By Randolph L Bruno (University College London), Riccardo Crescenzi (London School of Economics), Saul Estrin (London School of Economics) and Sergio Petralia (Utrecht University)

By Randolph L Bruno (University College London), Riccardo Crescenzi (London School of Economics), Saul Estrin (London School of Economics) and Sergio Petralia (Utrecht University)

Multinational enterprises (MNEs) locate their R&D activities around the world and their performance as innovators depends on this internal geography. But we also expect to see a link between their invention capabilities and how much innovation they actually do. In this paper, we explore whether and in what ways this relationship is influenced by the strength of intellectual property rights (IPR) protection, using a sample of highly innovative multinationals. We show that MNE innovative performance is enhanced when the firm’s R&D activities are based in locations where IPR protection is stronger. Moreover, the difference between the strength of IPR regulation in the home and host economies affects innovation performance, which we find deteriorates as the distance between home and host IPR regimes increases. Notably, MNEs from emerging countries exhibit a competitive edge when operating in highly protective systems thanks to their experience in more challenging environments in knowledge protection and involuntary leakages.

Introduction

How does the location of an R&D subsidiary impact the innovation of highly innovative MNEs? In particular, in what ways is the relationship between MNE innovation performance and the internal geography of their R&D activities influenced by the strength of Intellectual Property Rights (IPR) protection in the home and host country?

In order to answer these questions, in a recent article we have tested three closely inter-related hypotheses. First, we propose that, taking as given the internal geography of innovative capabilities across subsidiaries, MNE innovation performance is stronger when more of the MNE R&D activities are based in locations with stricter IPR protection. Second, we consider the impact of differences in the quality of institutions’ distance on innovation performance, particularly concerning home and host economy IPR regimes. We argue that as these differences (“institutional distance”) in the strictness of IPR regime increase, innovation performance declines. Finally, we investigate possible asymmetries in these distance effects. We propose that the impact of IPR regime differences depends on whether the MNE home economy has strong IPR protection, with the host economy of its subsidiaries being weaker, or vice-versa, when the home IPR regime is weak and the host economy stronger. Examples of such asymmetries are R&D subsidiaries of advanced economy MNEs located in emerging economies versus emerging economy MNE R&D subsidiaries located in developed economies.

Institutions and MNE innovation performance

Our arguments are based on analysing the costs of managing the innovation process. We suggest that protecting, managing and coordinating R&D activities when some research subsidiary locations have lower IPR protection raises MNE innovation costs and weakens performance. As a result, MNE innovative performance will be stronger when R&D activities are concentrated in institutional contexts with stronger IPR protection. The MNE can reduce the costs of new knowledge generation and its dissemination in distant locations. Further, when considering the effects of the internal geography of MNE location decisions, innovation performance will be sensitive to differences between the IPR regimes in the home and host countries. Innovative MNEs tend to locate “internal” R&D activities in countries with similar IPR regimes, either strong IPR protection in both the home and host country or weak protection in both. When MNEs locate their R&D activities in host economies with IPR regimes that are different from those in their home country, innovation performance is subject to distance effects. Moreover, MNEs whose home R&D facilities are located in low-IPR protection countries face additional information and coordination costs for managing knowledge creation overseas. However, these MNEs may experience lower costs of protecting their inventions when foreign R&D is located in a strict IPR regime, and they could learn from a different and possibly more technologically advanced host innovation environment. Even so, these costs will likely be higher than when they locate in low IPR protection regimes, because they have developed a better understanding of knowledge management processes in institutionally challenging environments in their home economy.

In contrast, MNEs based in high IPR protection home countries have developed management systems to limit the costs of knowledge creation in strict IPR regimes and find it more costly to pursue R&D activities in low IPR protection environments. For example, MNEs may need to provide additional protection (e.g. secrecy) for the fruits of their work. In table 1, we exemplify two potential opposite situations: Huawei from a low IPR country, locates R&D facilities in a high IPR country such as Canada; Daimler from a high IPR country, locates R&D facilities in a low IPR protection country such as China. The impact of innovation is positive in the former case and negative in the latter.

| Headquarter Location | Location of the R&D facility | Distance and Direction | Implied impact on innovation |

| Huawei (China, low IPR) | Canada (high IPR) | Low IPR->High IPR | Positive |

| Daimler (USA, high IPR) | China (low IPR) | High IPR ->Low IPR | Negative |

Table 1: Two asymmetric examples of highly “distant” R&D locations and their impact on innovation.

We test these ideas using a unique new dataset about the most innovative MNEs globally, a panel of around 900 multinationals that have patented at least once at the United States Patent and Trademark Office (USPTO). This sample comprises the world’s highly innovative MNEs, which granted approximately 690,000 patents between 2004 and 2013 and accounted for 32.5% of all patents granted at the USPTO over that period.

Key findings

Our results show that MNEs have the best innovation performance when their R&D subsidiaries are primarily or entirely located in high IPR protection regimes. However, the strength of IPR protection does not affect innovation performance for less technologically sophisticated MNEs. The consequences of potential knowledge seepage to competitors only begin to have cost impacts when MNEs exceed a certain level of knowledge capability to protect.

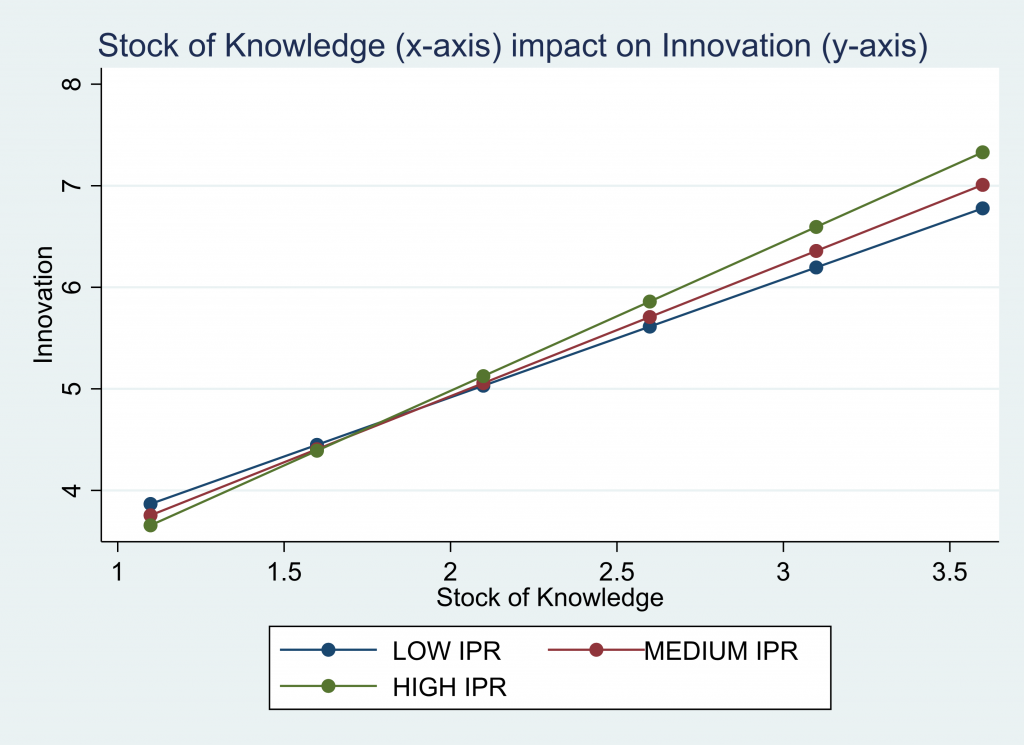

Predictive Margins of innovation output (measured by new patents filed by the MNE) for different levels of MNE knowledge stock (measured by patents per inventor) for companies operating in low, medium or high IPR protection economies (groups highlighted in green, red and blue lines respectively) as measured by the Patent Enforcement Index (PEI).

Figure 1 shows that returns to MNE knowledge stock are higher for firms operating in high IPR protection countries, namely only where MNE knowledge stock is above 1.8 log-points (around 6 patents per inventor).

We see that, for highly innovative MNEs with significant numbers of inventors geographically distributed in subsidiaries across the world, the negative impact of informational, coordination and administrative costs in managing overseas R&D subsidiaries in locations with weaker IPR protection outweigh any potential benefits in terms of learning from the less restricted transmission of knowledge in such contexts. In terms of learning and knowledge management, this evidence is also in line with strategic management insights, whereby firms consider gains from inward knowledge spillovers and the possible costs of outward spillovers. Technological leaders have the least to gain (given their leadership position) and the most to lose (given the potential for knowledge leakages) when locating their R&D activities in low IPR protection host locations.

Of course, this evidence does not imply that MNEs will only locate R&D subsidiaries in jurisdictions with strong IPR protection. This is because various host countries may bring very different advantages to the internal knowledge production process. For example, overseas locations may be attractive bases for R&D subsidiaries because they provide access to agglomerations of (relatively cheap) highly skilled labour or products, such as the availability of software engineers around Bangalore, India. Alternatively, overseas locations may offer a deeper understanding of consumer tastes in crucial markets and lower overall costs, for instance, in Brazil or Thailand. However, our findings temper those benefits: when choosing locations where IPR protection is weak, MNEs need to be aware that this comes at a cost in terms of innovation performance.

We find that the innovation performance of MNEs disproportionately located in lower IPR protection economies is worse. We argue that this is a consequence of the resulting higher costs of transmitting information and the coordination and administration of inventors. For example, when more R&D facilities are located where IPR protection is weaker, the firm must do more to protect its discoveries. This places potentially costly constraints on the free flow of information within the organisation.

Our results also show that as the distance between the IPR regime in the home country and the average of the host countries where the firm undertakes R&D increases, the impact of inventive capabilities on innovation performance is diminished. We again associate this finding with a higher cost of managing and coordinating knowledge exchange between R&D units within the MNE as IPR regimes differ. For example, for MNEs based in high IPR protection locations, the costs of erecting barriers to prevent learning by competitors from their knowledge creation in locations with lower IPR protection will be higher as that protection declines. At the same time, the administrative costs of coordinating between the different R&D locations are also higher. On the other hand, firms in low IPR protection locations face the same problem in reverse: the costs of knowledge protection and coordination and administrative costs become more important as the differences in home-host IPR protection are larger.

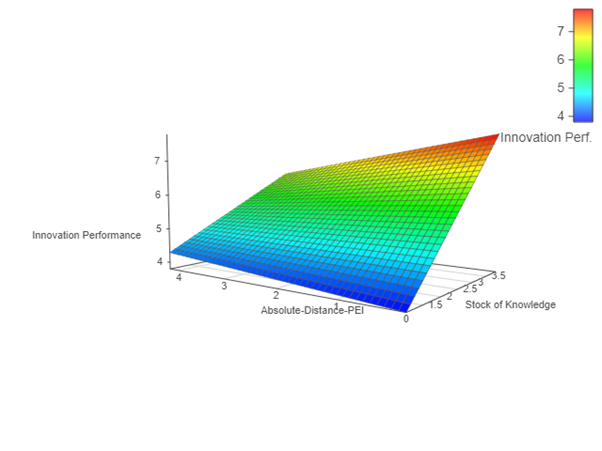

We find that MNEs for which the average level of IPR protection was higher in the host than the home countries (positive distance) show weaker innovation performance as IPR distance increases. This is shown in Figure 2, where innovation performance is measured on the vertical axis (blue being low and red being high) and the stock of knowledge and absolute patent enforcement index distance is shown on the two-horizontal axes, respectively. Combinations of high distance and low stock of knowledge (bottom left part of the plane) are associated with low innovation in blue. The stock of knowledge is critical: the higher its value, the higher the innovation (towards green and red areas on the top right part of the graph). However, when very high levels of stock of knowledge is associated with high absolute distance, innovation performance weakens (e.g., Daimler undertaking R&D in China, see Table 1). On the other hand, we find that innovation performance is better in MNEs where the average level of IPR protection was lower in the host than in the home country (e.g., Huawei locating R&D facilities in Canada, see table 1).

Managerial implications.

Our findings regarding the negative impact of weak IPR protection and the adverse effects of distance make salutary reading for managers contemplating offshoring R&D, especially for MNEs based in high IPR protection locations. There are many benefits from locating innovation abroad in terms of accessing skills, plugging into research hubs, and understanding new markets. However, our work indicates there can also be costs. Moreover, these costs increase with the distance in the strength of IPR protection between the home and host economies; the relevant indicator of distance here is not geographic but differences in IPR protection. Interestingly, our results also indicate that innovation performance is not significantly affected by firm size which suggests that relatively smaller MNEs can perform as well as large ones in the innovation space.

This post is based on the article, “Multinationals, innovation, and institutional context: IPR protection and distance effects” by the Authors in the Journal of International Business Studies (2022)

This post represents the views of the authors and not those of the GILD blog, nor the LSE.

Randolph Luca Bruno is Associate Professor in Economics at the UCL School of Slavonic and East European Studies

Riccardo Crescenzi is a Professor of Economic Geography at the London School of Economics.

Saul Estrin is Emeritus Professor of Management Economics and Strategy at LSE

Sergio Petralia is Assistant Professor at Utrecht University