The visit of Dani Rodrik to present at the Arthur Lewis memorial event at LSE (with Professor Sir Paul Collier), and again at ODI, has been warmly received. Duncan Green shares a few reflections on one of his heroes, and suggests why there is merit in Rodrik’s bleaker outlook for the future. (Originally posted on From Poverty to Power.)

Dani Rodrik was in town his week, and I attended a brilliant presentation at ODI. Very exciting.

He’s been one of my heroes ever since I joined the aid and development crowd in the late 90s, when he was one of the few high profile economists to be arguing against the liberalizing market-good/state-bad tide on trade, investment and just about everything else. Dani doggedly and brilliantly made the case for the role of the state in intelligent industrial policy. But now he’s feeling pessimistic about the future (one discussant described it as ‘like your local priest losing his faith’).

The gloom arises from his analysis of the causes and consequences of premature industrialization. I blogged about his paper on this a few months ago, but here are some additional thoughts that emerged in the discussion. He’s also happy for you to nick his powerpoint.

Dani identified two fundamental engines of growth. The first is a ‘neoclassical engine’, consisting of a slow accumulation of human capital (eg skills), institutions and other ‘fundamental capabilities’. The second, which he ascribed to Arthur Lewis, is driven by structural differences within national economies – islands of modern, high productivity industry in a sea of traditional low productivity. Countries go through a ‘structural transformation’ when an increasing amount of the economy moves from the traditional to the modern sector, with a resulting leap in productivity leading to the kinds of stellar growth that has characterized take-off countries over the last 60 years.

Manufacturing has been key to that second driver. It is technologically dynamic, with technologies spreading rapidly across the world, allowing poor countries to hitch a ride on stuff invented elsewhere. It has absorbed lots of unskilled labour (unlike mining, for example). And since manufactures are tradable, countries can specialize and produce loads of a particular kind of goods, without flooding the domestic market and driving down prices.

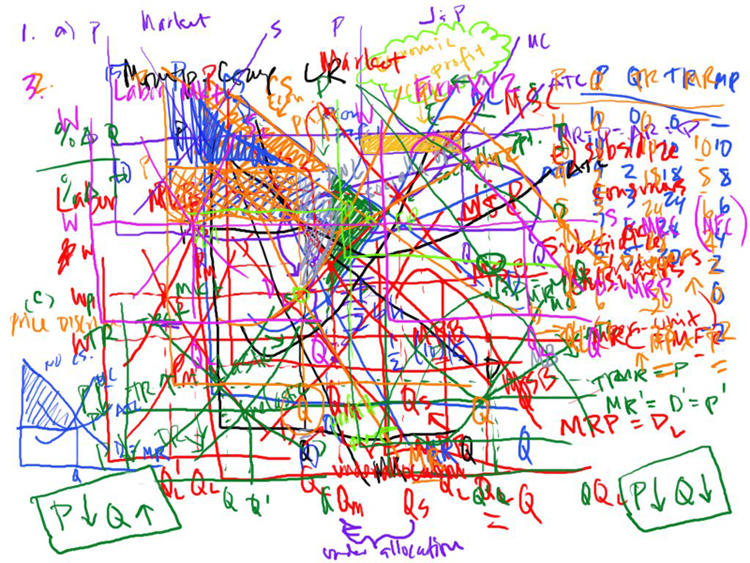

But that very dynamism has produced diminishing returns in terms of growth and (especially) jobs. Countries are hitting a peak of manufacturing jobs earlier and earlier in their development process (see graph). And it could get much worse – just imagine the impact if/when garments, the classic job-creating first rung on the industrialization ladder, shift to automated production in the same way as vehicle production.

At the same time, lower transport costs and globalization is making it harder and harder to pursue import substitution and use exports to boost the wider economy through local linkages – Ethiopia imports cardboard boxes from China in which it puts its cut flower exports. A return to import substitution would require much higher tariff barriers than in the past, to counter the lower transport costs and Asia’s hyper cheap production costs.

The result has been deindustrialization in much of Africa and Latin America, exacerbated by the recent commodity boom (now ending). A byproduct has been rising inequality – manufacturing has become more like mining – a low employment/high wage enclave with few linkages to the rest of the economy.

There is very little sign that services or agriculture can substitute as long term drivers of labour-intensive growth – hence Dani’s pessimism. The easy road of industrial policy and manufacturing catch-up that has driven such spectacular gains, is coming to an end. It’s back to the long haul of neoclassical growth, unless something new turns up.

The panellists (Nick Lea, Dirk Willem te Velde and chair Stephanie Griffith Jones) went into straw clutchist mode, looking for possible rays of light to ease Dani’s gloom. These included:

- The numbers may be better than we think: new calculations of GDP, especially in Africa, show a lot more economic activity than we realized, plus a lot of manufacturing may not be picked up in official stats.

- Global Value Chains: intriguing – in one direction, companies are outsourcing more stages like design, which are then counted as services, whereas before they would have been part of manufacturing. On the other hand, companies are also taking some services in-house, such as after-sales support. Not clear which is greater, but it means that the division between manufacturing and services is a lot more blurred than it appears.

- Fragile States: Nick Lea saw possibilities of leaps in growth in the ‘non-linear, chaotic group at the bottom of the pool’

- Climate Change: Stephanie Griffith-Jones wondered if the new techs required for the green revolution could fill some of the gap.

- Frugal Technology: she also wondered if the shift in design and innovation to countries such as India might partially reverse the trend to automation, and revive job creation.

- Even the earlier peak in industrialization is still decades away for most of Sub-Saharan Africa – hitting a wall at a GDP per capita of $5,000 would be a nice problem to have for many governments (missed this in first draft – thanks to Dirk for pointing it out).

All great stuff, although despite the panelists efforts, I found Dani’s pessimism rather too convincing for comfort.

One minor whinge on the panel – 3 male speakers, and a woman chair (even if it is the wonderful Stephanie Griffith-Jones) does not pass the CGD test, and every single person called on in Q&A was (I think) male (including me, I know, my bad). Come on ODI, please get with the anti-Hoff programme!

[It’s worth visiting the original post for the comments, not least the toe-to-toe discussion between Duncan and fellow Professor in Practice, Owen Barder.]

Related Posts

|