In the face of soaring wealth inequality, Ingrid Robeyns‘ Limitarianism: The Case Against Extreme Wealth calls for restrictions on individual fortunes. Robeyns puts forward a strong moral case for imposing wealth caps, though how to navigate the political and practical hurdles involved remains unclear, writes Stewart Lansley.

Watch a YouTube recording of an LSE event where Ingrid Robeyns spoke about the book.

Limitarianism: The Case Against Extreme Wealth. Ingrid Robeyns. Allen Lane. 2023.

Ingrid Robeyns’ Limitarianism is the latest in a long line of critiques – such as Thomas Piketty’s Capital and Branko Milanovic’s Visions of Inequality – of the soaring wealth and income gaps of recent decades. Limitarianism focuses on personal wealth, which is much more unequally distributed than incomes, and is arguably the most urgent of these trends. It draws most closely on the United States, where, according to Forbes, nine of the world’s top 15 billionaires are citizens.

Ingrid Robeyns’ Limitarianism is the latest in a long line of critiques – such as Thomas Piketty’s Capital and Branko Milanovic’s Visions of Inequality – of the soaring wealth and income gaps of recent decades. Limitarianism focuses on personal wealth, which is much more unequally distributed than incomes, and is arguably the most urgent of these trends. It draws most closely on the United States, where, according to Forbes, nine of the world’s top 15 billionaires are citizens.

Robeyns argues that given the wider damage from the enrichment of the few, with its negative impact on economic strength and on wider life chances and social resilience, we must now impose a limit on individual wealth holdings. Thinkers have been making the case for this “limitarianism” and the capping of business rewards for centuries. The Classical Greek Philosopher, Plato, argued that political stability required the richest to own no more than four times that of the poorest. The Gilded Age financier, J. P. Morgan – one of the most powerful of American plutocrats of the nineteenth century – maintained that executives should earn no more than twenty times the pay of the lowest paid worker. In 1942, President Roosevelt proposed a 100 percent top tax rate, stating that “[n]o American citizen ought to have a net income, after he has paid his taxes, of more than $25,000 a year (about $1m in today’s terms).” “The most forthright and effective way of enhancing equality within the firm would be to specify the maximum range between average and maximum compensation”, wrote the influential American economist J. K. Galbraith in 1973.

The Gilded Age financier, J. P. Morgan […] maintained that executives should earn no more than twenty times the pay of the lowest paid worker.

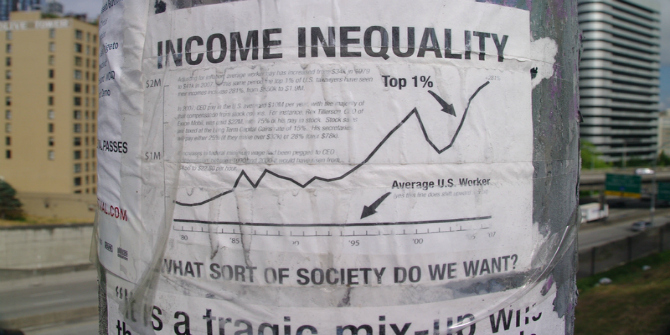

One of the effects of the 2008 financial crisis was to trigger a debate about the role played by excessive compensation packages in banking. Others have argued that the introduction of guaranteed minimum wages – which limits employer freedom over employees – should come with a maximum too. As wealth inequality has deepened in recent decades, there have been growing calls for measures to reduce this concentration, not least among some members of the global super-rich club. Yet there has been perilously little political action. Each year the world’s mega-rich, facing few constraints, carry on appropriating a larger share of national and global wealth pools.

Robeyns sets out a powerful moral case against today’s wealth divide and asks the all-important question: “how much is too much?”. She calls for setting limits to the size of individual fortunes that would vary across countries. In the case of the Netherlands, where she lives, “we should aim to create a society in which no one has more than €10m. There shouldn’t be any decamillionaires.” This, she argues should be politically imposed. She also adds a second aspirational goal, an appeal to a new voluntary moral code applied by individuals themselves: “I contend that … the ethical limit [on wealth] will be around 1 million pounds, dollars or euros per person.”

Although there are many critics who dismiss the philosophical concept as either unfeasible or undesirable, history suggests the idea is far from utopian. Limits operated pretty effectively among nations – including the UK and the US – in the post-war decades and became an important instrument in the move towards greater equality.

War has long proved a powerful equalising force, and the post-1945 decades brought peak egalitarianism.

War has long proved a powerful equalising force, and the post-1945 decades brought peak egalitarianism. States shifted from their pre-war pro-inequality role to become agents of equality. This brought (albeit temporary) upward pressure on the lowest incomes and downward pressure on the highest. These limits operated in two ways: through regulation and taxation, and changes in cultural norms. Nations imposed highly progressive tax systems, with especially high tax rates at the top – that were sustained in the UK until the 1980s – the expansion of protective welfare states, and a shift in bargaining power from the boardroom to the workforce.

These policies were also enabled by a significant pro-equality cultural shift. This brought a tighter check on top business rewards and the size of fortunes. Until the early 1980s, business behaviour became more restrained, and wealth gaps narrowed. The kind of business appropriation that has become so widespread today would, for the most part, have been unacceptable to public and political opinion then. Gone were the public displays of extravagance and the high living of the inter-war years. Up to the 1970s, and the return of what Edward Heath called the “unacceptable face of capitalism”, executive salaries in the UK were moderated by a kind of hidden “shame gene”, an unwritten social code – similar in some ways to Robeyns’ call for voluntary limits – which acted as a check on greed. It was a code that was largely adhered to, partly because of fear of public outrage towards excessive wealth.

Up to the 1970s, and the return of what Edward Heath called the ‘unacceptable face of capitalism’, executive salaries in the UK were moderated by a kind of hidden ‘shame gene’

Robeyns is making a conceptual case. She doesn’t give much detail of how limitarianism might work in practice, and doesn’t draw lessons from the post-war experience (though this was the product of the particular circumstances of the time). She recognises the hurdles needed to make the politics of limitarianism a reality. There are plenty of questions of detail that would need to be settled. How, as a society, would we determine the appropriate “rich lines” above which is too much? Would the “undeserving rich” whose wealth is achieved by extraction that hurts wider society, be treated differently from the ‘deserving’ who through exceptional skill, effort and risk-taking, create new wealth in ways that benefit others as well as themselves?

The expectation that the tremors of the 2008 meltdown would trigger a shift towards a more progressive governing philosophy that embraced a more equal sharing of wealth has failed to materialise.

The greatest hurdle is political. The expectation that the tremors of the 2008 meltdown would trigger a shift towards a more progressive governing philosophy that embraced a more equal sharing of wealth has failed to materialise. The pro-market, anti-state politics of recent decades are now largely discredited. International Monetary Fund staff, for example, have called neoliberal politics “oversold”. There are widespread calls for the reset of capitalism, with as Robeyns puts it, “a more considerate, values-based economic system”. Although such a system may yet emerge, there are few signs of the kind of value-shift and new cultural norms that would be a pre-condition for a politics of restraint and limitarianism.

This post gives the views of the author, and not the position of the LSE Review of Books blog, or of the London School of Economics and Political Science.

Image Credit: dvlcom on Shutterstock.

Great idea, let’s limit scientists to only one Nobel prize or prize of any sort, politicians to only one term in office, race car drivers to only one award, etc. you get my drift. If we implemented any of these idiotic limitations who gets limited is the rest of humanity by limiting the contributions of the very talented amongst us.

Sure but let’s be fair on all accounts, let’s LIMIT scientist to only one Nobel prize, Mathematicians to one Field Award, one soldier one metal, one theory per scientist, etc. you get my drift. We are equal and not equal, there are the very talented amongst us and if the author thinks that by making the best of us like the rest of us is good for society go to the Soviet Union around the 1970’s and see what you get.-