In The Wealth of a Nation: Institutional Foundations of English Capitalism, Geoffrey Hodgson traces the roots of modern capitalism to financial and legal institutions established in England in the 17th and 18th centuries. Hodgson’s astute historical analysis foregrounds the alienability of property rights as a key condition of capitalism’s rise to supremacy, though it leaves questions around the social dimensions of the free market system unanswered, writes S M Amadae.

The Wealth of a Nation: Institutional Foundations of English Capitalism. Geoffrey M. Hodgson. Princeton University Press. 2024.

English capitalism was built on empire and slavery…State intervention and slavery are examples of impurities within capitalism. Impurities can be necessary or contingent for the system. Some state intervention was arguably necessary, but slavery was not. (13)

English capitalism was built on empire and slavery…State intervention and slavery are examples of impurities within capitalism. Impurities can be necessary or contingent for the system. Some state intervention was arguably necessary, but slavery was not. (13)

Countering conventional understandings of capitalism, Geoffrey Hodgson contends that “Secure property rights were not enough,” because “[m]ore wealth had to become alienable and usable as collateral for borrowing and financing investment” (119). Hodgson’s The Wealth of a Nation: Institutional Foundations of English Capitalism is a welcome contribution to heterodox economics that incorporates historical excavation and theoretical analysis to provide refreshing nuance to established accounts of the rise of capitalism. Hodgson provides historical details of Great Britain’s early modern property rights and finance institutions, building on his previous works and covering a dense corpus of theories and data going back to Adam Smith’s 1776 Wealth of Nations. Hodgson’s analysis of the financial origins of English capitalism focuses on types of property rights from 1689 to 1760 and varieties of financial credit supporting British industrialisation between 1760 and 1830. While readers can expect a perceptive analysis of the origins of British capitalism, they should not expect a critique of the social dimensions of the free market system.

The Wealth of a Nation […] incorporates historical excavation and theoretical analysis to provide refreshing nuance to established accounts of the rise of capitalism.

Part II, “Explaining England’s Economic Development,” including Chapter Three “Land, Law, War,” Chapter Four “From the Glorious to the Industrial Revolution,” and Chapter Five “Finance and Industrialization,” carries the brunt of Hodgson’s argumentation. Three aspects of the book stand out. The first is his overarching argument that the central institution enabling the rise of modern political economy in England was finance: the ability to alienate the ownership of land and other property to serve as collateral for investment loans. The second is Hodgson’s heterodox economic analysis emphasising historical contingency (as opposed to universal laws); Darwinian Variation, Selection, Replication (203-206); and the role of institutions. The third is Hodgson’s apparent embrace of capitalism. He celebrates the productive power of finance capital and industrial investment, but eschews a critical analysis of capitalism’s social consequences articulated by the likes of Karl Marx, John Maynard Keynes and Karl Polanyi.

[Hodgson] celebrates the productive power of finance capital and industrial investment, but eschews a critical analysis of capitalism’s social consequences

Hodgson engages the theories of Karl Marx, Douglass North and Barry Weingast and Deirdre McCloskey, criticising their arguments for being incomplete or flawed. Marx identified the exploitation of the working class by the bourgeoisie; he missed that changes in law preceded changes in the material base that ultimately consolidated bourgeois power. North and Weingast apprehend the importance of secure property rights but missed that these could encompass feudal property rights mandating primogeniture (oldest son inherits all property) and entailments rather than the new class of alienable property rights. McCloskey rightly focuses on ideas as a force for social evolution but misses the exigencies of paying for costly wars and the practical need for legal means to pay off sovereign debt.

The key underlying factor of the British Industrial Revolution from 1760-1830 was the ability to obtain finance.

Hodgson’s treatment is astute. The Dutch were leaders in public finance, and William III’s accession to the British throne in 1689 brought those practices into Britain (121). The period from 1689-1815 was one of “war capitalism” requiring that the state be efficient in raising taxes. The state gained the right to create money by decree, and debt itself could be sold along with contractual obligations to repay the debt. Hodgson dates the financial revolution to 1660-1760 (135) and associates the growing sovereign debt with the need to finance war efforts. The key underlying factor of the British Industrial Revolution from 1760-1830 was the ability to obtain finance. Hodgson challenges the conventional view that entrepreneurs obtained loans from family and friends. His argument rests on documenting that investors were able to stake collateral for their loans. He presents evidence on mortgages, such as for canals, and the rising ratio of capital existing as financial assets versus as physical assets. The British banking system had to adapt to offer credit for investment because the central bank was focused on financing sovereign debt for war efforts.

Hodgson redirects attention from the security of property rights to their alienability as the driving institutional invention critical for capitalism to emerge. Slaves represented a crucial category of this exchangeable type of property. Hodgson acknowledges that “By the end of the eighteenth century, slaves amounted to about a third of the capital value of all owned assets in the British Empire” (109). A sizeable category of alienable property in the early 18th century was that of slaves: £6.4 billion was land, buildings, animals, ships, equipment and other non-human assets, while £3 billion was slaves (2021 currency values, 149). Hodgson’s treatment of slaves’ contribution to the origins of what Adam Smith called the “system of natural liberty” is limited to their functional role as legally institutionalised property that could be alienated. Readers looking to heterodox economics to provide a critical stance on the origins of western free markets may seek more than Hodgson’s proposition that the institution of slavery was merely a contingent factor in the system’s rise. Hodgson acknowledges that the £20 million compensation paid to former slave owners for the 1833 Slavery Abolition Act stands as a historically unprecedented sum of liquid financial capital freely available for industrial investment in the 19th century.

The £20 million compensation paid to former slave owners for the 1833 Slavery Abolition Act stands as a historically unprecedented sum of liquid financial capital freely available for industrial investment in the 19th century.

In a twist of prevailing perception that the burden of debt is a form of bondage (eg David Graeber’s Debt, 2012), Hodgson frames indebtedness as the means of liberation to finance capital, which in turn drives economic growth. Hodson effectively defends Hernando De Soto’s property rights institutions to increase the welfare of the destitute by issuing land titles as a means to obtain credit. In a similar inversion of conventional sentiment, we can recall Adam Smith’s admonishment, counter to contemporary American libertarians, that tax, including poll tax, “is to the person who pays it a badge, not of slavery, but of liberty” because tax payers are subjects of government.

Hodgson adopts a Darwinian-inspired methodology based on variation, selection, and replication (the “V-S-R” system, 204). The section “Applying Darwinism to Scientific and Economic Evolution,” (206) is conjectural. He observes that, “Some individuals were more successful than others, affecting their chances of survival and procreation” (207). He rejects either a material account or a mental account of agency. The latter refers to “folk psychology” which attributes action to individuals’ desires and beliefs. Hodgson follows the school of thought holding that human action occurs before intention is conscious or rationalised (189-190). He holds that habits and dispositions, rather than deliberately formed intentions, govern action and form the bedrock of institutions.

[Hodgson] holds that habits and dispositions, rather than deliberately formed intentions, govern action and form the bedrock of institutions.

How, then, do we assess the merits of, or the underlying affirming conditions for, either the institution of slavery or alienable property and financial capital? Hodgson observes that,

People often obey laws out of respect for authority and justice, and not because they calculate advantages and disadvantages of compliance. Dispositions to respect authority have evolved over millions of years because they aided cohesion and survival of primate and human groups (201).

Hodgson’s argument that alienable property and appropriate financial institutions for investment were a condition for the rise of capitalism in Britain is convincing. However, without a clear conceptualisation of effective human agency, other than that driven by dispositions and habits, we are left with the stubborn question of the extent to which capitalist institutions are either emancipatory or the best means to better the human condition.

Note: This post gives the views of the author, and not the position of the LSE Review of Books blog, or of the London School of Economics and Political Science.

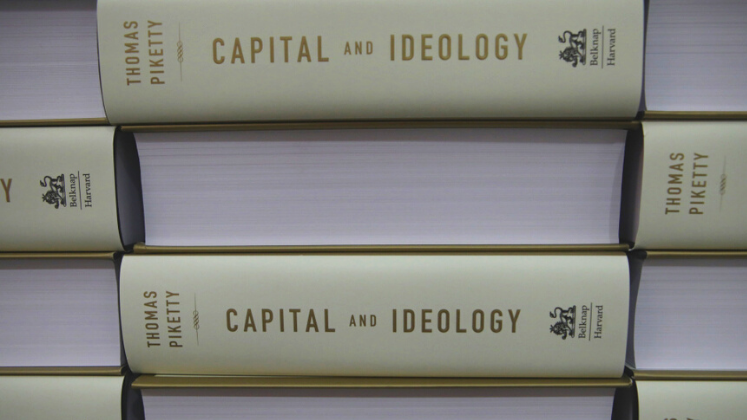

Image: The painting Coalbrookdale by Night by Philippe Jacques de Loutherbourg depicting the Bedlam furnaces at Coalbrookdale in Shropshire, England. Credit: The Science Museum, London.

I liked Geoff Hodgson’s much earlier works. But I fear he has lost the plot. Validating de Soto’s land titling ideas (i.e., provide land titles > more credit > poverty reduction) is a wrong step since they are very fundamentally flawed. One of the astounding examples of how de Soto’s ideas work out very badly in practise, if given the chance, is Cambodia, as I wrote about in a just released article here: https://www.mdpi.com/2073-445X/13/4/502