By Bernhard Dachs (AIT, left) and Georg Zahradnik (AIT, right).

By Bernhard Dachs (AIT, left) and Georg Zahradnik (AIT, right).

The internationalisation of private investments in Research and Development has been a major development within the globalisation of innovation over the past three decades. While multinational enterprises (MNEs) used to carry most of their R&D activities in their home countries, R&D investments by MNEs abroad now account for around 28% of all R&D investments. In this new international private innovation landscape, the United States and the European Union are the two biggest players, but emerging economies are playing an increasingly important role as home and host countries, Bernhard Dachs and Georg Zahradnik write.

In the last 30 years, multinational enterprises (MNEs) have expanded their research and development (R&D) activities to locations outside their home countries. This internationalisation of business R&D is a relatively recent phenomenon: before the 1980s, large firms relied on the strong ties that they had created with universities and research organisations in their home countries to conduct innovative research [1].

Recent research provides evidence that the internationalisation of business R&D is gaining momentum [2] [3] [4]. Foreign MNEs became the principal actors behind R&D investments in many countries, influencing the technological capabilities of countries and regions to a considerable degree. This makes the internationalisation of business R&D a key dimension of science, innovation and technology policy.

This contribution measures the internationalisation of MNE research activities with R&D expenditures of foreign-owned firms, collected by national statistical offices [5]. The key variable of the analysis is inward business R&D expenditures (BERD), which are the R&D expenditures of foreign-owned firms in a particular host country/sector. Inward BERD and domestic BERD – the R&D expenditures of domestic firms – together constitute total BERD in a particular country or sector.

R&D internationalisation is increasing

At the country level, data indicate a considerable increase in inward BERD, both in absolute and relative terms. The share of inward BERD on total BERD world-wide increased from 20% in 2001 to around 28% in 2013. This is in sharp contrast to studies based on patent data which find that R&D internationalisation stagnates [6].

Typically, the share of foreign-owned firms on total BERD is highest in small and medium sized countries. In some countries, for example Belgium, Ireland, Austria, the Chech Republic or Hungary, it even rises to more than half of total BERD. Exceptions to this rule are Switzerland, Demark or Finland which reveal only low levels of R&D internationalisation. The United Kingdom, in contrast, is a large country with a very high degree of R&D investments coming from foreign multinationals.

EU and US dominate R&D internationalisation

The internationalisation of R&D is dominated by US and European MNEs.

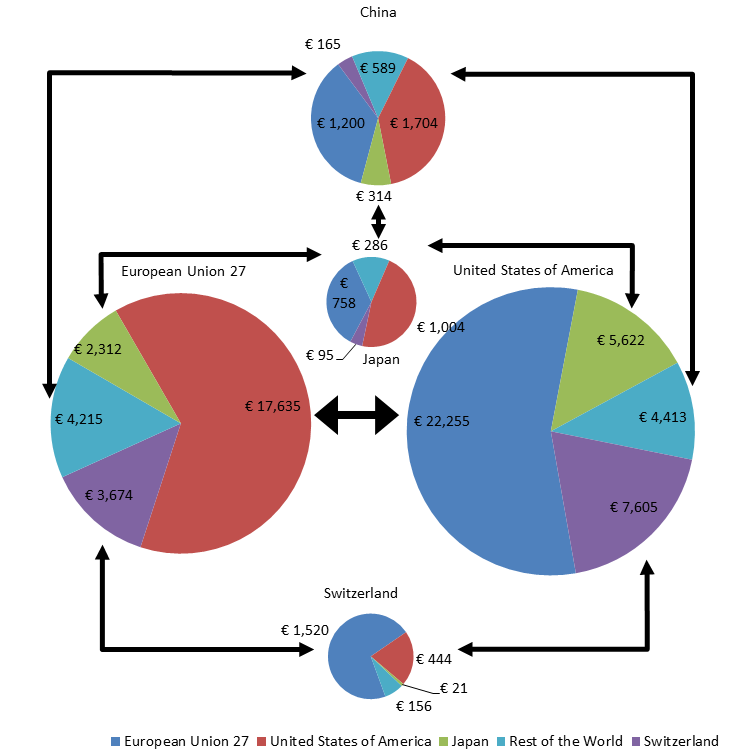

The Figure below summarizes inward BERD relations between EU, the US, Switzerland, Japan and China. The size of each pie chart depicts total inward BERD in the country or region. For the US, EU, Japan, China and Switzerland, each pie chart is split into the shares of US, EU, Japanese, Swiss firms and in the share of firms from the rest of the world. Moreover, the figure shows with solid lines the key linkages between countries (or regional blocks).

In 2013, US firms spent around 18 billion Euro on R&D in the European Union. R&D expenditures of EU firms in the US were about 22 billion Euro. Inward BERD from the US in the EU-28, and vice versa, accounts for more than half of all inward BERD worldwide, if inward BERD between EU member states is excluded.

Emerging economies, including China, still play only a minor role despite a fast growing inward BERD. Total inward BERD in China (about 4.3 billion Euro) is significantly smaller than the corresponding inward BERD in the US or the EU. From patent data and outward statistics, we estimate that India should be at about the same size as China, but exact data is not available. This minor role of emerging economies is the biggest difference between the internationalisation of R&D and the internationalisation of production.

Notes: No country breakdown for China and Japan available, country shares based on PCT patent data (average 2011-2013)

Source: OECD, Eurostat, national statistical offices, own calculations

More diversity in terms of sectors and investing countries

Data also reveal that R&D internationalisation became more diversified over the last decade, both in terms of the sectors and in terms of countries involved.

In a global perspective, R&D internationalisation is still concentrated in a few manufacturing industries, including chemicals, pharmaceuticals, machinery, computer and electronic products, and transport equipment. But inward BERD in services such as information, computer and software services, is growing fast. Service sectors are currently the most dynamic industries in R&D internationalisation; the increase of R&D expenditure of US firms aboad since 2007 can largely be attributed to service industries. From the available data, it apprears that services account for around a third of total inward BERD.

At the country level, R&D internationalisation moves from regional integration between neighbouring countries towards true internationalisation. The share of BERD accounted for by the top inward investing country – often large neighbouring countries – declines in the majority of countries between 2003 and 2013, and the number of investing countries increases.

Summary

The internationalisation of business R&D is shaping the technological capabilities of countries to a considerable degree. R&D expenditures of foreign-owned firms have increased in absolute terms as well as a share of total business R&D in nearly all countries. They constitute a considerable share of overall R&D expenditures in small and medium sized countries in particular.

In absolute terms the US and the EU are still the most important home and host countries for inward BERD, but emerging countries are catching up. Overall, the share of the largest investing country in total inward BERD is decreasing in the large majority of countries over time. Similarly, we also observe a growing diversity at the sectoral level. While R&D internationalisation is still concentrated in a few manufacturing industries, services – not visible in patent data – grew much faster in recent years.

This post is based on research produced by the authors for the European Commission: Iversen, E., Dachs, B., Poti, B., Patel, P., Cerulli, G., Spallone, R., Zahradnik, G., Knell., M, Scherngell, T. & Lang, F. (2016). “Internationalisation of business investments in R&D and analysis of their economic impact (BERD Flows).” Luxembourg: European Commission. DOI: 10.02777/888034

Bernhard Dachs is Senior Scientist at the Center for Innovation Systems and Policy of AIT Austrian Institute of Technology, Vienna. He holds a doctorate in economics. His areas of expertise are the economics of innovation and technological change, in particular with regard to the internationalisation of R&D, innovation in services, and the analysis of national and international technology policy.

Georg Zahradnik is a Scientist at AIT Austrian Institute of Technology, Center for Innovation Systems and Policy. He graduated in economics at the Vienna University of Economics and Business. He has worked on the internationalisation of research activities, public research funding, sectoral and national innovation systems in Europe.

[1] Patel, P., Pavitt, K. (1991) Large Firms in the Production of the World’s Technology: An Important Case of “Non-Globalisation”. Journal of International Business Studies 22, 1-22.

[2] UNCTAD. (2005). World Investment Report 2005: Transnational Corporations and the Internationalization of R&D. New York and Geneva: United Nations.

[3] OECD (2010). Measuring Globalisation: OECD Economic Globalisation Indicators 2010. Paris: Organisation for Economic Co-operation and Development.

[4] Dachs, B., R. Stehrer and G. Zahradnik (eds., 2014). The Internationalisation of Business R&D. Cheltenham: Edward Elgar.

[5] Iversen, E., Dachs, B., Poti, B., Patel, P., Cerulli, G., Spallone, R., Zahradnik, G., Knell, M. and F. Lang (2016), Internationalisation of business investments in R&D and analysis of their economic impact (BERD Flows). Project for the European Commission, DG Research and Innovation.

[6] Laurens, P., Le Bas, C., Schoen, A., Villard, L., Larédo, P. (2015). The rate and motives of the internationalisation of large firm R&D (1994–2005): Towards a turning point? Research Policy 44, 765-776.

Thumbnail image: Christopher Chan via a CC BY-NC-ND 2.0 licence