowing us to analyse the role of various types of government subsidies in keeping zombies alive.

Figure. One third of zombie-labelled firms are growing companies and two thirds recover from zombie status

Note: Zombies are defined as firms with the ratio of earnings before interest and taxes (ebit) and the interest paid+financial charges being less than one (ebit/interest<1) for three consecutive years. Manufacturing includes NACE rev. 2 sectors 10-33 and private services includes sectors 45-63 and 69-82.

Our findings challenge generally accepted views of these firms as presented in the recent literature and policy narratives. First, we find that a large share of zombie-labelled firms should not be considered unviable. Rather, conventional zombie-measures catch a large number of growing or restructuring firms that may be investing into future performance. One third of these allegedly distressed firms are in fact growing companies and two thirds recover from zombie status to become healthy firms again. For many firms, falling under the zombie label may thus just be a temporary phase of gathering strength before take-off. This may not be surprising for young start-ups, but the same pattern applies broadly across age groups and firm sizes.

Second, the literature has raised the concern that zombie firms have a detrimental effect on healthy firms, by misallocation of resources to poorly performing firms and thus congesting the markets. Interestingly, we find that both declining zombies (true zombies) and growing zombies (false zombies) have a negative effect on the performance of other firms in the same industry. This raises the question of whether it is simply a temporary excess supply of firms that squeezes the profits of all firms in the same sector, rather than misallocated resources. These findings cast doubt on the policy conclusion of rapidly getting rid of zombie-labelled companies.

A third observation we make is that Zombie spells tend to be relatively persistent, however half of zombie spells lasts for four years or more. This persistence may reflect inefficiencies or market failures in the economy and raises the issue of the potential of policy interventions to speed up the recovery out of zombie status for these firms. For this purpose, we analyse the role of various types of government subsidies at the firm level in keeping zombies alive and helping their recovery. We find that firms receiving government subsidies are less likely to die, but we do not find a robust positive association of subsidies with zombie recovery. Thus, subsidising zombies does not seem to be the recommended policy prescription.

Our analysis emphasises that the stock of zombies is generated by firms’ inflows into and outflows from zombie status. Recent narratives often focus only on the zombie exit margin: zombies are typically considered as being in a terminal state that ultimately leads to the death of the firm. Economic policies may in these narratives then (deliberately or not) postpone or bring forward the inevitable exit from the market of these weakly performing firms. But this is not the end of the story. For example, while expansive policies (e.g., low interest rates) may support the survival of non-viable firms in the market, at the same time they may increase the number of firms recovering from zombie status as well as reduce the share of firms becoming zombies in the first place. While the former effect tends to increase the number of zombies, the latter two effects tend to reduce it. The policy implications may thus be ambiguous and more complex than in the popular narratives.

Our findings challenge generally accepted views of zombie firms and their effects as presented in the recent literature and policy narratives. With the COVID-19 pandemic going on, and polices to support distressed firms being applied widely across countries, it should be recognised that many zombie-looking firms may in fact be viable growing companies.

Author’s disclaimer: The opinions expressed in this post are those of the authors, and do not necessarily reflect the views of Statistics Finland, the Bank of Finland or the Eurosystem.

♣♣♣

Notes:

- This blog post is based on the authors’ paper “The life and death of zombies – evidence from government subsidies to firms,” Research Discussion Papers 8/2020, Bank of Finland, presented at the European Economic Association’s Annual Congress, August 2020.

- The post expresses the views of its author(s), not the position of LSE Business Review or the London School of Economics.

- Featured image by Anthony Tyrrell on Unsplash

- When you leave a comment, you’re agreeing to our Comment Policy

Satu Nurmi is head of research at Statistics Finland and a Visiting Researcher at VATT Institute for Economic Research. Her research interests include firm dynamics, entrepreneurship and internationalisation. She participates in developing Statistics Finland’s Research Services and availability of research data.

Juuso Vanhala is a senior advisor at the Monetary Policy and Research Department at the Bank of Finland. His research interests include productivity growth, firm dynamics and labour markets. He participates in policy analysis and forecasting at the Bank of Finland.

Juuso Vanhala is a senior advisor at the Monetary Policy and Research Department at the Bank of Finland. His research interests include productivity growth, firm dynamics and labour markets. He participates in policy analysis and forecasting at the Bank of Finland.

Matti Virén is emeritus professor of economics in University of Turku and consultant at the Bank of Finland. His research interests cover various economic policy issues, in particular fiscal policy, banking and labour market reforms.

Matti Virén is emeritus professor of economics in University of Turku and consultant at the Bank of Finland. His research interests cover various economic policy issues, in particular fiscal policy, banking and labour market reforms.

Finnish Economy good = company make money

Finnish Economy bad = company not make money

The only (slightly) interesting part is that zombie company survival is basically about access to cheap money, and that survive or die they are a drain on the economy (because apparently the unproductive firm takes up investment money (Who invests in unproductive firms?))

P.S good to know that a Strong Finnish Economy SFE will set all those zombie companies in the U.K and U.S.A straight

The term ‘Zombie’ may be inaccurate to describe the temporary condition of these firms – by coming back into life the definition must be wrong