New research reveals corporate hypocrisy on climate change. Guosong Xu argues that green firms make political action committee contributions to anti-climate change legislators to enhance the value of their firms.

As governments around the world ramp up efforts to redefine climate rules, big corporations are increasing their political engagements to wield influence over climate priorities. By the end of 2020, large companies included in the MSCI Index donated at least three times more money to political candidates in the U.S. than they did at the beginning of the 1990’s, according to our recent paper (Fich and Xu, 2022). However, due, in part, to the opaque disclosure of corporate political activities, little is known about who are making these donations (climate leaders or brown firms), and which candidates receive firms’ backing (environmental obstructionists or pro-climate politicians).

The prevailing view on corporate engagement in the environmental regulation process is that firms with worse environmental records will back politicians who obstruct pro-climate policies, and that environmentally proactive firms will benefit from these policies. The intuition is that pro-climate firms have an intrinsic interest in pursuing a green political agenda when they overtly adhere to a philosophy of “doing well by doing good” (Benabou and Tirole, 2010). In practice, however, climate leaders often bear the largest burden from their sustainability commitments (Fisher-Vanden and Thorburn, 2011). Moreover, climate campaigners often claim that many corporate climate policies are merely attempts to greenwash. For example, U.S. Senator Sheldon Whitehouse said that “despite the statements emitted from oil companies’ executive suites about taking climate change seriously and supporting a price on carbon, their lobbying presence in Congress is 100 per cent opposed to any action.” We investigate these claims by studying the implications of corporate climate engagement in the legislative process.

Do green firms support more environmentally friendly lawmakers?

Surprisingly, the answer is “no.” In fact, the study finds the opposite: when firms increase their environmental performance—measured by the most widely used MSCI Environment Index—more of their political contributions are directed towards the politicians that obstruct pro-environment bills.

The research examines a comprehensive sample of over 1200 firms in the MSCI index that made political contributions through their political action committees (PACs) from 1995 to 2018. We collect the voting records of all U.S. Senators and House Representatives on climate issues from 1970, and as a result, we can observe the politicians’ revealed attitudes towards the climate. For example, until 2018, Mr. Michael Conaway, U.S. Representative for Texas’s 11th congressional district, voted just 6 times in favour of the environment out of 359 climate related votes since entering Congress in 2005. In contrast, Mr. Conaway’s fellow Republican, Mr. Christopher Shays, Representative for Connecticut’s 4th congressional district, supported 90 per cent of pro-climate bills. In our paper, we call a politician a salient environmental obstructionist (supporter) if his/her cumulative pro-climate votes stand at the bottom (top) decile of all politicians in an electoral cycle.

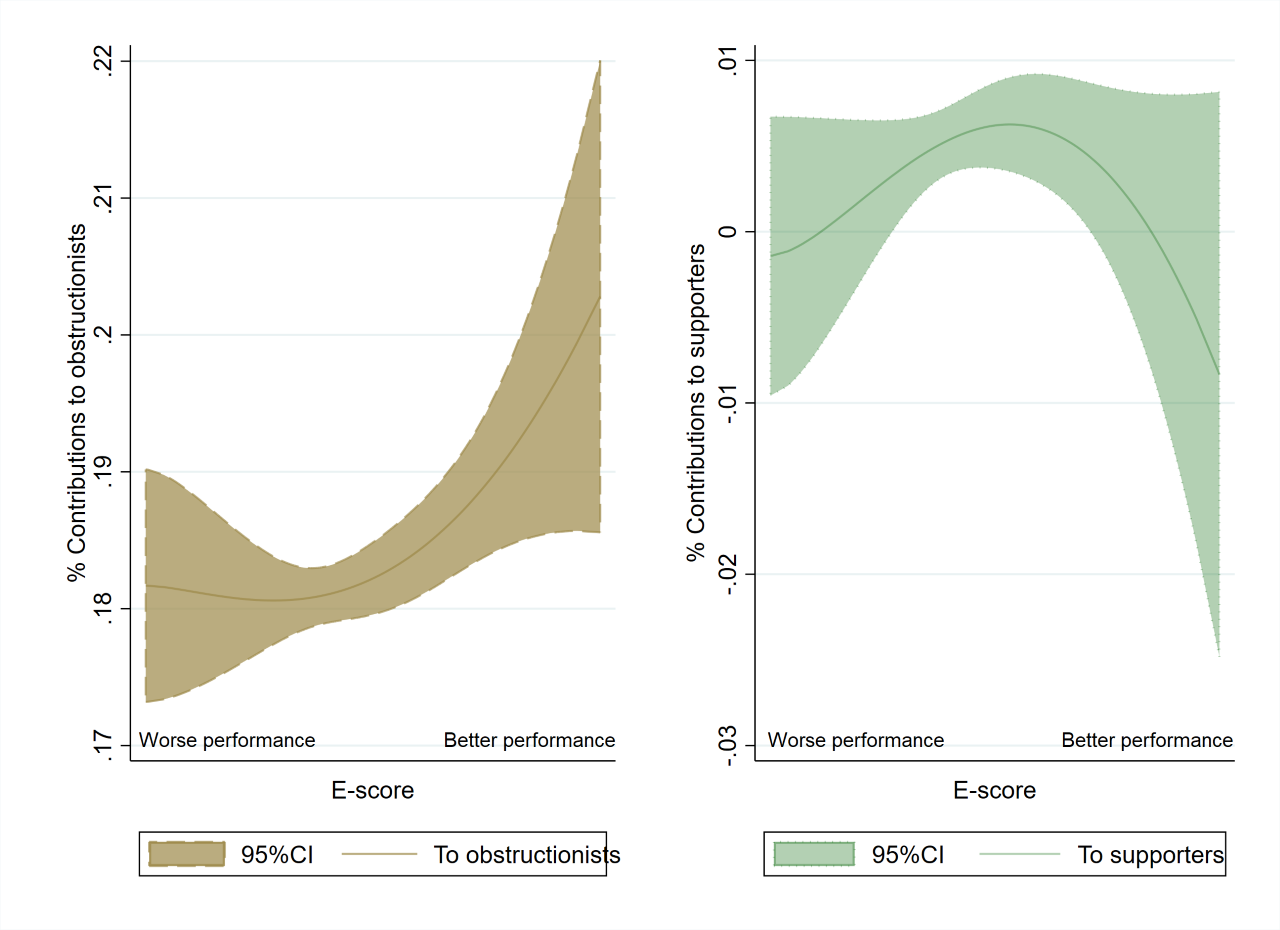

We find that when a firm moves from the median environment score to the top score, their political gifts to climate obstructionists jump by as much as 19 per cent. On the contrary, we do not find firms increase their support for pro-climate politicians when their environmental performance improves. The figure below vividly illustrates these relations.

Figure 1. Relations between corporate PAC contributions and environmental performance after controlling for various firm characteristics

Source: Fich and Xu, 2022, Is greed good for green firms? Evidence from corporate donations to anti-climate politicians

Moreover, the paper finds that political affiliations (such as Democrat versus Republican firms), general policy preferences, and other firm characteristics (such as industry, size and profitability) cannot explain the patterns documented above. The most likely explanation is based on economic costs. Namely, that green firms face the highest regulatory pressure – or “overregulation,” as is often proclaimed by industrial leaders.

Who drives corporate hypocrisy on the climate?

The striking findings propel a more interesting question: who drives the corporate PAC donations? Our investigation focuses on institutional investors, the most influential group of shareholders that affect major corporate decisions behind the scenes.

In recent years, more institutions (mutual funds, banks and insurance companies) have been geared towards sustainable investment. Despite this, a large group of investors still lack interest in socially responsible investing. We get a glimpse of institutional investors’ stance on the climate by examining their own PAC contributions to environmental obstructionists. With this approach, we identify a set of “brown investors,” namely those who mainly support obstructionist lawmakers. We find that firms with the highest brown ownership are indeed the ones that exhibit the most hypocritical behaviour on the climate. They support more obstructionists upon the improvement of their own E-performance. Green investors (such as ESG funds), however, fail to counteract with donations to climate-friendly lawmakers.

The value implications

Corporate hypocrisy on the climate pays. Our analysis reveals that, upon the passing of anti-environment bills in Congress, hypocritic firms (those that have excellent environmental grades and more benevolence towards environmental obstructionists) experience a jump in their market value. On average, the “return” to their political donation is large. For one US $ of contribution, hypocritic firms get over $900 increase in the market value when an anti-climate bill passes.

Another piece of evidence of financial benefit comes from the electoral victory of connected politicians. We examine close races in special elections. We find that, when an obstructionist supported by a green firm narrowly wins an election (by no more than five per cent margin against his/her opponent), the green firm’s market capitalization increases by about $103 million, on average.

Overall, our research provides novel evidence revealing corporate hypocrisy on climate change. Corporations that presumably support green initiatives actively work to derail pro-environment laws through PAC contributions to climate-unfriendly legislators. Notably, such hypocrisy is effective as contributions to E-obstructionist lawmakers ultimately enhance the value of green firms. These findings have important implications to investors that seek green firms in their portfolios, to government agencies that grant benefits to firms based on the environmental scores, and to policymakers that attempt to deliver effective regulations to combat the climate change.

♣♣♣

Notes:

- This blog post expresses the views of its author(s), not the position of LSE Business Review or the London School of Economics.

- Featured Image by Marcin Jozwiak on Unsplash

- When you leave a comment, you’re agreeing to our Comment Policy.