African governments aiming to industrialize their economies often revert to export bans on raw commodities to promote processing industries. Intriguingly, these are introduced much more frequently on some processable commodities than others. Based on a recent World Development article, Dr Nicolai Schulz makes the argument that policy-makers avoid imposing export bans on commodities produced by a large share of the population due to the high political risks involved.

In recent years, industrial commodity processing has increasingly been identified by academics and policy-makers alike as one of the most promising routes to reviving economic transformation on the African continent. Correspondingly, virtually all African governments have put commodity processing promotion at the forefront of their national development plans and numerous continental policy initiatives have emerged to support them. Resource-based industrialization, however, faces bottlenecks in Africa, such as poor energy and road infrastructure, difficult political environments, and a lack of adequate technical, financial, and human capital. Consequently, commodity processing is often more economical outside of Africa, foreign processors therefore usually outcompete domestic processors in buying domestic raw produce, and both foreign and domestic investors shy away from processing in the African countries of origin.

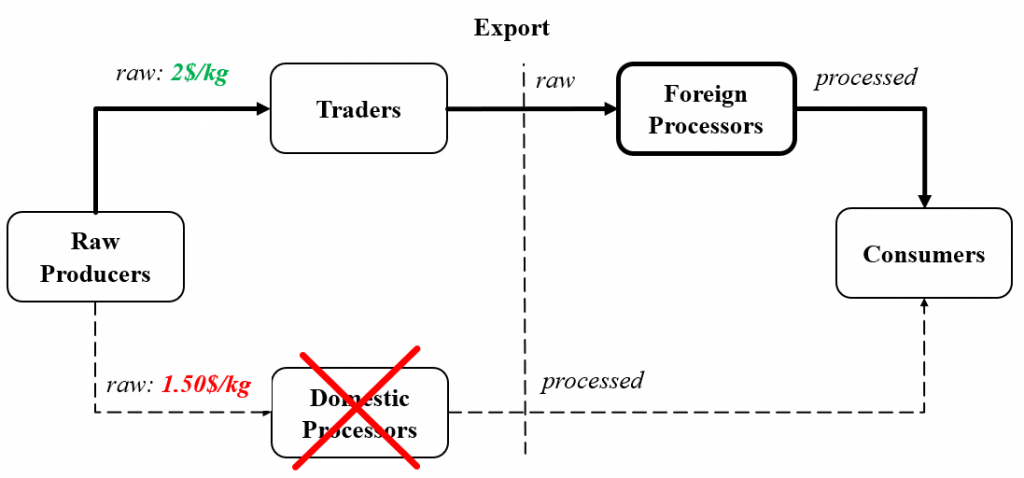

Governments across the Global South, above all in Africa, have increasingly reverted to export bans and other export restrictions on un- or semi-processed commodities to solve these problems. Export prohibitions increase the domestically available supply of raw materials, eventually leading to a fall in domestic prices. While domestic raw producers (e.g. farmers, loggers, and miners), middlemen, and exporters are likely to lose income, processing in the country of origin becomes more competitive vis-à-vis raw exportation and foreign processing, hereby incentivizing domestic and foreign entrepreneurs to invest in country of origin processing.

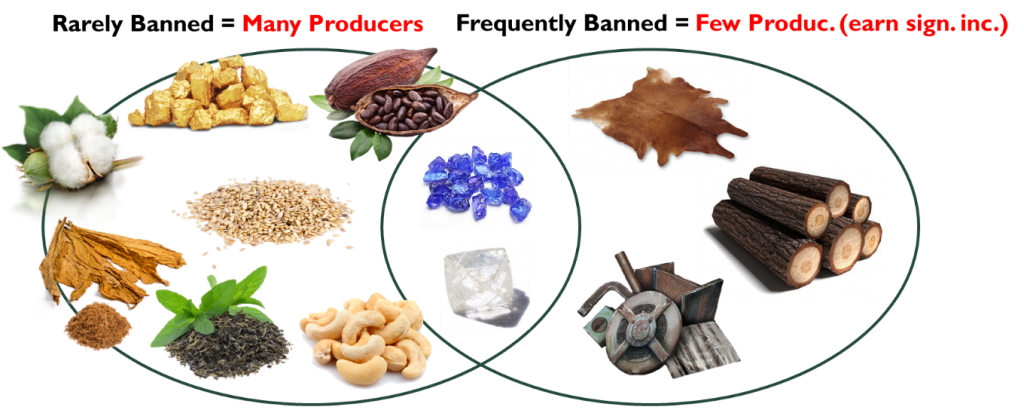

Intriguingly, however, African country governments tend to employ export bans very differently across commodities. When looking at an original dataset – the Export Prohibition and Taxation in Africa (EPTA) panel dataset – it appears that among commodities that could sensibly be banned from an economic viewpoint, some tend to be much more frequently restricted at export than others. On average, African governments do not tend to prohibit exports of unprocessed agricultural crops, such as tea, cashew, cocoa, cotton or sesame, as well as unrefined gold. In contrast, they tend to frequently impose export bans on commodities such as timber logs, raw hides and skins, metal wastes and scraps, as well as precious stones and chromite in some instances. The question arising is: Why do African governments restrict certain economically ‘bannable’ commodity exports more frequently than others?

I argue that this is fundamentally due to political considerations. African governments avoid imposing export bans on commodities produced by a large share of the population, because the risk that producers will mobilize against the bans is too high. There are several reasons for this. Usually, export bans radically reduce producer prices. But since bans are imposed at the border, beyond producers’ usual field of vision, producers normally struggle to see the origin of these price distortions. Left to themselves they thus might see no reason to be agitated.

Raw commodity traders, however, make the difference. Operating at the production sites and the border, traders can directly observe the implementation of bans. Since export bans are extremely damaging to their business, traders have the incentive to employ their comprehensive networks as well as the financial resources to inform producers about and organize them against bans. Mobilization, thus, becomes very likely. Critically, however, only when producers pose a large numerical threat – that is, they are many and could vote, protest, or riot against the government – will policy-makers fear anti-ban mobilization, and avoid imposing them in the first place.

While the same holds true for high export taxes, I argue it does not for low export taxes. Low export taxes are less severe and visible in their impact, and traders are less agitated given that it is easier for them to pass on price distortions to producers. Producer mobilization is thus less likely and imposing low export taxes even on larger groups poses no significant risk to policy-makers.

To test these arguments against competing explanations, I conducted a large-N analysis based on the ETPA dataset and found robust support for the core hypothesis: The larger the share of the population producing a commodity, the less likely governments will impose export bans on them. As expected, this also applies to high but not for low export taxes.

These findings supports recent research detailing the critical role politics plays in industrial policy-making in the Global South and shows that African mass producer groups can overcome collective action problems to oppose policies adverse to their interests in certain circumstances (despite decade-long assumptions to the contrary). Importantly, however, these findings also raise the question of how African governments can promote domestic processing of mass-produced commodities. Alternatives to export restrictions like subsidies, loan schemes, or building training institutes require significant bureaucratic capacity or funding (both scarce resources on the continent). Lower export taxes might be a more viable alternative. They are not only less risky politically than bans, as shown in my paper, but they are also economically more promising: The revenues generated by the tax could be used to support both producers and processors, for example, by funding the above alternatives. To assess to what degree this strategy is and should be occurring, however, further research is needed.

Nicolai Schulz has recently completed his PhD at the LSE’s Department of International Development on the politics of industrial policy and export restrictions in Africa. He works as a research associate at the University of Manchester’s Global Development Institute, where he leads a research project quantifying political settlements through a large-scale expert survey.

The views expressed in this post are those of the author and in no way reflect those of the International Development LSE blog or the London School of Economics and Political Science.