The self-employed have not recovered from the pandemic despite five rounds of government support, find Robert Blackburn (University of Liverpool), Stephen Machin and Maria Ventura (LSE). More than a quarter are in financial trouble and there has been increasing confusion about their eligibility for grants.

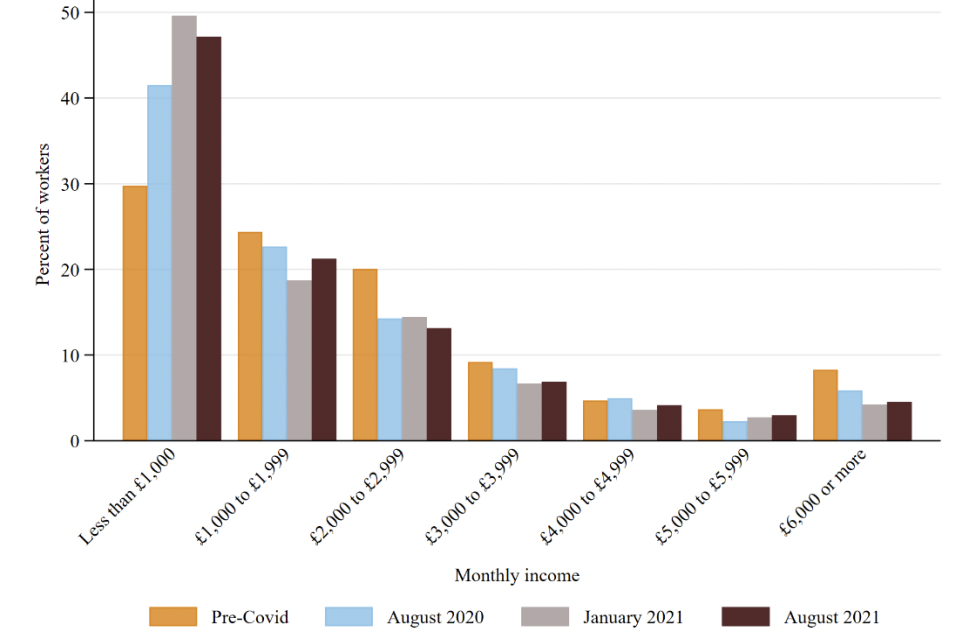

In spite of some widespread semblance of economic recovery and growth, our survey of 1,500 self-employed shows 39 per cent report having less work in August 2021 than they would usually have at that time of the year. The figure is an improvement from both the levels of January 2021 (62 per cent) and August 2020 (58 per cent). Nevertheless, just below three quarters (72 per cent) of these attribute the reduced work to COVID and government restrictions. This is reinforced in the distribution of monthly incomes pre- and post-COVID (Figure 1).

Figure 1: Monthly incomes – before COVID, August 2020, January 2021, and August 2021

Source: LSE-CEP Survey of UK self-employment, September 2021

After the initial shock of the first lockdown the share of self-employed workers in financial trouble has dropped – but has now plateaued, fluctuating around a lower, but still substantial 28 per cent. There is variation within the sample: for example, 35 per cent of parents report trouble paying for basic expenses over the previous month, 10 percentage points higher than workers without children. Among non-parents, women are about 7 percentage points more likely than men to have financial issues (30% compared with 23%). Similarly, 38 per cent of those under 30 report struggling financially – 40 percent more than those over 30 (27%). This confirms research from elsewhere on the uneven impact of the crisis on the self-employed.

In the last quarter, the government has continued to offer targeted support to the self-employed. While many business schemes have been progressively withdrawn, two additional rounds of the Self-Employed Income Support Scheme (SEISS) became available in 2021. The fourth payment was open for applications in late spring, while the fifth and last one closed on 30 September 2021. The latter also changed the payment criteria, establishing a low and a high payment depending on the reported drop suffered in turnover.

According to HMRC, 2.9 million self-employed have claimed at least one grant to date, although the take-up rate fell from 77% for the first grant to 33% for the most recent. Interestingly, about 10 per cent in self-employment applied for all five rounds of the programme, suggesting that there is a consistent core of SEISS beneficiaries. A detailed analysis finds that older self-employed, or those that have been longer in business, are more likely than younger newcomers to have received four or five grants.

The drop in applications for grants might, on first consideration, seem counterintuitive, especially given that the latest two grants (fourth and fifth) made eligible those self-employed who started trading after 6 April 2019, who were previously excluded. We looked at the main reasons reported by individuals who have claimed no payments under the SEISS scheme. We report responses from the last two surveys and exclude those self-employed who have no doubts about their ineligibility.

Changes in the requirements for the last SEISS grant seems to have created more uncertainty around the eligibility, and therefore discouraged some self-employed from applying. Consistently, a fifth of those who applied report having difficulties in calculating their turnover and 38 per cent are unsure, even after applying, of whether they will receive the high or the low payment. A Commons research briefing confirms that media coverage of the last grant has been lower than for the previous payments. The report also highlights the uncertainty around the fiscal treatment of the SEISS grants (effectively chargeable to income tax and National Insurance) and the fear amongst the self-employed that they could face unexpectedly high tax bills for 2020/21/22.

The economic fortunes of the self-employed continue their decline, 18 months into the crisis

A significant share of the self-employed were not sure about their eligibility for SEISS. A third has been consistently in doubt, albeit with a drop in this uncertainty of less than 10 percentage points since the scheme was first introduced in May 2020. The share of those in doubt is lower amongst those that have been self-employed for longer, and for those with employees. This further highlights the unevenness in the experiences of the effects of the crisis amongst the self-employed population and the greater know-how of those who have been in the business for years before the pandemic, compared with newly self-employed.

Whilst the financial well-being of the self-employed has been found to be relatively poor compared with employees during the crisis, these latest results demonstrate diversity within the self-employed. This may be a result of a combination of demographic, sector and scale factors. But overall the economic fortunes of the self-employed continue their decline 18 months into the crisis.

This post represents the views of the authors and not those of the COVID-19 blog, nor LSE. It is an edited extract from COVID-19 and the self-employed – 18 months into the crisis, a Centre for Economic Performance COVID-19 Analysis Series briefing.