Central bank digital currency is turning into a pre-occupation of central banks and much of the fintech world. Hundreds of pages of analysis have been produced in the last eighteen months. However, the concept dates back almost three decades and has so far had little impact on the world. So, what are the essential questions about CBDC that need to be answered?

1. What is it?

Money exists in many forms. Two of the most important, banknotes and central bank reserves are created (with a few exceptions in the case of banknotes such as Scotland and Hong Kong) by central banks. Though banknotes are physical and central bank reserves (the balances commercial banks deposit at central banks) are digital, they are economically equivalent. Central Bank Digital Currency (CBDC) is intended as another form of central bank money, digital like reserves but available to as wide a range of users as physical cash, for both retail and wholesale users. However, potential wholesale users typically have reserve accounts and access to market infrastructure that allows settlement using reserves. This makes the difference between reserves and wholesale CBDC more subtle than that between notes and retail CBDC.

2. Why the sudden interest?

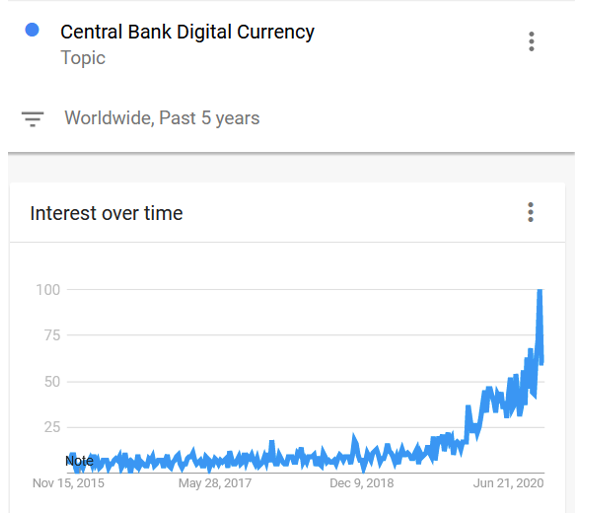

Over the last eighteen months there has been an outpouring of papers about CDBC from major central banks, multinational organisations and consultancies. Not to mention a great deal of discussion in conventional and social media.

Figure 1. Searches on Google

Source: Google Trends

The announcement of Facebook’s proposed digital currency, Libra, in 2019 was a major driver of interest. In his book “Libra Shrugged”, cryptocurrency expert David Gerard described the central banks’ reactions.

“Libra frightened the central banks – a popular private currency run by people who didn’t seem to know what they were doing could prove disastrous. Central banks started looking into CBDC with more urgency. There might be a gap in the market, for low-cost international settlement – and Facebook said Libra could fill that need. But Libra would run at a large enough scale to risk financial stability.”

Progress by People’s Bank of China (PBOC) in implementing a CBDC has also been a major driver of interest. In October 2019 Mark Zuckerberg (CEO of Facebook) warned a House of Representatives committee of the potential consequences of Chinese innovation in the area.

“..I also hope we can talk about the risks of not innovating. While we debate these issues, the rest of the world isn’t waiting. China is moving quickly to launch similar ideas in the coming months. Libra will be backed mostly by dollars and I believe it will extend America’s financial leadership as well as our democratic values and oversight around the world. If America doesn’t innovate, our financial leadership is not guaranteed.” (See here.)

3. What problems does it solve?

CBDC has been proposed as the solution to problems ranging from the hygienic to macroeconomic.

- The risk of spreading Covid-19 and other infectious diseases on banknotes

- The role of physical cash in supporting the black economy

- Lack of financial inclusion

- Limitations on the ability to deal with lack of demand in the economy by techniques such as “air dropping” money to a whole nation or imposing negative interest rates

- Delays in the introduction of technologies based on “Smart Contracts” or Distributed Ledger Technology (aka Blockchain).

However, CBDC is not the unique solution to any of these problems and it is not even obvious why CBDC is the best alternative. Replacing physical cash is increasingly unnecessary in most developed countries. In Sweden the proportion of people using physical cash had fallen to only 13% by 2018. Even in developing nations such as the People’s Republic of China, cash usage has collapsed as people turn to smart phone apps. Going further and fully eliminating cash to control the black economy requires imposing an outright ban on all forms of physical cash (including foreign currencies).

Increasing financial inclusion, airdrops and negative interest rates, also do not require a CBDC. There are alternatives such as giving all unbanked residents access to free basic bank accounts. The fundamental enablers of both low-cost bank accounts and CBDC are the same: A robust method of electronic identity, a method of storing account balances and some form of payments infrastructure.

Sometimes the problems may not be worth solving. Creating CBDC to make it easier to support blockchain based systems makes very strong assumptions about the intrinsic benefits of blockchain.

4. Are there real-life examples?

CBDC is not new. There have been multiple attempts at introducing CBDC. One of the first was the Bank of Finland’s Avant system in 1992. Avant was aimed at small scale retail payments and operated as a pre-paid stored value card. After only three years it was transferred to private ownership and technically stopped being CBDC. A more recent example was Ecuador’s Sistema de Dinero Electrónico in 2014. Unfortunately, it was born with a trust problem. Currency depreciations and financial crises had lead Ecuador to replace its currency with the US dollar in 2000. Dinero Electrónico required Ecuadorians to trust their state to keep electronic dollars fully backed by real dollars. The trust never materialised and the system was shut down in 2018.

2020 saw the launch of PROJECT BAKONG by the National Bank of Cambodia. It has features that resemble a conventional payments system rather than a CBDC such as incorporating the existing Cambodia faster payments system “FAST” and requiring banks to have central bank settlement accounts. The lessons to be learned from Bakong are likely to be very specific for Cambodia because one of the key objectives of the project was to encourage greater use of the local currency as opposed to the US dollar.

5. Does a CBDC need a Blockchain?

The simple answer to this question is “No”. Neither Avant nor Dinero Electrónico used blockchain. Bakong used a form of blockchain called Hyperledger Iroha. The sole role of blockchain in Bakong according to the white paper is to record processed transactions on a centralised permissioned ledger. A role that could be performed by many other technologies.

6. Are CBDCs good news for cryptocurrencies and blockchain?

Blockchain and cryptocurrency enthusiasts are quick to make the link between CBDCs and cryptocurrencies. Central bank proofs of concept demonstrated that elements of blockchain type technology could be included in the implementation of CBDC but did not demonstrate why blockchain was needed. The potential for interoperable CBDCs to be used for international payments further undermines the claims that cryptocurrencies can be a tool for cheaper international payments. Claims that are already very weak.

7. Does CBDC create any problems?

CDBCs potentially create a number of problems. A fundamental risk is of accelerated bank runs. The Bank of Bahamas CBDC, the “Sand Dollar” has specific safeguards built in to stop this happening including limits on the size of deposits and monitoring the liquidity of banks. Another major concern is privacy. CBDC makes it easier for governments to view transactions. However, most governments can already access records of financial transactions. Though in countries with rule of law a court order is usually required. The real threat to the privacy of using physical cash comes if introducing CBDC is combined with bans on physical cash.

8. What are the really big questions?

One of the “horror stories” told about a Chinese CBDC is that it will allow the Chinese Yuan to replace the US dollar as the main reserve currency and allow China to dominate international finance. This misses some fundamental points. The growth of the Yuan’s importance goes in hand with the growth in importance of the Chinese economy, already larger in purchasing parity terms than the US. The Dollar ultimately superseded Sterling because the US economy was considerably larger and more powerful than the Sterling bloc of nations. The other factor of course is the convertibility of the Yuan, a matter of economic policy rather than a technology.

The other big question is whether CBDC will disintermediate commercial banks. Fundamentally this is another policy issue that is not related to technology. The concept of “Narrow Banking” i.e. limiting the ability of the banks to create credit has been in discussion since the Chicago plan of the 1930s. CBDC does not push the direction of this debate in any particular direction.

9. Do we really need CBDC?

Creating CBDCs because of fear of Facebook or China is not a sensible basis for central bank policy. Neither is the desire to innovative for the sake of innovation. CBDCs have either failed or are in the very early days of adoption. A sensible approach determining whether to adopt is to consider the problems that need to be solved (which are often country specific) and the wider range of successful technologies available in the payments area that could achieve the same ends.

The author acknowledges Pan Ng’s assistance in editing.

♣♣♣

Notes:

- This blog post expresses the views of its author(s), not the position of the Center for Evidence-Based Management, LSE Business Review or the London School of Economics.

- Featured image by vjkombajn, under a Pixabay licence

- When you leave a comment, you’re agreeing to our Comment Policy

Martin C. W. Walker is director of banking and finance at the Center for Evidence-Based Management. He has published two books and several papers on banking technology. Previous roles include global head of securities finance IT at Dresdner Kleinwort and global head of prime brokerage technology at RBS Markets. He received his master’s degree in computing science from Imperial College, London and his bachelor’s degree in economics from LSE

Martin C. W. Walker is director of banking and finance at the Center for Evidence-Based Management. He has published two books and several papers on banking technology. Previous roles include global head of securities finance IT at Dresdner Kleinwort and global head of prime brokerage technology at RBS Markets. He received his master’s degree in computing science from Imperial College, London and his bachelor’s degree in economics from LSE

Excellent article which gets to many of the key questions surrounding the myths of “digital currencies” and block chain.

It is often easy to answer the question of “ what problems is this technology trying to overcome”. People frequently forget to then ask “is this a problem we really need to address” and “does this solution solve it better than the current environment does ?”

Interesting update on PROJECT BAKONG by the National Bank of

Chea Serey, assistant governor and director general of the National Bank of Cambodia (NBC) was adamant to clarify that although the system is built on DLT, it is not a central bank digital currency (CBDC) that some may be quick to assume. Instead, the platform augments the existing Fast and Secure Transfer (FAST), real-time retail payment system and Cambodian Shared Switch (CSS) that facilitate mainly interbank transactions among commercial banks and MFIs. They were launched respectively in 2016 and 2017 and are Cambodian riel (KHR) and US dollar account-based systems that do not interoperate with the twenty or so PSPs that serve mainly the unbanked.

https://www.radio.finance/episodes/nbcs-serey-bakong-is-not-a-cbdc-it-is-a-backbone-payment-system-built-on-dlt

.

Very uniformed both in crypto and on CBDC in general

CBDC means that governments fan individualise fiscal spending – a complete game changer

CBDC Yuan means that China can ensure all deals are done in its new currency not US$

Crypto payments are far quicker than sending digital fiat – fact

Some bias can be traditionally seen in the great and established institutions that try to analyze and explain what happens in the contemporary political and financial world (including here the academic factors and their alumni, too, despite of their exquisite backgrounds).

They express same *paternalistic state* assumption (aka ‘once people choose ages ago what state, banking or power structure are going to exist, nothing could change, God forbid!’ ) — which is entirely wrong and is based on the fear of the unknown and of course on their personal “wishful thinking” related to the status quo. Nothing new, here, as time as the uneducated people, too, hang themselves on the same faith (lately expressed as HODL by the crypto currency fans — but ultimately just a way of saying something as “you’ll see, the time will prove us to be right, no matter what happens in the mean time”).

Therefore what fears and what try to avoid these otherwise great actors?

Simply put, the inevitable and the inescapable character of the future.

I don’t defend here the position of the crypto believers, just say that you can’t avoid the transformative power of the diversity!

All academic and financial institutions couldn’t predict the invention of the bitcoin and its revolutionary power (market valued at a Godzilla size, now) therefore the position of the outcasts of (financial or generalist) education (people that rudely abandoned their college studies to pursue a spartan way of life and sometimes succeeded). Those outcasts, looking back to their former teachers, asked a very valid question Why the education system couldn’t prevent, predict, explain the born of a new financial reality or at least support people in aligning to this new economic reality?

Back to the topic, I would comment to this great post of Mr Walter with a simple question:why are you so convinced that the vast majority of crypto users wouldn’t gather a critical mass that would create a new government or central banking system? I remind you that old day banks dismissed the idea of the weak and maybe unsecured internet in regard to the serious stuff that was considered to be the banking transactions! Everything was either SWIFT or nothing (to be swift or not to be at all)… Surprise, surprise, all banks now offer their customers Android or iPhone apps to conduct their financial business. Are you kidding me? If general internet is so weak and unsecure, why do you use it nowadays, dear banks? The answer is simple Adapt, or die!

Fact is that the Bitcoin creation just gave people more choices — it is not a replacement for the traditional banking system. Not for the government monopoly of saying Stop, you owe me taxes because I need to survive! No, it’s like when kids want also ananas flavor ice-cream, because they are fed of only tasting vanilla or chocolate ice-cream. Right?

But you forgot that those kids will grow adults and will destroy any power system that would try to deny them the right of enjoying that ananas ice-cream.

That is called Elections, mr Walter, and this is the very own core of the democracy.

People have a constitutional right to elect and be elected, because they live in a free world where no traditional kings or queens are considered eternal or entitled to rule them, sorry!

So, yes, if the people of the near future will deem fit to their life to create a CBDC using their Central Banks, so be it! I personally would not want to live forever in a 70′ world, with no color TV, no internet, no mobile phone, no nothing! Progress is good, no matter how risky and threatening for the old establishment might seem sometimes!

Remember, blockchain is diversity not a threat! Is giving the clients a new option to decide for their financial life. Customers are not the possessions of the banks or the government to decide for them!

By the contrary, banks and banks must be the humble servants of the citizens that pay them!

I wouldn’t be surprised if nobody would eventually regulate the crypto world (because it seems that even the most important people in banking and political world love it)… as time as it serves them well on a personal level…

China had the same problem – the People Republic Communist Party tried to ban the Bitcoin until their individuals realized that this would compromise and make illegal their own earnings!!! We speak about corruption there, not jokes 🙂 And do you think that in the (fake) free world where everyone has a vested interest in bitcoin is there anyone who would shake the system? Actually, everything is political. Everything is connected to the money, be it dollars, bitcoin or tethers….

By the way, @Nesbit is wrong despite of still being in denial state: Revolut payments which are not blockchain payments are almost instant, because they don’t need some lazy block validation to happen. Revolut transaction is atomic and it doesn’t force me to wait who knows how many other transactions to happen and be pushed into some unique “cheap” fee meant to gather all of us in the same tight transaction.

What is the main factor for the blockchain exchanges to get rich is this simple wealth creating factor – one single fee for all passengers.

I am sure even the so expert Mr Walter didn’t understand this golden opportunity of them : they don’t pay commissions to the miners from the amounts transferred but a mere fee for the “telegram” saying that a huge lump of money has to be transferred.

It is like an airplane travel where each passenger pay 100 Euros to go London San Francisco while the pilot pays for the kerosene with just the same 100 Euros received from a single passenger, even if his plane can carry 100.000 passengers on one flight.

Smart economists just didn’t understood that even by now, therefore they still cry on the shoulder of the poor customer…..

Is that single fee much fair than what do the banks to their clients? You bet it is.

Because acting as banks do for example in the telegraph world (last centuries) or internet world (today) would be considered a fraud if in a telegram sent to a relative in America an European guy would just say”my dear I just won 1000 euros at lottery so enjoy the news with me” and being asked to pay 100 euros for that message because he’s “rich” or just 1 euro if he says ” my friend Im sad I only won 10 euros at lottery”. You got the point? Sending money by banks is just sending a telegram, so why cost more just because I put more Zero-es in my message? Because they are a monopoly which is not ethical not very legal, as we know.

Bitcoin breaks this monopoly. Do you know that Alibaba is almost going to be split because they tend to abuse their power?

Kudos to universities that teach students the new ways of paying (even if still in infancy as crypto things)

You can’t resist the future or will become irrelevant.

Thank you James and Eve for some fascinating comments

i really need to know if it is a link between cryptocurrencies & central bank digital currency

Not really much connection.

CBDCs don’t even need to use blockchain or DLT.

CBDCs do scare some crypto companies such as because it would undermine their already dubious uses cases in remittances and FX.

So some crypto firms are claiming you need crypto to bridge between different CBDCs which makes no sense. Interesting to note the funding crypto firms have provided to the Digital Pound Foundation.

Other crypto advocates claim cbdc and crypto are both forms of “digital assets” and therefore cbdc will increase crypto adoption. Another argument that has no based in logic or data.